A Little Rock Arkansas Complaint for Collection of Debt on an Open Account is a legal document filed by a plaintiff (creditor) against a defendant (debtor) when attempting to collect a debt owed on an open account. It is worth mentioning that there may be different types of complaints for collection of debt on an open account in Little Rock, Arkansas, depending on the specific circumstances of each case. Here is a detailed description of the general process and keywords associated with this legal action. Keywords: Little Rock Arkansas, complaint, collection of debt, open account, creditor, debtor. When an individual or business has provided goods or services to another party on credit, creating an open account, they can seek legal action to recover the outstanding debt under certain conditions. In Little Rock, Arkansas, a creditor can initiate this process by filing a Complaint for Collection of Debt on an Open Account with the appropriate court. The complaint serves as a formal document outlining the details and basis of the debt owed, providing evidence of the debtor's obligation to repay the creditor. It typically includes information such as the creditor's contact details, the debtor's contact details, the amount owed, the initial agreement made between the parties, and any pertinent supporting documentation. In Little Rock, Arkansas, there may be variations of a Complaint for Collection of Debt on an Open Account depending on the specific circumstances, including: 1. Standard Complaint: This refers to a typical complaint filed against a debtor for the collection of a debt on an open account. The complaint will follow the general format and requirements outlined by the court in Little Rock, Arkansas. 2. Verified Complaint: In some cases, a creditor may choose to file a verified complaint, which means that it is accompanied by a signed affidavit from the creditor affirming the debt's validity and accuracy. This provides additional proof to support the claim and can strengthen the creditor's case. 3. Joint Complaint: If multiple creditors are collectively pursuing a debtor for the same debt owed on an open account, they may file a joint complaint. This type of complaint allows multiple plaintiffs to consolidate their claims, making it more efficient to litigate a single case instead of multiple individual lawsuits. Once the complaint is filed, the court will serve a copy to the debtor, who then has a specified period to respond or contest the allegations presented. If the debtor fails to respond within the designated timeframe, the court may enter a default judgment in favor of the creditor, facilitating further efforts to collect the debt owed. In conclusion, a Little Rock Arkansas Complaint for Collection of Debt on an Open Account is a legal document that enables a creditor to pursue the collection of outstanding debt from a debtor. By understanding the specific requirements and variations of this legal process, creditors can take the necessary steps towards pursuing their claims effectively.

Little Rock Arkansas Complaint for Collection of Debt on an Open Account

State:

Arkansas

City:

Little Rock

Control #:

AR-RC-105-02

Format:

PDF

Instant download

This form is available by subscription

Description

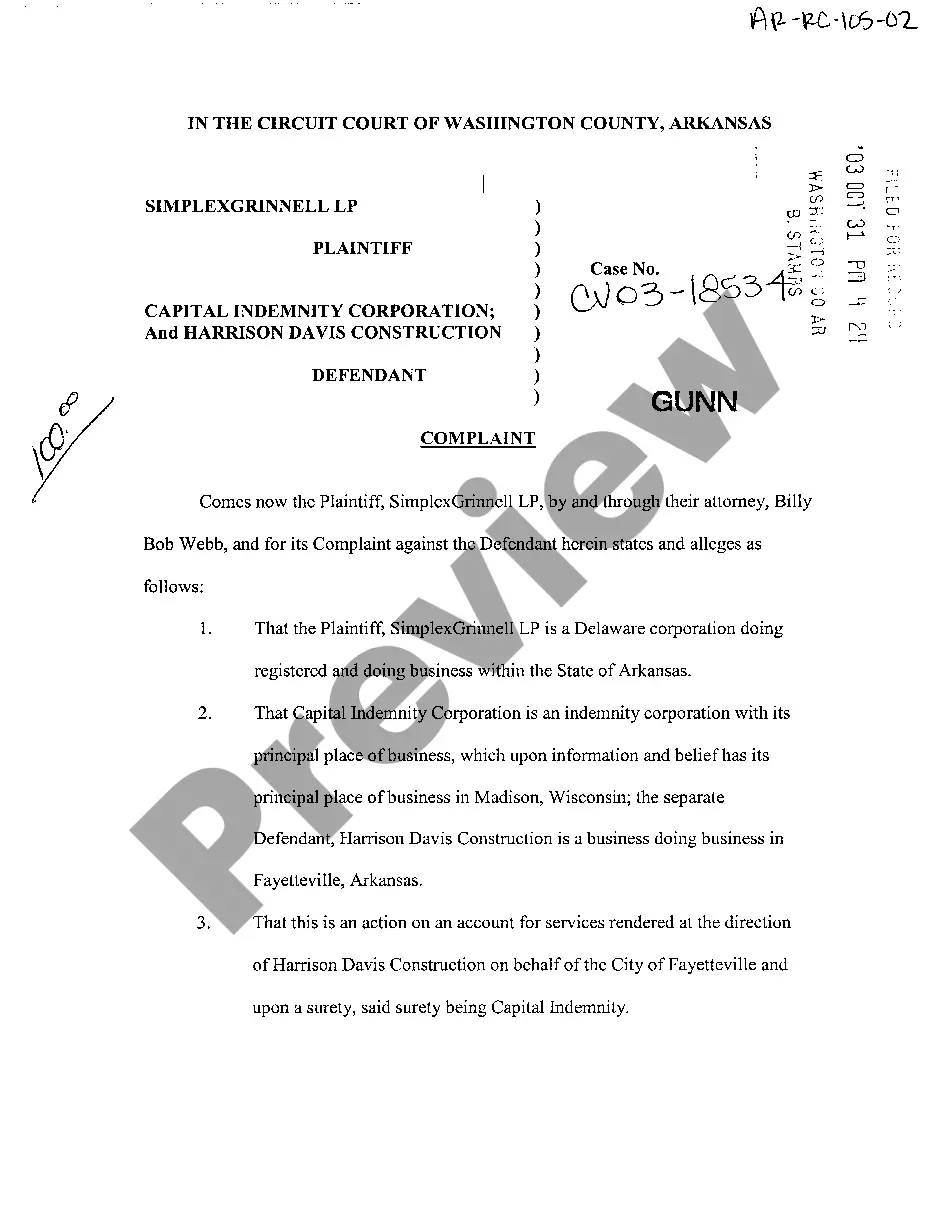

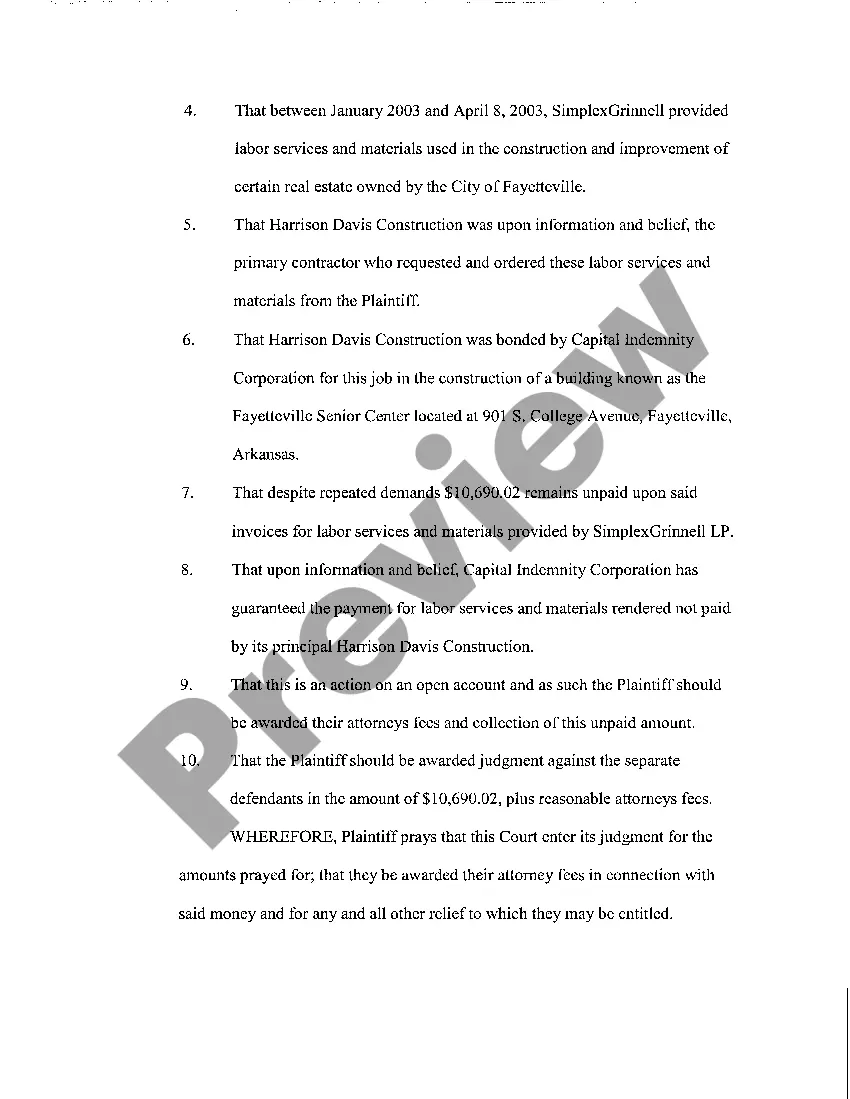

A02 Complaint for Collection of Debt on an Open Account

A Little Rock Arkansas Complaint for Collection of Debt on an Open Account is a legal document filed by a plaintiff (creditor) against a defendant (debtor) when attempting to collect a debt owed on an open account. It is worth mentioning that there may be different types of complaints for collection of debt on an open account in Little Rock, Arkansas, depending on the specific circumstances of each case. Here is a detailed description of the general process and keywords associated with this legal action. Keywords: Little Rock Arkansas, complaint, collection of debt, open account, creditor, debtor. When an individual or business has provided goods or services to another party on credit, creating an open account, they can seek legal action to recover the outstanding debt under certain conditions. In Little Rock, Arkansas, a creditor can initiate this process by filing a Complaint for Collection of Debt on an Open Account with the appropriate court. The complaint serves as a formal document outlining the details and basis of the debt owed, providing evidence of the debtor's obligation to repay the creditor. It typically includes information such as the creditor's contact details, the debtor's contact details, the amount owed, the initial agreement made between the parties, and any pertinent supporting documentation. In Little Rock, Arkansas, there may be variations of a Complaint for Collection of Debt on an Open Account depending on the specific circumstances, including: 1. Standard Complaint: This refers to a typical complaint filed against a debtor for the collection of a debt on an open account. The complaint will follow the general format and requirements outlined by the court in Little Rock, Arkansas. 2. Verified Complaint: In some cases, a creditor may choose to file a verified complaint, which means that it is accompanied by a signed affidavit from the creditor affirming the debt's validity and accuracy. This provides additional proof to support the claim and can strengthen the creditor's case. 3. Joint Complaint: If multiple creditors are collectively pursuing a debtor for the same debt owed on an open account, they may file a joint complaint. This type of complaint allows multiple plaintiffs to consolidate their claims, making it more efficient to litigate a single case instead of multiple individual lawsuits. Once the complaint is filed, the court will serve a copy to the debtor, who then has a specified period to respond or contest the allegations presented. If the debtor fails to respond within the designated timeframe, the court may enter a default judgment in favor of the creditor, facilitating further efforts to collect the debt owed. In conclusion, a Little Rock Arkansas Complaint for Collection of Debt on an Open Account is a legal document that enables a creditor to pursue the collection of outstanding debt from a debtor. By understanding the specific requirements and variations of this legal process, creditors can take the necessary steps towards pursuing their claims effectively.

Free preview

How to fill out Little Rock Arkansas Complaint For Collection Of Debt On An Open Account?

If you’ve already utilized our service before, log in to your account and save the Little Rock Arkansas Complaint for Collection of Debt on an Open Account on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make sure you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Little Rock Arkansas Complaint for Collection of Debt on an Open Account. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!