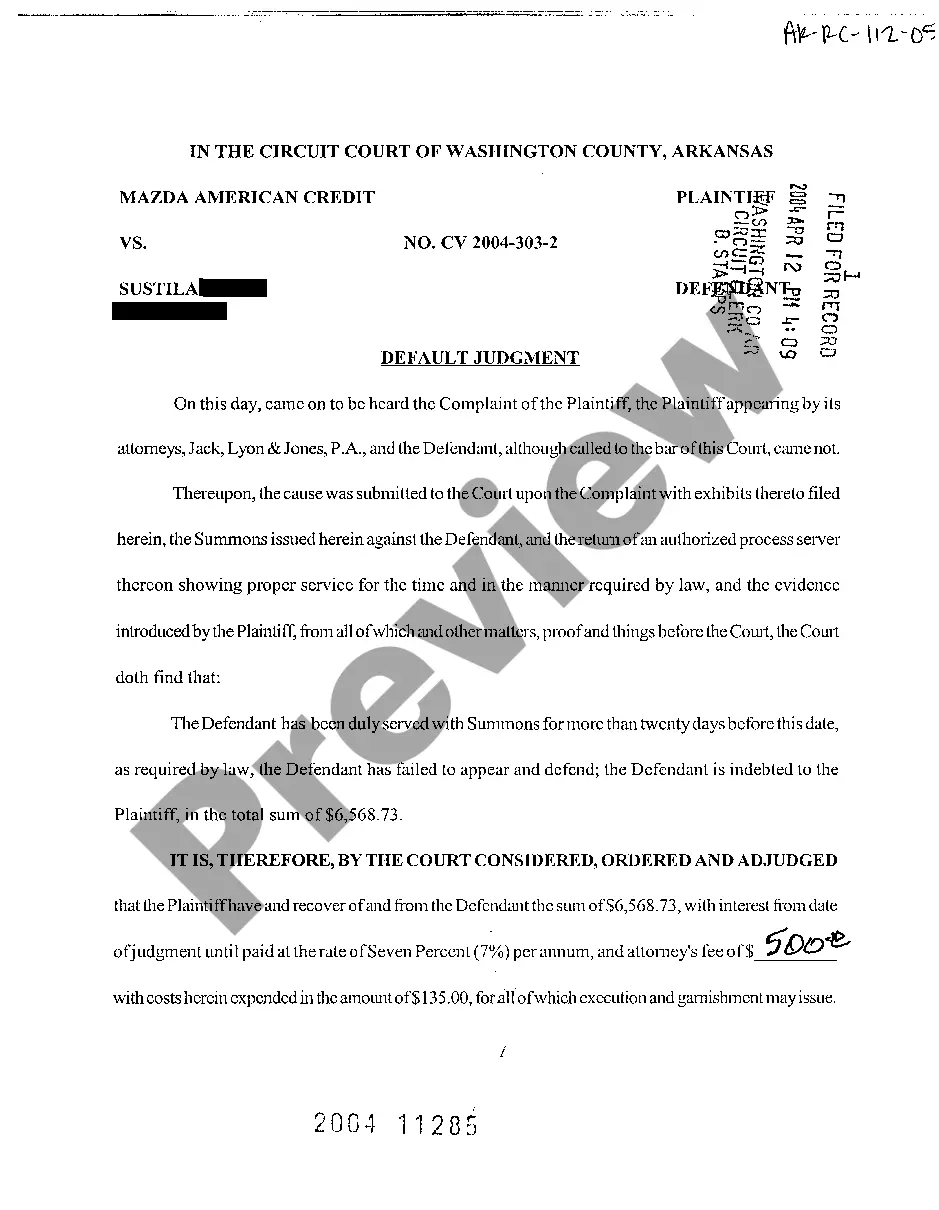

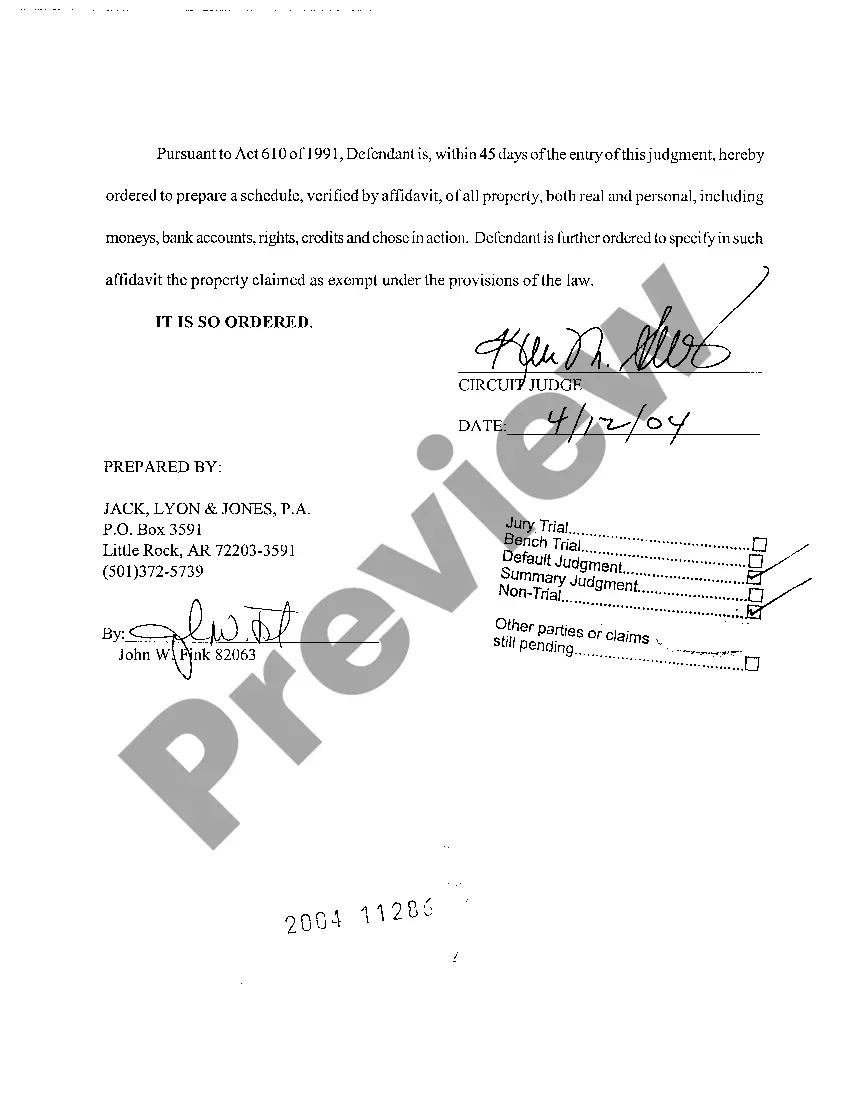

Little Rock Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile

Description

How to fill out Arkansas Default Judgment On Complaint For Deficiency After Repossession And Sale Of Automobile?

We consistently endeavor to reduce or avert legal complications when handling intricate law-related or financial issues.

To achieve this, we enlist legal services that are typically exorbitant.

Nonetheless, not every legal issue is that complicated.

Many of them can be resolved independently.

Take advantage of US Legal Forms whenever you need to locate and download the Little Rock Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile or any other form swiftly and securely.

- US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our collection empowers you to manage your own affairs without the need for a lawyer.

- We provide access to legal form templates that are not always publicly accessible.

- Our templates are specific to states and areas, which greatly eases the searching process.

Form popularity

FAQ

According to various reports, the state that often experiences the highest number of car repossessions is Arkansas. This trend impacts many residents who face the repercussions, leading to situations involving a Little Rock Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile. When a vehicle is repossessed, the owner may still hold a deficiency balance, which can result in court actions. If you're dealing with such a case, seeking assistance through platforms like uslegalforms can provide valuable guidance and support.

The eleven-word phrase that can effectively stop debt collectors is, 'I do not wish to be contacted by you again.' This statement conveys your request clearly and can help you manage unwanted communication. If you are facing challenges related to a Little Rock Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile, utilizing this phrase can provide you immediate relief. Combining this approach with guidance from UsLegalForms can empower you in your situation.

A debt is usually considered 'written off' or charged off when it remains unpaid for 180 days. This action means that creditors will no longer pursue the bill actively, but the debt still exists and can affect your credit. If you're dealing with issues surrounding a Little Rock Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile, it’s beneficial to consult with legal sources. UsLegalForms offers insights that can clarify your obligations and potential actions.

In Arkansas, a debt collector can pursue an old debt for as long as the statute of limitations permits, typically five years for most debts. However, it's important to be aware that even after this period, a collector may still attempt to contact you. If you've received a notice regarding a Little Rock Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile, understanding your rights is crucial. Using resources like UsLegalForms can help you navigate this process effectively.

In Arkansas, a creditor generally has five years to file a lawsuit after a debt becomes due. This period is defined by the statute of limitations for written contracts. Therefore, if you face a situation involving a Little Rock Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile, keep in mind that creditors must act within this timeframe. If they fail to do so, the debt can become unenforceable in court.

Repossession laws in Arkansas allow lenders to reclaim vehicles if borrowers default on their loans. The process must be conducted peacefully and without breaching the peace. If you are facing repercussions such as a Little Rock Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile, understanding these laws will empower you to take appropriate action and protect your rights.

You may get your car back after repossession in Arkansas if you settle your past due payments, including any fees associated with the repossession process. Arkansas law allows a redemption period before the lender sells the vehicle. If you need resources to navigate this situation and address potential Little Rock Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile, consider using the US Legal Forms platform.

In Arkansas, the statute of limitations for collecting car repossession debt is typically three years. This means a lender has three years from the date of repossession to initiate legal action against you for any remaining balance owed after the sale of the vehicle. If you find yourself dealing with a Little Rock Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile, being aware of this timeline can be crucial for your defense.

Yes, in Arkansas, a repossession agent can move another vehicle if it is blocking access to your car. However, they must do this lawfully and without causing damage. If you face issues regarding a Little Rock Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile, it's essential to consult legal guidance to understand your rights and the proper procedures.