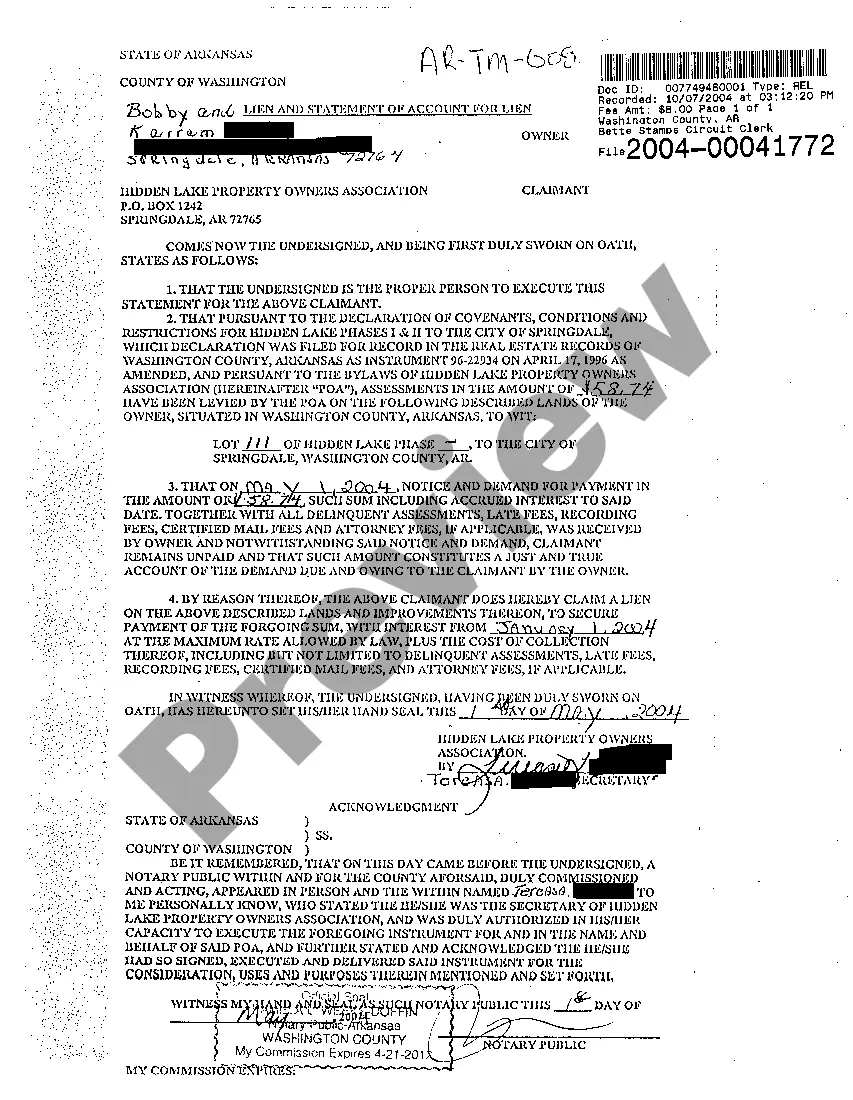

Little Rock Arkansas Lien and Statement of Account For Lien: A lien is a legal claim against a property that serves as security for a debt or obligation owed by the property owner. In Little Rock, Arkansas, liens can play a significant role in various scenarios, such as construction projects, unpaid debts, and property tax delinquencies. When it comes to liens, two common types in Little Rock are the construction lien and the property tax lien. 1. Construction Lien: A construction lien, also known as a mechanics' lien, is filed by contractors, subcontractors, suppliers, or laborers who haven't received payment for their work or materials used in a construction project. This lien ensures that these parties have a stake or claim on the property until they are properly compensated. To file a construction lien in Little Rock, individuals or businesses must follow specific procedures outlined by Arkansas law. These procedures include filing a Notice of Intent to Claim a Lien within a specific timeframe, such as 75 days after the last provision of labor or materials, and later filing the Statement of Account For Lien. The Statement of Account For Lien is a detailed document that provides an itemized breakdown of the money owed to the claimant. It includes information such as the labor and materials provided, dates of work, costs, and any other relevant expenses or fees incurred. By submitting this statement, the claimant establishes the amount owed and strengthens their position as a lien holder. If the debt remains unpaid, the lien holder may eventually seek to foreclose on the property to secure payment. 2. Property Tax Lien: A property tax lien is imposed on properties when the owner fails to pay their property taxes. The county tax collector, in this case, may place a lien on the property and can eventually sell it to recover the unpaid taxes. Before the sale of the property, the tax collector must provide the property owner with a Statement of Account For Lien detailing the outstanding taxes, penalties, and fees. This statement serves as an official notice of the impending auction and allows the property owner to settle their debt before the property is sold at a tax sale. In conclusion, Little Rock, Arkansas, has two main types of liens: construction liens and property tax liens. The Statement of Account For Lien is an essential document associated with both types of liens. It provides a comprehensive breakdown of the debt, allowing claimants or property owners to assess the outstanding amount and take the necessary steps to either receive payment or reconcile their tax obligations.

Little Rock Arkansas Lien and Statement of Account For Lien: A lien is a legal claim against a property that serves as security for a debt or obligation owed by the property owner. In Little Rock, Arkansas, liens can play a significant role in various scenarios, such as construction projects, unpaid debts, and property tax delinquencies. When it comes to liens, two common types in Little Rock are the construction lien and the property tax lien. 1. Construction Lien: A construction lien, also known as a mechanics' lien, is filed by contractors, subcontractors, suppliers, or laborers who haven't received payment for their work or materials used in a construction project. This lien ensures that these parties have a stake or claim on the property until they are properly compensated. To file a construction lien in Little Rock, individuals or businesses must follow specific procedures outlined by Arkansas law. These procedures include filing a Notice of Intent to Claim a Lien within a specific timeframe, such as 75 days after the last provision of labor or materials, and later filing the Statement of Account For Lien. The Statement of Account For Lien is a detailed document that provides an itemized breakdown of the money owed to the claimant. It includes information such as the labor and materials provided, dates of work, costs, and any other relevant expenses or fees incurred. By submitting this statement, the claimant establishes the amount owed and strengthens their position as a lien holder. If the debt remains unpaid, the lien holder may eventually seek to foreclose on the property to secure payment. 2. Property Tax Lien: A property tax lien is imposed on properties when the owner fails to pay their property taxes. The county tax collector, in this case, may place a lien on the property and can eventually sell it to recover the unpaid taxes. Before the sale of the property, the tax collector must provide the property owner with a Statement of Account For Lien detailing the outstanding taxes, penalties, and fees. This statement serves as an official notice of the impending auction and allows the property owner to settle their debt before the property is sold at a tax sale. In conclusion, Little Rock, Arkansas, has two main types of liens: construction liens and property tax liens. The Statement of Account For Lien is an essential document associated with both types of liens. It provides a comprehensive breakdown of the debt, allowing claimants or property owners to assess the outstanding amount and take the necessary steps to either receive payment or reconcile their tax obligations.