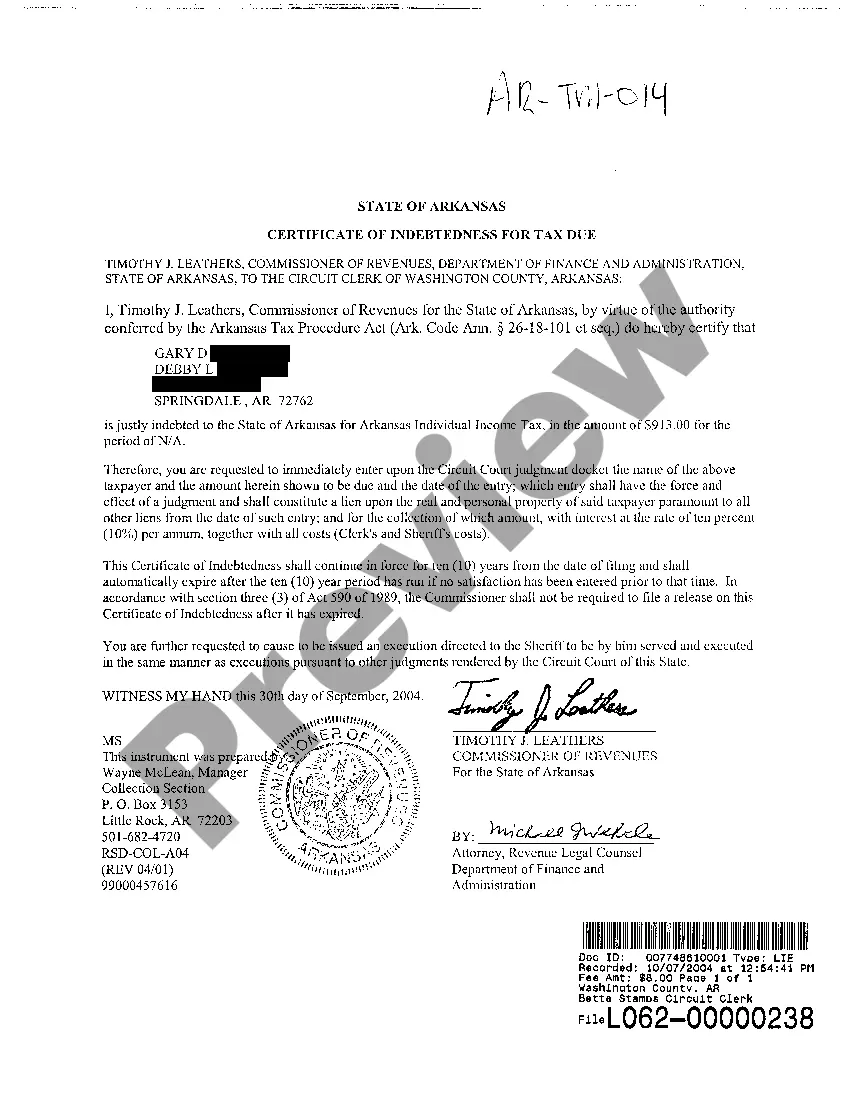

The Little Rock Arkansas Certificate of Indebtedness For Tax Due is a legal document issued by the city government of Little Rock, Arkansas, to individuals or businesses who owe unpaid taxes. This certificate is a form of debt instrument that the city utilizes to collect outstanding tax liabilities and ensure compliance with tax regulations. When a taxpayer fails to pay their taxes on time, the city may issue a Certificate of Indebtedness For Tax Due, which serves as a formal notice of the outstanding tax liability. This certificate will include essential details such as the taxpayer's name, address, tax amount owed, and the tax year or period for which the debt is accrued. The Little Rock Arkansas Certificate of Indebtedness For Tax Due is typically issued for various tax types, including property tax, sales tax, use tax, business license tax, and other applicable taxes within the city's jurisdiction. Each type of tax may have its own separate certificate, depending on the nature of the delinquent taxes. This legal document is an important tool for the city government to collect overdue taxes. Once a Certificate of Indebtedness For Tax Due is issued, the city has the authority to take necessary actions to recover the outstanding tax debt. This may include placing a lien on the taxpayer's property, garnishing wages, or initiating legal proceedings to seize assets in cases of severe non-compliance. It's worth noting that the Little Rock Arkansas Certificate of Indebtedness For Tax Due may also accrue interest over time. This means that if the taxpayer fails to pay the debt promptly, additional charges may be applied to the total amount owed. Overall, the Little Rock Arkansas Certificate of Indebtedness For Tax Due is a significant instrument used by the city government to enforce tax compliance and collect unpaid taxes. It serves as a formal document that notifies taxpayers of their outstanding tax liabilities and empowers the city to pursue appropriate legal actions to recover the debt.

Little Rock Arkansas Certificate of Indebtedness For Tax Due

Description

How to fill out Little Rock Arkansas Certificate Of Indebtedness For Tax Due?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Little Rock Arkansas Certificate of Indebtedness For Tax Due gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Little Rock Arkansas Certificate of Indebtedness For Tax Due takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a few more steps to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve chosen the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Little Rock Arkansas Certificate of Indebtedness For Tax Due. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!