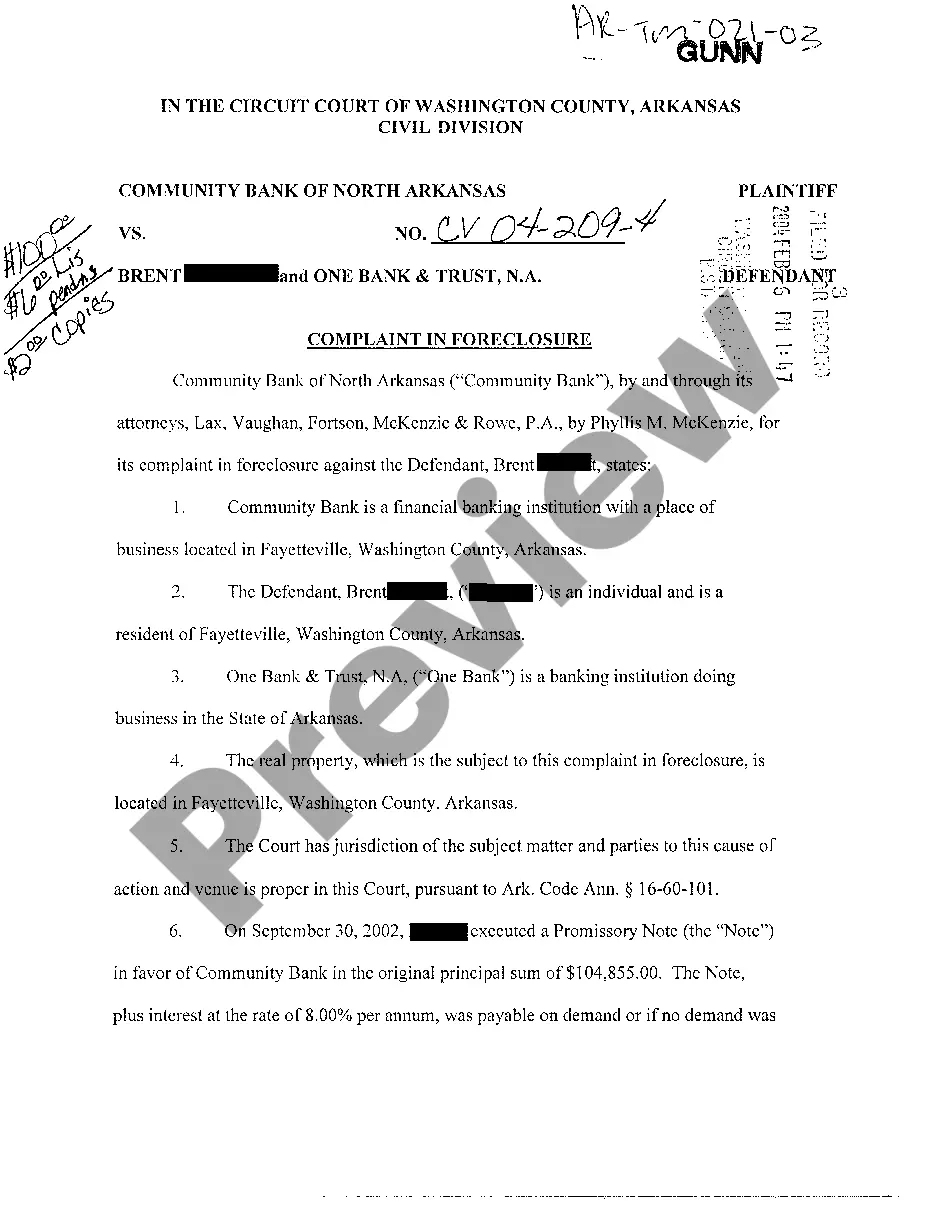

Little Rock, Arkansas Complaint in Foreclosure: A Comprehensive Overview Keywords: Little Rock, Arkansas, complaint, foreclosure, legal process, mortgage, default, lender, court, mediation, deficiency judgment, sale, homeowner, debt, lawsuit. Introduction: A Little Rock, Arkansas complaint in foreclosure refers to the legal action initiated by a lender against a homeowner who has defaulted on their mortgage payments. The complaint acts as a formal notification to the homeowner that the lender intends to foreclose on their property in order to recover the outstanding debt. This detailed description will explore the different types of complaints in foreclosure that can occur in Little Rock, Arkansas, shedding light on the legal process, homeowner's rights, and potential resolutions. 1. Judicial Foreclosure Complaint: In Little Rock, Arkansas, a judicial foreclosure complaint is the most common type of complaint initiated by lenders. The process starts when the lender files a complaint with the court, which includes details of the mortgage default and requests permission to foreclose on the property. Once the complaint is filed, the court will issue a summons to the homeowner, informing them about the lawsuit and the need to respond within a specific timeframe. 2. Non-Judicial Foreclosure Complaint: In some cases, Little Rock, Arkansas allows for non-judicial foreclosure proceedings, meaning the lender does not have to file a complaint with the court. Instead, the lender follows the procedures outlined in the mortgage contract or state law to initiate foreclosure. However, non-judicial foreclosure complaints are less common in Little Rock compared to judicial foreclosure complaints. 3. Mediation Complaint: Little Rock, Arkansas offers mediation programs for homeowners facing foreclosure. Homeowners who receive a foreclosure complaint may have the opportunity to participate in mediation, allowing both parties to negotiate and explore alternatives to foreclosure. The mediation complaint indicates the intention of the lender to involve the homeowner in a mediated resolution, providing an opportunity for a mutually agreeable outcome. 4. Deficiency Judgment Complaint: In situations where the foreclosure sale does not generate enough funds to cover the outstanding debt, lenders in Little Rock, Arkansas may file a deficiency judgment complaint. This type of complaint seeks to collect the remaining balance from the homeowner after the foreclosure sale. The court determines whether the homeowner is responsible for the deficiency, potentially leading to further financial obligations for the homeowner even after the property is sold. Conclusion: Understanding the different types of complaints in foreclosure in Little Rock, Arkansas is crucial for homeowners facing the threat of foreclosure. Whether it is a judicial or non-judicial foreclosure complaint, mediation complaint, or deficiency judgment complaint, homeowners should seek legal advice and explore potential resolutions to protect their rights and assets. It is important to respond promptly and engage in the legal process to increase the chances of a favorable outcome or potential alternatives to foreclosure.

Little Rock, Arkansas Complaint in Foreclosure: A Comprehensive Overview Keywords: Little Rock, Arkansas, complaint, foreclosure, legal process, mortgage, default, lender, court, mediation, deficiency judgment, sale, homeowner, debt, lawsuit. Introduction: A Little Rock, Arkansas complaint in foreclosure refers to the legal action initiated by a lender against a homeowner who has defaulted on their mortgage payments. The complaint acts as a formal notification to the homeowner that the lender intends to foreclose on their property in order to recover the outstanding debt. This detailed description will explore the different types of complaints in foreclosure that can occur in Little Rock, Arkansas, shedding light on the legal process, homeowner's rights, and potential resolutions. 1. Judicial Foreclosure Complaint: In Little Rock, Arkansas, a judicial foreclosure complaint is the most common type of complaint initiated by lenders. The process starts when the lender files a complaint with the court, which includes details of the mortgage default and requests permission to foreclose on the property. Once the complaint is filed, the court will issue a summons to the homeowner, informing them about the lawsuit and the need to respond within a specific timeframe. 2. Non-Judicial Foreclosure Complaint: In some cases, Little Rock, Arkansas allows for non-judicial foreclosure proceedings, meaning the lender does not have to file a complaint with the court. Instead, the lender follows the procedures outlined in the mortgage contract or state law to initiate foreclosure. However, non-judicial foreclosure complaints are less common in Little Rock compared to judicial foreclosure complaints. 3. Mediation Complaint: Little Rock, Arkansas offers mediation programs for homeowners facing foreclosure. Homeowners who receive a foreclosure complaint may have the opportunity to participate in mediation, allowing both parties to negotiate and explore alternatives to foreclosure. The mediation complaint indicates the intention of the lender to involve the homeowner in a mediated resolution, providing an opportunity for a mutually agreeable outcome. 4. Deficiency Judgment Complaint: In situations where the foreclosure sale does not generate enough funds to cover the outstanding debt, lenders in Little Rock, Arkansas may file a deficiency judgment complaint. This type of complaint seeks to collect the remaining balance from the homeowner after the foreclosure sale. The court determines whether the homeowner is responsible for the deficiency, potentially leading to further financial obligations for the homeowner even after the property is sold. Conclusion: Understanding the different types of complaints in foreclosure in Little Rock, Arkansas is crucial for homeowners facing the threat of foreclosure. Whether it is a judicial or non-judicial foreclosure complaint, mediation complaint, or deficiency judgment complaint, homeowners should seek legal advice and explore potential resolutions to protect their rights and assets. It is important to respond promptly and engage in the legal process to increase the chances of a favorable outcome or potential alternatives to foreclosure.