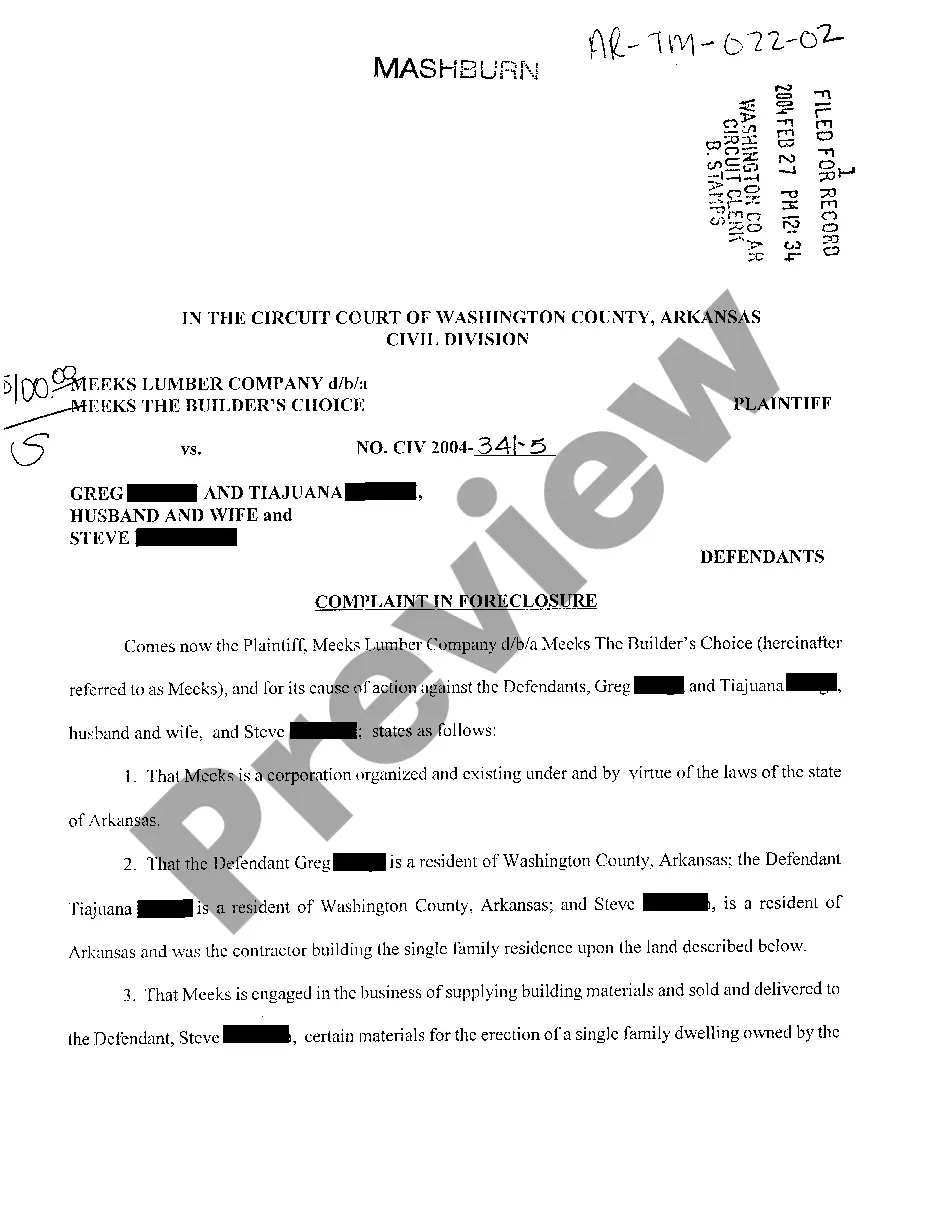

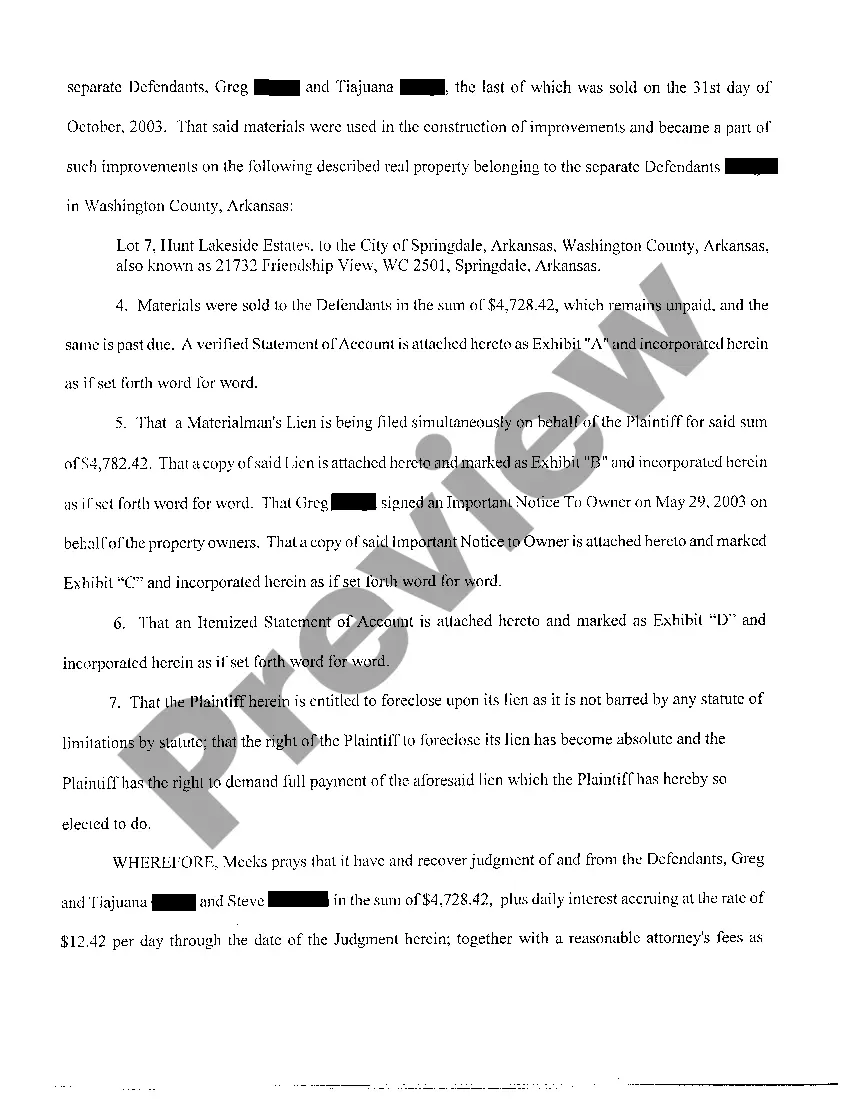

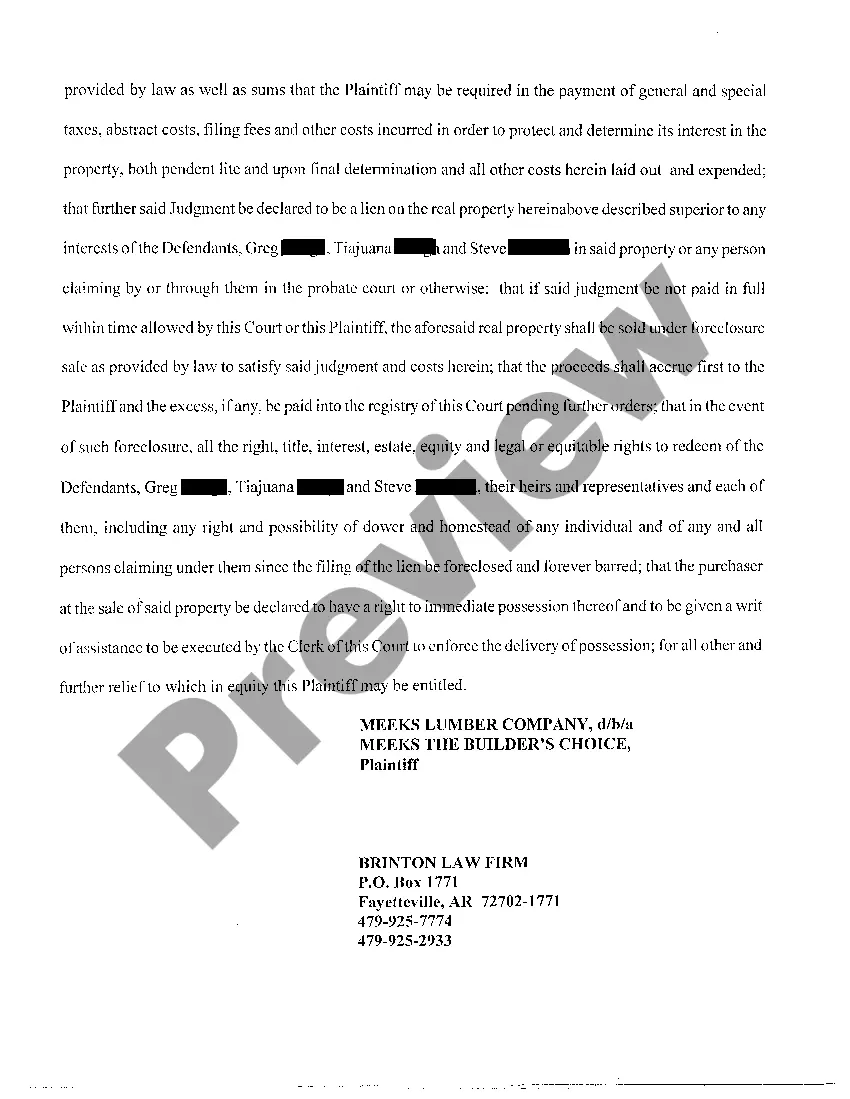

Little Rock Arkansas Complaint in Foreclosure is a legal document filed by a lender or financial institution in the state of Arkansas when a borrower defaults on their mortgage payments, leading to the initiation of a foreclosure process. This complaint serves as the initial step in the legal proceedings involved in foreclosing a property. Keywords: Little Rock Arkansas, complaint, foreclosure, legal document, lender, financial institution, borrower, defaults, mortgage payments, foreclosure process, legal proceedings. In Little Rock, Arkansas, there are three common types of complaints filed in foreclosure cases: 1. Judicial Foreclosure Complaint: This type of complaint is filed in Little Rock, Arkansas when a lender pursues a judicial foreclosure process. The lender initiates the complaint by stating the borrower's default, the outstanding balance due on the mortgage, and the details of the mortgage agreement. This complaint serves as a formal notification that legal action is being taken to foreclose on the property. 2. Non-Judicial Foreclosure Complaint: This type of complaint is filed when a lender chooses a non-judicial foreclosure process, wherein the foreclosure is conducted without court involvement. In Little Rock, Arkansas, the lender files a complaint stating the borrower's default and their intention to proceed with the foreclosure process according to state laws and the terms of the mortgage agreement. 3. Notice of Li's Pendent: Although not technically a complaint, the Notice of Li's Pendent is an important document filed in Little Rock, Arkansas, during the foreclosure process. This notice is recorded in the county or circuit clerk's office and provides public notice that a lawsuit or foreclosure action is pending on a specific property. While not a complaint itself, it is closely related to the foreclosure procedure. When Little Rock, Arkansas Complaints in Foreclosure are filed, they act as the initial legal documents that set the foreclosure process in motion. These complaints provide the borrower with notice of the lender's intent to foreclose and establish a timeline for further legal actions. It is crucial for borrowers to seek legal advice and respond appropriately to these complaints to protect their rights and explore possible alternatives or solutions to foreclosure.

Little Rock Arkansas Complaint in Foreclosure is a legal document filed by a lender or financial institution in the state of Arkansas when a borrower defaults on their mortgage payments, leading to the initiation of a foreclosure process. This complaint serves as the initial step in the legal proceedings involved in foreclosing a property. Keywords: Little Rock Arkansas, complaint, foreclosure, legal document, lender, financial institution, borrower, defaults, mortgage payments, foreclosure process, legal proceedings. In Little Rock, Arkansas, there are three common types of complaints filed in foreclosure cases: 1. Judicial Foreclosure Complaint: This type of complaint is filed in Little Rock, Arkansas when a lender pursues a judicial foreclosure process. The lender initiates the complaint by stating the borrower's default, the outstanding balance due on the mortgage, and the details of the mortgage agreement. This complaint serves as a formal notification that legal action is being taken to foreclose on the property. 2. Non-Judicial Foreclosure Complaint: This type of complaint is filed when a lender chooses a non-judicial foreclosure process, wherein the foreclosure is conducted without court involvement. In Little Rock, Arkansas, the lender files a complaint stating the borrower's default and their intention to proceed with the foreclosure process according to state laws and the terms of the mortgage agreement. 3. Notice of Li's Pendent: Although not technically a complaint, the Notice of Li's Pendent is an important document filed in Little Rock, Arkansas, during the foreclosure process. This notice is recorded in the county or circuit clerk's office and provides public notice that a lawsuit or foreclosure action is pending on a specific property. While not a complaint itself, it is closely related to the foreclosure procedure. When Little Rock, Arkansas Complaints in Foreclosure are filed, they act as the initial legal documents that set the foreclosure process in motion. These complaints provide the borrower with notice of the lender's intent to foreclose and establish a timeline for further legal actions. It is crucial for borrowers to seek legal advice and respond appropriately to these complaints to protect their rights and explore possible alternatives or solutions to foreclosure.