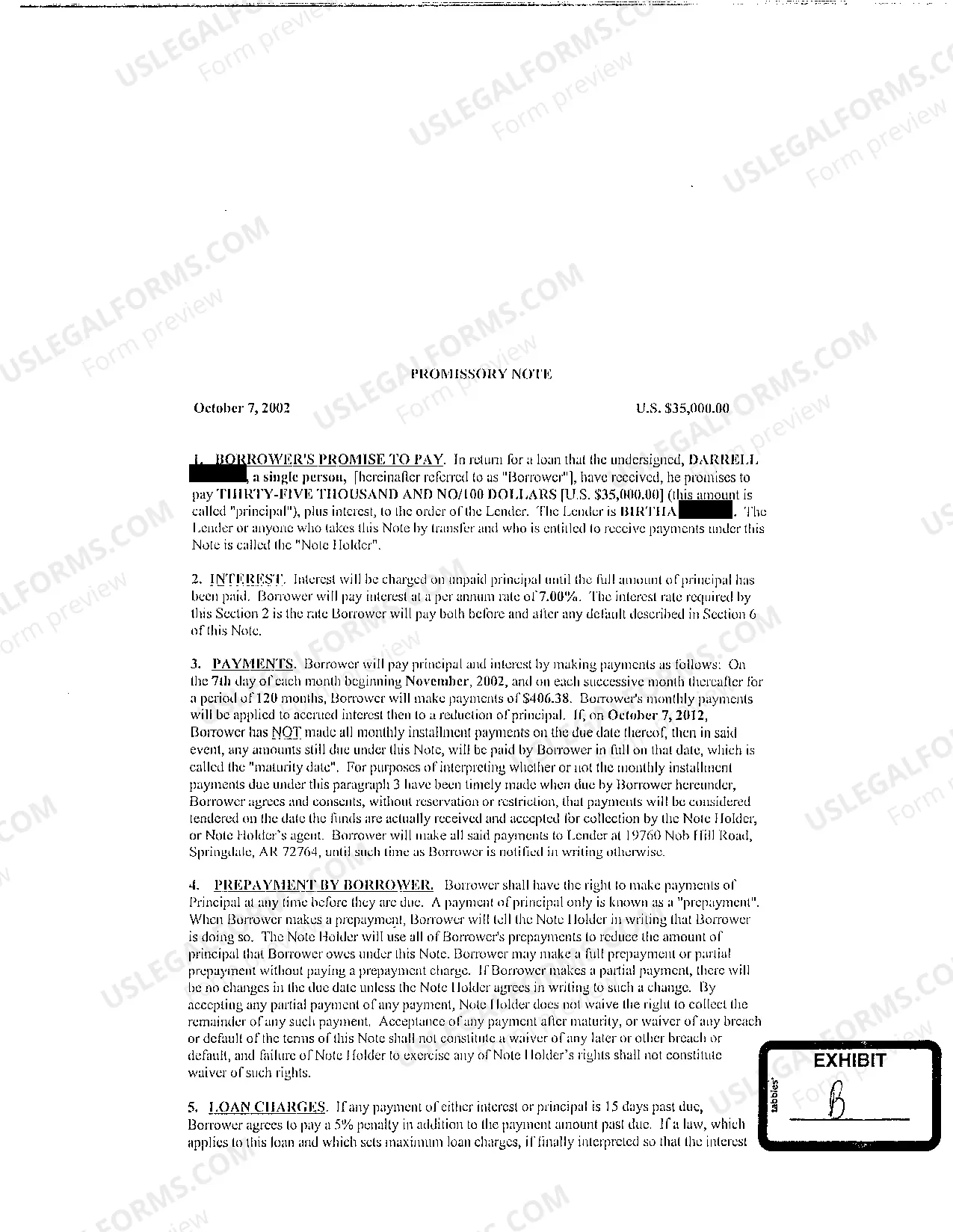

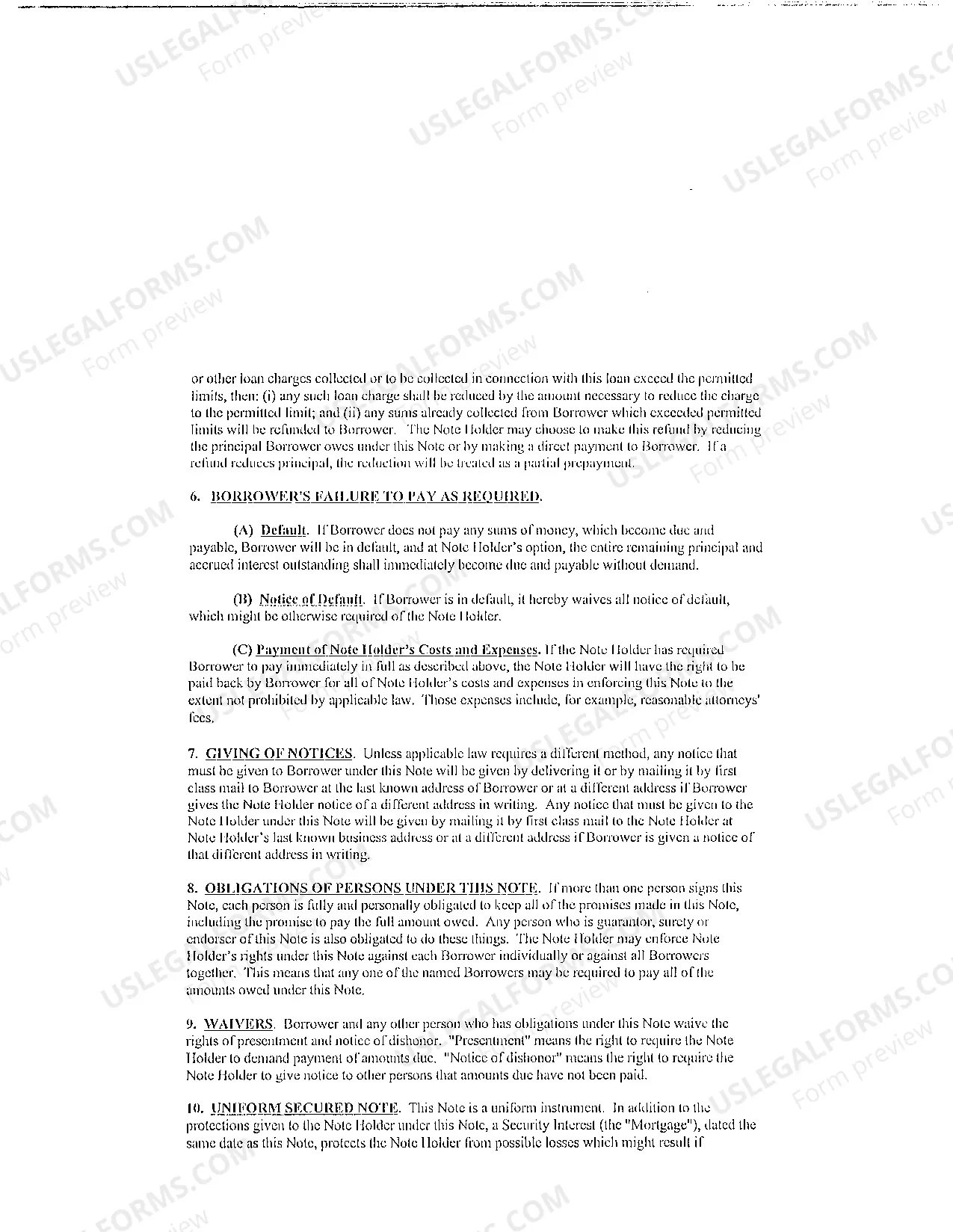

A foreclosure complaint in Little Rock, Arkansas is a legal document filed by a mortgage lender or bank when a homeowner fails to make their mortgage payments, leading to default and potential foreclosure of the property. This complaint initiates a judicial process wherein the lender seeks to reclaim possession of the property and sell it to recover the unpaid loan amount. Typically, the complaint includes details about the borrower, property, loan agreement, and the default amount. In Little Rock, Arkansas, there are various types of foreclosure complaints depending on the specific circumstances involved. These may include: 1. Judicial Foreclosure Complaint: This is the most common type of foreclosure complaint in Little Rock, Arkansas. It involves the lender filing a lawsuit against the borrower in order to obtain a court order allowing the foreclosure to proceed. This type of complaint requires the lender to provide evidence of the unpaid debt and the borrower's default. 2. Non-Judicial Foreclosure Complaint: Little Rock, Arkansas also allows for non-judicial foreclosure proceedings. In this case, the lender initiates the foreclosure without going through the court system. Non-judicial foreclosure complaints follow a specific procedure outlined in the state's foreclosure statutes, regulations, and mortgage documents. 3. Strict Foreclosure Complaint: A strict foreclosure complaint is less common in Little Rock, Arkansas, but it is an alternative process available to lenders. Under this method, the court grants the lender title to the property without a foreclosure sale if the borrower fails to cure the default according to the court's predetermined timeline. 4. Foreclosure by Advertisement: Little Rock, Arkansas also permits foreclosure by advertisement, sometimes referred to as a power of sale. It involves the lender selling the property at a public auction after publishing a notice of the foreclosure sale in a local newspaper for a specified period. This type of foreclosure complaint allows for a quicker resolution compared to a judicial foreclosure. When a foreclosure complaint is filed in Little Rock, Arkansas, the borrower has the opportunity to respond to the allegations and present a defense. They may be able to prevent the foreclosure or negotiate a resolution, such as a loan modification or repayment plan. It is essential for borrowers to seek legal advice and explore all available options when facing a foreclosure complaint in Little Rock, Arkansas.

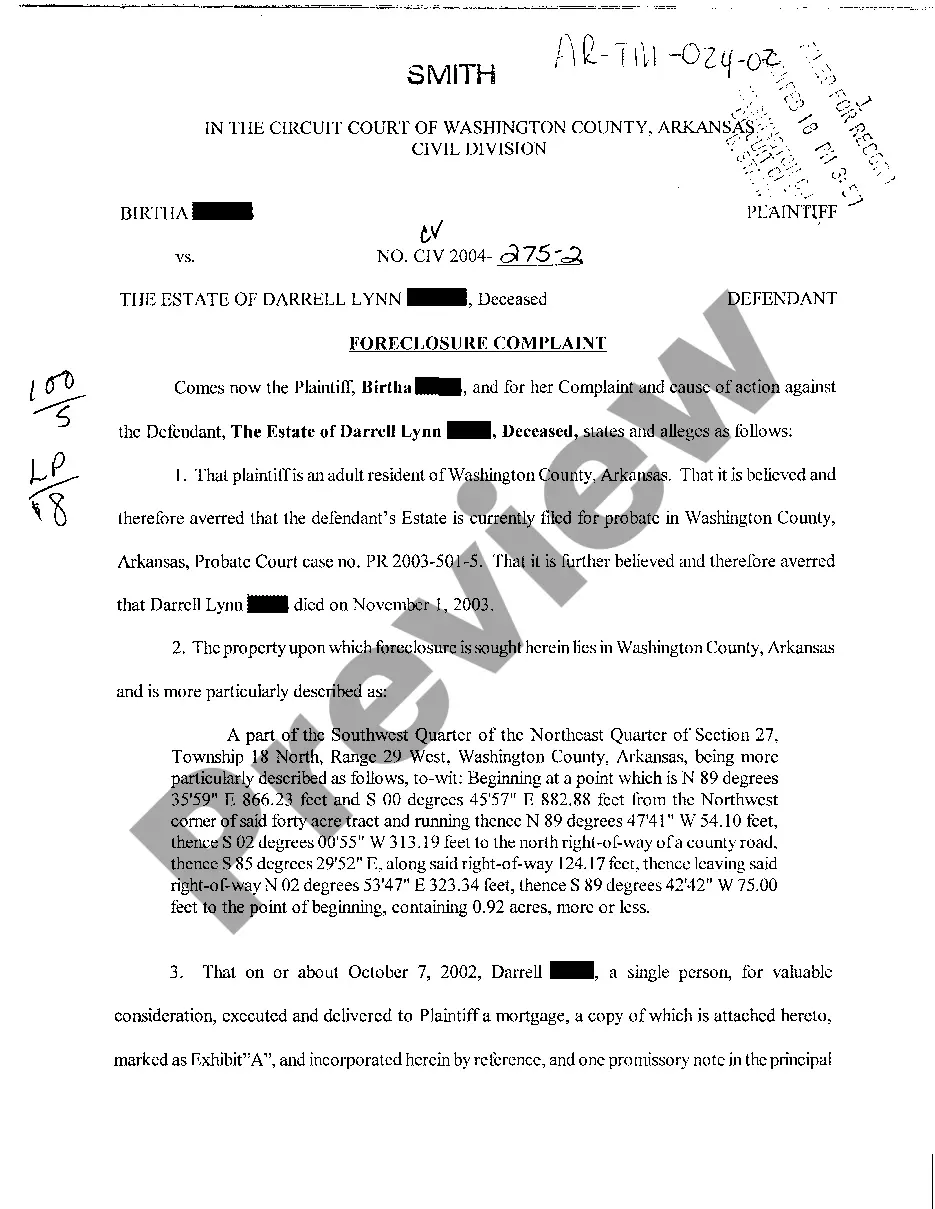

Little Rock Arkansas Foreclosure Complaint

Description

How to fill out Little Rock Arkansas Foreclosure Complaint?

Locating authenticated templates pertinent to your regional laws can be challenging unless you utilize the US Legal Forms repository.

It’s an online archive of over 85,000 legal documents catering to both personal and professional requirements and various real-world situations.

All the files are accurately classified by usage area and jurisdiction, making it as straightforward as pie to find the Little Rock Arkansas Foreclosure Complaint.

- Review the Preview mode and form description.

- Ensure you’ve selected the correct one that meets your needs and fully complies with your local jurisdiction regulations.

- Look for an alternative template, if necessary.

- Once you notice any discrepancies, use the Search tab above to find the accurate one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

A 10-day pre-foreclosure notice in Arkansas is a formal notification sent to homeowners before the foreclosure process begins. It informs homeowners that they have ten days to resolve certain issues, such as outstanding payments. This notice provides homeowners in Little Rock an opportunity to seek help and understand their options, potentially preventing the filing of foreclosure complaints.

Foreclosures can affect various regions, but areas with higher housing costs and economic instability are often hit harder. In Little Rock, Arkansas, certain neighborhoods may experience more foreclosure complaints due to unemployment and housing market fluctuations. Staying informed about these trends can help potential homebuyers make better financial decisions.

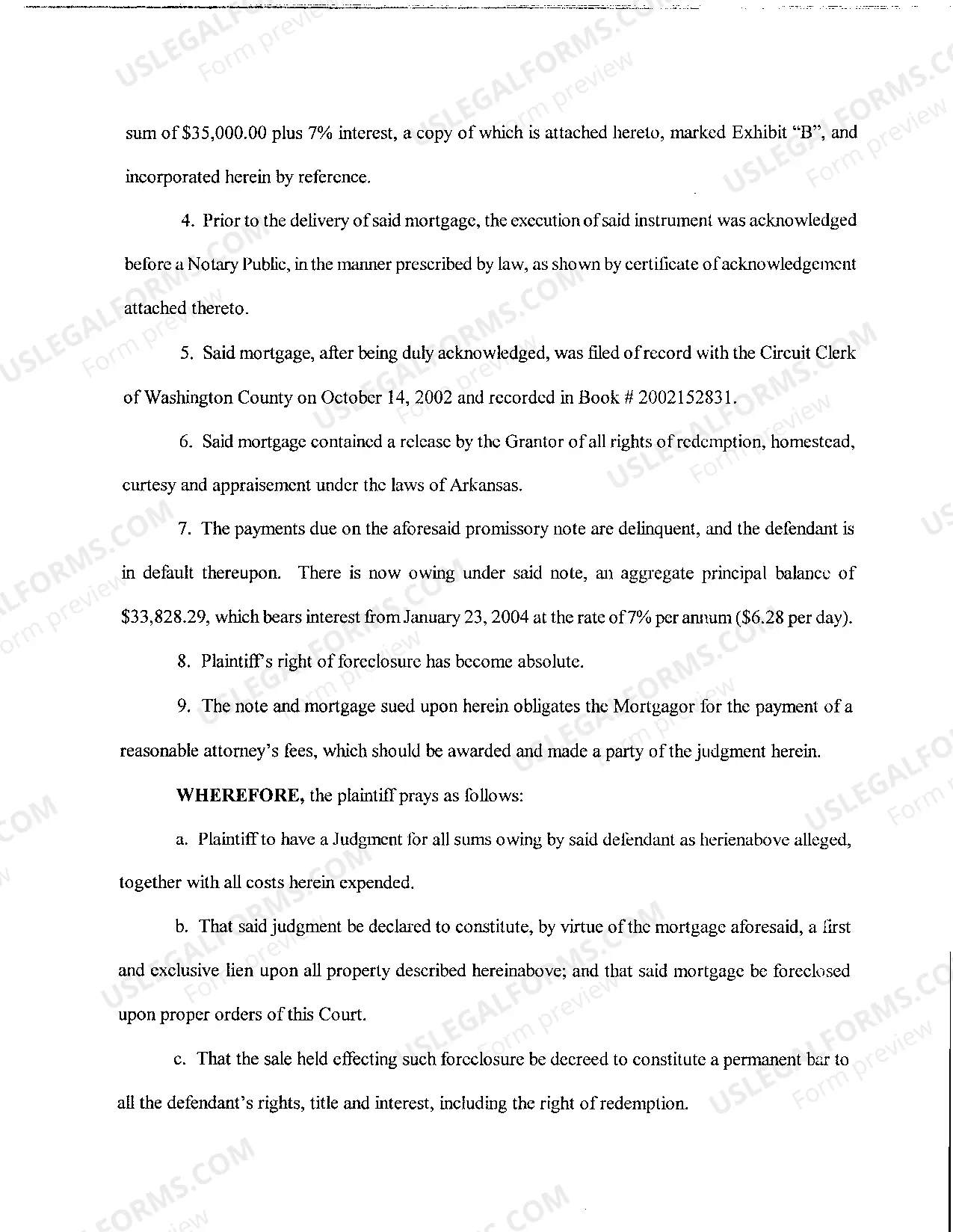

The most likely reason for foreclosure is the inability to make mortgage payments due to various personal circumstances. In Little Rock, Arkansas, foreclosure complaints may happen due to factors like unexpected job changes or other financial hardships. Understanding these triggers can help homeowners take proactive measures to avoid foreclosure.

Homeowners typically suffer the most significant financial loss in a foreclosure. When a foreclosure occurs, the equity built up in the home is lost, impacting their long-term financial health. Moreover, in Little Rock, Arkansas, foreclosure complaints can leave lasting marks on credit scores, making future homeownership opportunities more challenging.

The biggest cause of foreclosures is often a financial crisis faced by homeowners due to job loss, medical expenses, or unexpectedly high debt. In Little Rock, Arkansas, foreclosure complaints frequently arise when homeowners cannot keep up with mortgage payments. This financial strain can lead to a series of missed payments, ultimately culminating in a foreclosure action.

The foreclosure process in Little Rock, Arkansas, generally takes around six months to a year from the initial filing of the complaint to the final sale. The length can vary based on several factors, including court delays or the complexity of the case. It is essential to act quickly if you are facing foreclosure. Seeking guidance from resources like USLegalForms can help you navigate the legal landscape effectively.

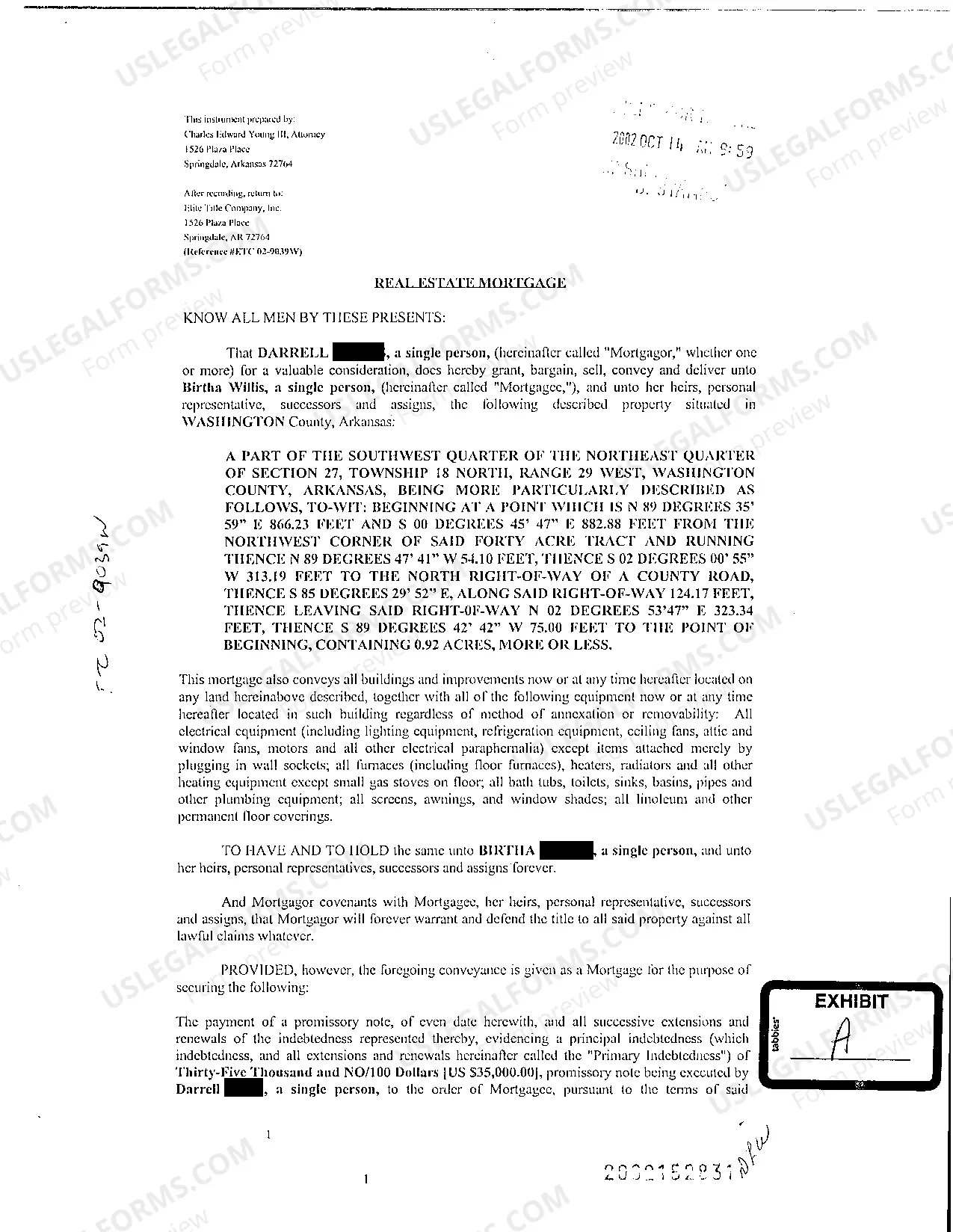

Yes, Arkansas offers a redemption period after foreclosure, which typically lasts for one year. During this time, homeowners can make arrangements to redeem their property by repaying outstanding debts and fees. This gives you a valuable opportunity to reclaim your home. Finding proper legal documentation and support can simplify this process, so consider USLegalForms for your needs.

In Little Rock, Arkansas, the redemption period for a mortgage typically lasts one year after the foreclosure sale. This period allows you to reclaim your property by paying off the total amount owed, including any fees. Staying aware of this timeline is crucial for safeguarding your home. If you need assistance understanding the process, consider visiting USLegalForms for helpful resources.

Arkansas has specific laws governing foreclosure proceedings to protect homeowners. These laws require lenders to provide written notice of default and allow homeowners a redemption period that typically lasts for one year after a sale. Understanding these laws in the context of a Little Rock Arkansas Foreclosure Complaint can provide homeowners with valuable insights. If you need further guidance on your rights, the US Legal Forms platform can assist you in navigating these legalities effectively.

In Arkansas, the redemption period for foreclosure is typically nine months after the sale of the property. During this time, homeowners have the right to reclaim their home by paying the full amount owed, along with accrued costs. This provision emphasizes the importance of understanding the Little Rock Arkansas Foreclosure Complaint process and the potential options available to you. Consulting legal resources can guide you effectively through this period.