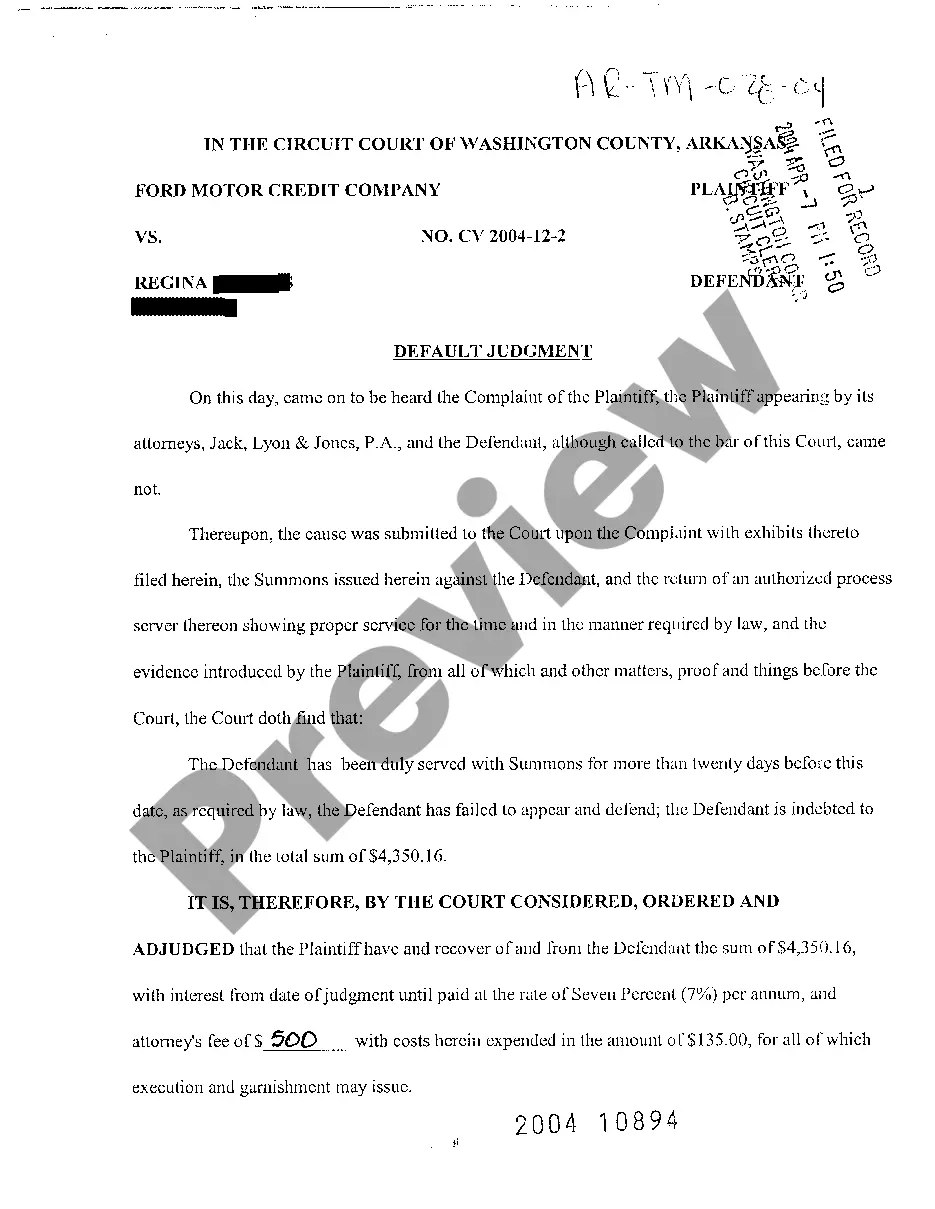

Little Rock, Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile: A Detailed Description In Little Rock, Arkansas, a Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile refers to a legal ruling issued by a court when a borrower fails to respond to a lawsuit filed against them for the remaining debt following the repossession and sale of a vehicle. This judgment can have various types depending on the specific circumstances of the case. Let's explore some different types of judgments that may arise in such situations: 1. Money Judgment: This type of judgment is the most common and is issued when the court determines the outstanding deficiency amount owed by the borrower to the creditor after the repossession and sale of the vehicle. The monetary judgment may include the balance of the loan, interest, repossession fees, legal costs, and additional charges. 2. Default Judgment: A Default Judgment occurs when the borrower fails to respond or appear in court after being served with a complaint for deficiency. In such cases, the court typically decides in favor of the creditor, assuming the allegations made in the complaint are true. This judgment can allow the creditor to pursue legal actions to collect the debt owed. 3. Judgment Lien: If a Default Judgment is granted, the creditor may seek a judgment lien against the borrower's property, including real estate, to secure the repayment of the debt. This lien can prevent the borrower from selling or transferring ownership of their property without first satisfying the debt owed. 4. Wage Garnishment: In some instances, the court may grant a Default Judgment that allows the creditor to obtain a wage garnishment order. This order enables the creditor to collect the outstanding deficiency directly from the borrower's wages, usually through a percentage deduction imposed on their earnings. 5. Bank Account Levy: Another type of judgment that may be issued is a bank account levy. This enables the creditor to freeze or withdraw funds from the borrower's bank accounts to fulfill the unpaid deficiency judgment. When faced with a Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile in Little Rock, Arkansas, it is crucial for borrowers to seek legal advice promptly. They may have options to challenge the judgment, negotiate repayment plans, or explore the possibility of bankruptcy to find relief from the debt burden. Dealing with a default judgment can be overwhelming, but being well-informed is the first step to protecting your rights and finding a potential resolution.

Little Rock Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile

Description

How to fill out Little Rock Arkansas Default Judgment On Complaint For Deficiency After Repossession And Sale Of Automobile?

We always strive to reduce or avoid legal damage when dealing with nuanced law-related or financial affairs. To do so, we sign up for legal solutions that, as a rule, are very costly. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to an attorney. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Little Rock Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is equally straightforward if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Little Rock Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Little Rock Arkansas Default Judgment on Complaint for Deficiency after Repossession and Sale of Automobile is suitable for your case, you can pick the subscription option and make a payment.

- Then you can download the form in any suitable format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!