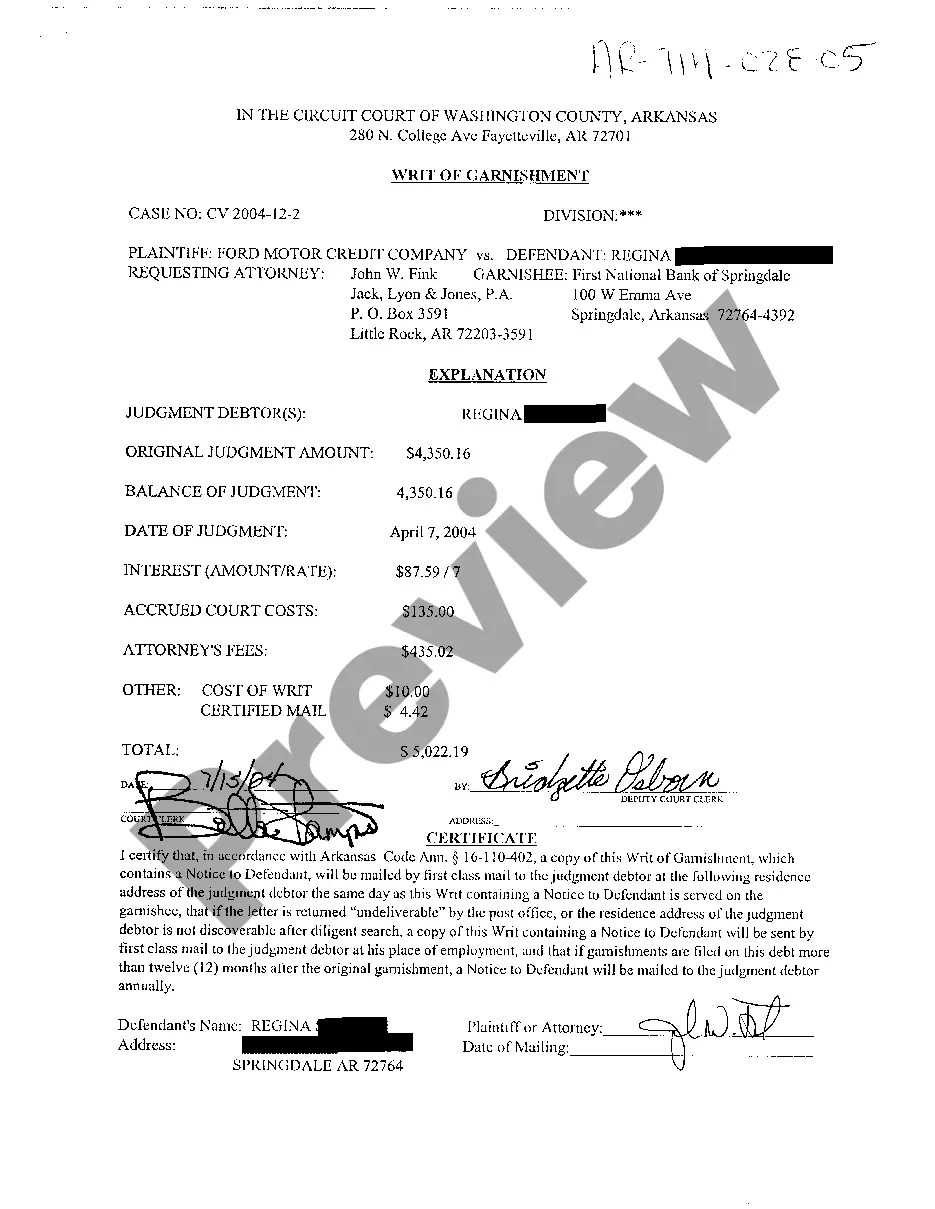

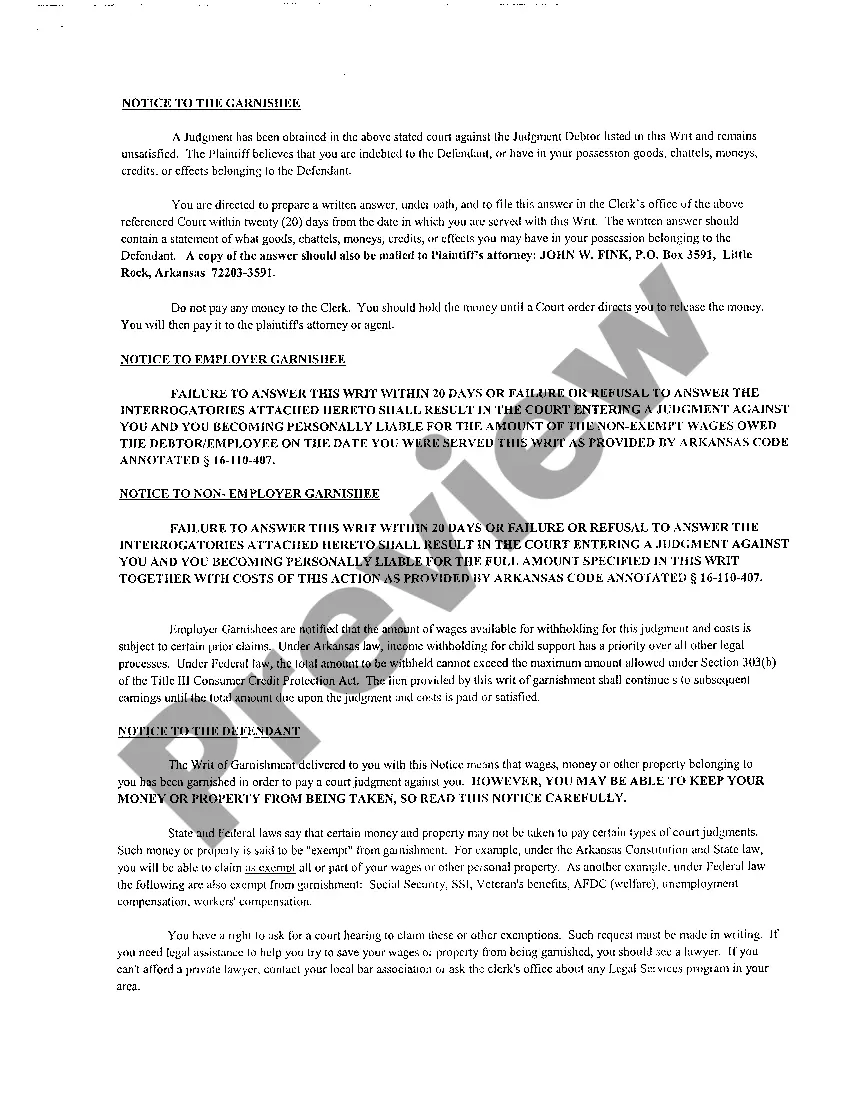

Little Rock, Arkansas Writ of Garnishment: A Detailed Description and Types Introduction: The Little Rock, Arkansas Writ of Garnishment is a legal process used to collect outstanding debts by seizing a portion of a debtor's wages or assets. It allows creditors to obtain a court order that directs a third party, such as an employer or financial institution, to withhold funds owed to the debtor to satisfy the debt. This mechanism provides a means for individuals and businesses to enforce judgments and recover owed amounts. Key Keywords: — Little RockArkansassa— - Writ of Garnishment — Legal proc—sOutstandingdDEg de—t— - Seizing wages or assets — Coorderorde— - Third party - Withhold funds — Satisfy deb— - Enforce judgments - Recover owed amounts Types of Little Rock, Arkansas Writ of Garnishment: 1. Wage Garnishment: — Little Rock employers may be served with a Writ of Garnishment, obligating them to withhold a certain percentage of an employee's wages to satisfy a debt. This type of garnishment aims to secure periodic payments from the debtor's earnings. 2. Bank Account Garnishment: — The Writ of Garnishment can also be used to target a debtor's bank account. Upon receiving the court order, financial institutions in Little Rock are required to freeze and eventually transfer funds held in the debtor's account to the creditor. This method offers an effective means to collect debts in a lump sum or through installments. 3. Property or Asset Garnishment: — In some cases, the Little Rock, Arkansas Writ of Garnishment can be applied to seize and sell a debtor's assets to satisfy the debt. This may include real estate, vehicles, investments, or other valuable possessions. The proceeds from the sale are then used to settle the outstanding obligation. 4. Federal and State Tax Garnishment: — When a debtor owes federal or state taxes, the Little Rock, Arkansas Writ of Garnishment can be utilized to intercept portions of the debtor's income tax refund or other eligible government payments. This process assists in collecting outstanding tax liabilities and redirecting the funds to the appropriate tax authorities. Conclusion: The Little Rock, Arkansas Writ of Garnishment is a powerful legal tool for creditors seeking to collect outstanding debts. Whether through wage garnishment, bank account garnishment, property or asset garnishment, or federal and state tax garnishment, this process allows creditors to recover owed amounts by compelling third parties to withhold funds owed to the debtor. It is crucial for debtors to be aware of their rights and seek appropriate legal counsel when faced with a Writ of Garnishment.

Little Rock Arkansas Writ of Garnishment

Description

How to fill out Little Rock Arkansas Writ Of Garnishment?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Little Rock Arkansas Writ of Garnishment becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the Little Rock Arkansas Writ of Garnishment takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve selected the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Little Rock Arkansas Writ of Garnishment. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!