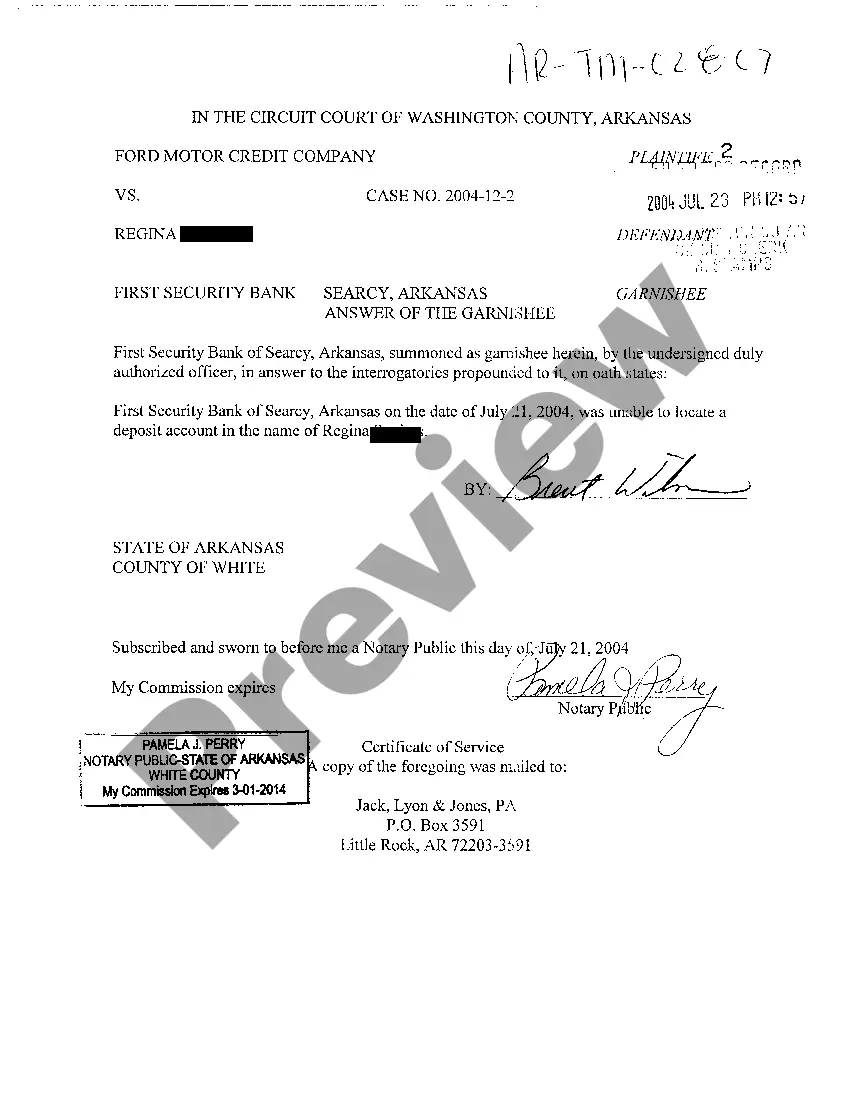

The Little Rock Arkansas Answer of the Garnishee is a legal document that outlines the response of a garnishee in a garnishment case. In simpler terms, garnishment is the legal process where a creditor collects a debt owed by a debtor by taking a portion of their wages or assets through a court order. The Little Rock Arkansas Answer of the Garnishee provides information on how the garnishee plans to handle the garnishment order and their role in the process. The garnishee is typically a third party such as an employer, bank, or financial institution that holds the debtor's money, property, or assets. In the Little Rock Arkansas Answer of the Garnishee, the garnishee is required to disclose any funds or property they hold that belong to the debtor. This includes bank accounts, wages, stocks, or any other assets that the debtor may have. The garnishee must provide detailed information about the amount of these assets and their current status. Additionally, the Little Rock Arkansas Answer of the Garnishee may include the garnishee's intention to claim any exemptions allowed by law. Exemptions in Arkansas may vary, and the garnishee may notify the court of any applicable exemptions the debtor might be entitled to, such as exemptions on certain types of income or property. It is important to note that there can be different types of Little Rock Arkansas Answer of the Garnishee, depending on the specific nature of the garnishment case. For instance: 1. Little Rock Arkansas Answer of the Garnishee (Wage Garnishment): This type of garnishment occurs when a debtor's wages are being garnished. The garnishee, which is typically the debtor's employer, would provide details regarding the debtor's wages and any deductions that will be made to satisfy the debt. 2. Little Rock Arkansas Answer of the Garnishee (Bank Account Garnishment): In cases where the debtor's bank account is being garnished, the bank would act as the garnishee. The answer of the garnishee in this scenario would involve disclosing the account balance and any upcoming transactions. 3. Little Rock Arkansas Answer of the Garnishee (Property Garnishment): If the debtor's property is involved in the garnishment process, the garnishee could be a landlord, tenant, or any other party holding the debtor's property. The Little Rock Arkansas Answer of the Garnishee would outline the details of the property and its value. Overall, the Little Rock Arkansas Answer of the Garnishee is a crucial legal document that ensures transparency and compliance with the garnishment process. It provides important information about the assets held by the garnishee and their role in satisfying the debtor's debt.

Little Rock Arkansas Answer of The Garnishee

Description

How to fill out Little Rock Arkansas Answer Of The Garnishee?

If you are looking for a legitimate form, it’s exceptionally challenging to select a more suitable service than the US Legal Forms site – one of the largest collections on the internet.

With this collection, you can discover numerous form examples for business and personal needs categorized by types and states, or keywords.

Thanks to the top-notch search feature, acquiring the latest Little Rock Arkansas Answer of The Garnishee is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finish the account registration process.

Obtain the template. Choose the file format and download it to your device.

- Additionally, the accuracy of each document is verified by a group of professional lawyers who routinely review the templates on our platform and refresh them according to the most current state and county regulations.

- If you are already familiar with our platform and possess an account, all that's required to obtain the Little Rock Arkansas Answer of The Garnishee is to Log In to your account and click the Download button.

- If this is your first time using US Legal Forms, simply adhere to the instructions below.

- Ensure you have located the form you need. Examine its description and utilize the Preview feature (if available) to review its content. If it does not fulfill your requirements, use the Search bar at the top of the page to find the necessary record.

- Validate your selection. Click the Buy now button. Subsequently, choose the desired subscription plan and input your details to create an account.

Form popularity

FAQ

The small claims court in Arkansas primarily handles civil cases involving disputes of $5,000 or less. This court has jurisdiction over various cases, including personal injury, property damage, and debts. If you have a case that fits this description, you may find US Legal Forms useful in understanding the specific requirements and procedures. This can help you navigate the Little Rock Arkansas Answer of The Garnishee confidently.

Suing the state of Arkansas involves specific steps that differ from suing private individuals. You often need to file a claim with the Arkansas Claims Commission first. If the claim is not resolved, you can then file a lawsuit in the appropriate state court. Utilizing the US Legal platform can provide you with the necessary forms and important details for this unique legal process.

In Arkansas, the time frame for filing criminal charges, known as the statute of limitations, depends on the nature of the crime. For most felonies, the time limit is typically three years, while some serious crimes may have no time limit. It's essential to understand the statutes relevant to your situation for accurate information.

Filing a writ of garnishment in Arkansas involves a specific legal process. You must first obtain a judgment in your favor, then complete the necessary forms to initiate the garnishment. These forms must be filed with the court, along with a proposed writ for the judge's signature. Using the US Legal platform can help simplify this process by providing the correct forms and guidance.

In Arkansas, the time limit to file a civil suit can vary based on the type of claim. Generally, the statute of limitations ranges from one to six years. For example, personal injury cases usually must be filed within three years. To avoid missing deadlines, it's crucial to review the details of your case and seek advice if needed.

In Arkansas, the maximum amount you can sue for in civil court generally depends on the type of case you are pursuing. For small claims, the limit is typically $5,000. However, for more significant claims, there is no strict monetary cap. It is advisable to verify the specifics based on your case and consult legal resources for detailed guidance.

To file a lawsuit in Arkansas, you must prepare and submit a complaint to the appropriate court. The complaint outlines your claims and the relief you seek. You should also ensure that you follow the rules for service of process to notify the defendant. For assistance with legal forms, consider using the US Legal platform to access the necessary documents efficiently.

Winning a lawsuit in Little Rock Arkansas requires thorough preparation, understanding the legal issues at stake, and gathering substantial evidence to support your claims. Building a strong case often benefits from legal guidance, ensuring you adhere to procedural rules. Using platforms like US Legal Forms can help you craft compelling documents that enhance your chances of success.

Yes, debt collectors can garnish wages in Little Rock Arkansas, but only after obtaining a court judgment against the debtor. The process involves the creditor filing for a garnishment order, and certain limits and exemptions apply to protect a portion of your income. Familiarizing yourself with these legal intricacies through resources like US Legal Forms can empower you during such situations.

Yes, Arkansas is indeed a garnishment state, which means creditors can legally collect debts by garnishing wages or bank accounts through court orders. However, there are specific rules and exemptions in place to protect certain income and assets. Understanding these laws, especially in Little Rock Arkansas, is essential when dealing with garnishment.