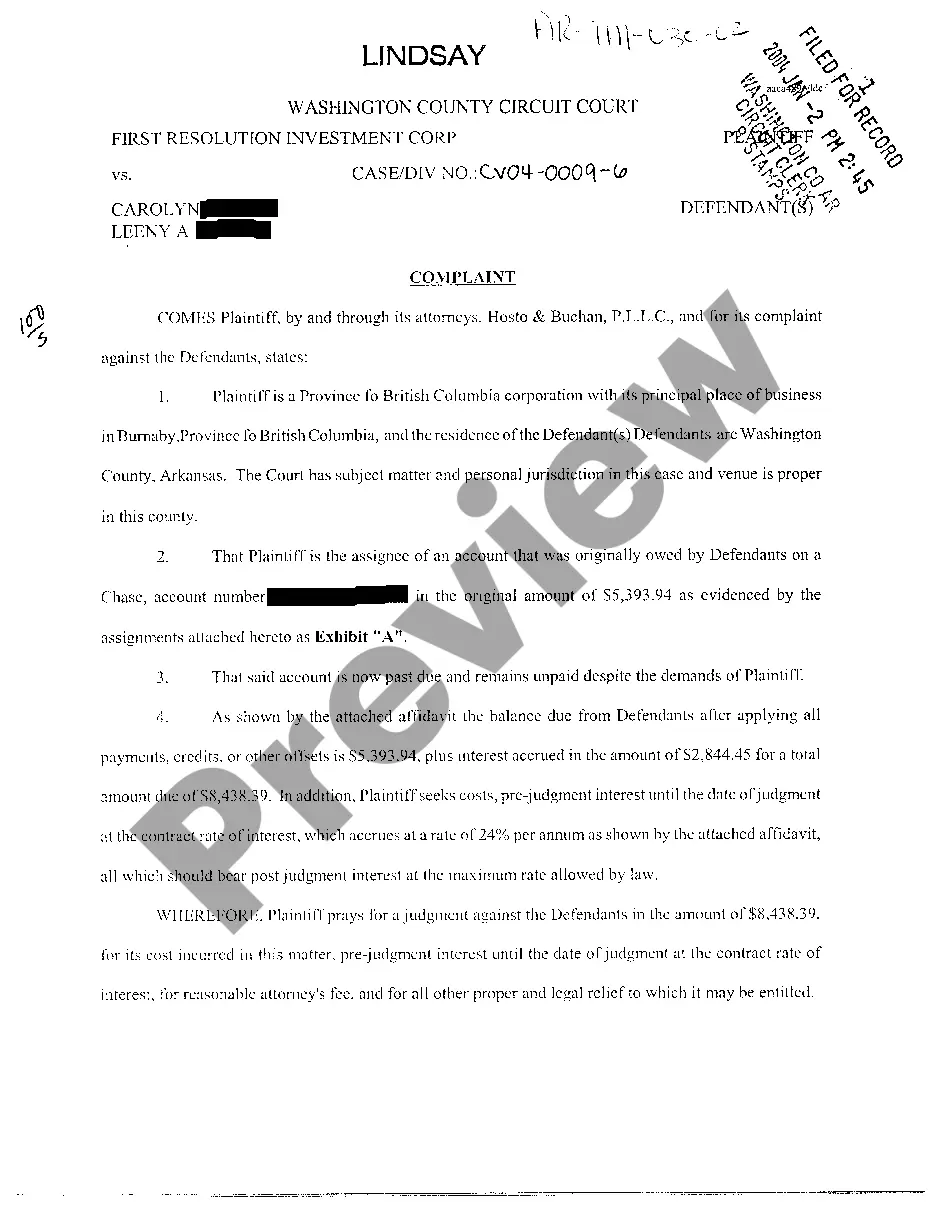

Little Rock Arkansas Complaint for Collection of Debt: In Little Rock, Arkansas, a Complaint for Collection of Debt is a legal document filed by a creditor or debt collection agency to initiate a lawsuit against a debtor who has failed to repay a debt. This legal action aims to enforce the collection of the outstanding amount owed by the debtor. The Complaint for Collection of Debt begins with the plaintiff, the party filing the lawsuit, providing their identifying information, such as the name and address of the creditor or collection agency. The debtor, also known as the defendant, is then identified with their personal information, such as full name, address, and contact details. The document also includes a detailed account of the debt in question, outlining the type of debt incurred by the defendant, such as credit card debt, personal loan, medical expenses, or auto loan. Additionally, it includes the original amount owed, any interest accrued, and all relevant dates concerning the debt's origination and subsequent transactions. Furthermore, the Little Rock Arkansas Complaint for Collection of Debt emphasizes the defendant's failure to fulfill their repayment obligations. It highlights the debtor's noncompliance with previous repayment agreements, defaults on payments, and their refusal or inability to resolve the debt despite multiple collection attempts and notifications. Apart from these key components, the Little Rock Arkansas Complaint for Collection of Debt also provides an itemized statement of the debt, including a breakdown of the principal owed, any interest or penalties incurred, and any additional costs related to the collection process, such as attorney fees or court costs. The Complaint for Collection of Debt may vary depending on the specific circumstances and parties involved. Some types of Little Rock Arkansas Complaint for Collection of Debt include: 1. Consumer Debt Complaint: Involves debts owed by individuals for personal expenses, credit card debts, or medical bills. 2. Commercial Debt Complaint: Pertains to outstanding debts owed by businesses or commercial entities for goods or services rendered. 3. Medical Debt Complaint: Focuses specifically on delinquent medical bills and healthcare expenses owed by patients. 4. Student Loan Debt Complaint: Relates to the collection of unpaid student loans, typically offered through federal or private lenders to fund education. Resolving a Little Rock Arkansas Complaint for Collection of Debt often requires the defendant to respond within a specified period, usually by filing an answer or seeking legal representation. Failure to respond or contest the complaint may result in a default judgment being issued against the defendant, potentially leading to wage garnishment, asset seizure, or other methods of debt collection authorized by law.

Little Rock Arkansas Complaint for Collection of Debt

Description

How to fill out Little Rock Arkansas Complaint For Collection Of Debt?

If you are searching for a valid form, it’s difficult to choose a better place than the US Legal Forms website – one of the most considerable online libraries. Here you can find thousands of templates for business and individual purposes by categories and regions, or keywords. With our advanced search function, getting the most up-to-date Little Rock Arkansas Complaint for Collection of Debt is as easy as 1-2-3. Additionally, the relevance of each document is confirmed by a group of skilled lawyers that on a regular basis check the templates on our platform and revise them based on the latest state and county demands.

If you already know about our platform and have a registered account, all you should do to receive the Little Rock Arkansas Complaint for Collection of Debt is to log in to your profile and click the Download option.

If you make use of US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have discovered the sample you want. Check its explanation and use the Preview feature (if available) to see its content. If it doesn’t meet your needs, utilize the Search field near the top of the screen to get the needed record.

- Affirm your selection. Click the Buy now option. After that, choose the preferred pricing plan and provide credentials to sign up for an account.

- Make the financial transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Get the template. Select the format and download it to your system.

- Make adjustments. Fill out, revise, print, and sign the acquired Little Rock Arkansas Complaint for Collection of Debt.

Every single template you add to your profile has no expiry date and is yours forever. You always have the ability to access them using the My Forms menu, so if you want to receive an extra copy for enhancing or creating a hard copy, you may return and download it again at any time.

Take advantage of the US Legal Forms professional library to gain access to the Little Rock Arkansas Complaint for Collection of Debt you were seeking and thousands of other professional and state-specific samples on one platform!