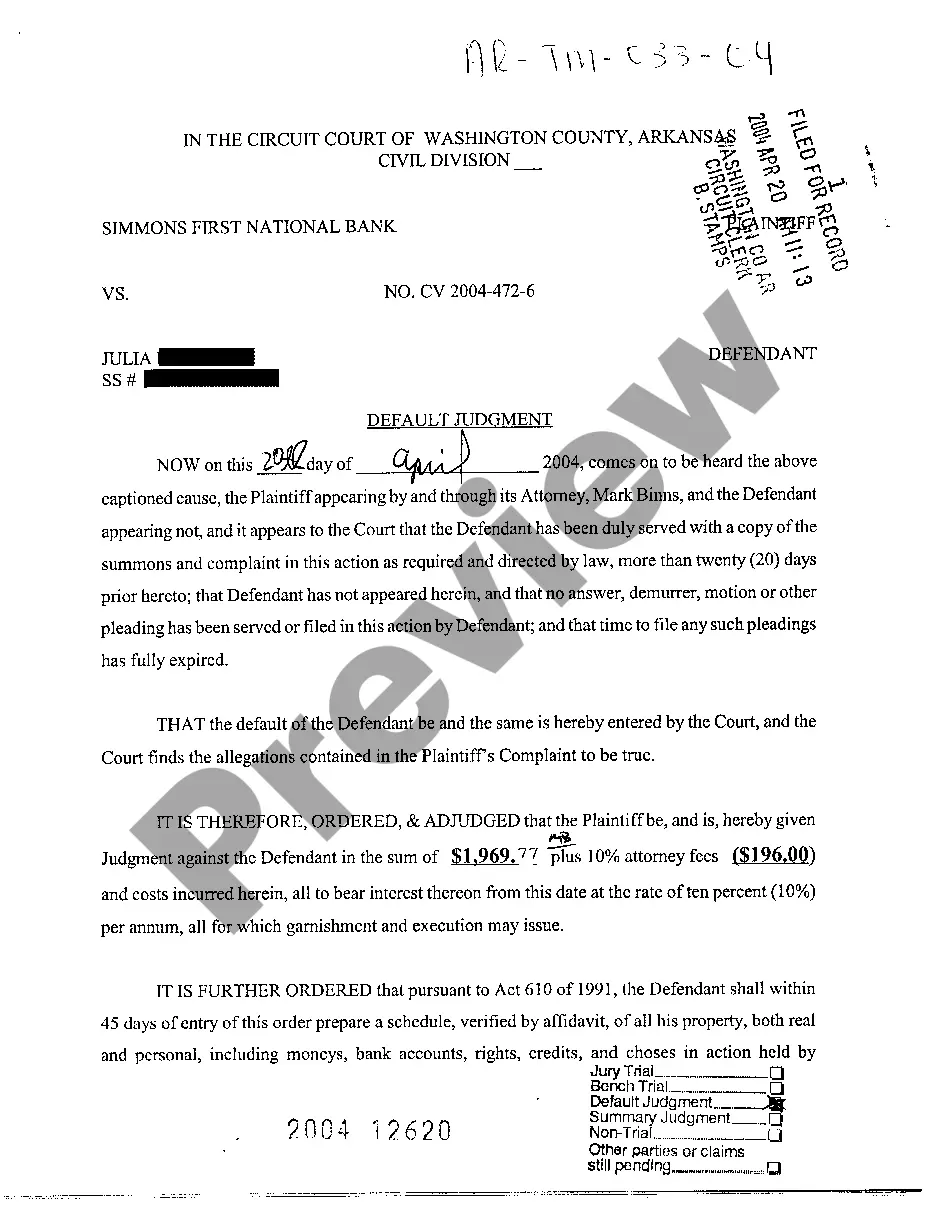

In Little Rock, Arkansas, a Default Judgment on Complaint for Collection of Debt is a legal ruling made when the defendant fails to respond or appear in court after being served with a complaint for debt collection. This judgment is issued in favor of the plaintiff, who is typically the creditor or debt collector, and enables them to pursue various collection actions to recover the owed amount from the defendant. The Little Rock Arkansas Default Judgment on Complaint for Collection of Debt signifies that the court has reviewed the evidence presented by the plaintiff and accepted it as sufficient to establish that the defendant indeed owes the debt. It also demonstrates the defendant's failure to contest or defend against the allegations outlined in the complaint. Default judgments are crucial in debt collection cases as they grant the plaintiff certain rights and remedies. These may include: 1. Garnishment of wages: With a Little Rock Arkansas Default Judgment on Complaint for Collection of Debt, the plaintiff can seek an order to deduct money directly from the defendant's wages. This process allows the creditor to recover a portion of the debt regularly until it's fully paid. 2. Bank account levy: The plaintiff can request the court to freeze the defendant's bank accounts and seize funds to satisfy the debt owed. 3. Asset seizure: If the defendant possesses valuable assets, such as real estate or personal property, the plaintiff may request the court to seize these assets and sell them to repay the debt. 4. Credit reporting: The default judgment is likely to impact the defendant's credit score negatively, making it harder for them to obtain credit in the future. While the term "Little Rock Arkansas Default Judgment on Complaint for Collection of Debt" may not have distinct subtypes, there can be variations in the specific details of the judgment based on factors such as the total amount owed, the debt's nature (credit card, medical bills, loans, etc.), and the court's discretion in determining the collection methods. In summary, a Little Rock Arkansas Default Judgment on Complaint for Collection of Debt is a court ruling issued against a defendant who fails to respond or appear in court regarding a debt collection complaint. It authorizes the plaintiff to take legal actions to recover the owed amount, including wage garnishment, bank account levy, asset seizure, and impacts the defendant's creditworthiness.

Little Rock Arkansas Default Judgment on Complaint for Collection of Debt

Description

How to fill out Little Rock Arkansas Default Judgment On Complaint For Collection Of Debt?

Do you require a trustworthy and budget-friendly legal forms supplier to obtain the Little Rock Arkansas Default Judgment on Complaint for Collection of Debt? US Legal Forms is your top option.

Whether you need a simple contract to establish guidelines for living with your partner or a collection of templates to proceed with your separation or divorce in court, we have you covered. Our platform offers over 85,000 current legal document samples for both personal and commercial use. All templates we provide are not generic and are structured in alignment with the regulations of specific states and counties.

To retrieve the document, you must Log In to your account, find the necessary form, and click the Download button next to it. Please remember that you can download your previously acquired document templates at any time from the My documents section.

Are you a newcomer to our website? No need to worry. You can create an account with ease, but first, ensure you do the following.

Now you can establish your account. Then choose the subscription plan and proceed with payment. After payment is completed, download the Little Rock Arkansas Default Judgment on Complaint for Collection of Debt in any available file format. You can revisit the website at any time and redownload the document free of charge.

Locating current legal forms has never been simpler. Try US Legal Forms today and no longer spend your precious time searching for legal documents online.

- Verify that the Little Rock Arkansas Default Judgment on Complaint for Collection of Debt complies with the regulations of your state and locality.

- Review the form's specifics (if available) to learn who and what the document pertains to.

- Restart your search if the form does not fit your legal circumstances.

Form popularity

FAQ

Most lawsuits tend to settle before reaching trial, often within a few months after filing. In the context of Little Rock, Arkansas, parties usually reach an agreement during negotiations or mediation, especially when seeking a default judgment on a complaint for collection of debt. Settlements can provide quicker resolutions compared to prolonged litigation. Engaging legal support, such as platforms like uslegalforms, often yields better outcomes in negotiations.

In Arkansas, collection agencies have five years to try collecting a debt, according to state law. This timeframe starts from the date of last activity on the account. If a default judgment has been obtained, the agency may have more power to collect, but they still operate within this period. Understanding these time limits can provide you with crucial leverage regarding a complaint for collection of debt.

In Arkansas, the minimum amount you can sue for generally starts at $0, but there are practical limits. While you can file a claim for a very small amount, consider the costs involved in litigation. For a little more substantial sum, pursuing a default judgment on a complaint for collection of debt may be more effective. Always weigh the effort against the potential recovery.

Responding to a default judgment requires prompt action to avoid losing your rights. In Little Rock, Arkansas, you may file a motion to vacate the judgment, explaining why you didn’t respond originally. Ensure you gather supporting evidence, as the court will review your reasons. Additionally, understanding the process related to a complaint for collection of debt can help strengthen your case.

Suing for $500 can be worthwhile, particularly if the amount is significant to you. In Little Rock, Arkansas, pursuing a default judgment on a complaint for collection of debt can prompt the debtor to settle. It’s important to consider court costs and potential legal fees, as these can add up. Ultimately, the decision depends on your financial situation and the likelihood of recovering the debt.

To answer a lawsuit in Arkansas, start by drafting a formal written response that addresses each allegation made in the complaint. Be sure to include any defenses you may have and file your answer with the court in a timely manner. Staying organized and on schedule is crucial, especially if you're facing a Little Rock Arkansas Default Judgment on Complaint for Collection of Debt. You can utilize platforms like USLegalForms for templates and guidance.

The best way to win a lawsuit often involves thorough preparation and evidence gathering. Understand the claims made against you and construct a solid defense. Additionally, consult with legal experts who specialize in cases like Little Rock Arkansas Default Judgment on Complaint for Collection of Debt to improve your chances of success.

In Arkansas, you typically have 30 days to respond to a lawsuit after being served with the complaint. It’s important to mark your calendar and prepare a thorough response within this timeframe. Failure to respond could result in a default judgment against you. If you are navigating a case that includes a Little Rock Arkansas Default Judgment on Complaint for Collection of Debt, it's best to act quickly.

After a default judgment is entered in Arkansas, the winning party can take steps to collect the awarded amount. This might include garnishing wages, placing liens on property, or other legal collection methods. Unfortunately, a default judgment can significantly impact your credit score and financial future. If you're dealing with a Little Rock Arkansas Default Judgment on Complaint for Collection of Debt, it’s wise to explore your options with a legal professional.

The best way to answer a summons is to read the document carefully and understand the claims against you. You should then prepare a written response that clearly addresses each point made in the summons. Filing your answer on time is crucial to avoid a default judgment. If you are facing a Little Rock Arkansas Default Judgment on Complaint for Collection of Debt, consider consulting with an attorney.