Little Rock Arkansas Complaint for Breach of Fiduciary Duty: A Comprehensive Overview Keywords: Little Rock Arkansas, Complaint, Breach of Fiduciary Duty, Types Introduction: In Little Rock, Arkansas, complaints for breach of fiduciary duty occur when an individual or entity entrusted with a fiduciary duty fails to act in the best interests of another party, resulting in harm or financial loss. These complaints can arise in various contexts, such as corporate governance, financial planning, trust administration, and more. This article aims to provide a detailed description of Little Rock Arkansas complaints for breach of fiduciary duty, including relevant keywords and potential types of such complaints. Description: In Little Rock, Arkansas, a complaint for breach of fiduciary duty typically starts with a plaintiff (the aggrieved party) alleging that a defendant owed them a fiduciary duty, which is a legal obligation to act in the best interests of the plaintiff. The complaint outlines specific acts or omissions where the defendant breached this duty, causing harm or financial loss to the plaintiff. Keywords: — Little Rock Arkansas: Refers to the specific geographic location where the complaint is being filed, ensuring jurisdiction within the state laws and court systems of Arkansas. — Complaint: The formal legal document filed with the court that initiates the lawsuit against the alleged breaching party. — Breach of Fiduciary Duty: The core claim in the complaint, indicating the defendant's failure to act in the plaintiff's best interests, violating their fiduciary obligation. — Fiduciary Duty: The legal duty requiring one party (the fiduciary) to act with loyalty, good faith, and in the best interests of another party (the beneficiary). — Little Rock Arkansas Complaint for Breach of Fiduciary Duty: Signifies the specific type of legal action taken within Little Rock, Arkansas, relating to a breach of fiduciary duty. Types of Little Rock Arkansas Complaints for Breach of Fiduciary Duty: 1. Corporate Governance: In cases involving shareholders, officers, directors, or executives, a complaint for breach of fiduciary duty may be filed. Allegations could include self-dealing, conflicts of interest, misuse of corporate assets, mismanagement, or acts contrary to shareholder interests. 2. Financial Planning: Complaints may arise when financial advisors or planners breach their fiduciary duties by providing misleading advice, overcharging fees, making unsuitable investments, or failing to disclose conflicts of interest. 3. Trust Administration: A complaint could arise against a trustee who mismanages trust assets, fails to distribute assets to beneficiaries according to the trust's terms, or engages in self-dealing, resulting in financial harm to the beneficiaries. 4. Professional Fiduciaries: Professionals in occupations such as attorneys, accountants, or agents appointed under power of attorney may be subject to complaints for breaching their fiduciary duties by acting outside the scope of their authority, misusing client funds, or failing to act diligently and in their clients' best interests. Conclusion: In Little Rock, Arkansas, complaints for breach of fiduciary duty encompass a wide range of scenarios, involving allegations of wrongdoing by individuals or entities who hold a fiduciary duty towards another party. These complaints can arise in various contexts, including corporate governance, financial planning, and trust administration. By understanding the core concepts and potential types of complaints related to Little Rock Arkansas breach of fiduciary duty cases, individuals can be better informed regarding their legal rights and potential courses of action.

Little Rock Arkansas Complaint for Breach of Fiduciary Duty

Description

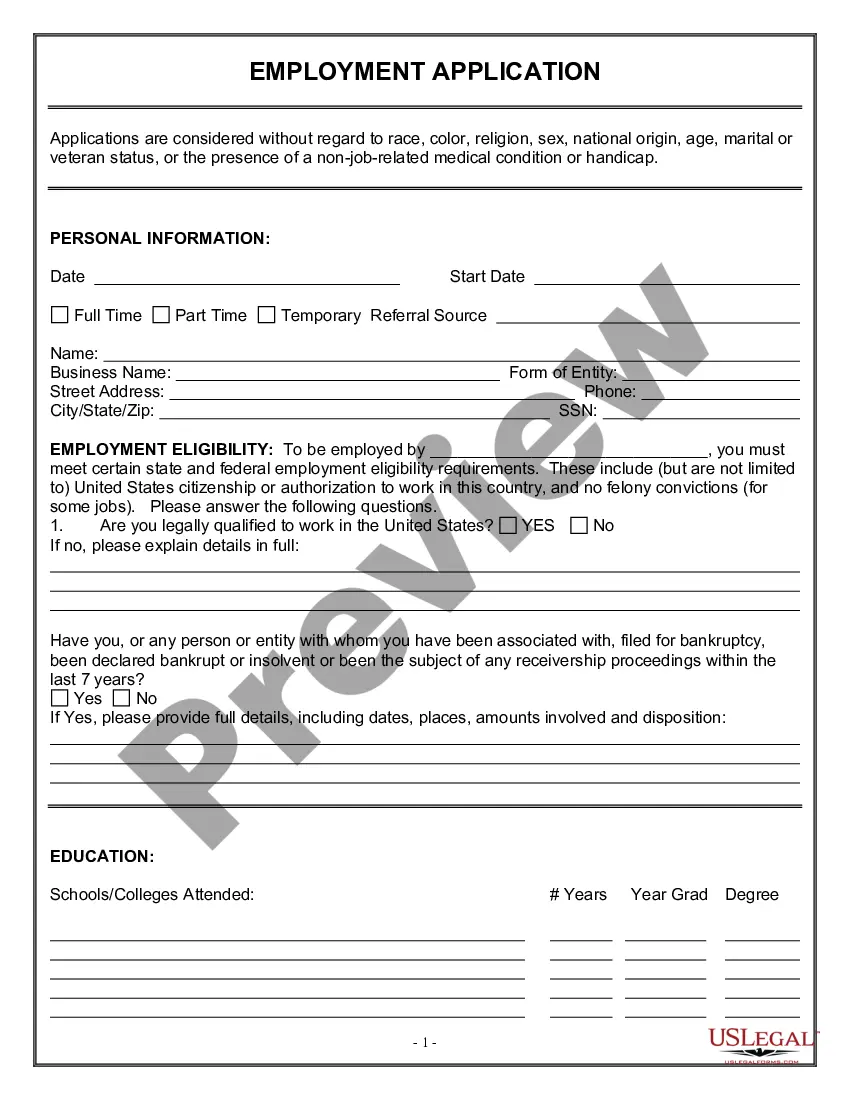

How to fill out Little Rock Arkansas Complaint For Breach Of Fiduciary Duty?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person without any legal background to create such paperwork from scratch, mostly due to the convoluted terminology and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our service provides a huge library with over 85,000 ready-to-use state-specific documents that work for practically any legal situation. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you want the Little Rock Arkansas Complaint for Breach of Fiduciary Duty or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Little Rock Arkansas Complaint for Breach of Fiduciary Duty quickly using our reliable service. In case you are already an existing customer, you can go ahead and log in to your account to get the needed form.

Nevertheless, in case you are unfamiliar with our platform, ensure that you follow these steps prior to downloading the Little Rock Arkansas Complaint for Breach of Fiduciary Duty:

- Ensure the form you have chosen is suitable for your location since the regulations of one state or area do not work for another state or area.

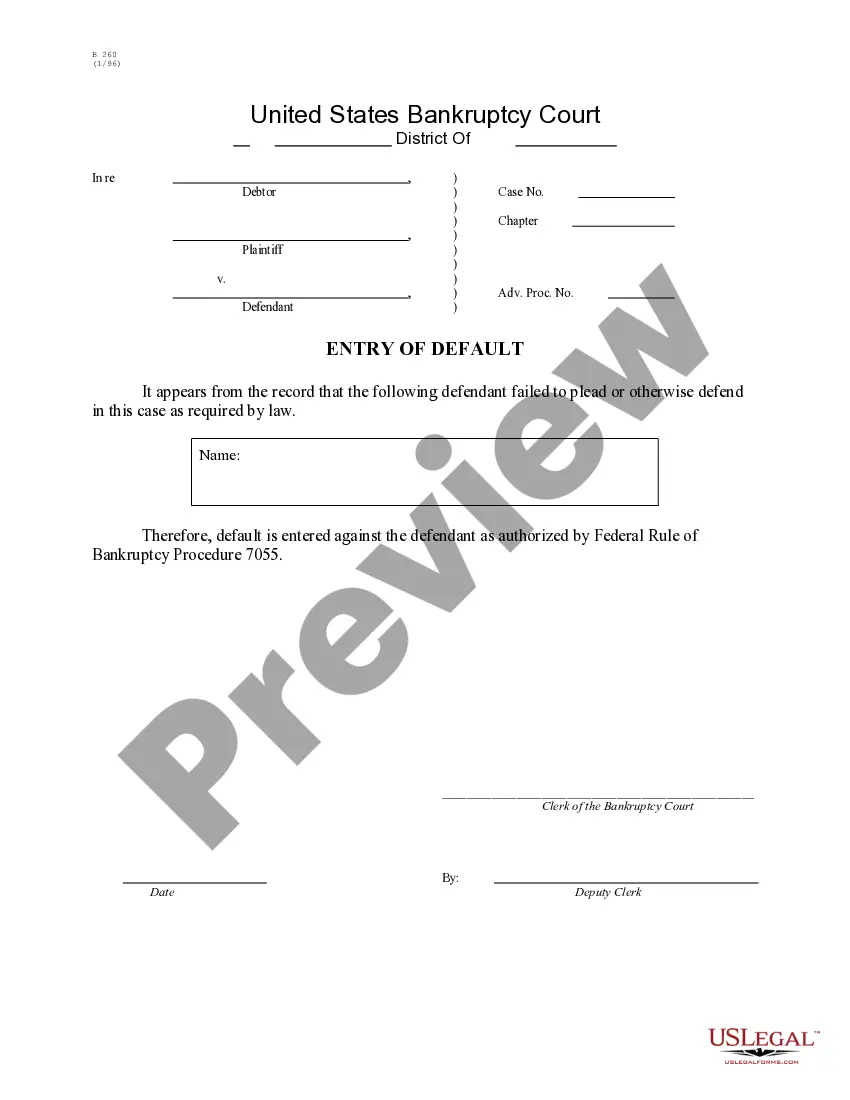

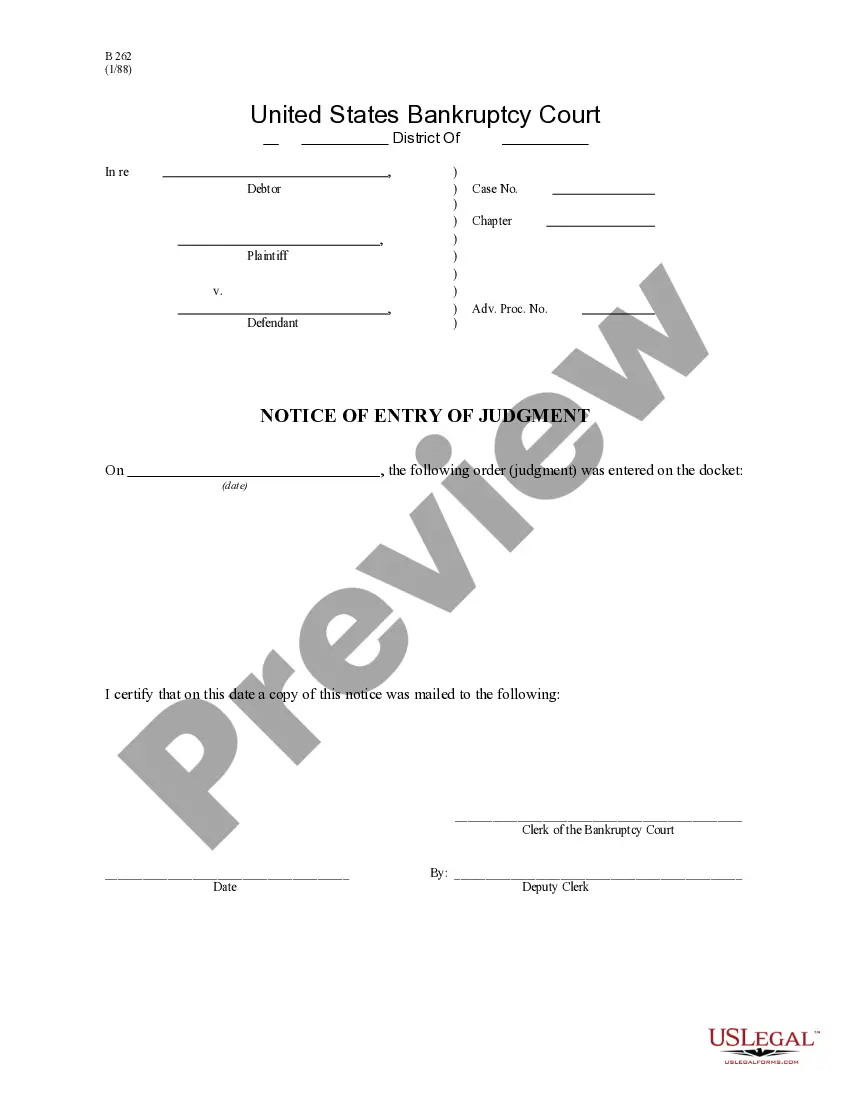

- Preview the document and go through a short description (if available) of scenarios the document can be used for.

- If the one you selected doesn’t meet your requirements, you can start over and look for the needed document.

- Click Buy now and choose the subscription plan you prefer the best.

- Access an account {using your login information or create one from scratch.

- Pick the payment gateway and proceed to download the Little Rock Arkansas Complaint for Breach of Fiduciary Duty once the payment is completed.

You’re all set! Now you can go ahead and print out the document or fill it out online. Should you have any issues locating your purchased documents, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.