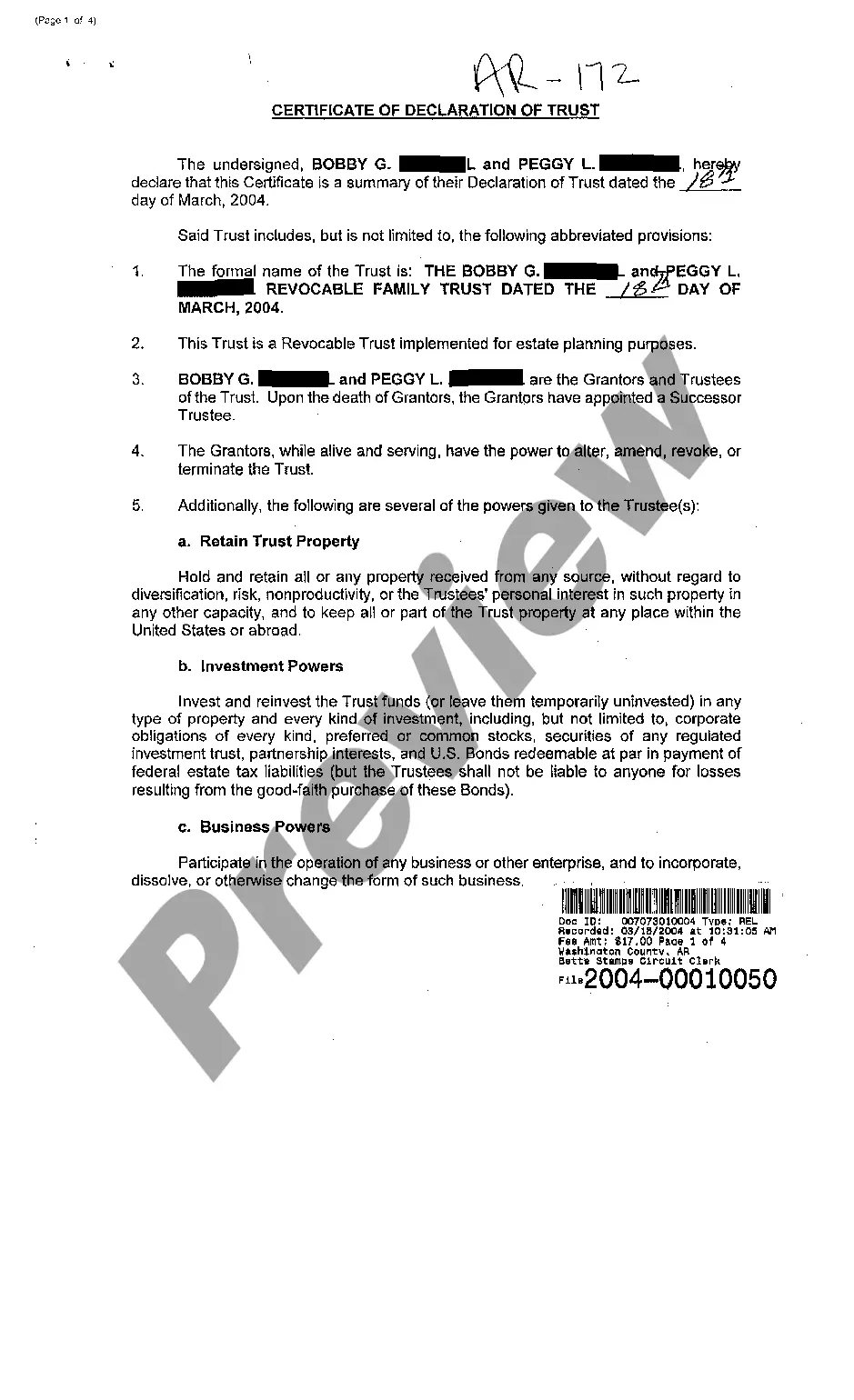

The Little Rock Arkansas Certificate of Declaration of Trust is a legal document that establishes a trust in the city of Little Rock, Arkansas. It outlines the terms and conditions under which the trust operates, including the purpose of the trust, the powers and duties of the trustee, and the beneficiaries of the trust. Keywords: Little Rock Arkansas, Certificate of Declaration of Trust, legal document, trust, terms and conditions, purpose, powers and duties, trustee, beneficiaries. There are several types of Little Rock Arkansas Certificate of Declaration of Trust, each catering to different needs and circumstances. The most common types include: 1. Revocable Living Trust: This type of trust allows the creator (known as the granter or settler) to retain control over the assets placed in the trust during their lifetime. The trust provisions can be modified or revoked by the granter at any time. Keywords: Little Rock Arkansas, Certificate of Declaration of Trust, revocable living trust, granter, settler, control, assets, lifetime. 2. Irrevocable Trust: Unlike a revocable living trust, an irrevocable trust cannot be modified or revoked once it is established. This type of trust provides added protection and tax benefits, as the assets placed in the trust are permanently transferred out of the granter's estate. Keywords: Little Rock Arkansas, Certificate of Declaration of Trust, irrevocable trust, modified, revoked, protection, tax benefits, assets, granter's estate. 3. Charitable Trust: A charitable trust is established with the intention of benefiting a charitable organization or cause. This type of trust allows individuals to support organizations they are passionate about while potentially receiving tax benefits. Keywords: Little Rock Arkansas, Certificate of Declaration of Trust, charitable trust, charitable organization, cause, support, tax benefits, passionate. 4. Special Needs Trust: A special needs trust is designed to provide for the care and support of a disabled individual without jeopardizing their eligibility for government benefits. It allows assets to be set aside for the individual's benefit, ensuring they receive critical support without impacting their eligibility. Keywords: Little Rock Arkansas, Certificate of Declaration of Trust, special needs trust, care, support, disabled individual, government benefits, assets, eligibility. 5. Testamentary Trust: A testamentary trust is established through a will and only takes effect upon the granter's death. This type of trust enables individuals to determine how their assets will be managed and distributed after their passing, providing for their loved ones in a structured manner. Keywords: Little Rock Arkansas, Certificate of Declaration of Trust, testamentary trust, will, effect, death, assets, managed, distributed, loved ones. It is essential to consult with an attorney or legal professional well-versed in trust law in Little Rock, Arkansas, to ensure that the Certificate of Declaration of Trust is drafted and executed properly, aligning with the granter's specific intentions and objectives.

Little Rock Arkansas Certificate of Declaration of Trust

Description

How to fill out Little Rock Arkansas Certificate Of Declaration Of Trust?

We always want to minimize or avoid legal issues when dealing with nuanced law-related or financial affairs. To do so, we apply for legal services that, usually, are very costly. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to an attorney. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Little Rock Arkansas Certificate of Declaration of Trust or any other document easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is equally effortless if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Little Rock Arkansas Certificate of Declaration of Trust adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Little Rock Arkansas Certificate of Declaration of Trust would work for you, you can pick the subscription option and proceed to payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!