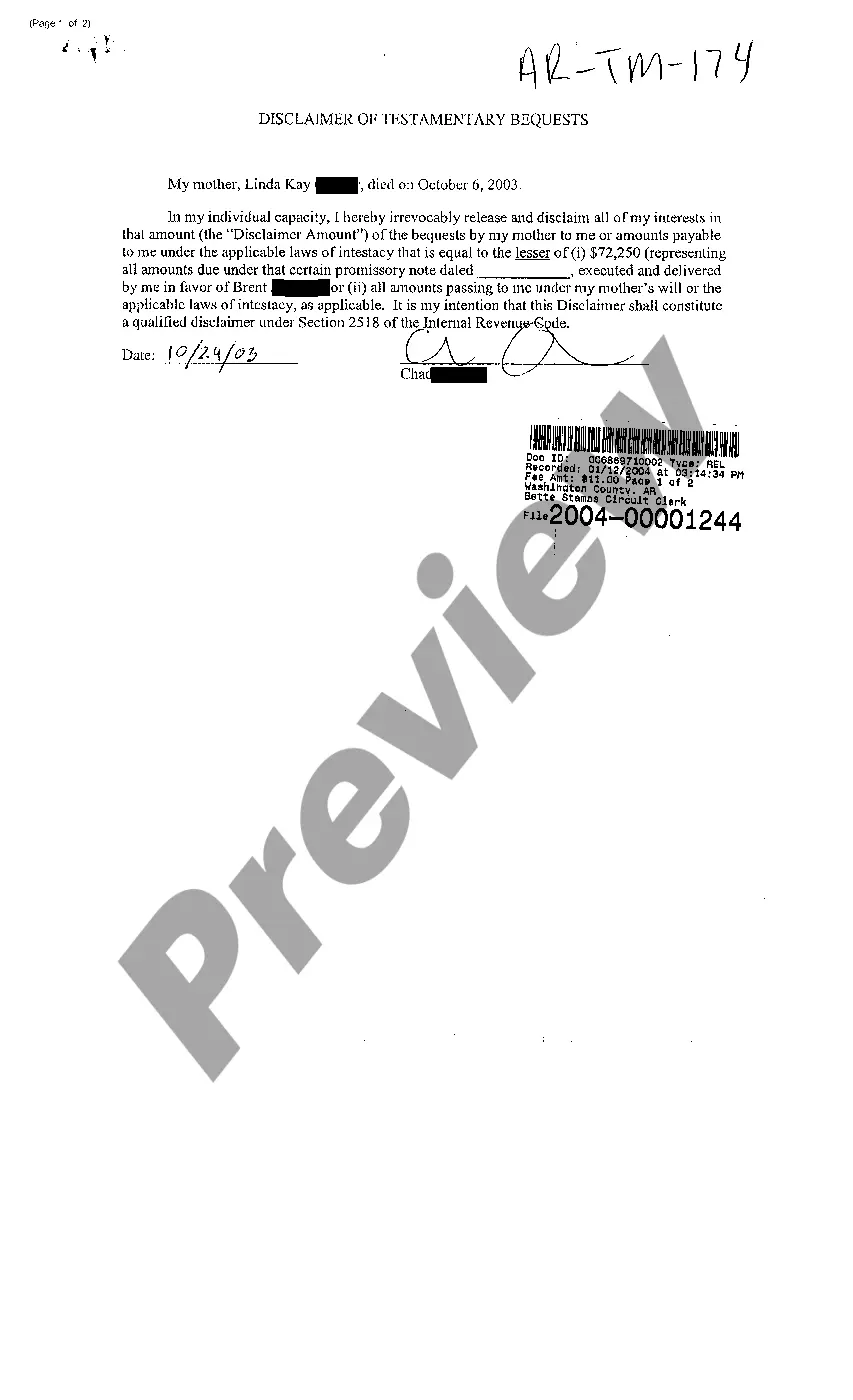

Little Rock Arkansas Disclaimer of Testamentary Bequests refers to the legal act of renouncing or declining an inheritance or bequest mentioned in a deceased person's will in the city of Little Rock, Arkansas. This disclaimer allows the intended beneficiary of the testamentary bequest to refuse the gift or inheritance, effectively renouncing their right to claim any portion of the deceased person's assets. In Little Rock, Arkansas, there are different types of disclaimers of testamentary bequests that individuals may encounter. These include: 1. Absolute Disclaimer: An individual can fully reject the testamentary bequest in its entirety, relinquishing any interest or claim associated with it. By filing an absolute disclaimer, the individual ensures that the bequest passes to the next eligible beneficiary as indicated in the deceased person's will. 2. Partial Disclaimer: Sometimes a testamentary bequest may consist of multiple assets or properties. In such cases, an individual may choose to disclaim only a specific portion or asset within the bequest. The disclaimed portion then passes to the next eligible beneficiary or is distributed according to the terms of the will. 3. Conditional Disclaimer: In some situations, an individual may want to disclaim a testamentary bequest subject to certain conditions. For example, they may choose to disclaim the bequest if it involves significant tax implications or if accepting it would result in legal obligations or debts. The conditional disclaimer allows the individual to disclaim the bequest only if specific conditions are met. 4. Qualified Disclaimer: A qualified disclaimer is a legal term indicating that the individual declining the testamentary bequest does so in adherence to specific requirements laid out by federal or state laws. By following the legal guidelines for a qualified disclaimer, the individual avoids negative tax consequences or other legal complications associated with the inheritance. It is important to consult with an attorney specializing in estate planning and probate law in Little Rock, Arkansas, to fully understand the implications and procedures involved in a disclaimer of testamentary bequests. The attorney can guide individuals through the legal process, ensuring compliance with all relevant laws and protecting their rights and interests. Disclaiming a testamentary bequest requires filing the disclaimer with the appropriate court, typically within a certain timeframe after the deceased person's passing.

Little Rock Arkansas Disclaimer of Testamentary Bequests

Description

How to fill out Little Rock Arkansas Disclaimer Of Testamentary Bequests?

We always strive to minimize or prevent legal issues when dealing with nuanced law-related or financial affairs. To do so, we sign up for attorney services that, as a rule, are extremely expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of a lawyer. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Little Rock Arkansas Disclaimer of Testamentary Bequests or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is just as straightforward if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Little Rock Arkansas Disclaimer of Testamentary Bequests adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Little Rock Arkansas Disclaimer of Testamentary Bequests is suitable for you, you can choose the subscription option and proceed to payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!