The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

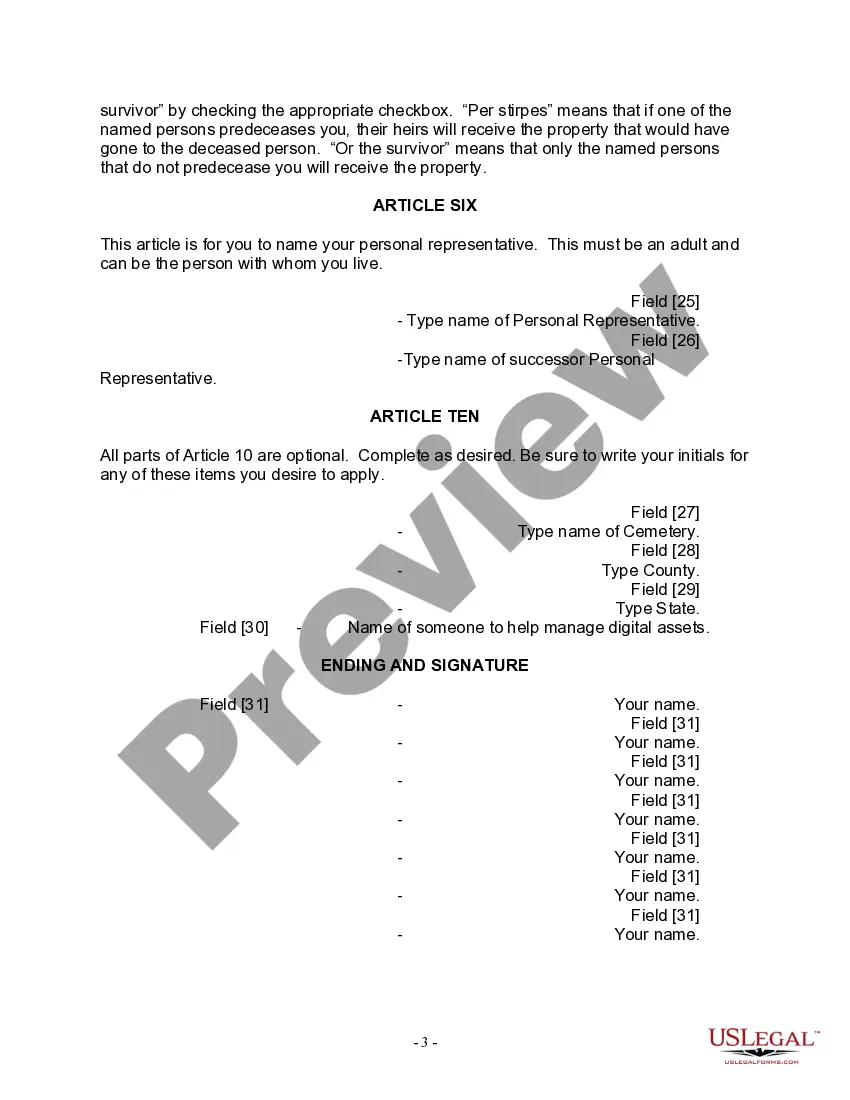

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

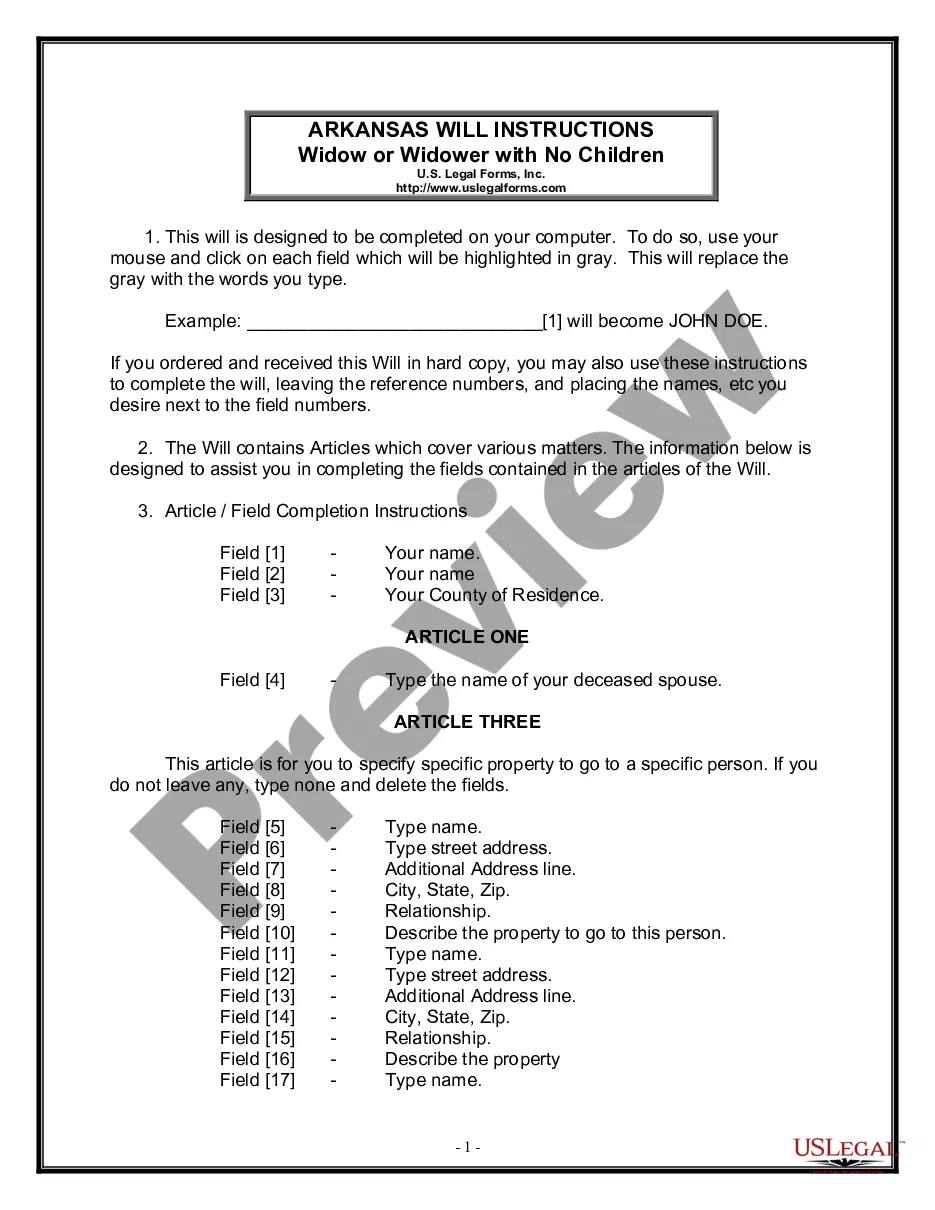

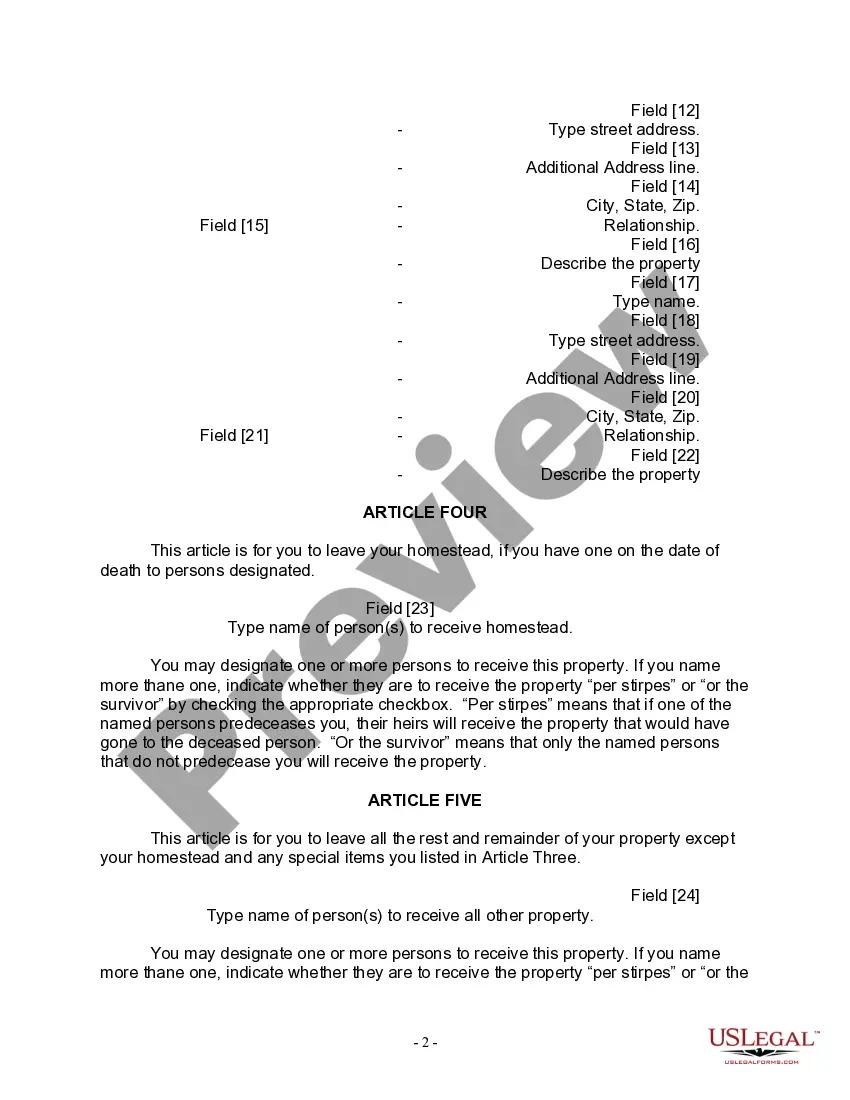

Title: Little Rock Arkansas Legal Last Will Form for a Widow or Widower with no Children Introduction: Creating a legal last will is crucial for individuals, including widows or widowers with no children, to ensure their assets and final wishes are properly addressed after their passing. This article will provide a detailed description of the Little Rock Arkansas Legal Last Will Form specifically designed for widows and widowers with no children. Additionally, different variations or types of this form will also be discussed for a comprehensive understanding of the available options. Keywords: Little Rock Arkansas, legal last will, widow, widower, no children Detailed Description: 1. Importance of a Last Will: In times of emotional turmoil after losing a spouse, it is essential for widows or widowers with no children to secure their assets and provide clarity regarding the distribution of their estate. A Little Rock Arkansas Legal Last Will Form for a widow or widower without children offers a legally binding framework to express their final wishes, name beneficiaries, and select an executor. 2. Components of the Little Rock Arkansas Legal Last Will Form: a. Personal Information: The form begins with the inclusion of personal details such as name, address, date of birth, and marital status. b. Executor Appointment: The testator (the person making the will) designates an executor responsible for managing and distributing the estate. c. Asset Distribution: The form provides sections to specify the beneficiaries and detail how the assets, including properties, investments, and personal belongings, will be distributed among them. d. Alternate Beneficiaries: The form may provide an option to name alternate beneficiaries in case the primary beneficiaries pass away before the testator. e. Funeral Arrangements: Testators can include their desired funeral arrangements, specifying burial, cremation, or any specific requests. f. Debts and Taxes: The form allows individuals to address any outstanding debts or tax obligations, ensuring they are settled from the assets appropriately. g. Health Care Directives: Some will forms may include health care directives, such as a living will or power of attorney, granting someone the authority to make medical decisions on the testator's behalf if they become incapacitated. 3. Types of Little Rock Arkansas Legal Last Will Forms for Widows or Widowers without Children: a. Simple Last Will Form: This is a basic will form that allows the testator to distribute their assets among beneficiaries and name an executor. b. Pour-Over Will Form: This form is used in conjunction with a living trust, allowing the testator to transfer any remaining assets to the trust upon their death, ensuring seamless asset management. c. Holographic Will Form: In certain cases, individuals may wish to draft a handwritten will, referred to as a holographic will, which may be recognized in Arkansas under specific circumstances. Consultation with a legal professional is advised for drafting such a will. Conclusion: Utilizing a Little Rock Arkansas Legal Last Will Form specifically designed for widows or widowers with no children is a prudent step to secure one's assets and ensure their final wishes are honored. By understanding the various components and types of will form available, individuals can create a legally binding document that offers peace of mind and protects their estate. Seek guidance from an attorney to ensure compliance with Arkansas state laws and to tailor the will form to your specific needs.Title: Little Rock Arkansas Legal Last Will Form for a Widow or Widower with no Children Introduction: Creating a legal last will is crucial for individuals, including widows or widowers with no children, to ensure their assets and final wishes are properly addressed after their passing. This article will provide a detailed description of the Little Rock Arkansas Legal Last Will Form specifically designed for widows and widowers with no children. Additionally, different variations or types of this form will also be discussed for a comprehensive understanding of the available options. Keywords: Little Rock Arkansas, legal last will, widow, widower, no children Detailed Description: 1. Importance of a Last Will: In times of emotional turmoil after losing a spouse, it is essential for widows or widowers with no children to secure their assets and provide clarity regarding the distribution of their estate. A Little Rock Arkansas Legal Last Will Form for a widow or widower without children offers a legally binding framework to express their final wishes, name beneficiaries, and select an executor. 2. Components of the Little Rock Arkansas Legal Last Will Form: a. Personal Information: The form begins with the inclusion of personal details such as name, address, date of birth, and marital status. b. Executor Appointment: The testator (the person making the will) designates an executor responsible for managing and distributing the estate. c. Asset Distribution: The form provides sections to specify the beneficiaries and detail how the assets, including properties, investments, and personal belongings, will be distributed among them. d. Alternate Beneficiaries: The form may provide an option to name alternate beneficiaries in case the primary beneficiaries pass away before the testator. e. Funeral Arrangements: Testators can include their desired funeral arrangements, specifying burial, cremation, or any specific requests. f. Debts and Taxes: The form allows individuals to address any outstanding debts or tax obligations, ensuring they are settled from the assets appropriately. g. Health Care Directives: Some will forms may include health care directives, such as a living will or power of attorney, granting someone the authority to make medical decisions on the testator's behalf if they become incapacitated. 3. Types of Little Rock Arkansas Legal Last Will Forms for Widows or Widowers without Children: a. Simple Last Will Form: This is a basic will form that allows the testator to distribute their assets among beneficiaries and name an executor. b. Pour-Over Will Form: This form is used in conjunction with a living trust, allowing the testator to transfer any remaining assets to the trust upon their death, ensuring seamless asset management. c. Holographic Will Form: In certain cases, individuals may wish to draft a handwritten will, referred to as a holographic will, which may be recognized in Arkansas under specific circumstances. Consultation with a legal professional is advised for drafting such a will. Conclusion: Utilizing a Little Rock Arkansas Legal Last Will Form specifically designed for widows or widowers with no children is a prudent step to secure one's assets and ensure their final wishes are honored. By understanding the various components and types of will form available, individuals can create a legally binding document that offers peace of mind and protects their estate. Seek guidance from an attorney to ensure compliance with Arkansas state laws and to tailor the will form to your specific needs.