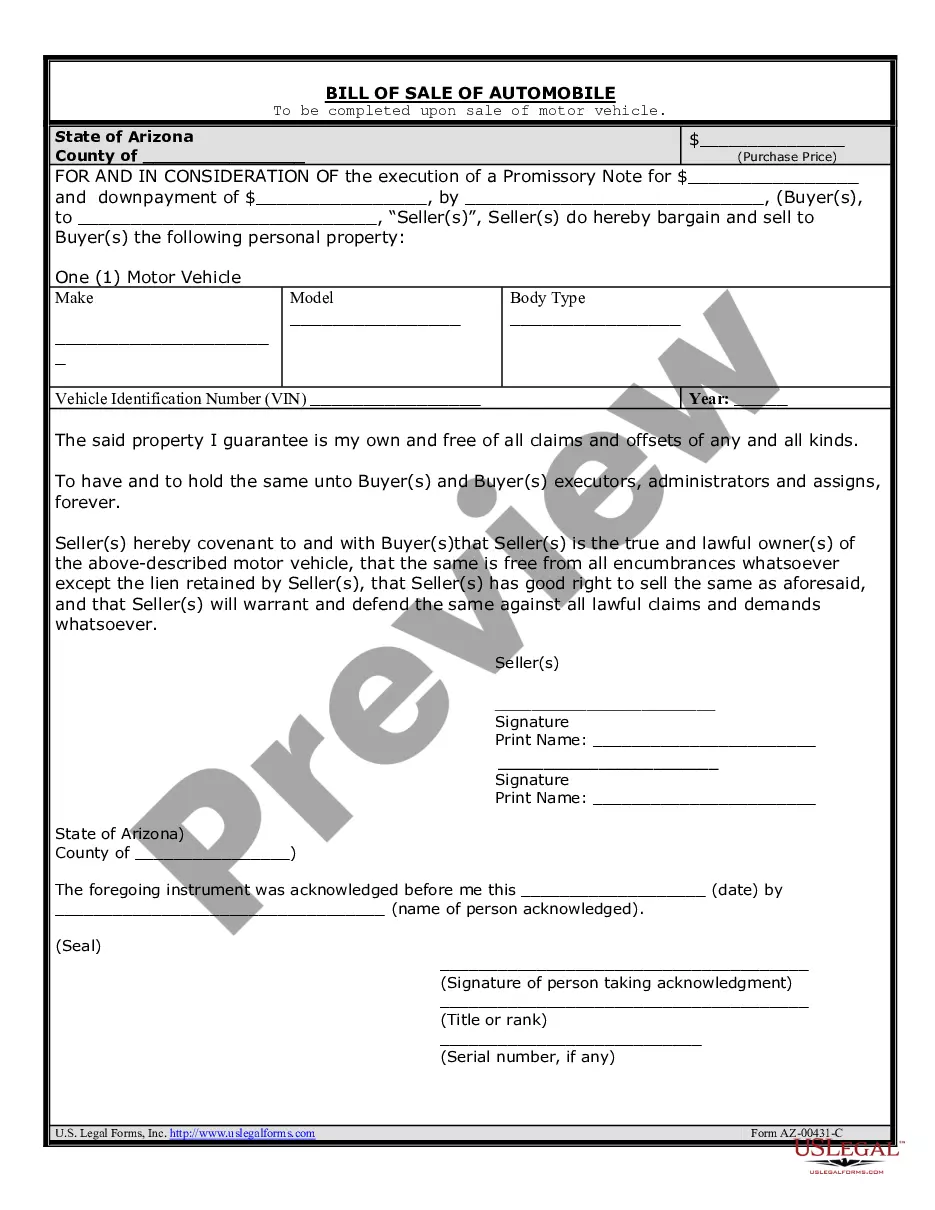

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

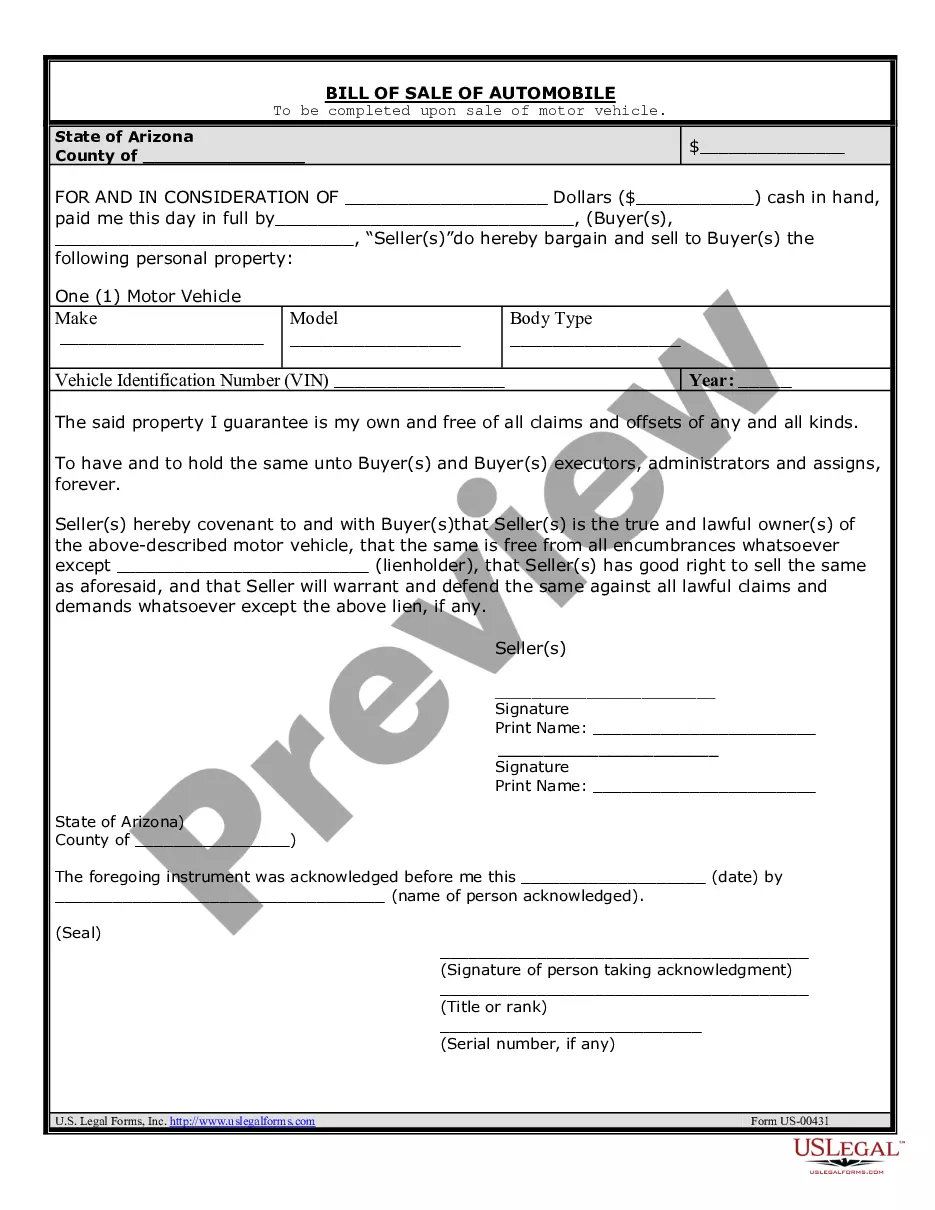

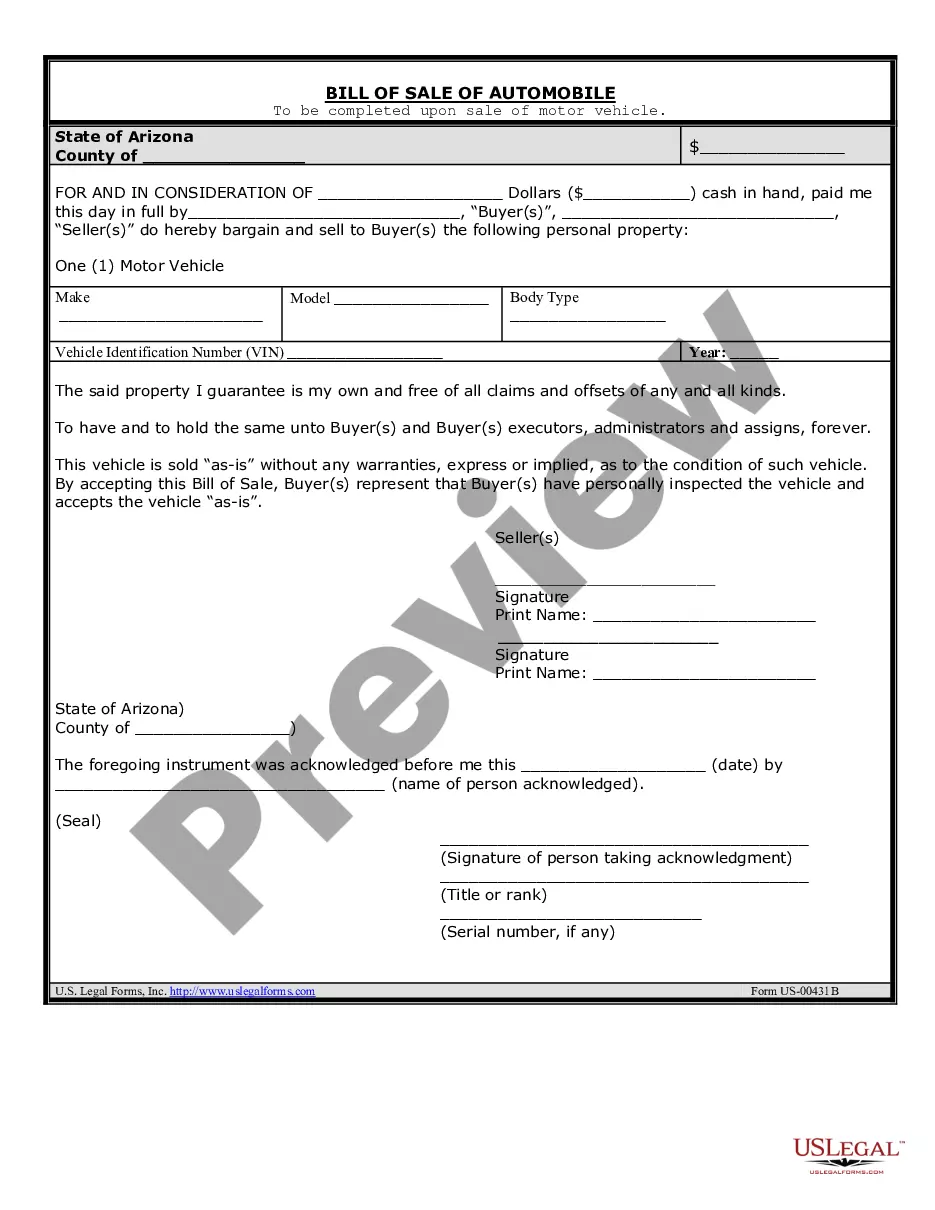

The Phoenix Arizona Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between a seller and a buyer in the state of Arizona. This promissory note is specifically designed for the purchase or sale of a motor vehicle or automobile. The promissory note serves as a binding contract between the parties involved, detailing the repayment terms, interest rates, and any penalties or consequences for defaulting on the loan. It ensures that both the buyer and the seller are protected throughout the transaction and provides a clear understanding of the financial obligations and responsibilities of each party. Different types of Phoenix Arizona Promissory Note in Connection with Sale of Vehicle or Automobile may include: 1. Installment Promissory Note: This type of promissory note specifies that the buyer will make regular payments in installments over a specific period of time until the loan is fully repaid. It includes details such as the payment schedule, interest rate, and consequences for late or missed payments. 2. Balloon Promissory Note: This type of promissory note involves the buyer making smaller monthly payments over a certain period, with a large final payment, known as a balloon payment, due at the end of the loan term. The balloon payment typically covers the remaining balance of the loan and may include accrued interest. 3. Secured Promissory Note: This type of promissory note includes a security interest in the vehicle being financed. It means that if the buyer defaults on the loan, the seller has the right to repossess the vehicle as collateral. The promissory note outlines the specific details regarding the collateral, as well as the process for repossession and sale of the vehicle to recover the outstanding balance. 4. Unsecured Promissory Note: This type of promissory note does not involve any collateral or security interest in the vehicle. It is solely based on the buyer's promise to repay the loan according to the agreed-upon terms. However, without collateral, the seller may have fewer legal remedies in case of default. It is important for both the buyer and the seller to carefully review and understand the terms and conditions detailed in the Phoenix Arizona Promissory Note in Connection with Sale of Vehicle or Automobile. Consulting with a legal professional experienced in Arizona laws can ensure that the promissory note is legally binding, protects the interests of all parties involved, and complies with applicable state regulations.