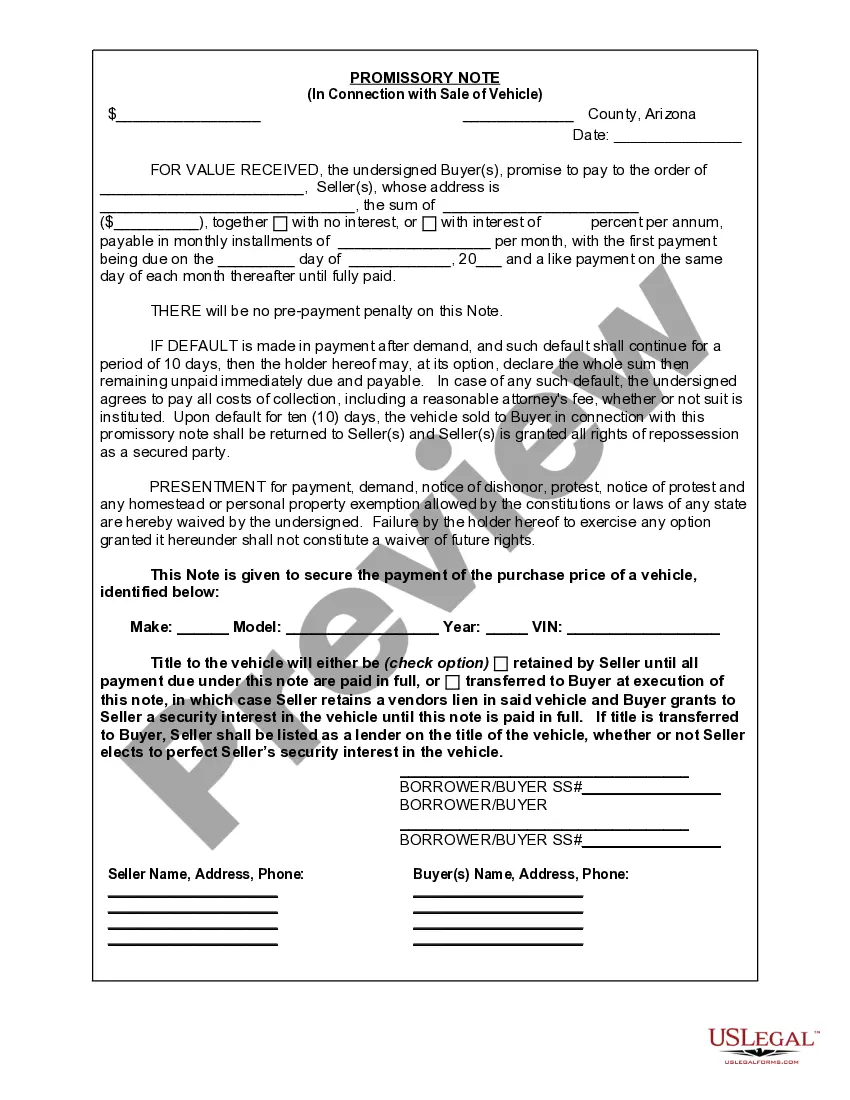

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Lima Arizona promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a loan agreement between the buyer (borrower) and the seller (lender) for the purchase of a vehicle. This promissory note serves as evidence of the loan and indicates the amount borrowed, interest rates, repayment schedule, consequences of default, and any other agreed-upon terms. Keywords: Lima Arizona Promissory Note, sale of vehicle, sale of automobile, loan agreement, borrower, lender, terms and conditions, amount borrowed, interest rates, repayment schedule, default, agreed-upon terms. There might be different types of Lima Arizona Promissory Notes in connection with the sale of a vehicle depending on the specific requirements of the buyer and seller. Some commonly used types include: 1. Simple Promissory Note: This type of promissory note outlines basic loan terms such as the principal amount, interest rate, and repayment schedule. 2. Secured Promissory Note: In this type, the vehicle itself acts as collateral for the loan, offering security for the lender. It details the consequences of default and procedures for repossession if the borrower fails to repay the loan. 3. Installment Promissory Note: This note specifies that the loan will be repaid in equal installments over a defined period, including interest. 4. Balloon Promissory Note: With this type, the borrower pays lower monthly installments during the loan term, but the remaining balance becomes due in a lump sum at the end of the term. This can be useful for buyers who expect a significant sum of money in the future. 5. Interest-Only Promissory Note: In an interest-only note, the borrower pays only the interest on the loan for a specified period. The principal amount is then repaid in full at the end of this period. Each type of promissory note has its unique features, and it is important for both parties to carefully review and understand the terms before entering into an agreement. It is also advisable to consult legal professionals or experts to ensure compliance with local laws and regulations in Lima, Arizona.A Lima Arizona promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a loan agreement between the buyer (borrower) and the seller (lender) for the purchase of a vehicle. This promissory note serves as evidence of the loan and indicates the amount borrowed, interest rates, repayment schedule, consequences of default, and any other agreed-upon terms. Keywords: Lima Arizona Promissory Note, sale of vehicle, sale of automobile, loan agreement, borrower, lender, terms and conditions, amount borrowed, interest rates, repayment schedule, default, agreed-upon terms. There might be different types of Lima Arizona Promissory Notes in connection with the sale of a vehicle depending on the specific requirements of the buyer and seller. Some commonly used types include: 1. Simple Promissory Note: This type of promissory note outlines basic loan terms such as the principal amount, interest rate, and repayment schedule. 2. Secured Promissory Note: In this type, the vehicle itself acts as collateral for the loan, offering security for the lender. It details the consequences of default and procedures for repossession if the borrower fails to repay the loan. 3. Installment Promissory Note: This note specifies that the loan will be repaid in equal installments over a defined period, including interest. 4. Balloon Promissory Note: With this type, the borrower pays lower monthly installments during the loan term, but the remaining balance becomes due in a lump sum at the end of the term. This can be useful for buyers who expect a significant sum of money in the future. 5. Interest-Only Promissory Note: In an interest-only note, the borrower pays only the interest on the loan for a specified period. The principal amount is then repaid in full at the end of this period. Each type of promissory note has its unique features, and it is important for both parties to carefully review and understand the terms before entering into an agreement. It is also advisable to consult legal professionals or experts to ensure compliance with local laws and regulations in Lima, Arizona.