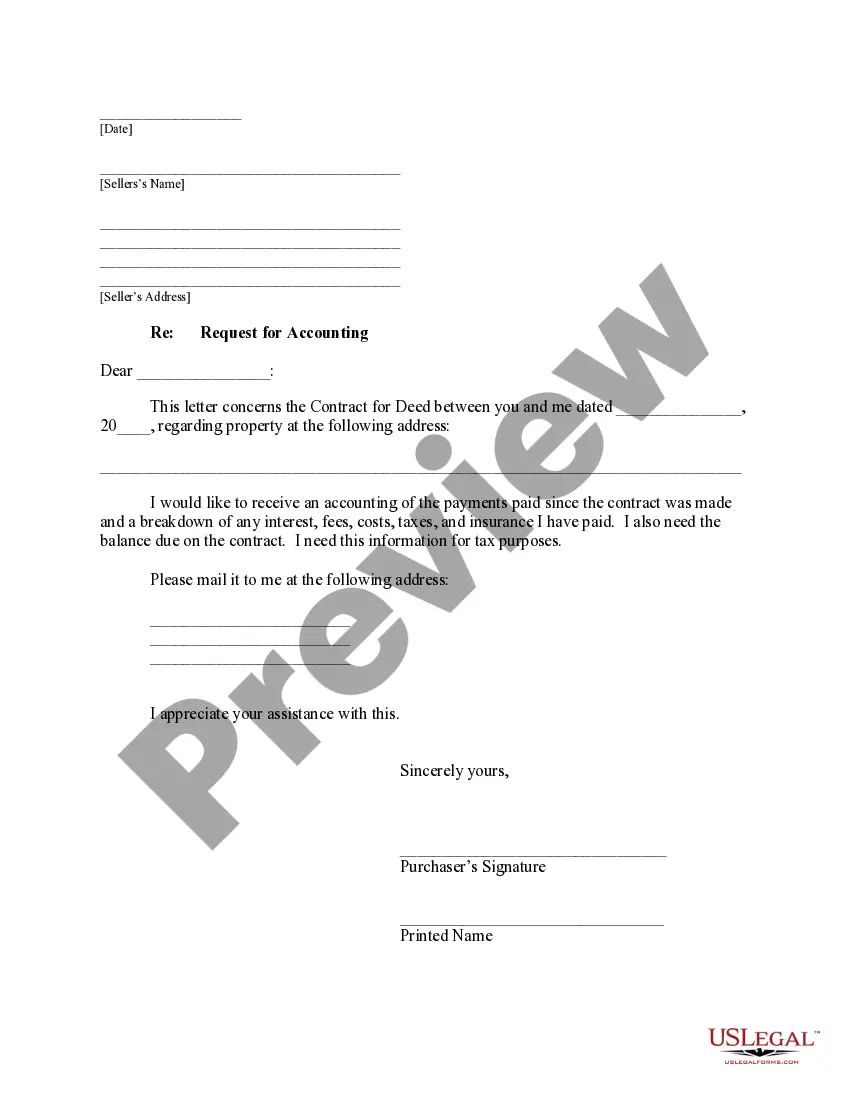

This is a Purchaser's Request of Accounting Statement from Seller. It is a request in writing to receive an accounting of the payments paid since the contract was made and a breakdown of any interest, fees, costs, taxes and insurance paid. It is also a request for the balance due on the contract.

Surprise Arizona Buyer's Request for Accounting from Seller under Contract for Deed Description: The Surprise Arizona Buyer's Request for Accounting from Seller under Contract for Deed is a formal document that is typically submitted by a buyer to the seller in a real estate transaction involving a contract for deed. This request serves as a means for the buyer to seek transparency and clarity regarding the financial aspects of the property sale, ensuring that both parties have a clear understanding of the financial obligations and rights tied to the contract for deed. Keywords: — SurprisArizonaon— - Buyer's Request - Accounting — Selle— - Contract for Deed - Real Estate Transaction Transparentnc— - Financial Obligations - Clear Understanding Types of Surprise Arizona Buyer's Request for Accounting from Seller under Contract for Deed: 1. Basic Accounting Request: This type of request encompasses a comprehensive breakdown of the financial transactions related to the contract for deed. It includes a detailed summary of the purchase price, any down payments made, installment payments, interest charges, and other financial components. 2. Payment History Request: This request focuses specifically on the payment history associated with the contract for deed. It may include information such as the dates of payment, amounts paid, outstanding balance, and any late payment penalties or credits applied. 3. Escrow Account Review Request: In some cases, the buyer may request a review of the escrow account tied to the contract for deed. This type of request ensures that the funds held in escrow for taxes, insurance, or other purposes are being managed appropriately and in accordance with the contract terms. 4. Tax and Liens Verification Request: This request seeks to verify if there are any outstanding taxes or liens on the property that may impact the buyer's ownership rights or financial responsibilities. The seller is typically responsible for providing documentation regarding the property's tax status and any existing liens. 5. Maintenance and Repair Expense Disclosure Request: This specific request focuses on the disclosure of any maintenance or repair expenses incurred by the seller during their ownership of the property. The aim is to understand whether any outstanding repair obligations or costs may be transferred to the buyer upon completion of the contract for deed. Overall, the Surprise Arizona Buyer's Request for Accounting from Seller under Contract for Deed ensures that both parties involved in the real estate transaction have a clear understanding of the financial aspects tied to the contract for deed and facilitates transparency for a smooth transaction process.Surprise Arizona Buyer's Request for Accounting from Seller under Contract for Deed Description: The Surprise Arizona Buyer's Request for Accounting from Seller under Contract for Deed is a formal document that is typically submitted by a buyer to the seller in a real estate transaction involving a contract for deed. This request serves as a means for the buyer to seek transparency and clarity regarding the financial aspects of the property sale, ensuring that both parties have a clear understanding of the financial obligations and rights tied to the contract for deed. Keywords: — SurprisArizonaon— - Buyer's Request - Accounting — Selle— - Contract for Deed - Real Estate Transaction Transparentnc— - Financial Obligations - Clear Understanding Types of Surprise Arizona Buyer's Request for Accounting from Seller under Contract for Deed: 1. Basic Accounting Request: This type of request encompasses a comprehensive breakdown of the financial transactions related to the contract for deed. It includes a detailed summary of the purchase price, any down payments made, installment payments, interest charges, and other financial components. 2. Payment History Request: This request focuses specifically on the payment history associated with the contract for deed. It may include information such as the dates of payment, amounts paid, outstanding balance, and any late payment penalties or credits applied. 3. Escrow Account Review Request: In some cases, the buyer may request a review of the escrow account tied to the contract for deed. This type of request ensures that the funds held in escrow for taxes, insurance, or other purposes are being managed appropriately and in accordance with the contract terms. 4. Tax and Liens Verification Request: This request seeks to verify if there are any outstanding taxes or liens on the property that may impact the buyer's ownership rights or financial responsibilities. The seller is typically responsible for providing documentation regarding the property's tax status and any existing liens. 5. Maintenance and Repair Expense Disclosure Request: This specific request focuses on the disclosure of any maintenance or repair expenses incurred by the seller during their ownership of the property. The aim is to understand whether any outstanding repair obligations or costs may be transferred to the buyer upon completion of the contract for deed. Overall, the Surprise Arizona Buyer's Request for Accounting from Seller under Contract for Deed ensures that both parties involved in the real estate transaction have a clear understanding of the financial aspects tied to the contract for deed and facilitates transparency for a smooth transaction process.