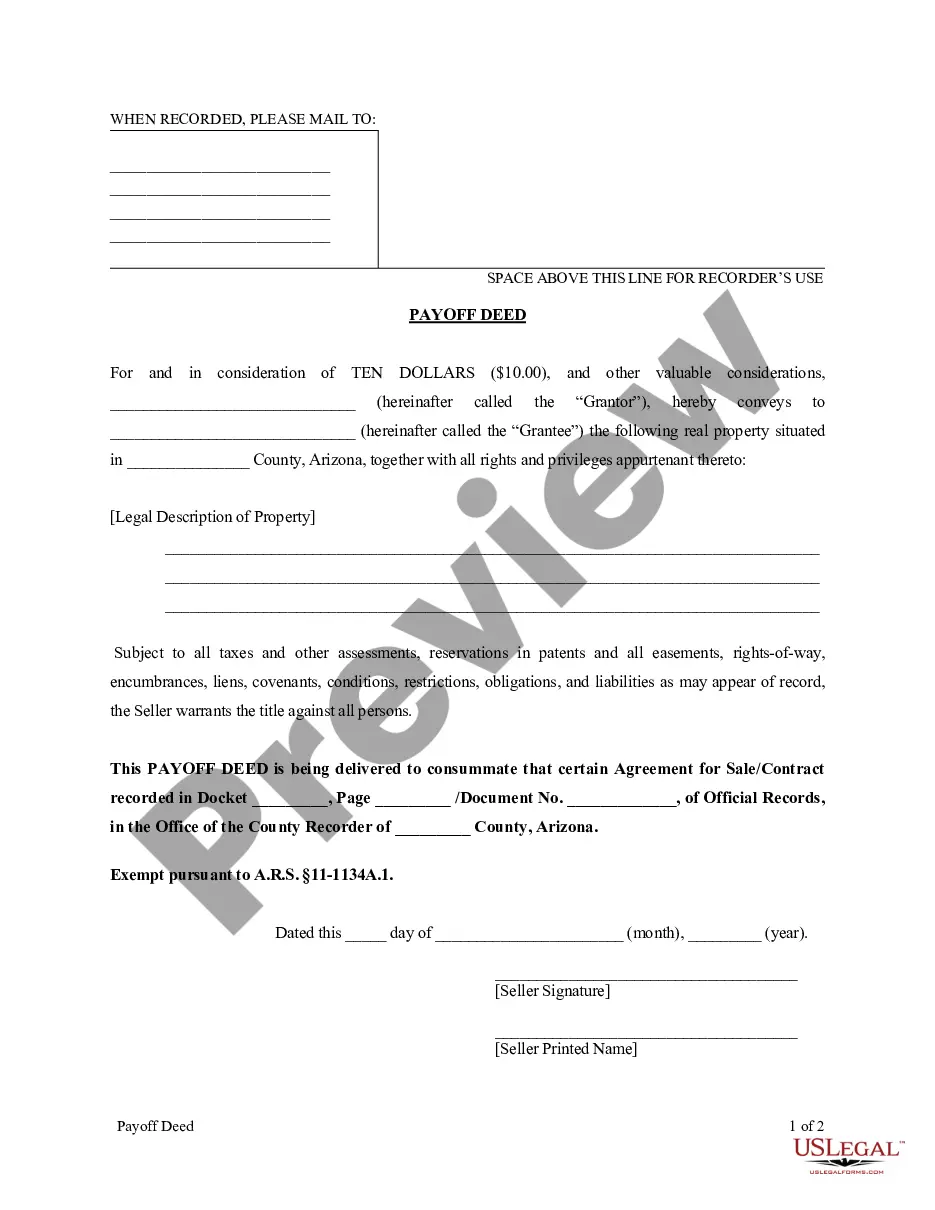

A Payoff Deed in Tucson, Arizona refers to a legal document that signifies the completion of a mortgage payment or the full repayment of a loan. It is an important instrument that is used to officially release the borrower's obligation to the lender. This document is crucial in the real estate industry as it allows property owners to gain full ownership and clear any encumbrances on their property. The Tucson Payoff Deed serves as proof of a completed payment, ensuring that the borrower has met all financial obligations associated with their loan. It includes details such as the property address, the lender's name, the borrower's information, and the loan amount. By issuing a Payoff Deed, the lender acknowledges that the mortgage has been satisfied, and the property now belongs solely to the borrower. Different types of Payoff Deeds that may be encountered in Tucson, Arizona include: 1. Mortgage Payoff Deed: This type of Payoff Deed is used to release the lien on a property once the mortgage has been fully repaid. It declares that the borrower has fulfilled their financial responsibilities and the lender no longer has any claim on the property. 2. Loan Payoff Deed: A Loan Payoff Deed is utilized when a borrower has entirely paid off a loan, such as an auto loan or personal loan. It acts as evidence that the borrower has settled all outstanding balances and is no longer indebted to the lender. 3. Trust Deed Payoff Deed: In some cases, properties in Tucson may have a trust deed instead of a traditional mortgage. A Trust Deed Payoff Deed is used to release the trust deed lien once the borrower has fully paid off their obligations. It is important to note that a Payoff Deed should be recorded with the appropriate county office, typically the County Recorder's Office, ensuring that the release of the lien is officially documented. This step protects both the borrower and the lender, as it prevents any future disputes regarding the property's ownership or unpaid debts. In conclusion, a Tucson Arizona Payoff Deed is a crucial legal document that signifies the successful completion of a mortgage or loan payment. It releases the borrower's obligation and grants full ownership rights to the property. By recording this document, parties involved can avoid potential conflicts and establish a clear title for the property.

Tucson Arizona Payoff Deed

Description

How to fill out Tucson Arizona Payoff Deed?

We always want to reduce or avoid legal damage when dealing with nuanced legal or financial matters. To do so, we apply for legal solutions that, as a rule, are extremely costly. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of legal counsel. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Tucson Arizona Payoff Deed or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is equally easy if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the Tucson Arizona Payoff Deed complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Tucson Arizona Payoff Deed is proper for you, you can choose the subscription option and proceed to payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!