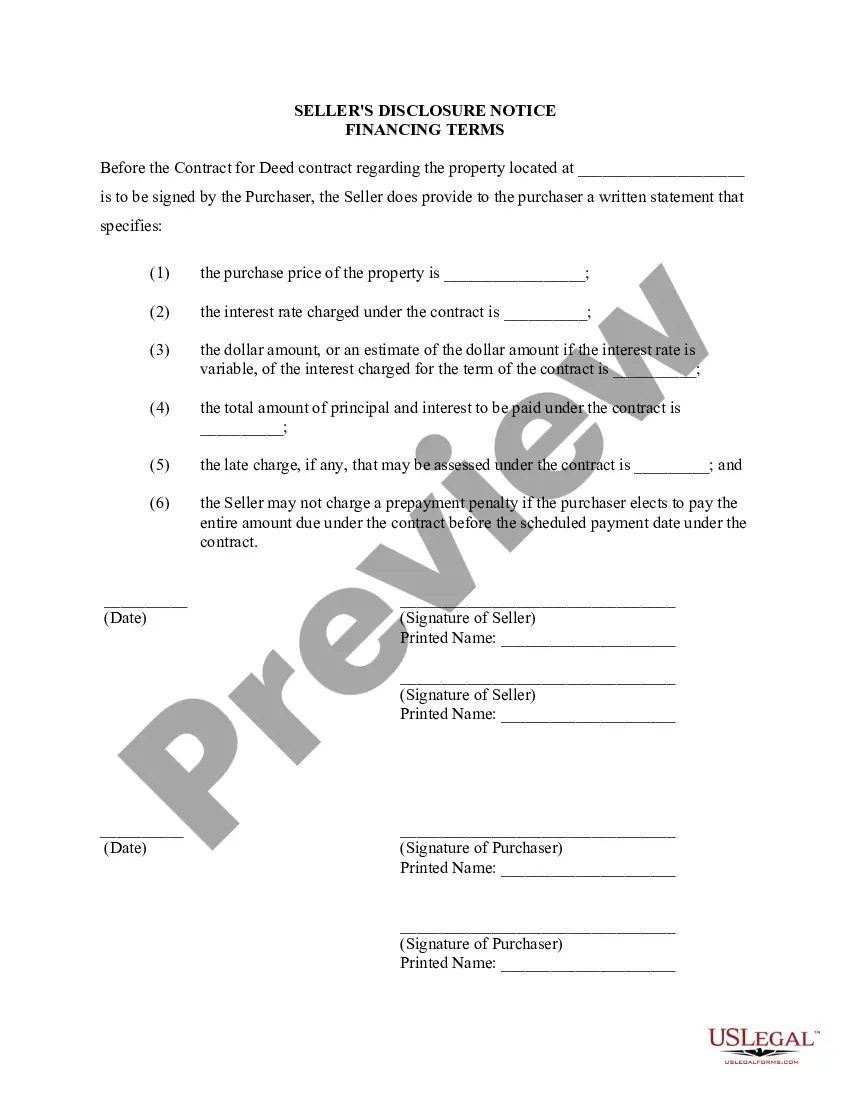

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Title: Understanding Chandler Arizona Seller's Disclosure of Financing Terms for Residential Property Regarding Contract or Agreement for Deed (Land Contract) Introduction: In Chandler, Arizona, when engaging in a Contract or Agreement for Deed (also known as a Land Contract) to finance the purchase of a residential property, it is essential for both buyers and sellers to have a clear understanding of the financing terms involved. The Chandler Arizona Seller's Disclosure of Financing Terms for Residential Property provides crucial information regarding these terms, ensuring transparency and protecting the rights of all parties involved. 1. Types of Chandler Arizona Seller's Disclosure of Financing Terms for Residential Property: a) Basic Financing Terms: This disclosure outlines the fundamental details of the financing arrangement, including the purchase price, interest rate, repayment schedule, and any additional fees or charges. b) Amortization Schedule: This disclosure includes a breakdown of the principal, interest, and remaining balance, allowing buyers to track their equity build-up and understand the payments required throughout the duration of the agreement. c) Prepayment Penalties: Some contracts may include provisions allowing sellers to charge penalties if the buyer chooses to pay off the debt early. This disclosure highlights the conditions and potential consequences of prepaying the loan. d) Balloon Payment Terms: In certain Land Contracts, a balloon payment requiring a larger lump sum payment may be due at a specific date. This disclosure outlines the details of the balloon payment, including the amount, due date, and consequences for non-payment. e) Escrow Accounts: This disclosure explains whether an escrow account will be established to hold funds for insurance and property tax payments, providing clarity on responsibilities and potential changes in monthly payments. f) Default and Remedies: This disclosure outlines the consequences of defaulting on the contract, including potential remedies such as foreclosure, termination of agreement, or additional fees. g) Property Condition Disclosure: While not solely related to financing, this disclosure highlights any known issues or defects with the property that may affect its value or habitability, ensuring buyers are fully informed before entering into the agreement. Conclusion: The Chandler Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed (Land Contract) is crucial for buyers and sellers to understand the obligations, risks, and rights associated with their agreement. By providing relevant information and clarifying the financing terms, this disclosure promotes transparency and minimizes potential disputes throughout the contract's duration. Both parties should carefully review and consult legal professionals to ensure a thorough understanding of the disclosed terms before proceeding with the transaction.Title: Understanding Chandler Arizona Seller's Disclosure of Financing Terms for Residential Property Regarding Contract or Agreement for Deed (Land Contract) Introduction: In Chandler, Arizona, when engaging in a Contract or Agreement for Deed (also known as a Land Contract) to finance the purchase of a residential property, it is essential for both buyers and sellers to have a clear understanding of the financing terms involved. The Chandler Arizona Seller's Disclosure of Financing Terms for Residential Property provides crucial information regarding these terms, ensuring transparency and protecting the rights of all parties involved. 1. Types of Chandler Arizona Seller's Disclosure of Financing Terms for Residential Property: a) Basic Financing Terms: This disclosure outlines the fundamental details of the financing arrangement, including the purchase price, interest rate, repayment schedule, and any additional fees or charges. b) Amortization Schedule: This disclosure includes a breakdown of the principal, interest, and remaining balance, allowing buyers to track their equity build-up and understand the payments required throughout the duration of the agreement. c) Prepayment Penalties: Some contracts may include provisions allowing sellers to charge penalties if the buyer chooses to pay off the debt early. This disclosure highlights the conditions and potential consequences of prepaying the loan. d) Balloon Payment Terms: In certain Land Contracts, a balloon payment requiring a larger lump sum payment may be due at a specific date. This disclosure outlines the details of the balloon payment, including the amount, due date, and consequences for non-payment. e) Escrow Accounts: This disclosure explains whether an escrow account will be established to hold funds for insurance and property tax payments, providing clarity on responsibilities and potential changes in monthly payments. f) Default and Remedies: This disclosure outlines the consequences of defaulting on the contract, including potential remedies such as foreclosure, termination of agreement, or additional fees. g) Property Condition Disclosure: While not solely related to financing, this disclosure highlights any known issues or defects with the property that may affect its value or habitability, ensuring buyers are fully informed before entering into the agreement. Conclusion: The Chandler Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed (Land Contract) is crucial for buyers and sellers to understand the obligations, risks, and rights associated with their agreement. By providing relevant information and clarifying the financing terms, this disclosure promotes transparency and minimizes potential disputes throughout the contract's duration. Both parties should carefully review and consult legal professionals to ensure a thorough understanding of the disclosed terms before proceeding with the transaction.