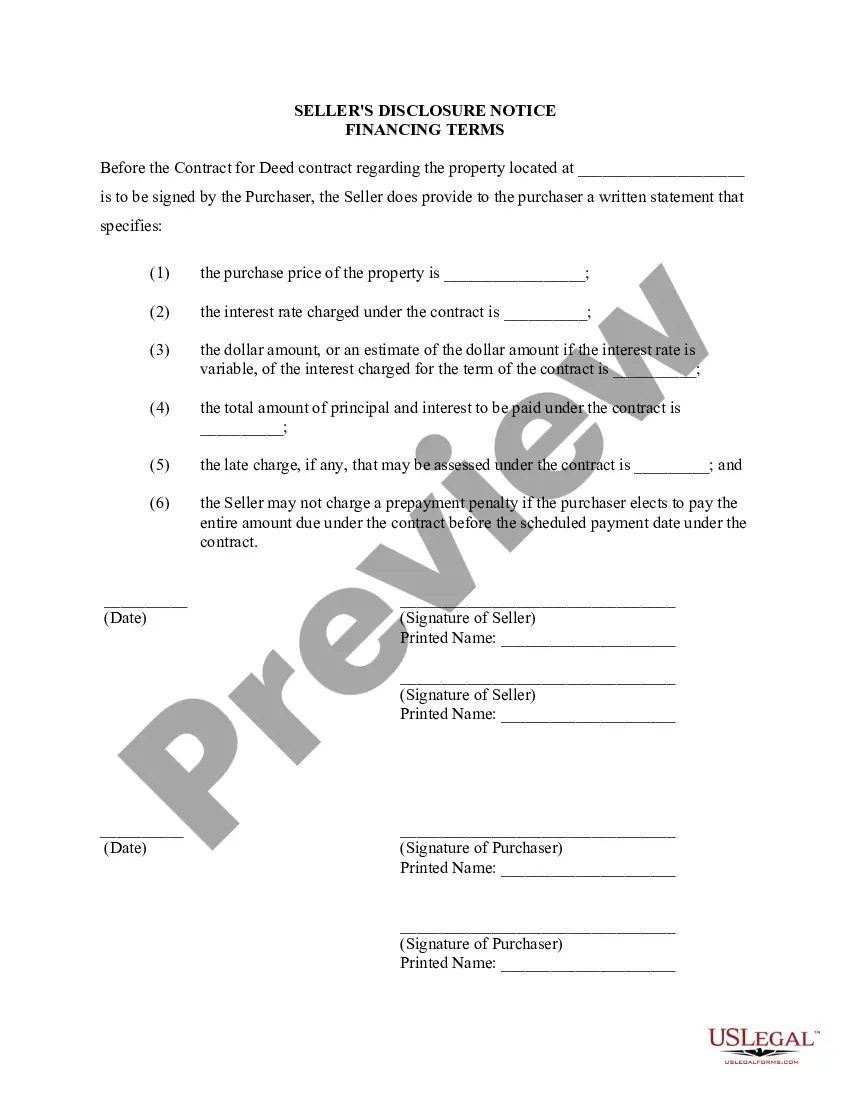

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Gilbert Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Gilbert Arizona Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Utilize the US Legal Forms to gain immediate access to any template you require.

Our user-friendly website, featuring a vast array of document templates, helps you locate and obtain nearly any sample document you need.

You can download, complete, and sign the Gilbert Arizona Seller's Disclosure of Financing Terms for Residential Property related to the Contract or Agreement for Deed also known as Land Contract within minutes, rather than spending hours online searching for a suitable template.

Using our catalog is an excellent method to enhance the security of your document submissions.

Moreover, you can access all previously saved documents from the My documents section.

If you don’t have an account yet, follow the instructions below.

- Our knowledgeable attorneys routinely review all documents to ensure that the templates are appropriate for a specific state and adhere to current laws and regulations.

- How can you acquire the Gilbert Arizona Seller's Disclosure of Financing Terms for Residential Property related to the Contract or Agreement for Deed also known as Land Contract.

- If you possess a profile, simply Log Into your account.

- The Download button will be available on all the documents you browse.

Form popularity

FAQ

The most commonly required disclosure is the Seller Property Disclosure Statement (SPDS). In Arizona, sellers are obligated to fill out this statement, which includes vital information about the property's condition and details regarding financing arrangements. This requirement ensures buyers receive comprehensive insights, particularly in relation to the Gilbert Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract, ultimately leading to more informed purchasing decisions.

Yes, Seller Property Disclosures (SPDs) are required in Arizona. Sellers must provide buyers with a disclosure statement that outlines any known issues with the property, including the financing terms described in the Gilbert Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract. This requirement helps protect both parties by ensuring that all relevant information is shared before the sale.

The most common listing type in real estate is the Multiple Listing Service (MLS) listing. This type of listing allows agents to share properties with other members, maximizing visibility and reaching a larger pool of potential buyers. For sellers in Gilbert, Arizona, understanding these listings alongside the Gilbert Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract can facilitate a smoother selling process.

The most common disclosure in residential real estate includes the Gilbert Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract. This disclosure informs potential buyers about important financing terms and conditions, ensuring they have the necessary information to make an informed decision. Transparency in these disclosures promotes trust between buyers and sellers, which is essential in real estate transactions.

Although it is not legally required for a contract for deed to be notarized in Arizona, having it notarized is advisable. Notarization adds a layer of legitimacy to the contract and can help prevent legal disputes in the future. If you are considering this option, make sure your contract outlines all necessary terms, including the Gilbert Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract for clarity.

The most commonly required disclosure in residential real estate is the seller's disclosure statement, which includes information about property conditions, past repairs, and financial terms. In Arizona, this is particularly important because it outlines the financing terms and can impact the transaction significantly. Including the Gilbert Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract can help buyers make informed decisions.

While there are advantages, a contract for deed does come with disadvantages. One significant drawback is that the buyer may lose all equity in the event of default, and sellers maintain title until full payment. Another concern is that buyers might not receive the same protections as they would with a traditional mortgage. It is essential to consult resources like the Gilbert Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract for guidance.

Yes, a contract for deed is legal in Arizona. This agreement allows the seller to retain the title to the property while the buyer makes payments over time. However, it's crucial to understand the legal implications involved. Familiarizing yourself with the Gilbert Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract can help ensure that both parties are protected.

In Arizona, a contract becomes valid when it includes an offer, acceptance, and consideration. The parties must have the legal capacity to contract, and the terms must be clear enough to be enforceable. Furthermore, the contract must have a lawful purpose. Ensuring you have the Gilbert Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract can provide clarity and help avoid disputes.

The seller's property disclosure statement is utilized to share important information about the property's condition and any potential defects. It covers aspects such as structural issues, plumbing, electrical systems, and any prior repairs made. In particular, the Gilbert Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract highlights specific financing details that a buyer should consider. By using U.S. Legal Forms, sellers can ensure that they disclose all necessary information accurately and completely.

Interesting Questions

More info

The contract generally provides the buyer with the right to obtain a certain amount of the contract's value at a future date. Under the written contract, the seller then agrees to meet the buyer's future demand for the payment of the value of the contract. One example occurs when a seller agrees to grant a mortgage which the buyer has the right to terminate at any time during the term of the mortgage. The buyer then terminates the mortgage for, among other reasons, the price the buyer feels he or she would receive at termination. The seller has acted fraudulently. In order to be able to use credit cards, some merchants require you to pay by cash or check in advance. This is a form of advance payment not subject to the standard prepayment penalty. In order to use that card, the seller then has to give you the power and right to prepay the entire amount. The seller is the one who should have provided you with a form which gave the pre-payment power, not the merchant.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.