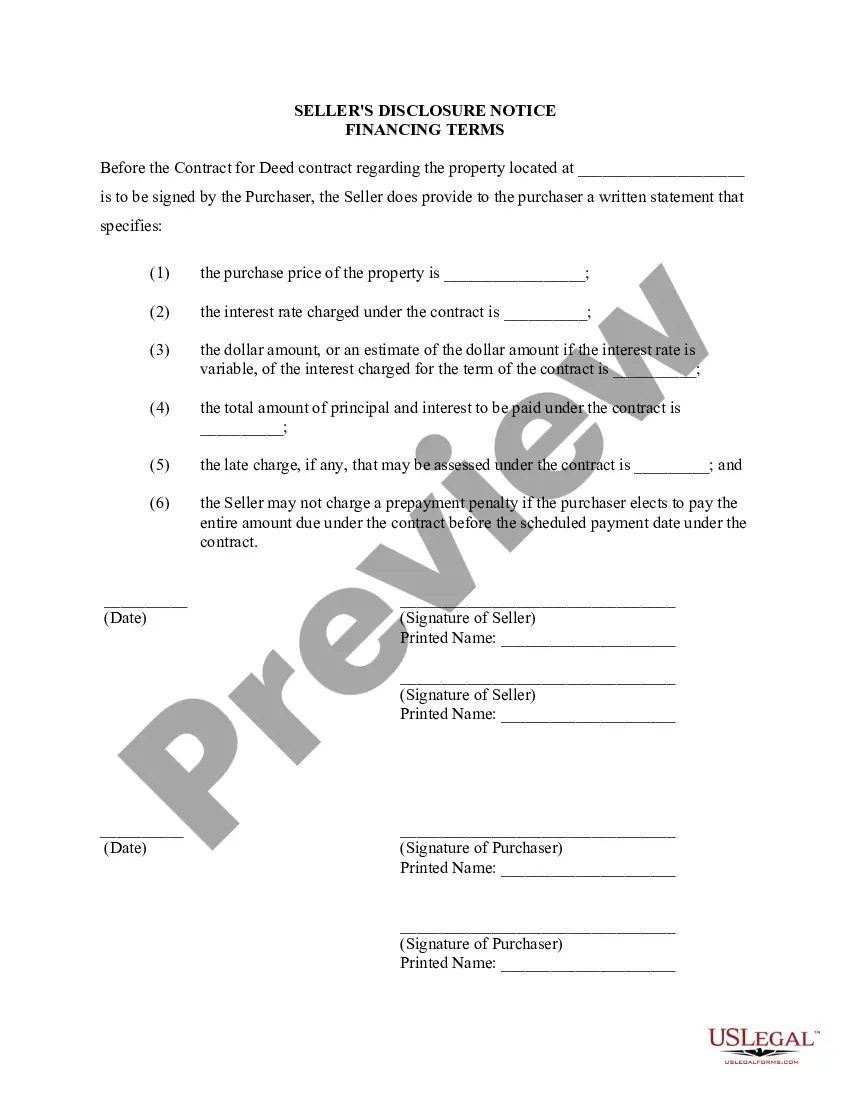

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Description: The Glendale Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is a legal document that outlines the specific terms and conditions related to the financing arrangement between the seller and the buyer of a residential property in Glendale, Arizona. This disclosure is a crucial component of the overall contract or agreement for deed, providing clarity and transparency to all parties involved. As there may be different types of Seller's Disclosures of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed in Glendale, Arizona, it is essential to understand the specific nuances and variations that may exist. These additional types of disclosures, if applicable to the transaction, may include: 1. Fixed Financing Terms Disclosure: This type of disclosure stipulates that the financing terms offered by the seller are fixed and will remain unchanged throughout the agreed-upon period. The interest rate, payment structure, and other essential financial details will be explicitly mentioned in this disclosure. 2. Adjustable Financing Terms Disclosure: In contrast to fixed financing terms, an adjustable financing terms disclosure states that the financing terms offered by the seller may fluctuate over time. This disclosure typically includes information on interest rate adjustments, frequency of adjustments, and caps or limits on rate changes. 3. Balloon Payment Disclosure: A balloon payment disclosure is applicable when the seller and buyer agree to a financing arrangement that involves a large, final payment (balloon payment) at the end of the contract's term. This disclosure informs the buyer about the presence of a balloon payment, its due date, and any related conditions. 4. Prepayment Penalties Disclosure: If the seller intends to charge a prepayment penalty if the buyer decides to pay off the remaining balance of the contract before the agreed-upon term, a prepayment penalties disclosure should be included. This disclosure outlines the penalty amount or calculation method, as well as any conditions that trigger the penalty. 5. Default and Remedies Disclosure: The default and remedies disclosure clarifies the consequences if either party fails to fulfill their obligations under the contract. This disclosure outlines the specific remedies available to the non-defaulting party in case of default, such as the right to terminate the contract, seek damages, or pursue legal action. In any Glendale Arizona Seller's Disclosure of Financing Terms for Residential Property, it is crucial to provide a comprehensive and accurate overview of the financing terms agreed upon by both parties. This disclosure ensures that all relevant financial details are transparently communicated, promoting a fair and informed transaction between the seller and buyer.Description: The Glendale Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is a legal document that outlines the specific terms and conditions related to the financing arrangement between the seller and the buyer of a residential property in Glendale, Arizona. This disclosure is a crucial component of the overall contract or agreement for deed, providing clarity and transparency to all parties involved. As there may be different types of Seller's Disclosures of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed in Glendale, Arizona, it is essential to understand the specific nuances and variations that may exist. These additional types of disclosures, if applicable to the transaction, may include: 1. Fixed Financing Terms Disclosure: This type of disclosure stipulates that the financing terms offered by the seller are fixed and will remain unchanged throughout the agreed-upon period. The interest rate, payment structure, and other essential financial details will be explicitly mentioned in this disclosure. 2. Adjustable Financing Terms Disclosure: In contrast to fixed financing terms, an adjustable financing terms disclosure states that the financing terms offered by the seller may fluctuate over time. This disclosure typically includes information on interest rate adjustments, frequency of adjustments, and caps or limits on rate changes. 3. Balloon Payment Disclosure: A balloon payment disclosure is applicable when the seller and buyer agree to a financing arrangement that involves a large, final payment (balloon payment) at the end of the contract's term. This disclosure informs the buyer about the presence of a balloon payment, its due date, and any related conditions. 4. Prepayment Penalties Disclosure: If the seller intends to charge a prepayment penalty if the buyer decides to pay off the remaining balance of the contract before the agreed-upon term, a prepayment penalties disclosure should be included. This disclosure outlines the penalty amount or calculation method, as well as any conditions that trigger the penalty. 5. Default and Remedies Disclosure: The default and remedies disclosure clarifies the consequences if either party fails to fulfill their obligations under the contract. This disclosure outlines the specific remedies available to the non-defaulting party in case of default, such as the right to terminate the contract, seek damages, or pursue legal action. In any Glendale Arizona Seller's Disclosure of Financing Terms for Residential Property, it is crucial to provide a comprehensive and accurate overview of the financing terms agreed upon by both parties. This disclosure ensures that all relevant financial details are transparently communicated, promoting a fair and informed transaction between the seller and buyer.