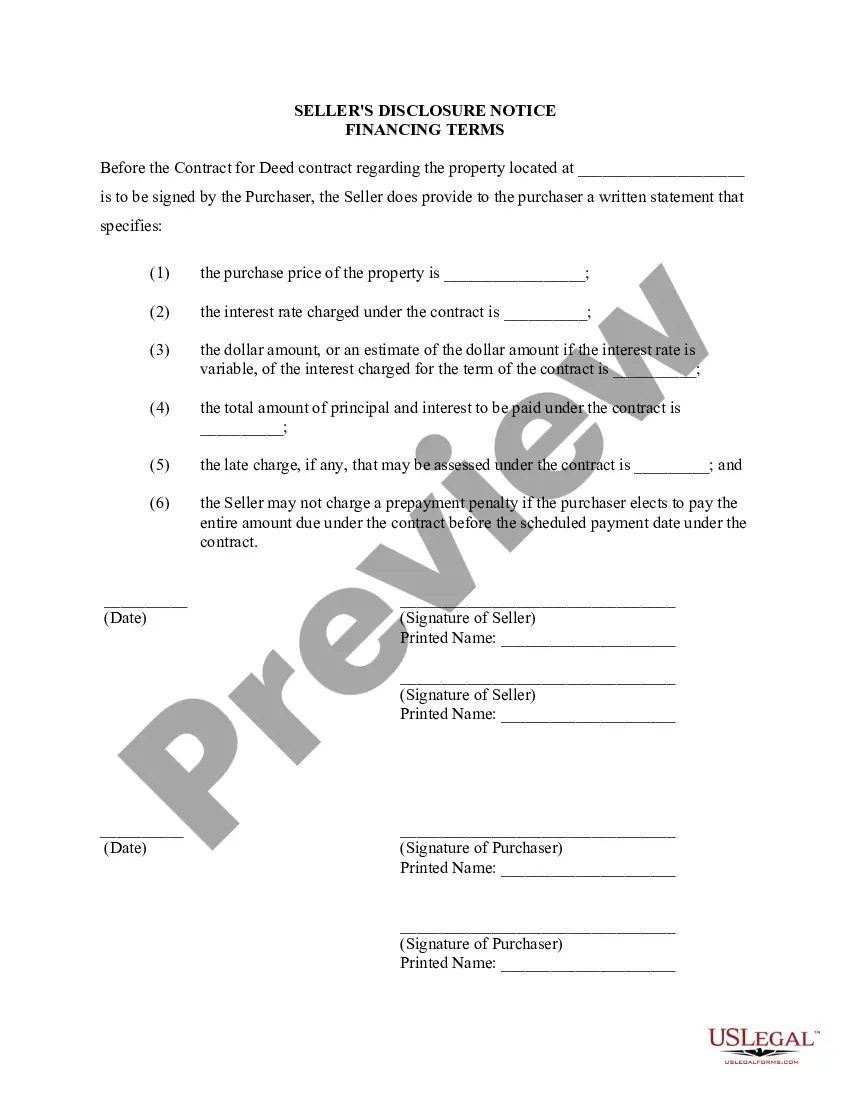

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Title: Understanding Maricopa Arizona Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed a/k/a Land Contract Keywords: Maricopa Arizona, Seller's Disclosure, Financing Terms, Residential Property, Contract, Agreement for Deed, Land Contract Introduction: In Maricopa, Arizona, when a property owner sells their residential property through a contract or agreement for deed, locally known as a land contract, it is vital to provide a Seller's Disclosure of Financing Terms. This document ensures transparency and protection for both the buyer and seller involved in this alternative form of property sale. Let's explore the details of the Maricopa Arizona Seller's Disclosure of Financing Terms for Residential Property. Types of Maricopa Arizona Seller's Disclosure of Financing Terms: 1. Standard Financing Terms Disclosure: The Standard Financing Terms Disclosure is the most common form used in Maricopa, Arizona. It outlines the financing terms offered by the seller, such as the interest rate, repayment schedule, pre-payment penalties (if any), and any other relevant details specific to the agreed-upon financing terms. 2. Balloon Payment Disclosure: In some land contracts or agreement for deeds, the seller and buyer may agree on a balloon payment, where the majority of the principal amount is due at the end of a specific term. This type of Seller's Disclosure would outline the balloon payment amount, the repayment terms, and any consequences for non-compliance. 3. Adjustable-Rate Mortgage (ARM) Disclosure: If the financing terms offered by the seller involve an adjustable-rate mortgage (ARM), this type of Seller's Disclosure would elaborate on the details. It would cover the initial interest rate, the frequency of rate adjustments, the index used as a basis for adjustments, and any limitations regarding rate increases or decreases. 4. Seller Financing Disclosure: When the seller is financing the purchase instead of traditional lenders, a Seller Financing Disclosure is necessary. This document would outline the agreed-upon interest rate, repayment schedule, and other financing details, similar to a standard financing terms disclosure. Content of the Seller's Disclosure: 1. Parties Involved: This section would identify the buyer(s) and seller(s) involved in the land contract, mentioning their legal names and contact information. 2. Property Details: Describe the residential property being sold, including the address, size, lot information, and any specific considerations or restrictions. 3. Financing Terms: Elaborate on the financing terms agreed upon between the buyer and the seller. Include information about the interest rate, payment amount, repayment schedule, length of the term (if applicable), and any related fees or penalties. 4. Disclosures and Warranties: Provide any additional disclosures or warranties required by state or local laws relating to the property, such as regarding environmental hazards, lead-based paint, or other relevant factors. 5. Default and Remedies: Outline the consequences of default by either party and the remedies available to the non-defaulting party in case of non-compliance with the agreed-upon terms. 6. Signatures: Include spaces for the signatures of both the buyer and seller, along with the date on which the Seller's Disclosure of Financing Terms was completed. Conclusion: When engaging in a land contract or agreement for deed in Maricopa, Arizona, a comprehensive Seller's Disclosure of Financing Terms is crucial to ensure transparency and protect the rights of both parties involved. This document provides clarity regarding the financing terms offered by the seller and protects the buyer from any unexpected issues that may arise during the transaction.Title: Understanding Maricopa Arizona Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed a/k/a Land Contract Keywords: Maricopa Arizona, Seller's Disclosure, Financing Terms, Residential Property, Contract, Agreement for Deed, Land Contract Introduction: In Maricopa, Arizona, when a property owner sells their residential property through a contract or agreement for deed, locally known as a land contract, it is vital to provide a Seller's Disclosure of Financing Terms. This document ensures transparency and protection for both the buyer and seller involved in this alternative form of property sale. Let's explore the details of the Maricopa Arizona Seller's Disclosure of Financing Terms for Residential Property. Types of Maricopa Arizona Seller's Disclosure of Financing Terms: 1. Standard Financing Terms Disclosure: The Standard Financing Terms Disclosure is the most common form used in Maricopa, Arizona. It outlines the financing terms offered by the seller, such as the interest rate, repayment schedule, pre-payment penalties (if any), and any other relevant details specific to the agreed-upon financing terms. 2. Balloon Payment Disclosure: In some land contracts or agreement for deeds, the seller and buyer may agree on a balloon payment, where the majority of the principal amount is due at the end of a specific term. This type of Seller's Disclosure would outline the balloon payment amount, the repayment terms, and any consequences for non-compliance. 3. Adjustable-Rate Mortgage (ARM) Disclosure: If the financing terms offered by the seller involve an adjustable-rate mortgage (ARM), this type of Seller's Disclosure would elaborate on the details. It would cover the initial interest rate, the frequency of rate adjustments, the index used as a basis for adjustments, and any limitations regarding rate increases or decreases. 4. Seller Financing Disclosure: When the seller is financing the purchase instead of traditional lenders, a Seller Financing Disclosure is necessary. This document would outline the agreed-upon interest rate, repayment schedule, and other financing details, similar to a standard financing terms disclosure. Content of the Seller's Disclosure: 1. Parties Involved: This section would identify the buyer(s) and seller(s) involved in the land contract, mentioning their legal names and contact information. 2. Property Details: Describe the residential property being sold, including the address, size, lot information, and any specific considerations or restrictions. 3. Financing Terms: Elaborate on the financing terms agreed upon between the buyer and the seller. Include information about the interest rate, payment amount, repayment schedule, length of the term (if applicable), and any related fees or penalties. 4. Disclosures and Warranties: Provide any additional disclosures or warranties required by state or local laws relating to the property, such as regarding environmental hazards, lead-based paint, or other relevant factors. 5. Default and Remedies: Outline the consequences of default by either party and the remedies available to the non-defaulting party in case of non-compliance with the agreed-upon terms. 6. Signatures: Include spaces for the signatures of both the buyer and seller, along with the date on which the Seller's Disclosure of Financing Terms was completed. Conclusion: When engaging in a land contract or agreement for deed in Maricopa, Arizona, a comprehensive Seller's Disclosure of Financing Terms is crucial to ensure transparency and protect the rights of both parties involved. This document provides clarity regarding the financing terms offered by the seller and protects the buyer from any unexpected issues that may arise during the transaction.