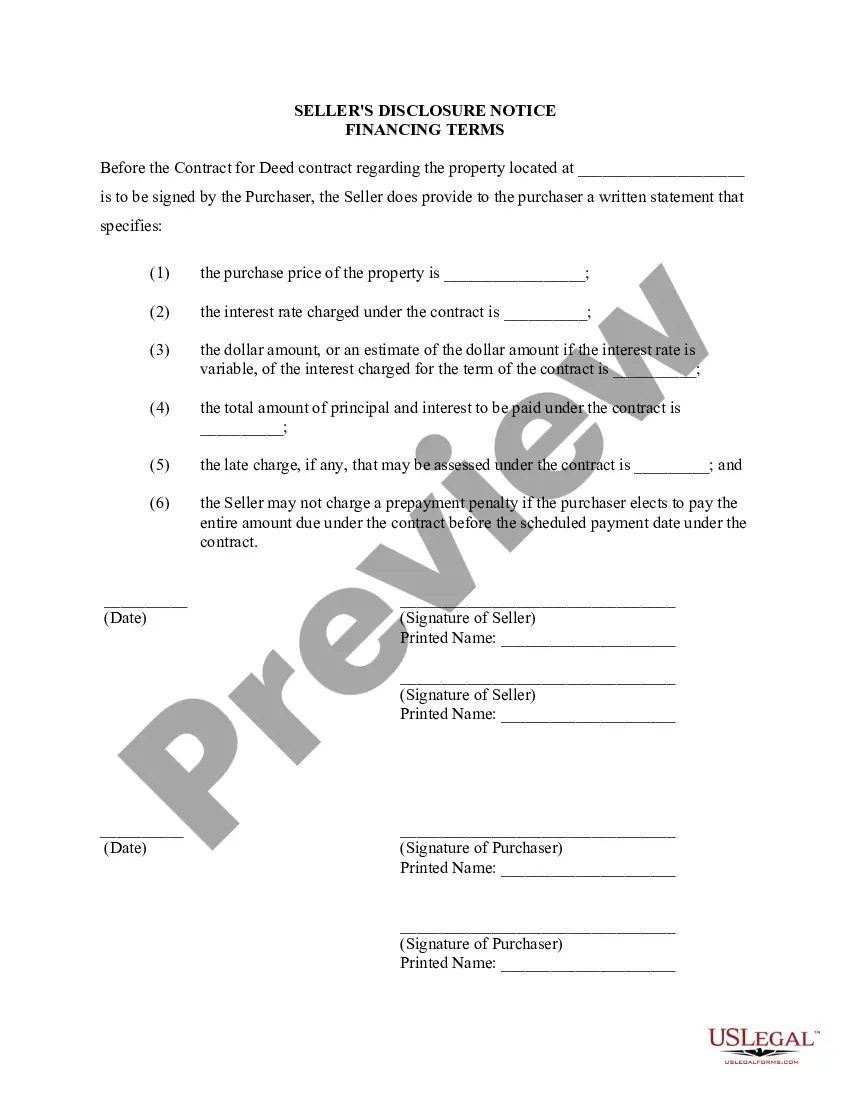

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Tucson Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an essential document that outlines the financing terms and conditions between a seller and buyer for the purchase of a residential property. This disclosure assists both parties in understanding the specific details and obligations associated with the financial arrangement. Below, we will explore several types of Tucson Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed: 1. Standard Financing Terms: This type of disclosure outlines the basic financing terms commonly associated with a residential property purchase. It typically covers aspects such as the sale price, down payment amount, interest rate, payment schedule, and duration of the contract. 2. Interest Rate and Payment Schedule Disclosure: In some cases, the Tucson Arizona Seller's Disclosure of Financing Terms might focus mainly on the interest rate and payment schedule details. This type of document provides precise information about the interest rate applied to the purchase amount, the frequency of payments (weekly, bi-weekly, monthly, etc.), and when the payments are due. 3. Balloon Payment Disclosure: A Balloon Payment Disclosure is a specific type of Tucson Arizona Seller's Disclosure that highlights the presence of a balloon payment within the financing terms. A balloon payment typically involves paying off the remaining balance of the purchase price in a lump sum at the end of the contract term. This type of disclosure outlines when the balloon payment is due and its specific amount. 4. Prepayment Penalty Disclosure: If the financing terms for the residential property include a prepayment penalty, a specific disclosure is necessary. This disclosure explains the conditions under which a penalty might be imposed in the event the buyer chooses to pay off the contract early. It will detail the penalty amount and the circumstances in which it applies. 5. Default and Repossession Disclosure: This disclosure is crucial in situations where the buyer may default on their payment obligations. It outlines the consequences of defaulting on the contract, including potential repossession of the property by the seller. It may also include information on the grace period, late fees, and the seller's rights in case of default. 6. Additional Terms and Conditions Disclosure: In certain cases, additional terms and conditions might be included in the financing terms disclosure. These additional provisions could encompass requirements for property insurance, property maintenance responsibilities, or any other specific obligations agreed upon by both parties. It is important for both buyers and sellers to thoroughly review and understand the Tucson Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed. This document plays a vital role in providing transparency and clarity regarding the financial aspects of the property purchase, ensuring a smooth transaction for all parties involved.The Tucson Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an essential document that outlines the financing terms and conditions between a seller and buyer for the purchase of a residential property. This disclosure assists both parties in understanding the specific details and obligations associated with the financial arrangement. Below, we will explore several types of Tucson Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed: 1. Standard Financing Terms: This type of disclosure outlines the basic financing terms commonly associated with a residential property purchase. It typically covers aspects such as the sale price, down payment amount, interest rate, payment schedule, and duration of the contract. 2. Interest Rate and Payment Schedule Disclosure: In some cases, the Tucson Arizona Seller's Disclosure of Financing Terms might focus mainly on the interest rate and payment schedule details. This type of document provides precise information about the interest rate applied to the purchase amount, the frequency of payments (weekly, bi-weekly, monthly, etc.), and when the payments are due. 3. Balloon Payment Disclosure: A Balloon Payment Disclosure is a specific type of Tucson Arizona Seller's Disclosure that highlights the presence of a balloon payment within the financing terms. A balloon payment typically involves paying off the remaining balance of the purchase price in a lump sum at the end of the contract term. This type of disclosure outlines when the balloon payment is due and its specific amount. 4. Prepayment Penalty Disclosure: If the financing terms for the residential property include a prepayment penalty, a specific disclosure is necessary. This disclosure explains the conditions under which a penalty might be imposed in the event the buyer chooses to pay off the contract early. It will detail the penalty amount and the circumstances in which it applies. 5. Default and Repossession Disclosure: This disclosure is crucial in situations where the buyer may default on their payment obligations. It outlines the consequences of defaulting on the contract, including potential repossession of the property by the seller. It may also include information on the grace period, late fees, and the seller's rights in case of default. 6. Additional Terms and Conditions Disclosure: In certain cases, additional terms and conditions might be included in the financing terms disclosure. These additional provisions could encompass requirements for property insurance, property maintenance responsibilities, or any other specific obligations agreed upon by both parties. It is important for both buyers and sellers to thoroughly review and understand the Tucson Arizona Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed. This document plays a vital role in providing transparency and clarity regarding the financial aspects of the property purchase, ensuring a smooth transaction for all parties involved.