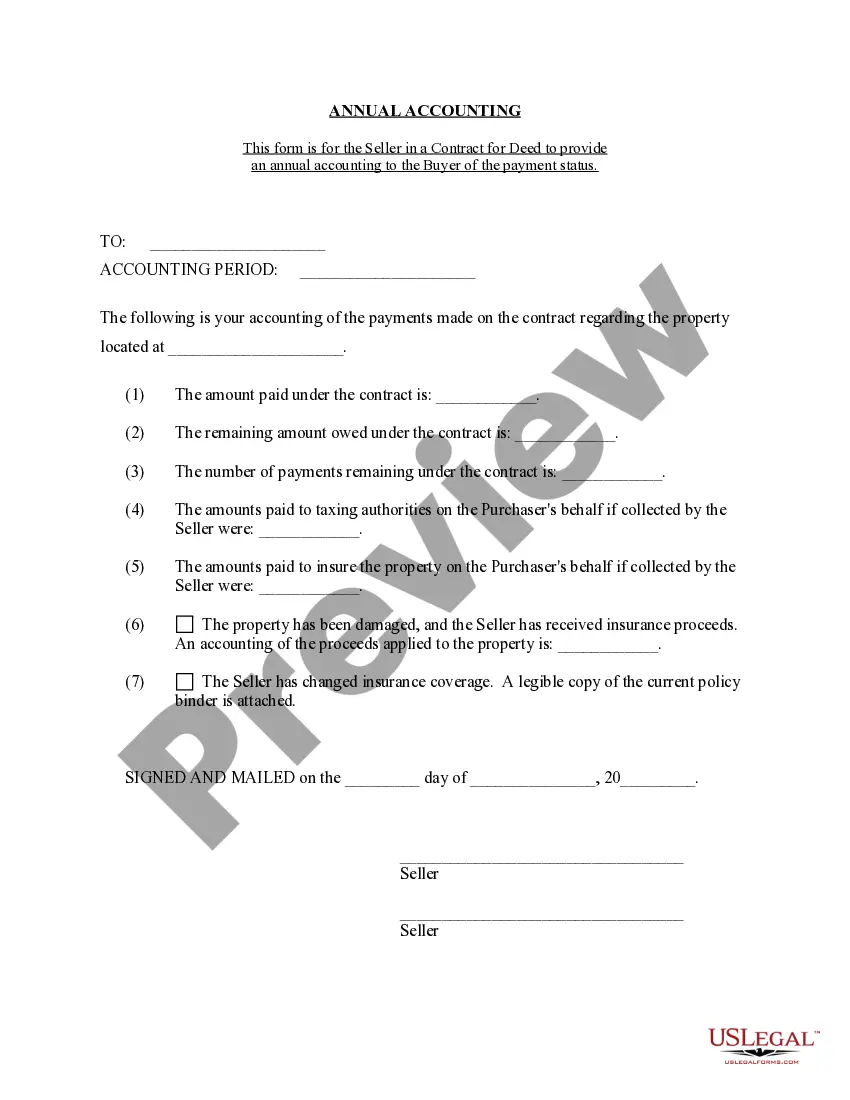

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Gilbert Arizona Contract for Deed Seller's Annual Accounting Statement is a comprehensive document that outlines the financial details related to a contract for deed transaction in Gilbert, Arizona. This statement serves as a crucial tool for both the seller and the buyer to track and evaluate the financial aspects of the agreement. By providing a transparent breakdown of income, expenses, and other pertinent information, the annual accounting statement aims to facilitate transparency and accountability between the involved parties. Keywords: Gilbert Arizona, Contract for Deed, Seller's Annual Accounting Statement, financial details, transaction, transparency, accountability. Different types of Gilbert Arizona Contract for Deed Seller's Annual Accounting Statement: 1. Basic Annual Accounting Statement: This type of statement provides a simplified overview of the financial information related to the contract for deed transaction. It includes essential details such as the total income received by the seller, expenses incurred, and any outstanding payments or liabilities. 2. Detailed Income and Expense Statement: This specific type of accounting statement provides a more comprehensive breakdown of income and expenses associated with the contract for deed transaction. It includes a detailed list of income sources, such as monthly payments from the buyer, interest earned, and any additional fees or charges received. Additionally, it outlines all expenses incurred by the seller, such as property taxes, insurance costs, maintenance expenses, and any other relevant financial obligations. 3. Payment History Statement: This statement primarily focuses on tracking and documenting the payment history of the buyer in relation to the contract for deed agreement. It provides a comprehensive record of all payments made by the buyer, including the date, amount, and any outstanding balances. This statement helps both parties to monitor the progress of the contract and ensure that all payments are accurately accounted for. 4. Tax-related Accounting Statement: In some cases, a separate accounting statement may be required to fulfill tax obligations associated with the contract for deed transaction. This statement provides detailed information required for tax reporting purposes, such as the buyer's interest paid, seller's interest received, and any other relevant financial data necessary for filing taxes accurately. In conclusion, the Gilbert Arizona Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial document that ensures transparency and accountability between the seller and buyer in a contract for deed transaction. It aids in tracking income, expenses, payment history, and tax-related details. By providing different types of accounting statements tailored to specific needs, it facilitates smooth financial management and strengthens the trust between the parties involved.