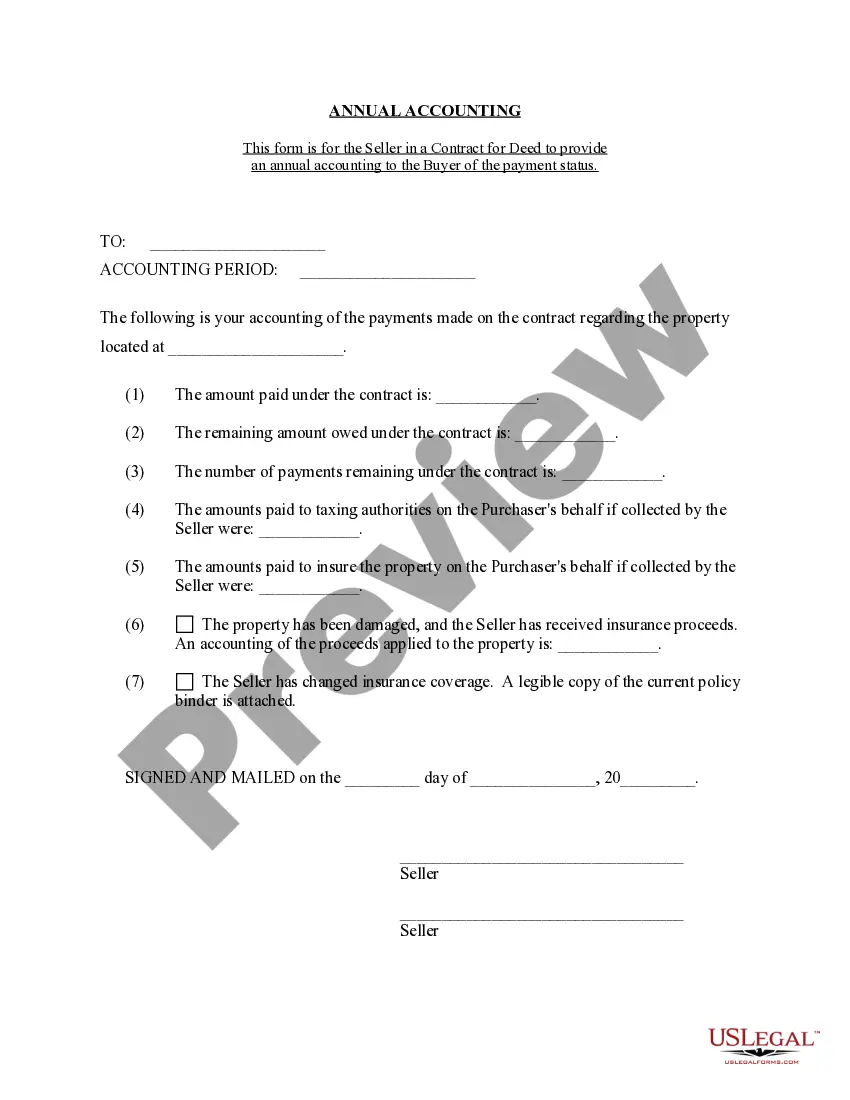

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Glendale, Arizona Contract for Deed Seller's Annual Accounting Statement is a financial document that provides a comprehensive overview of the financial transactions and obligations related to a property sale through a contract for deed arrangement in Glendale, Arizona. This statement outlines the seller's annual accounting, ensuring transparency and accountability within the contractual agreement. The Glendale, Arizona Contract for Deed Seller's Annual Accounting Statement is designed to assist both the seller and buyer in tracking the monetary exchanges involved in the contract for deed process. It encompasses various financial aspects, including payments received, expenses incurred, and any outstanding balances. This statement serves as a crucial tool for parties involved to evaluate the financial performance of the contract and maintain accurate records. Key components of a Glendale, Arizona Contract for Deed Seller's Annual Accounting Statement may include: 1. Transaction Summary: This section provides an overview of all financial transactions related to the contract for deed during the specified accounting period. It includes information such as the total amount received from the buyer, any interest charged, and the current outstanding balance. 2. Payment Breakdown: In this section, the statement breaks down each payment received from the buyer, showcasing the amount paid towards the principal, interest, taxes, insurance, and other specified expenses. This breakdown serves as a clear representation of how the buyer's payments are allocated. 3. Expenses Incurred: The statement should list any expenses incurred by the seller during the accounting period, such as property taxes, insurance premiums, or maintenance costs. These expenses are subtracted from the payments received to calculate the net profit or loss for the seller. 4. Outstanding Balances: The statement outlines the outstanding balance of the contract for deed, providing a snapshot of the remaining amount owed by the buyer. It may also include any penalties or late fees assessed for missed payments. 5. Interest Calculation: If applicable, the interest accrued on the outstanding balance should be calculated and presented in the statement. This demonstrates the interest earned by the seller over the accounting period. Different types of Glendale, Arizona Contract for Deed Seller's Annual Accounting Statements may exist based on specific contract terms or additional clauses agreed upon by the parties involved. For example: — Simple Contract for Deed Seller's Annual Accounting Statement: This type of statement covers the basic financial details outlined above. — Comprehensive Contract for Deed Seller's Annual Accounting Statement: In addition to the standard elements, this statement may provide a more detailed breakdown of expenses and highlight any contingencies or adjustments made during the accounting period. — Contract for Deed Seller's Annual Accounting Statement with Balloon Payment: If the contract for deed includes a balloon payment, this statement will outline the remaining balance after the balloon payment is made, as well as any adjusted terms for the subsequent accounting period. In conclusion, the Glendale, Arizona Contract for Deed Seller's Annual Accounting Statement is a critical document that ensures financial transparency and record-keeping for both the seller and buyer. It serves as a comprehensive summary of all financial aspects related to the contract for deed, allowing parties to evaluate the financial performance and accurately assess the status of the agreement.