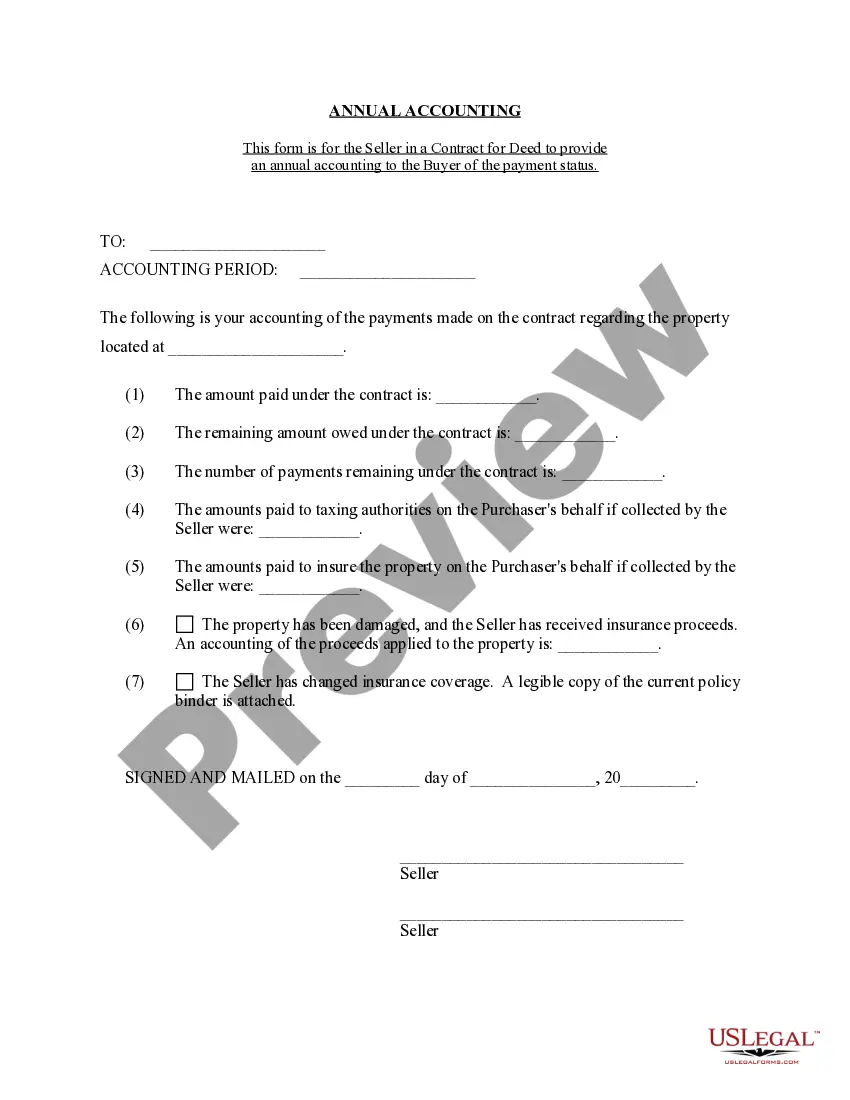

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Maricopa Arizona Contract for Deed Seller's Annual Accounting Statement is a document that provides a comprehensive financial report to the seller of a property sold through a contract for deed arrangement in Maricopa, Arizona. This statement outlines the financial transactions and details regarding the property sale, ensuring transparency and accountability throughout the contract period. Key elements included in the Maricopa Arizona Contract for Deed Seller's Annual Accounting Statement may vary depending on the terms agreed upon by both parties. However, typically, the following information is presented: 1. Property Details: The statement begins with a complete description of the property, including its address, legal description, and any specific details regarding its location or features. 2. Buyer Information: The name and contact information of the buyer involved in the contract for deed agreement are mentioned, ensuring clear identification. 3. Transaction Summary: This section provides a comprehensive summary of all financial transactions related to the property sale. It outlines the initial down payment received from the buyer, the principal amount of the contract, any subsequent payments made by the buyer, and any interest charges or fees associated with the contract. 4. Payment Schedule: The statement details the payment schedule agreed upon between the buyer and the seller. It includes the due dates of the payments, the principal amount, and the interest charged, if applicable. 5. Payments Received: This section summarizes the payments received by the seller from the buyer throughout the year. It includes the payment date, payment amount, and any additional information relevant to each payment. 6. Outstanding Balance: The statement presents the remaining balance owed by the buyer at the end of the accounting period. It may also include any additional fees or charges that have accrued during the period. 7. Expenses: If there are any expenses incurred by the seller related to the property during the specified period, such as property taxes, insurance, repairs, or maintenance costs, they will be detailed in this section. 8. Closing Costs: This section outlines any closing costs associated with the property sale that the seller may have covered. It includes a breakdown of the costs and their corresponding amounts. 9. Net Income: The statement concludes with the calculation of the net income generated from the contract for deed arrangement. It deducts all expenses and outstanding balance from the total payments received during the year. Different variations or types of Maricopa Arizona Contract for Deed Seller's Annual Accounting Statement may exist based on specific contractual agreements or legal requirements. However, the general purpose remains the same, focusing on transparency and accountability in financial matters for sellers and buyers involved in contract for deed arrangements in Maricopa, Arizona.Maricopa Arizona Contract for Deed Seller's Annual Accounting Statement is a document that provides a comprehensive financial report to the seller of a property sold through a contract for deed arrangement in Maricopa, Arizona. This statement outlines the financial transactions and details regarding the property sale, ensuring transparency and accountability throughout the contract period. Key elements included in the Maricopa Arizona Contract for Deed Seller's Annual Accounting Statement may vary depending on the terms agreed upon by both parties. However, typically, the following information is presented: 1. Property Details: The statement begins with a complete description of the property, including its address, legal description, and any specific details regarding its location or features. 2. Buyer Information: The name and contact information of the buyer involved in the contract for deed agreement are mentioned, ensuring clear identification. 3. Transaction Summary: This section provides a comprehensive summary of all financial transactions related to the property sale. It outlines the initial down payment received from the buyer, the principal amount of the contract, any subsequent payments made by the buyer, and any interest charges or fees associated with the contract. 4. Payment Schedule: The statement details the payment schedule agreed upon between the buyer and the seller. It includes the due dates of the payments, the principal amount, and the interest charged, if applicable. 5. Payments Received: This section summarizes the payments received by the seller from the buyer throughout the year. It includes the payment date, payment amount, and any additional information relevant to each payment. 6. Outstanding Balance: The statement presents the remaining balance owed by the buyer at the end of the accounting period. It may also include any additional fees or charges that have accrued during the period. 7. Expenses: If there are any expenses incurred by the seller related to the property during the specified period, such as property taxes, insurance, repairs, or maintenance costs, they will be detailed in this section. 8. Closing Costs: This section outlines any closing costs associated with the property sale that the seller may have covered. It includes a breakdown of the costs and their corresponding amounts. 9. Net Income: The statement concludes with the calculation of the net income generated from the contract for deed arrangement. It deducts all expenses and outstanding balance from the total payments received during the year. Different variations or types of Maricopa Arizona Contract for Deed Seller's Annual Accounting Statement may exist based on specific contractual agreements or legal requirements. However, the general purpose remains the same, focusing on transparency and accountability in financial matters for sellers and buyers involved in contract for deed arrangements in Maricopa, Arizona.