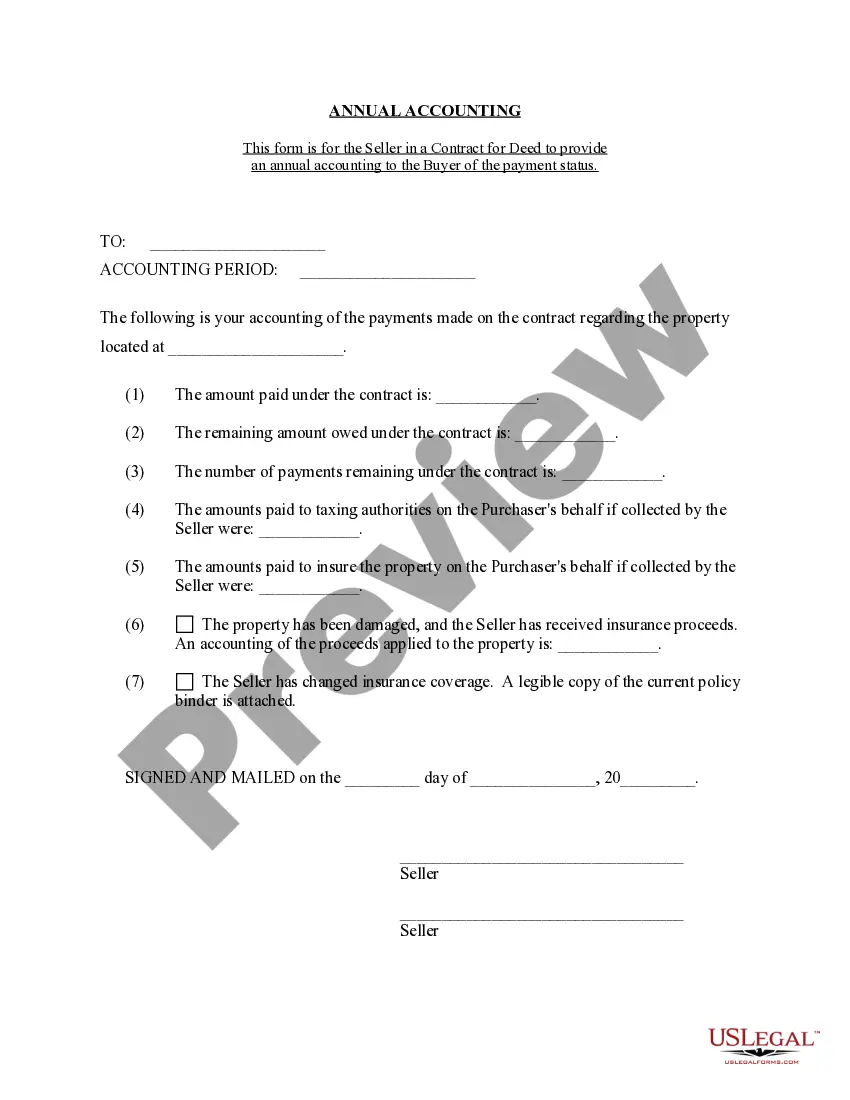

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Phoenix Arizona Contract for Deed Seller's Annual Accounting Statement is a financial document that provides a comprehensive overview of the financial transactions and activities related to the contract for deed agreement between the seller and the buyer. This statement is prepared annually by the seller and serves as a transparent record of the financial status of the contract. Keywords: 1. Phoenix, Arizona: These terms specify the geographical location where the contract for deed is being executed and represents the legal jurisdiction under which the contract is bound. 2. Contract for Deed: This refers to a real estate agreement where the seller acts as the financing entity, allowing the buyer to make payments directly to the seller instead of obtaining traditional mortgage financing from a bank. 3. Seller's Annual Accounting Statement: This is the main document that provides a detailed breakdown of the financial transactions and activities relevant to the contract for deed. It serves as an annual financial report detailing the income, expenses, and overall financial position of the seller. 4. Financial Transactions: This refers to any monetary transactions involved in the contract for deed, including the initial down payment, subsequent payments, interest payments, and penalties. 5. Activities: This encompasses any actions or events that impact the financial status of the contract for deed, such as property maintenance, repairs, or improvements made by either the buyer or seller. 6. Transparency: This emphasizes the importance of maintaining clear and accurate financial records to promote trust and transparency between the seller and buyer, ensuring that both parties have a clear understanding of the financial status of the contract. 7. Financial Status: This term signifies the overall financial health and position of the seller in relation to the contract, reflecting the total revenue generated, expenses incurred, and any outstanding balances or liabilities. 8. Buyer: This refers to the individual or entity who purchased the property through the contract for deed agreement and is obligated to make agreed-upon payments to the seller. 9. Geographical Context: The inclusion of "Phoenix, Arizona" emphasizes that this accounting statement is specific to the state of Arizona, and any local regulations or requirements applicable in that region must be adhered to. Different types of Phoenix Arizona Contract for Deed Seller's Annual Accounting Statement may include variations based on the specific terms and conditions outlined in the contract, such as whether interest is charged and at what rate, the duration of the agreement, and any agreed-upon penalties. The statement may also be customized to include additional sections that focus on specific financial aspects, such as a section outlining property-related expenses or a breakdown of any outstanding balances.The Phoenix Arizona Contract for Deed Seller's Annual Accounting Statement is a financial document that provides a comprehensive overview of the financial transactions and activities related to the contract for deed agreement between the seller and the buyer. This statement is prepared annually by the seller and serves as a transparent record of the financial status of the contract. Keywords: 1. Phoenix, Arizona: These terms specify the geographical location where the contract for deed is being executed and represents the legal jurisdiction under which the contract is bound. 2. Contract for Deed: This refers to a real estate agreement where the seller acts as the financing entity, allowing the buyer to make payments directly to the seller instead of obtaining traditional mortgage financing from a bank. 3. Seller's Annual Accounting Statement: This is the main document that provides a detailed breakdown of the financial transactions and activities relevant to the contract for deed. It serves as an annual financial report detailing the income, expenses, and overall financial position of the seller. 4. Financial Transactions: This refers to any monetary transactions involved in the contract for deed, including the initial down payment, subsequent payments, interest payments, and penalties. 5. Activities: This encompasses any actions or events that impact the financial status of the contract for deed, such as property maintenance, repairs, or improvements made by either the buyer or seller. 6. Transparency: This emphasizes the importance of maintaining clear and accurate financial records to promote trust and transparency between the seller and buyer, ensuring that both parties have a clear understanding of the financial status of the contract. 7. Financial Status: This term signifies the overall financial health and position of the seller in relation to the contract, reflecting the total revenue generated, expenses incurred, and any outstanding balances or liabilities. 8. Buyer: This refers to the individual or entity who purchased the property through the contract for deed agreement and is obligated to make agreed-upon payments to the seller. 9. Geographical Context: The inclusion of "Phoenix, Arizona" emphasizes that this accounting statement is specific to the state of Arizona, and any local regulations or requirements applicable in that region must be adhered to. Different types of Phoenix Arizona Contract for Deed Seller's Annual Accounting Statement may include variations based on the specific terms and conditions outlined in the contract, such as whether interest is charged and at what rate, the duration of the agreement, and any agreed-upon penalties. The statement may also be customized to include additional sections that focus on specific financial aspects, such as a section outlining property-related expenses or a breakdown of any outstanding balances.