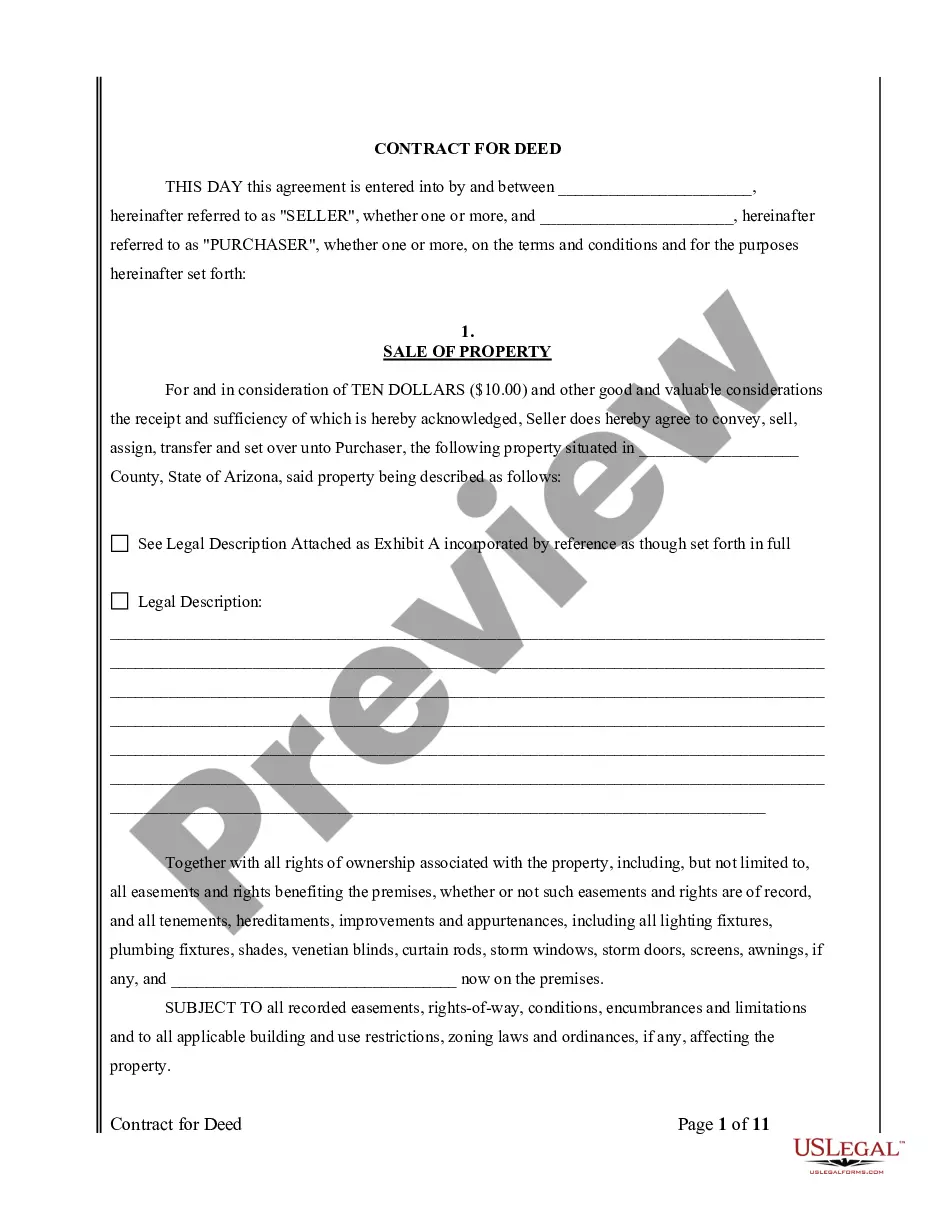

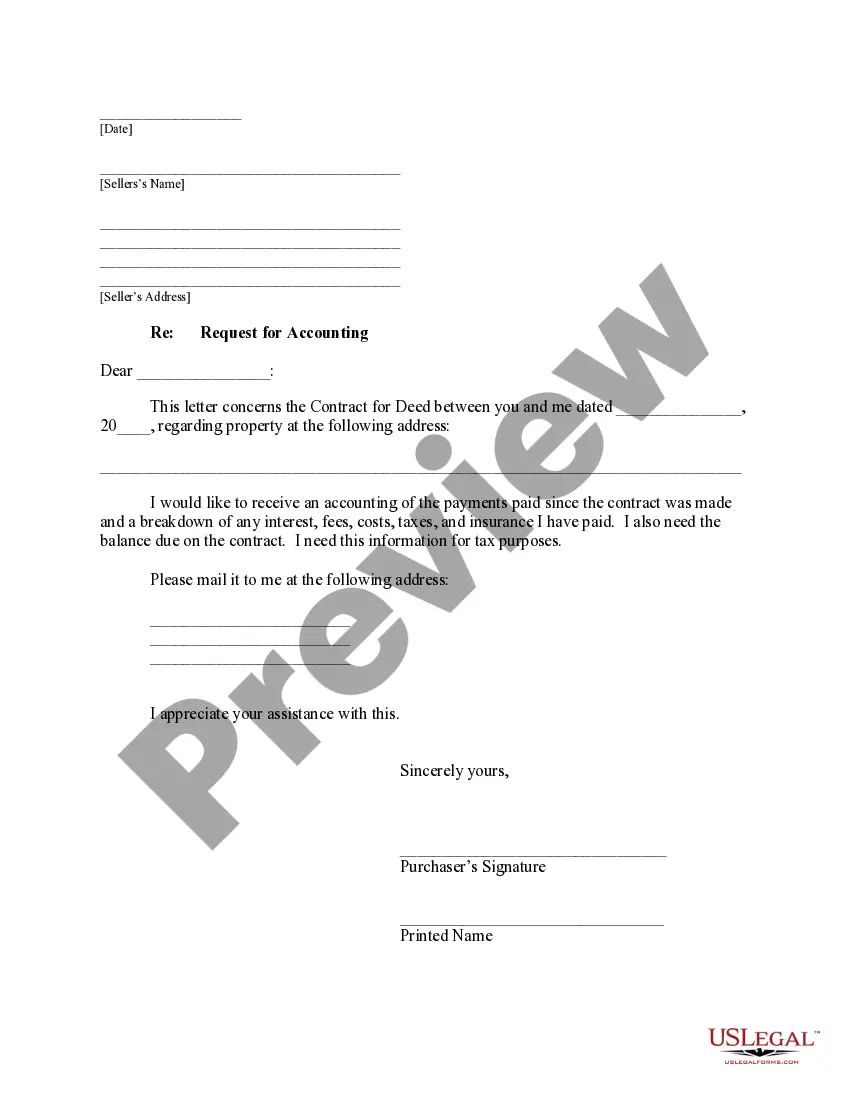

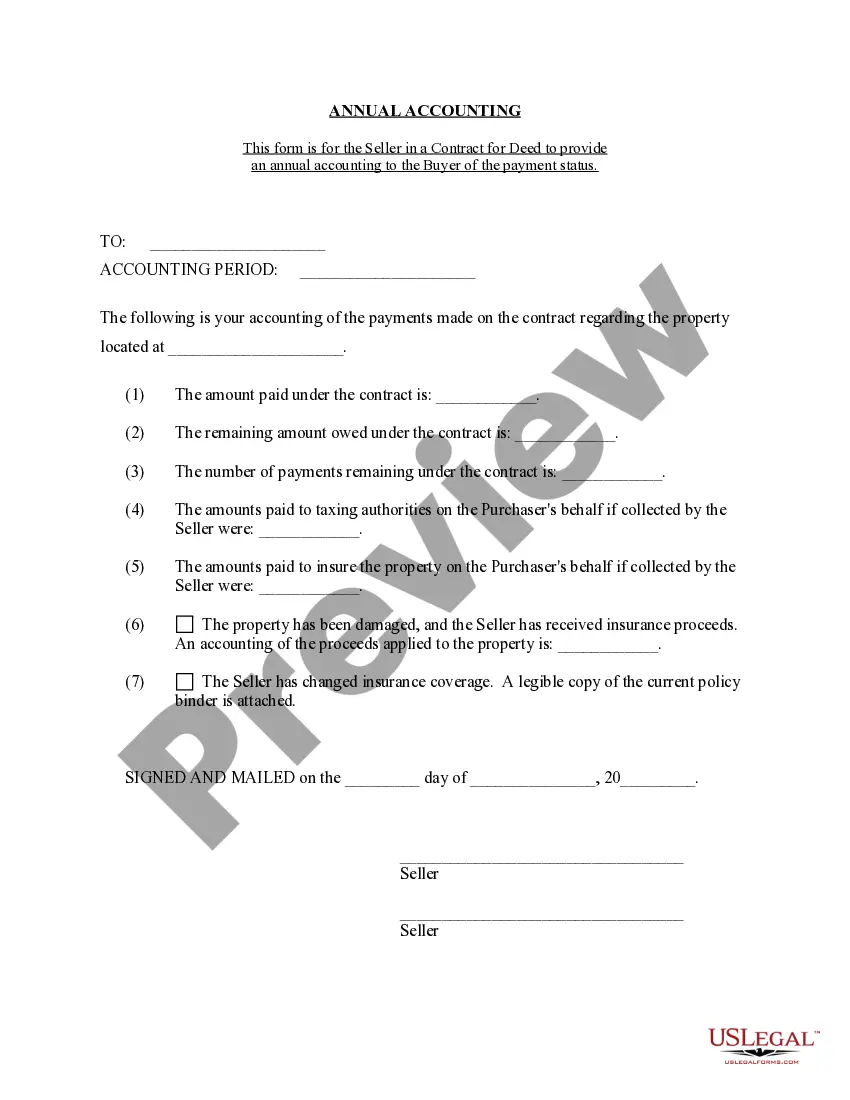

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

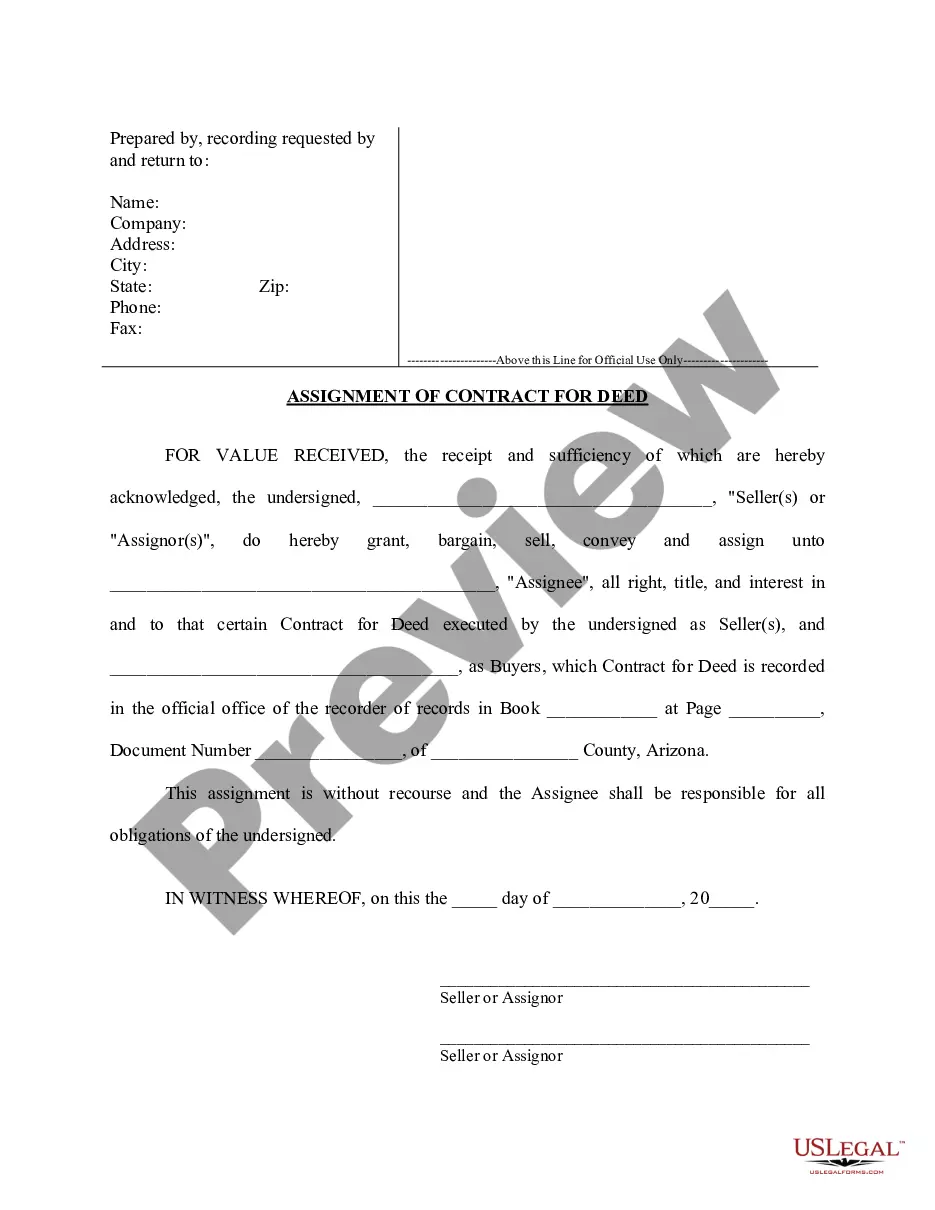

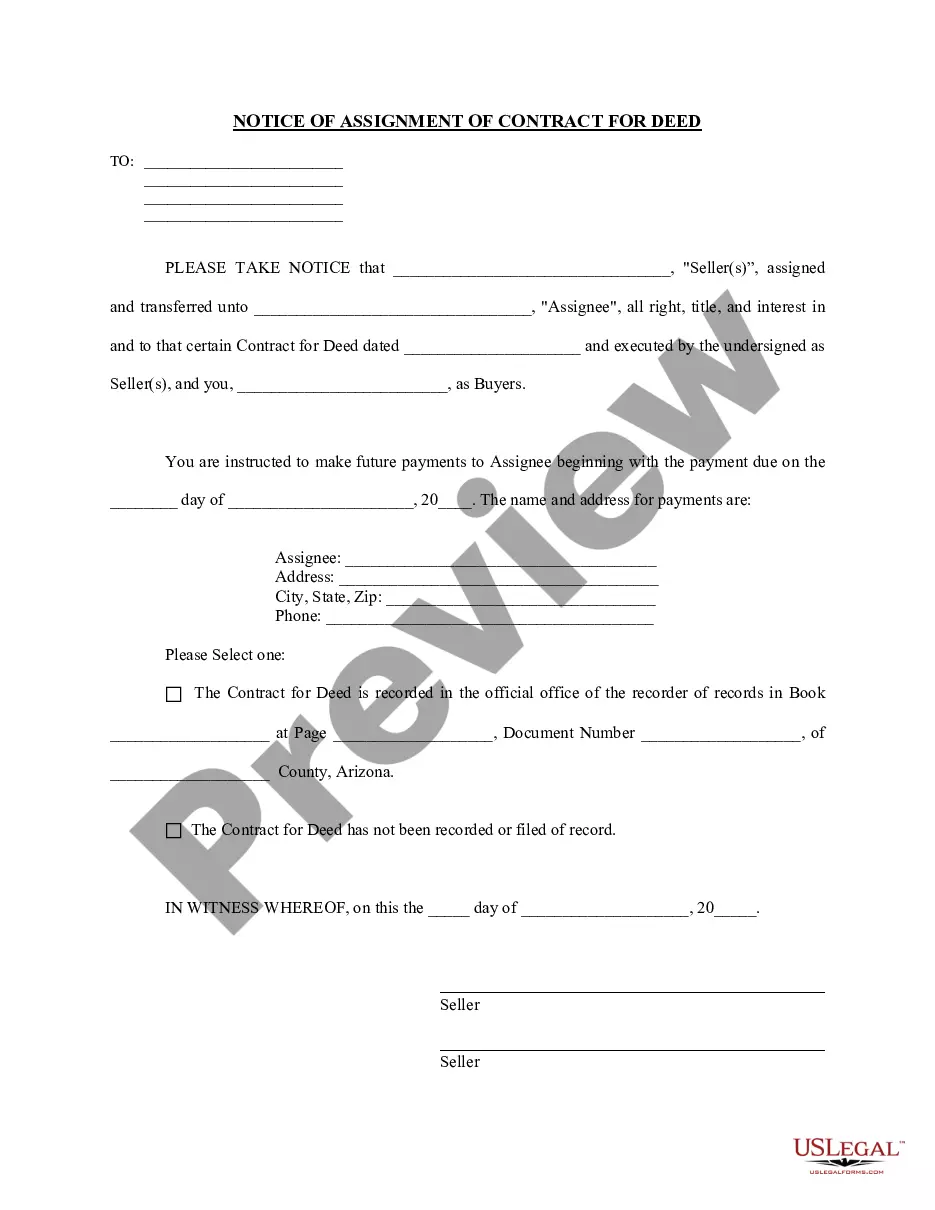

The Lima Arizona Contract for Deed Seller's Annual Accounting Statement is a crucial document that outlines the financial transactions and obligations between the seller and buyer in a contract for deed transaction in Lima, Arizona. This statement provides a comprehensive breakdown of the financial status of the contract, ensuring transparency and accountability for both parties involved. The Lima Arizona Contract for Deed Seller's Annual Accounting Statement may consist of various types, including: 1. Income Statement: This section of the annual accounting statement outlines the seller's total income generated from the contract for deed, including the principal payments, interest charges, and any other charges or fees specified in the contract. 2. Expense Statement: Here, the seller details all expenses incurred during the year related to the contract for deed. These expenses might include property taxes, insurance payments, maintenance costs, and any other fees or charges agreed upon in the contract. 3. Principal Balance Statement: This part of the accounting statement presents the remaining principal balance on the contract for deed. It helps the buyer understand how much is left to be paid and serves as a reference for both parties to track the progress of the contract. 4. Interest Statement: The interest statement outlines the interest accrued on the contract for deed throughout the year. It includes details such as the interest rate, the amount of interest paid, and any changes made to the interest terms as per the contract. 5. Payment Schedule: This part of the accounting statement provides a clear breakdown of the buyer's payment schedule, including due dates, payment amounts, and any penalties or late fees applied if payments are not made on time. 6. Additional Terms and Conditions: The Lima Arizona Contract for Deed Seller's Annual Accounting Statement may include additional terms and conditions specific to the agreement between the seller and buyer. These could cover topics such as prepayment options, dispute resolution processes, or any modifications made to the original contract during the year. Overall, the Lima Arizona Contract for Deed Seller's Annual Accounting Statement serves as a crucial tool for maintaining financial transparency and accountability within a contract for deed transaction. It enables both sellers and buyers to keep track of their financial obligations and helps ensure a fair and clear understanding of the financial aspects of the agreement.The Lima Arizona Contract for Deed Seller's Annual Accounting Statement is a crucial document that outlines the financial transactions and obligations between the seller and buyer in a contract for deed transaction in Lima, Arizona. This statement provides a comprehensive breakdown of the financial status of the contract, ensuring transparency and accountability for both parties involved. The Lima Arizona Contract for Deed Seller's Annual Accounting Statement may consist of various types, including: 1. Income Statement: This section of the annual accounting statement outlines the seller's total income generated from the contract for deed, including the principal payments, interest charges, and any other charges or fees specified in the contract. 2. Expense Statement: Here, the seller details all expenses incurred during the year related to the contract for deed. These expenses might include property taxes, insurance payments, maintenance costs, and any other fees or charges agreed upon in the contract. 3. Principal Balance Statement: This part of the accounting statement presents the remaining principal balance on the contract for deed. It helps the buyer understand how much is left to be paid and serves as a reference for both parties to track the progress of the contract. 4. Interest Statement: The interest statement outlines the interest accrued on the contract for deed throughout the year. It includes details such as the interest rate, the amount of interest paid, and any changes made to the interest terms as per the contract. 5. Payment Schedule: This part of the accounting statement provides a clear breakdown of the buyer's payment schedule, including due dates, payment amounts, and any penalties or late fees applied if payments are not made on time. 6. Additional Terms and Conditions: The Lima Arizona Contract for Deed Seller's Annual Accounting Statement may include additional terms and conditions specific to the agreement between the seller and buyer. These could cover topics such as prepayment options, dispute resolution processes, or any modifications made to the original contract during the year. Overall, the Lima Arizona Contract for Deed Seller's Annual Accounting Statement serves as a crucial tool for maintaining financial transparency and accountability within a contract for deed transaction. It enables both sellers and buyers to keep track of their financial obligations and helps ensure a fair and clear understanding of the financial aspects of the agreement.