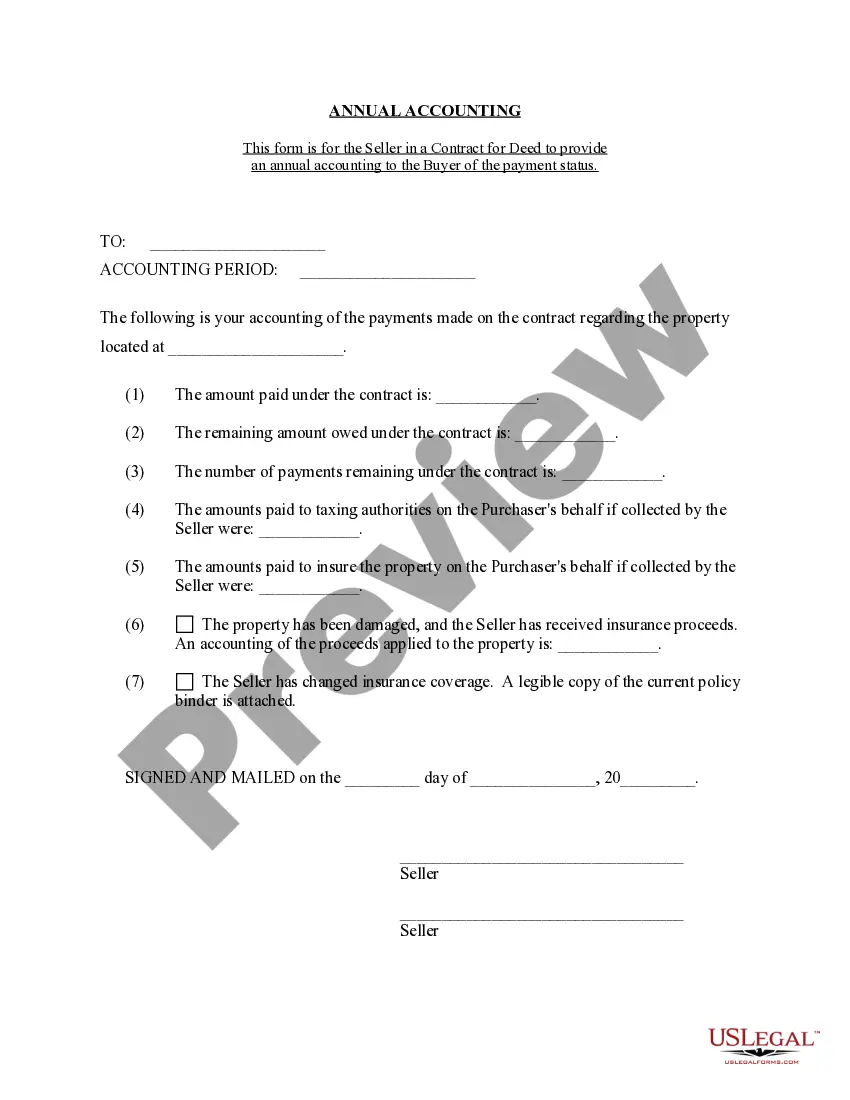

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Surprise Arizona Contract for Deed Seller's Annual Accounting Statement is a crucial document that provides transparent financial disclosure for sellers in real estate transactions. This statement enables the seller to present a detailed breakdown of the financial aspects related to the contract for deed agreement. Keywords: Surprise Arizona, Contract for Deed, Seller's Annual Accounting Statement, financial disclosure, real estate transactions. This comprehensive statement encompasses various financial components such as revenue, expenses, and distributions associated with the contract for deed. It serves as an accountability tool, ensuring transparency and clear communication between sellers and buyers in Surprise, Arizona. The Surprise Arizona Contract for Deed Seller's Annual Accounting Statement includes the following key elements: 1. Sales Revenue: This section outlines the total revenue generated from the sale of the property through the contract for deed. It includes the principal amount, interest, and any additional fees or charges. 2. Expenses: Here, all expenses incurred during the reporting period are itemized. This may include property maintenance costs, property taxes, insurance fees, or any other related expenses. 3. Distributions: This part provides details of any payments made to the buyer, such as principal repayments, interest payments, or any other financial obligations outlined in the contract for deed agreement. 4. Escrow Account: If the contract for deed includes an escrow account, this section provides an overview of the account activity. It details any funds deposited or disbursed from the escrow account, ensuring transparency in financial transactions. 5. Late Payment Charges: In cases where the buyer has failed to make timely payments, this section highlights any late payment charges incurred, if applicable. 6. Contingency Reserves: The Annual Accounting Statement may also include information on contingency reserves. These reserves are funds set aside for unforeseen events or repairs that might arise during the contract period. Types of Surprise Arizona Contract for Deed Seller's Annual Accounting Statement: 1. Basic Annual Accounting Statement: This is a standard statement that includes all the necessary elements mentioned above. It provides a comprehensive overview of the financial performance of the contract for deed for a specific reporting period. 2. Detailed Annual Accounting Statement: This statement provides a more in-depth analysis of the financials associated with the contract for deed. It includes additional information such as specific expense categories, payment breakdowns, and other relevant financial metrics. 3. Customized Annual Accounting Statement: Depending on the requirements of the contract for deed agreement, sellers may opt for a customized statement that caters to specific financial reporting needs. This allows for flexibility in presenting the financial information tailored to the preferences and specifications of the seller or buyer.The Surprise Arizona Contract for Deed Seller's Annual Accounting Statement is a crucial document that provides transparent financial disclosure for sellers in real estate transactions. This statement enables the seller to present a detailed breakdown of the financial aspects related to the contract for deed agreement. Keywords: Surprise Arizona, Contract for Deed, Seller's Annual Accounting Statement, financial disclosure, real estate transactions. This comprehensive statement encompasses various financial components such as revenue, expenses, and distributions associated with the contract for deed. It serves as an accountability tool, ensuring transparency and clear communication between sellers and buyers in Surprise, Arizona. The Surprise Arizona Contract for Deed Seller's Annual Accounting Statement includes the following key elements: 1. Sales Revenue: This section outlines the total revenue generated from the sale of the property through the contract for deed. It includes the principal amount, interest, and any additional fees or charges. 2. Expenses: Here, all expenses incurred during the reporting period are itemized. This may include property maintenance costs, property taxes, insurance fees, or any other related expenses. 3. Distributions: This part provides details of any payments made to the buyer, such as principal repayments, interest payments, or any other financial obligations outlined in the contract for deed agreement. 4. Escrow Account: If the contract for deed includes an escrow account, this section provides an overview of the account activity. It details any funds deposited or disbursed from the escrow account, ensuring transparency in financial transactions. 5. Late Payment Charges: In cases where the buyer has failed to make timely payments, this section highlights any late payment charges incurred, if applicable. 6. Contingency Reserves: The Annual Accounting Statement may also include information on contingency reserves. These reserves are funds set aside for unforeseen events or repairs that might arise during the contract period. Types of Surprise Arizona Contract for Deed Seller's Annual Accounting Statement: 1. Basic Annual Accounting Statement: This is a standard statement that includes all the necessary elements mentioned above. It provides a comprehensive overview of the financial performance of the contract for deed for a specific reporting period. 2. Detailed Annual Accounting Statement: This statement provides a more in-depth analysis of the financials associated with the contract for deed. It includes additional information such as specific expense categories, payment breakdowns, and other relevant financial metrics. 3. Customized Annual Accounting Statement: Depending on the requirements of the contract for deed agreement, sellers may opt for a customized statement that caters to specific financial reporting needs. This allows for flexibility in presenting the financial information tailored to the preferences and specifications of the seller or buyer.