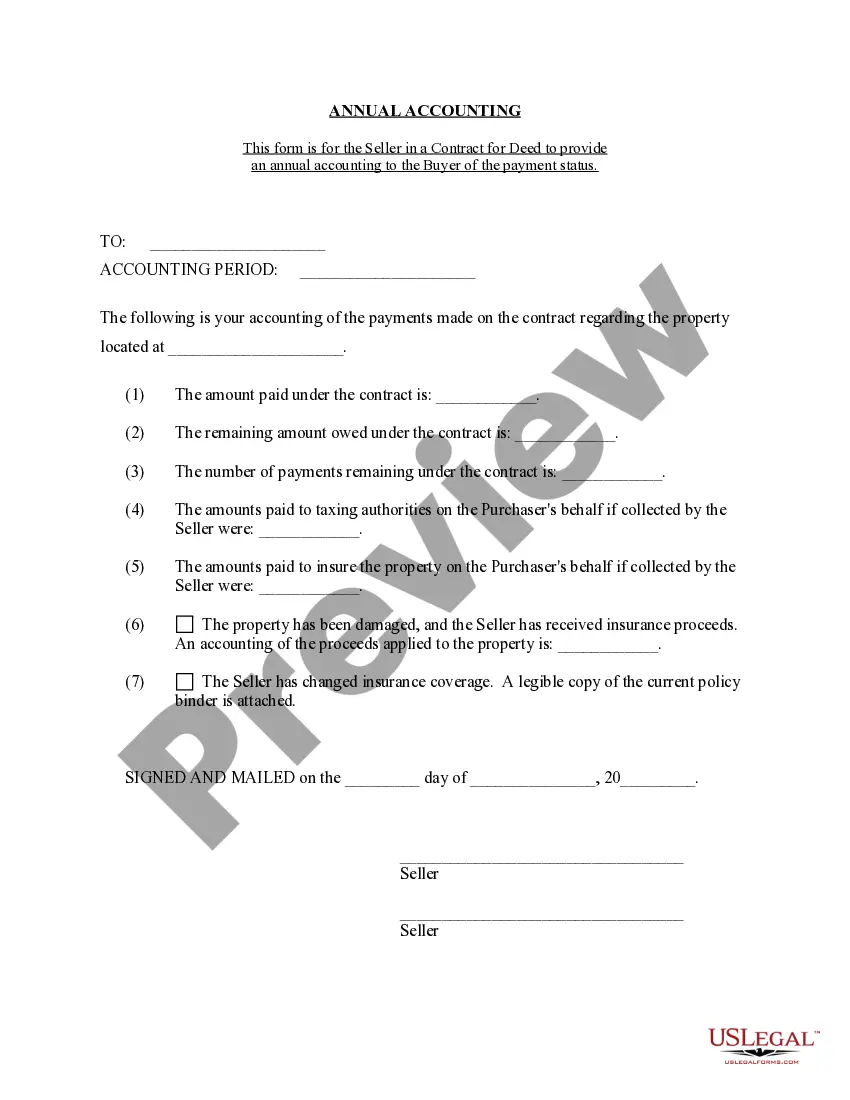

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Tempe Arizona Contract for Deed Seller's Annual Accounting Statement is a document that serves as a comprehensive financial report provided by the seller to the buyer in a contract for deed transaction. This statement outlines the financial transactions, balances, and other pertinent information concerning the property being sold. It serves as an important tool for both parties involved in the contract, ensuring transparency and accountability. Keywords: Tempe Arizona, contract for deed, seller's annual accounting statement, financial report, transactions, balances, property, transparency, accountability. Different types of Tempe Arizona Contract for Deed Seller's Annual Accounting Statement may include: 1. Basic Annual Accounting Statement: This type of statement provides a concise overview of the financial transactions and balances related to the contract for deed. It includes information such as payments made by the buyer, outstanding balance, interest accrued, and any additional charges or fees. 2. Detailed Transactional Statement: This type of accounting statement provides a more detailed breakdown of all financial transactions between the seller and the buyer. It includes information on each payment made, interest calculations, penalties (if any), taxes, insurance, and any other financial obligations outlined in the contract. 3. Property Maintenance and Repair Statement: In addition to the financial aspects, this type of accounting statement includes details about the maintenance and repairs conducted on the property during the year. It outlines the expenses incurred by the seller and how they were addressed. 4. Escrow Account Statement: In cases where an escrow account is involved in the contract for deed, this type of accounting statement is provided by the seller. It outlines the funds deposited into the escrow account, how they were used, and any remaining balance. 5. Tax and Insurance Statement: This type of accounting statement focuses specifically on the property taxes and insurance payments made by the seller. It includes details on the amounts paid and any applicable deadlines or renewals. Overall, the Tempe Arizona Contract for Deed Seller's Annual Accounting Statement serves as a crucial financial document that ensures transparency and provides a clear understanding of the financial aspects related to the contract for deed transaction in Tempe, Arizona.