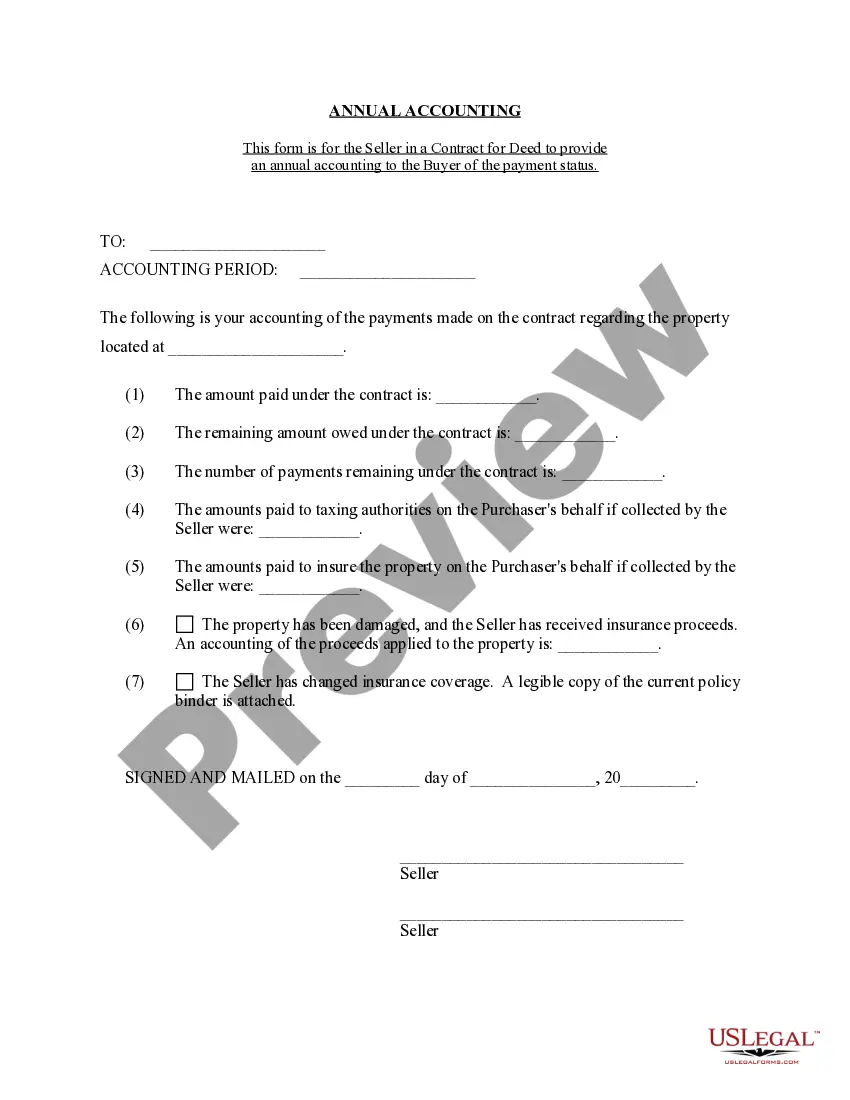

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Tucson Arizona Contract for Deed Seller's Annual Accounting Statement is a crucial document that provides a comprehensive overview of the financial transactions and obligations associated with a contract for deed agreement in Tucson, Arizona. This statement serves as an accounting record and facilitates transparency between the seller and buyer throughout the duration of the contract. The Contract for Deed Seller's Annual Accounting Statement outlines the financial aspects of the agreement, including the buyer's periodic payments, any interest accrued, and the allocation of funds towards principal reduction. It highlights the seller's income received from the buyer, detailing the payment schedule, and the amount applied to the purchase price, interest, and administration fees. This accounting statement is an essential tool for both parties involved in the contract for deed agreement. It ensures that the seller maintains accurate records of the payments received and properly applies them to the appropriate financial categories. Additionally, it enables the buyer to stay informed about their financial status within the contract, including the remaining balance, interest accrued, and any other pertinent financial information. Different types of Tucson Arizona Contract for Deed Seller's Annual Accounting Statements may vary based on the specific terms and conditions agreed upon between the parties involved. However, some common types may include: 1. Basic Accounting Statement: This statement provides a simple breakdown of the buyer's payments, the amount applied to the principal, interest, and any additional fees. 2. Detailed Accounting Statement: This type of statement offers a more comprehensive breakdown of the financial aspects, including both numerical figures and explanatory notes. It provides a clear understanding of how each payment is allocated and applied. 3. Amortization Schedule Statement: An amortization schedule statement outlines the specific payment schedule, including the principal reduction, interest accrued, and the remaining balance over time. It helps both parties track the progress of the contract and project future payments. 4. Escrow Account Statement: In certain cases, an escrow account may be included in the contract for deed agreement. This statement outlines the detailed transactions and balances associated with the escrow account, covering property taxes, insurance payments, and other related expenses. In conclusion, the Tucson Arizona Contract for Deed Seller's Annual Accounting Statement acts as a financial record and communication tool for both the seller and buyer within a contract for deed agreement. It helps maintain transparency, ensures accurate accounting, and provides a comprehensive overview of the financial status of the contract.