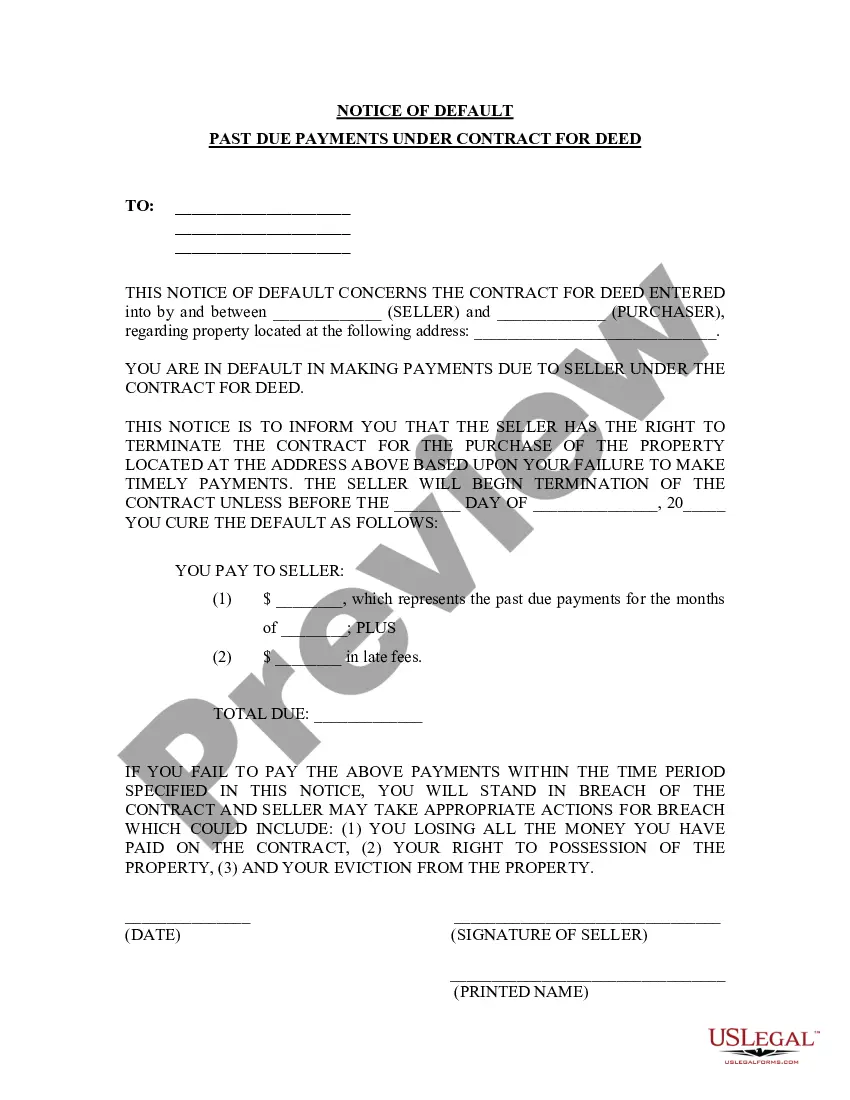

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

A Gilbert Arizona Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document notifying a party in a contract for deed agreement that they have failed to make their required payments on time. This document serves as a formal notice to the defaulting party, informing them of their breach of contract and detailing the consequences that may follow if they do not rectify the situation promptly. Here are some key points to consider: 1. Purpose and Importance of Notice of Default: The Notice of Default is a crucial step in the process of addressing delinquent payments in a Contract for Deed agreement. It informs the defaulting party that they have violated the terms of the contract, placing them on notice that immediate action is necessary to resolve the issues. 2. Key Elements of a Notice of Default: A comprehensive Notice of Default typically contains the following information: — Identification of the parties involved: Clearly identifying both the party initiating the notice (often the seller or the holder of the contract) and the defaulting party (the buyer or the party who failed to make payments). — Contract details: Explicitly stating the terms of the original Contract for Deed, including the payment schedule, due dates, and any specific conditions regarding the default. — Description of default: Clearly articulating the specific ways in which the buyer has failed to meet their payment obligations, such as late or missed payments or inadequate funds. — Demand for payment: Requesting immediate payment of the past-due amounts, including any late fees or penalties, within a designated timeframe (often a notice period, typically 30 days). — Consequences of non-compliance: Clearly outlining the repercussions of continued non-payment, such as foreclosure or legal action. — Contact information: Providing the necessary contact details for the initiating party, allowing the defaulting party to discuss payment arrangements and find a potential solution. 3. Types of Gilbert Arizona Notices of Default for Past Due Payments: a) Initial Notice of Default: The first notice issued to the defaulting party, indicating their failure to make timely payments and informing them of the impending consequences if they do not remedy the situation within a specified period. b) Final Notice of Default: If the defaulting party fails to cure their default after receiving the initial notice, a final notice is issued. This notice reiterates the initial demands for payment and warns the defaulting party that legal proceedings or foreclosure may be initiated if they do not fulfill their payment obligations by a specific deadline. In summary, a Gilbert Arizona Notice of Default for Past Due Payments in connection with a Contract for Deed is a vital legal document that formally notifies a defaulting party of their breach of contract and provides details regarding the specific violations. It aims to prompt the defaulting party to take immediate corrective actions to avoid further legal repercussions or the possibility of losing their property.

A Gilbert Arizona Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document notifying a party in a contract for deed agreement that they have failed to make their required payments on time. This document serves as a formal notice to the defaulting party, informing them of their breach of contract and detailing the consequences that may follow if they do not rectify the situation promptly. Here are some key points to consider: 1. Purpose and Importance of Notice of Default: The Notice of Default is a crucial step in the process of addressing delinquent payments in a Contract for Deed agreement. It informs the defaulting party that they have violated the terms of the contract, placing them on notice that immediate action is necessary to resolve the issues. 2. Key Elements of a Notice of Default: A comprehensive Notice of Default typically contains the following information: — Identification of the parties involved: Clearly identifying both the party initiating the notice (often the seller or the holder of the contract) and the defaulting party (the buyer or the party who failed to make payments). — Contract details: Explicitly stating the terms of the original Contract for Deed, including the payment schedule, due dates, and any specific conditions regarding the default. — Description of default: Clearly articulating the specific ways in which the buyer has failed to meet their payment obligations, such as late or missed payments or inadequate funds. — Demand for payment: Requesting immediate payment of the past-due amounts, including any late fees or penalties, within a designated timeframe (often a notice period, typically 30 days). — Consequences of non-compliance: Clearly outlining the repercussions of continued non-payment, such as foreclosure or legal action. — Contact information: Providing the necessary contact details for the initiating party, allowing the defaulting party to discuss payment arrangements and find a potential solution. 3. Types of Gilbert Arizona Notices of Default for Past Due Payments: a) Initial Notice of Default: The first notice issued to the defaulting party, indicating their failure to make timely payments and informing them of the impending consequences if they do not remedy the situation within a specified period. b) Final Notice of Default: If the defaulting party fails to cure their default after receiving the initial notice, a final notice is issued. This notice reiterates the initial demands for payment and warns the defaulting party that legal proceedings or foreclosure may be initiated if they do not fulfill their payment obligations by a specific deadline. In summary, a Gilbert Arizona Notice of Default for Past Due Payments in connection with a Contract for Deed is a vital legal document that formally notifies a defaulting party of their breach of contract and provides details regarding the specific violations. It aims to prompt the defaulting party to take immediate corrective actions to avoid further legal repercussions or the possibility of losing their property.