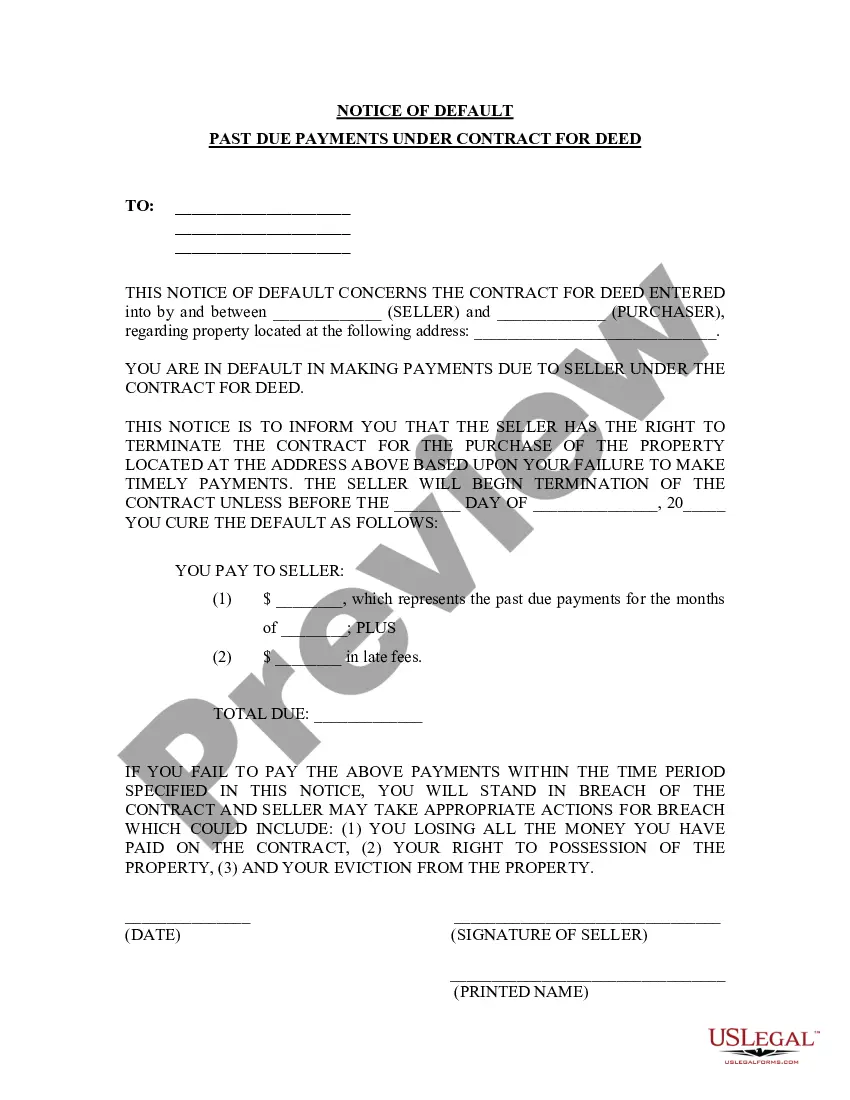

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

The Phoenix Arizona Notice of Default for Past Due Payments in connection with Contract for Deed serves as a formal notification to the party involved that they have failed to make the required payments in accordance with a Contract for Deed agreement. This legal document outlines the specific details and consequences of the default, ultimately initiating the process towards potential foreclosure or other legal actions. The Notice of Default typically includes pertinent information such as the names and addresses of both the recipient (the borrower) and the sender (the lender or seller). It also outlines the date of the initial Contract for Deed, along with the specific terms and conditions agreed upon. The notice highlights the exact payment(s) that have been missed or not made in a timely manner, emphasizing the total amount of the outstanding balance along with any additional fees or penalties incurred due to the default. In the case of Phoenix, Arizona, there may be different types of Notice of Default for Past Due Payments in connection with Contract for Deed, depending on the unique circumstances and agreements between the parties involved. Some common variations may include: 1. Initial Notice of Default: This is the first formal notification sent to the borrower after they have failed to make the payment(s) on time. It serves as a warning, urging the borrower to rectify the situation by paying the outstanding amount within a specified timeframe. 2. Second Notice of Default: If the borrower does not respond to the initial notice or fails to make the required payment(s) within the given timeframe, a second notice may be sent. This notice typically involves a more stringent warning, informing the borrower of the potential consequences if the default is not resolved promptly. 3. Notice of Sale: If the borrower fails to rectify the default after receiving multiple notices, a Notice of Sale may be issued. This indicates that the lender or seller intends to sell the property in order to recover the outstanding balance. The notice typically includes the date and location of the proposed sale, as well as the necessary details regarding the legal procedures to be followed. It is crucial for both parties involved in a Contract for Deed agreement to carefully review and understand the terms outlined within the Notice of Default, as it provides explicit information that can significantly impact their rights and obligations. Seeking legal advice or guidance is highly recommended ensuring that all parties are fully aware of the consequences and potential options available to them in the event of a default.The Phoenix Arizona Notice of Default for Past Due Payments in connection with Contract for Deed serves as a formal notification to the party involved that they have failed to make the required payments in accordance with a Contract for Deed agreement. This legal document outlines the specific details and consequences of the default, ultimately initiating the process towards potential foreclosure or other legal actions. The Notice of Default typically includes pertinent information such as the names and addresses of both the recipient (the borrower) and the sender (the lender or seller). It also outlines the date of the initial Contract for Deed, along with the specific terms and conditions agreed upon. The notice highlights the exact payment(s) that have been missed or not made in a timely manner, emphasizing the total amount of the outstanding balance along with any additional fees or penalties incurred due to the default. In the case of Phoenix, Arizona, there may be different types of Notice of Default for Past Due Payments in connection with Contract for Deed, depending on the unique circumstances and agreements between the parties involved. Some common variations may include: 1. Initial Notice of Default: This is the first formal notification sent to the borrower after they have failed to make the payment(s) on time. It serves as a warning, urging the borrower to rectify the situation by paying the outstanding amount within a specified timeframe. 2. Second Notice of Default: If the borrower does not respond to the initial notice or fails to make the required payment(s) within the given timeframe, a second notice may be sent. This notice typically involves a more stringent warning, informing the borrower of the potential consequences if the default is not resolved promptly. 3. Notice of Sale: If the borrower fails to rectify the default after receiving multiple notices, a Notice of Sale may be issued. This indicates that the lender or seller intends to sell the property in order to recover the outstanding balance. The notice typically includes the date and location of the proposed sale, as well as the necessary details regarding the legal procedures to be followed. It is crucial for both parties involved in a Contract for Deed agreement to carefully review and understand the terms outlined within the Notice of Default, as it provides explicit information that can significantly impact their rights and obligations. Seeking legal advice or guidance is highly recommended ensuring that all parties are fully aware of the consequences and potential options available to them in the event of a default.