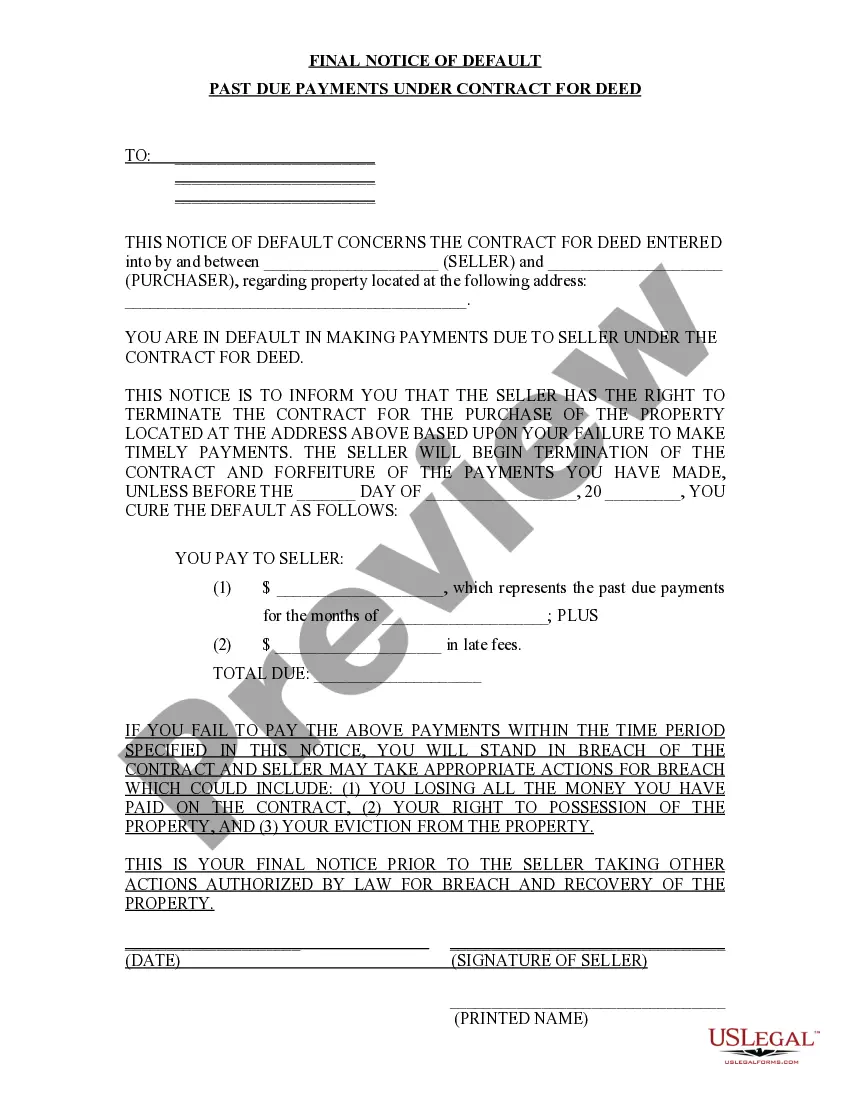

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Chandler Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Arizona Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Utilize the US Legal Forms to gain instant access to any form example you need.

Our user-friendly platform featuring a multitude of document samples enables you to discover and obtain almost any document example you seek.

You can save, fill out, and sign the Chandler Arizona Final Notice of Default for Past Due Payments related to Contract for Deed in just a few minutes, rather than spending hours searching online for an appropriate template.

Using our collection is an excellent method to enhance the security of your document submission.

If you have not yet created an account, follow the steps outlined below.

Access the page containing the form you require. Verify that it is the document you were searching for: review its title and summary, and utilize the Preview feature when available. Alternatively, use the Search bar to locate the desired one.

- Our knowledgeable attorneys continuously examine all records to confirm that the templates are applicable for a specific state and compliant with the latest laws and regulations.

- How do you access the Chandler Arizona Final Notice of Default for Past Due Payments linked to the Contract for Deed.

- If you already hold a subscription, simply Log In to your account.

- The Download button will be visible on all samples you view.

- Moreover, you can retrieve all previously saved documents from the My documents section.

Form popularity

FAQ

In Arizona, a property tax reassessment can occur when the ownership of the property changes, such as through a sale or transfer. Additionally, substantial improvements made to the property, like renovations or new constructions, may also trigger a reassessment. It's important to be aware of these changes, as they can lead to a Chandler Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed if property taxes go unpaid. For assistance in handling these matters, consider using the US Legal Forms platform, which offers resources to help you navigate property tax processes.

Arizona is indeed a lien state, meaning that tax liens can be placed on properties for unpaid taxes. This practice helps ensure that the government can recover owed taxes effectively. If you find yourself facing a Chandler Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed, understanding Arizona's lien laws will empower you to take decisive steps.

In Arizona, a tax lien typically lasts for three years if left unpaid, allowing the government time to collect. After this period, the tax lien could lead to property foreclosure if the taxes remain unpaid. Prompt action is vital, especially if you are issued a Chandler Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed.

Yes, Arizona does have tax deed auctions, where properties with delinquent taxes are sold. These auctions provide an opportunity for buyers to acquire properties at potentially lower prices. If you’re facing a Chandler Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed, it’s wise to explore these auctions as a possible solution.

In Arizona, a tax lien is placed on a property when taxes go unpaid for a certain period. This lien secures the government's right to collect back taxes, and it can eventually lead to property tax foreclosure. If you receive a Chandler Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed, understanding tax liens becomes crucial for resolving your financial obligations.

To locate property with back taxes, you can start by checking county tax assessor records. These records often display properties with unpaid taxes and might include details regarding a Chandler Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed. Local auction sites may also list properties available due to tax delinquencies.

If you own property in Arizona, it's essential to know if you owe taxes. The county assessor provides information on property taxes, which could include any outstanding amounts. Understanding your tax obligations helps you avoid receiving a Chandler Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed.

To search for tax liens in Arizona, you can utilize online resources such as county treasurer websites or property databases that record tax lien information. The Chandler Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed is an essential document that you may encounter in your search. This can inform you of any outstanding obligations related to a property. For guidance, consider seeking services that specialize in tax documentation and records.

Foreclosing on a tax lien property typically involves adhering to the procedures set by your state, which might include providing notice and conducting hearings. In Arizona, receiving a Chandler Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed can be a pivotal moment in this process. Acting quickly and obtaining legal advice can enhance your chances of a favorable outcome. Knowledgeable support can make a difference in managing tax lien issues effectively.

To foreclose on a tax lien property in Arizona, you must follow state-specific procedures that can include filing legal documents and potentially going to court. The Chandler Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed can indicate the initiation of this process. It's advisable to engage with attorneys who specialize in tax law to navigate the complexities. This can ensure your rights are protected throughout the process.