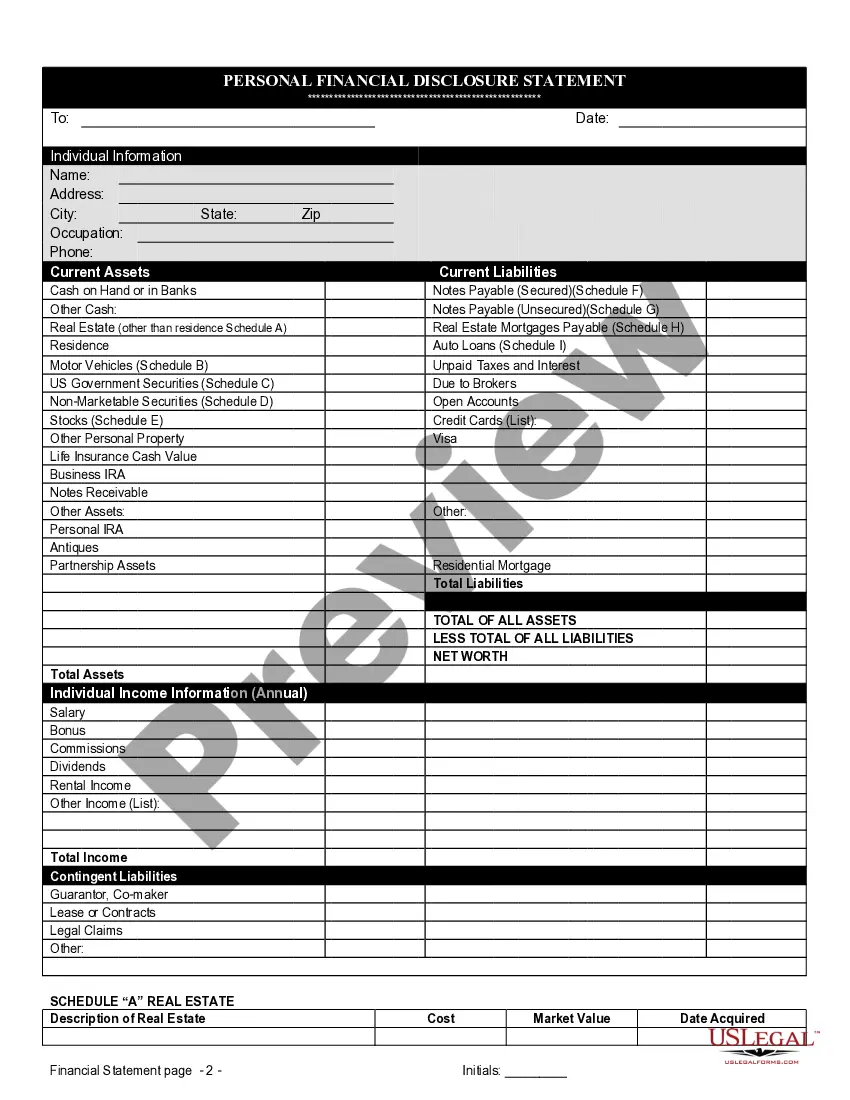

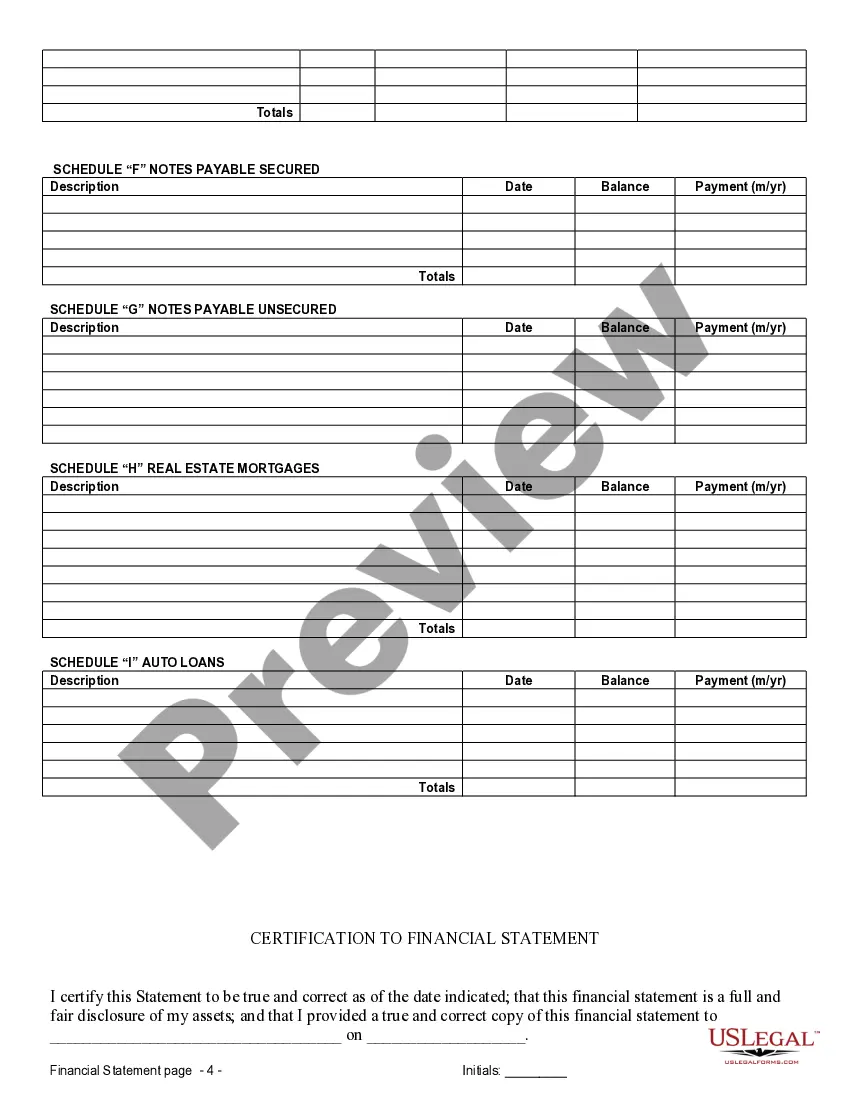

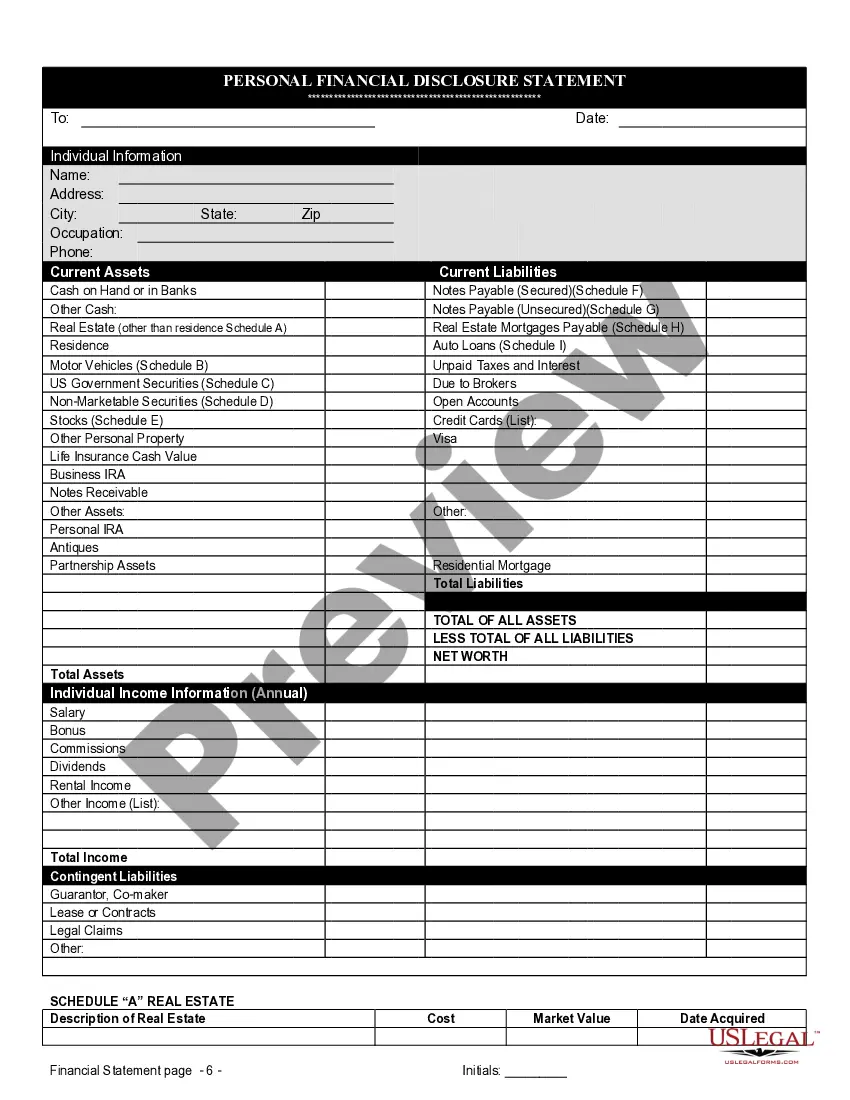

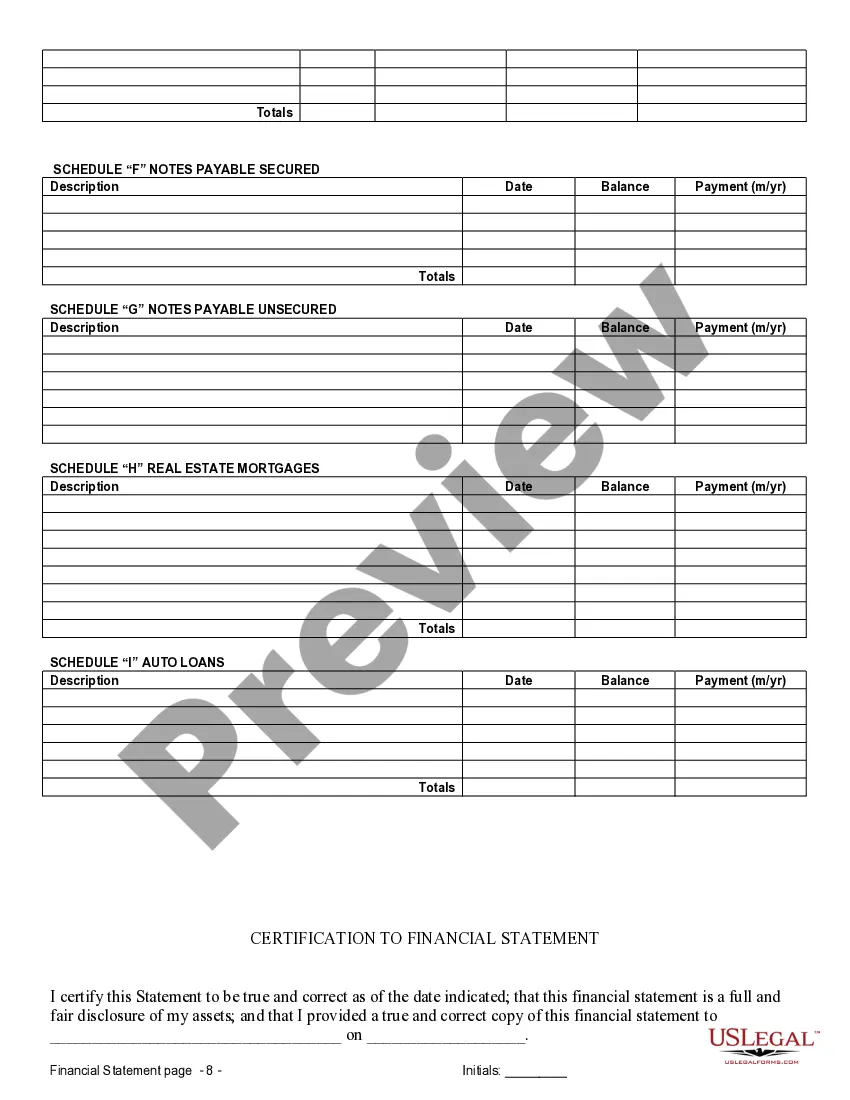

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

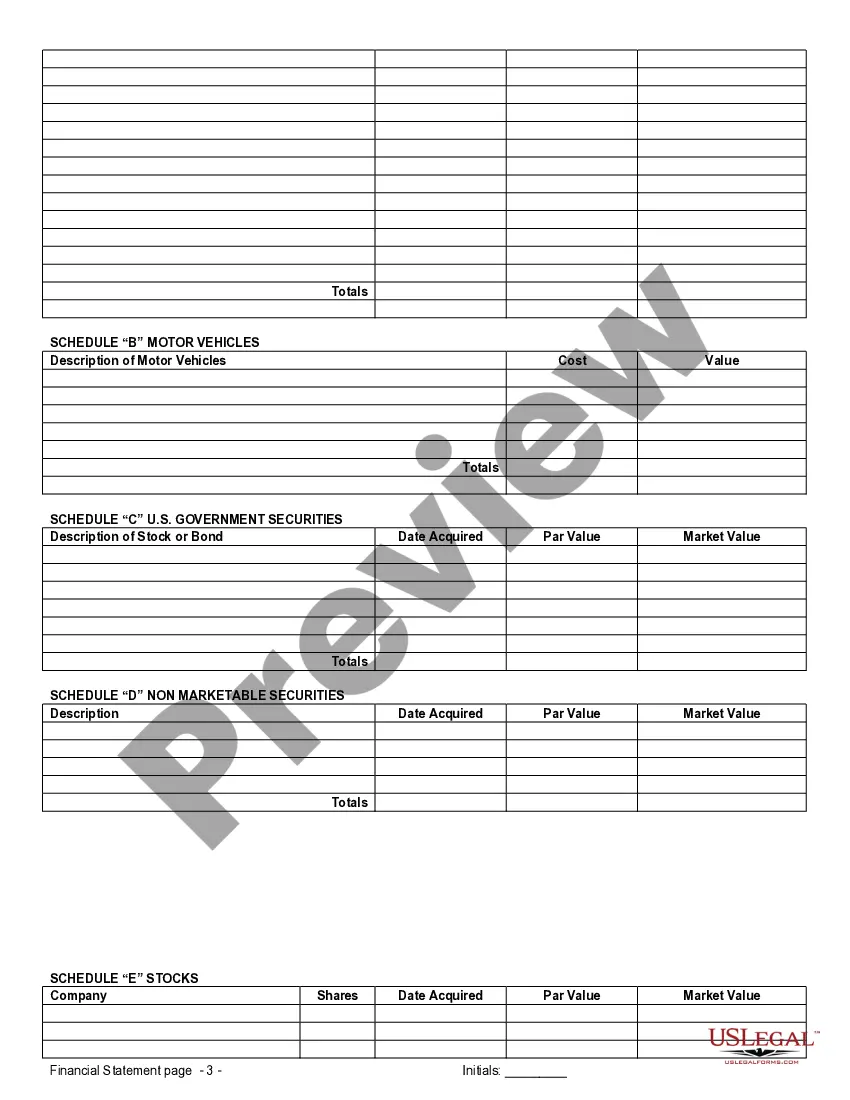

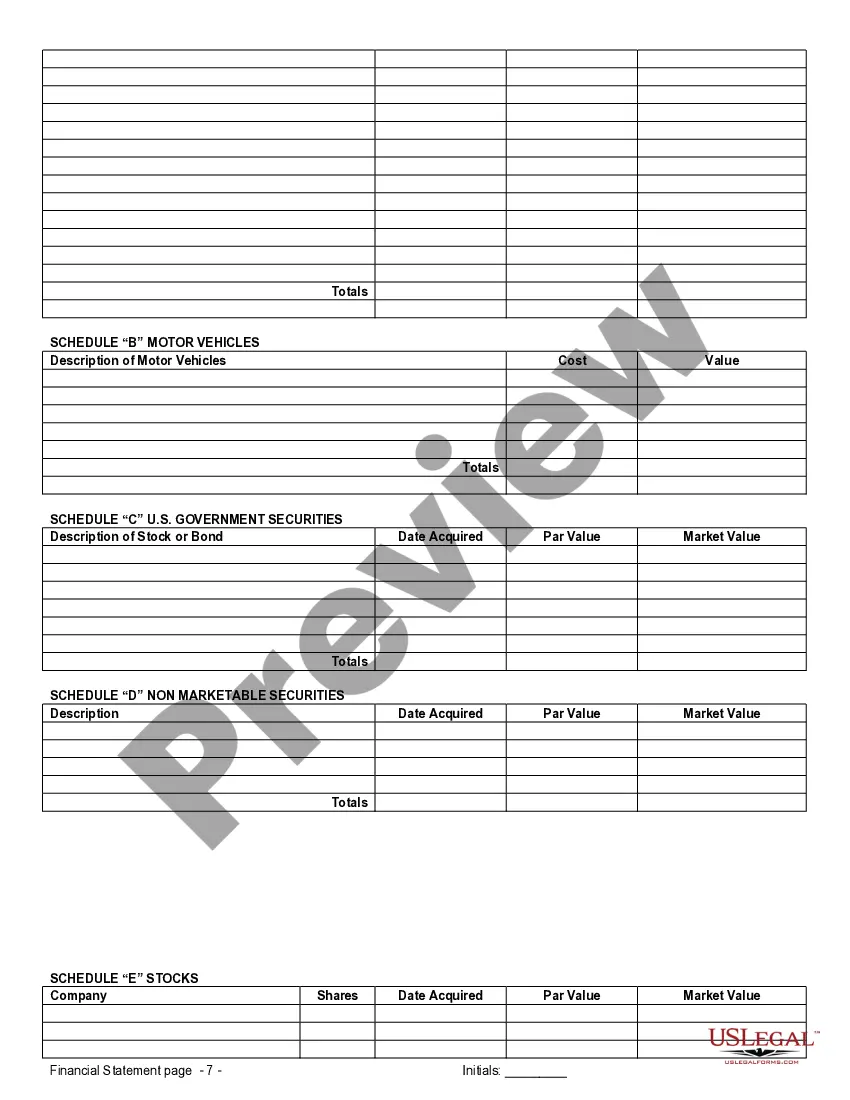

Chandler, Arizona Financial Statements only in Connection with Prenuptial Premarital Agreement When couples in Chandler, Arizona decide to enter into a prenuptial or premarital agreement, it is common for each party to provide detailed financial statements. These statements aim to disclose the financial standing and assets of both individuals before they marry, ensuring transparency and clarity in the agreement. Chandler, Arizona financial statements only in connection with prenuptial or premarital agreements hold great importance as they form the basis of the agreement and protect the interests of both parties involved. 1. Personal Financial Statement: This type of financial statement provides a comprehensive overview of an individual's personal assets, including real estate, investments, retirement accounts, bank accounts, and any other relevant financial information. It also includes liabilities such as outstanding debts, loans, and mortgages. 2. Income Statement: This statement outlines the individual's income sources, including salary, bonuses, investments, rental income, or any other earnings. It provides a clear picture of their financial inflow. 3. Balance Sheet: The balance sheet provides an overview of an individual's assets, liabilities, and equity as of a specific date. It includes details about real estate properties, vehicles, investments, cash, credit card debts, loans, and other financial obligations. This statement helps determine an individual's net worth. 4. Tax Returns: Providing recent tax returns as a financial statement is also essential. They offer evidence of the individual's income, deductions, credits, and taxable transactions. Tax returns help establish a precise financial picture and verify the accuracy of the provided statements. 5. Retirement Account Statements: If either party holds retirement accounts like a 401(k), IRA, or pension plans, providing accurate statements for these accounts is crucial. This ensures that the value of the retirement assets is accurately represented in the agreement. 6. Bank Account Statements: Providing bank account statements for both personal and joint accounts is critical. These statements show the individual's liquidity, saving patterns, and cash transactions, leaving no room for ambiguity during the agreement process. In Chandler, Arizona, financial statements are often required to be up-to-date, accurate, and reflective of the individual's true financial position. These statements act as a foundation for establishing the division of assets, property, and potential spousal support in case of a divorce or dissolution of the marriage. Therefore, due diligence and transparency in disclosing all financial details are crucial to ensure the integrity and enforceability of the prenuptial or premarital agreement. In conclusion, Chandler, Arizona financial statements only in connection with prenuptial or premarital agreements play a vital role in protecting the interests of both parties. They provide a clear picture of the financial assets and liabilities of each individual, ensuring transparency and fairness in the agreement. Properly prepared financial statements, including personal financial statements, income statements, balance sheets, tax returns, retirement account statements, and bank account statements, are essential components in creating a comprehensive prenuptial or premarital agreement.Chandler, Arizona Financial Statements only in Connection with Prenuptial Premarital Agreement When couples in Chandler, Arizona decide to enter into a prenuptial or premarital agreement, it is common for each party to provide detailed financial statements. These statements aim to disclose the financial standing and assets of both individuals before they marry, ensuring transparency and clarity in the agreement. Chandler, Arizona financial statements only in connection with prenuptial or premarital agreements hold great importance as they form the basis of the agreement and protect the interests of both parties involved. 1. Personal Financial Statement: This type of financial statement provides a comprehensive overview of an individual's personal assets, including real estate, investments, retirement accounts, bank accounts, and any other relevant financial information. It also includes liabilities such as outstanding debts, loans, and mortgages. 2. Income Statement: This statement outlines the individual's income sources, including salary, bonuses, investments, rental income, or any other earnings. It provides a clear picture of their financial inflow. 3. Balance Sheet: The balance sheet provides an overview of an individual's assets, liabilities, and equity as of a specific date. It includes details about real estate properties, vehicles, investments, cash, credit card debts, loans, and other financial obligations. This statement helps determine an individual's net worth. 4. Tax Returns: Providing recent tax returns as a financial statement is also essential. They offer evidence of the individual's income, deductions, credits, and taxable transactions. Tax returns help establish a precise financial picture and verify the accuracy of the provided statements. 5. Retirement Account Statements: If either party holds retirement accounts like a 401(k), IRA, or pension plans, providing accurate statements for these accounts is crucial. This ensures that the value of the retirement assets is accurately represented in the agreement. 6. Bank Account Statements: Providing bank account statements for both personal and joint accounts is critical. These statements show the individual's liquidity, saving patterns, and cash transactions, leaving no room for ambiguity during the agreement process. In Chandler, Arizona, financial statements are often required to be up-to-date, accurate, and reflective of the individual's true financial position. These statements act as a foundation for establishing the division of assets, property, and potential spousal support in case of a divorce or dissolution of the marriage. Therefore, due diligence and transparency in disclosing all financial details are crucial to ensure the integrity and enforceability of the prenuptial or premarital agreement. In conclusion, Chandler, Arizona financial statements only in connection with prenuptial or premarital agreements play a vital role in protecting the interests of both parties. They provide a clear picture of the financial assets and liabilities of each individual, ensuring transparency and fairness in the agreement. Properly prepared financial statements, including personal financial statements, income statements, balance sheets, tax returns, retirement account statements, and bank account statements, are essential components in creating a comprehensive prenuptial or premarital agreement.