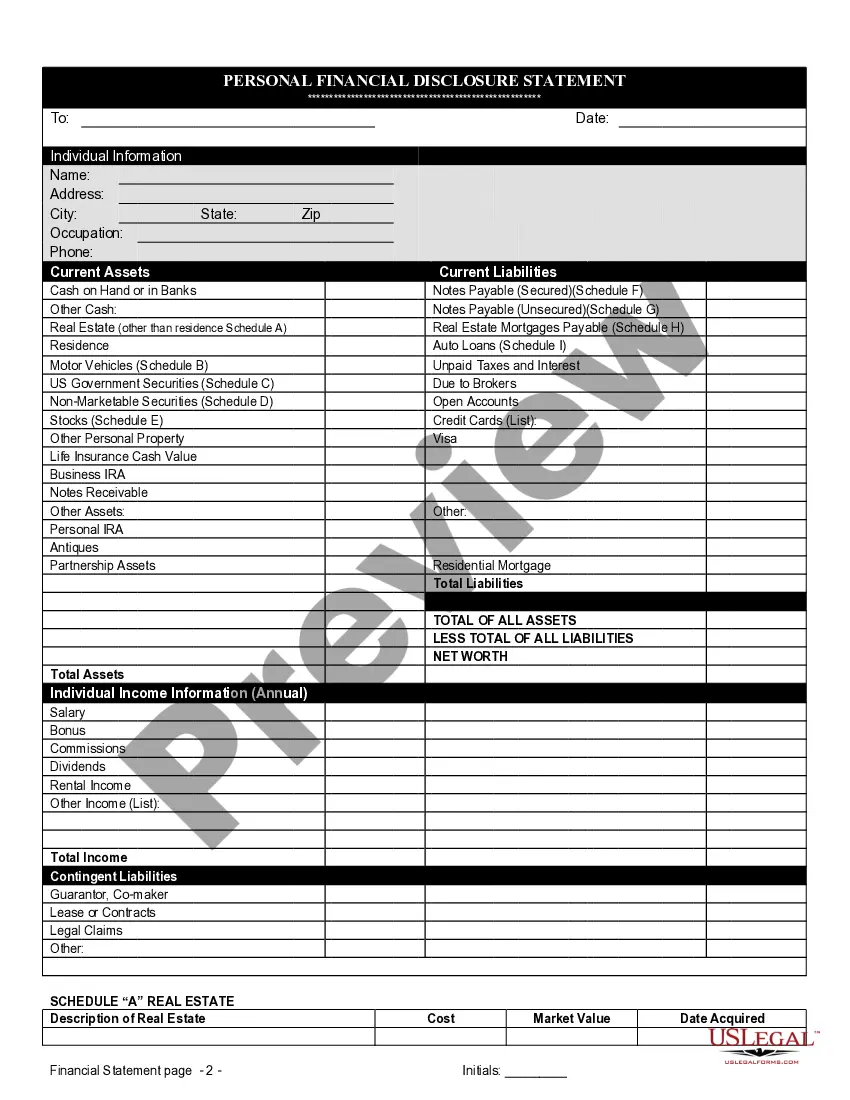

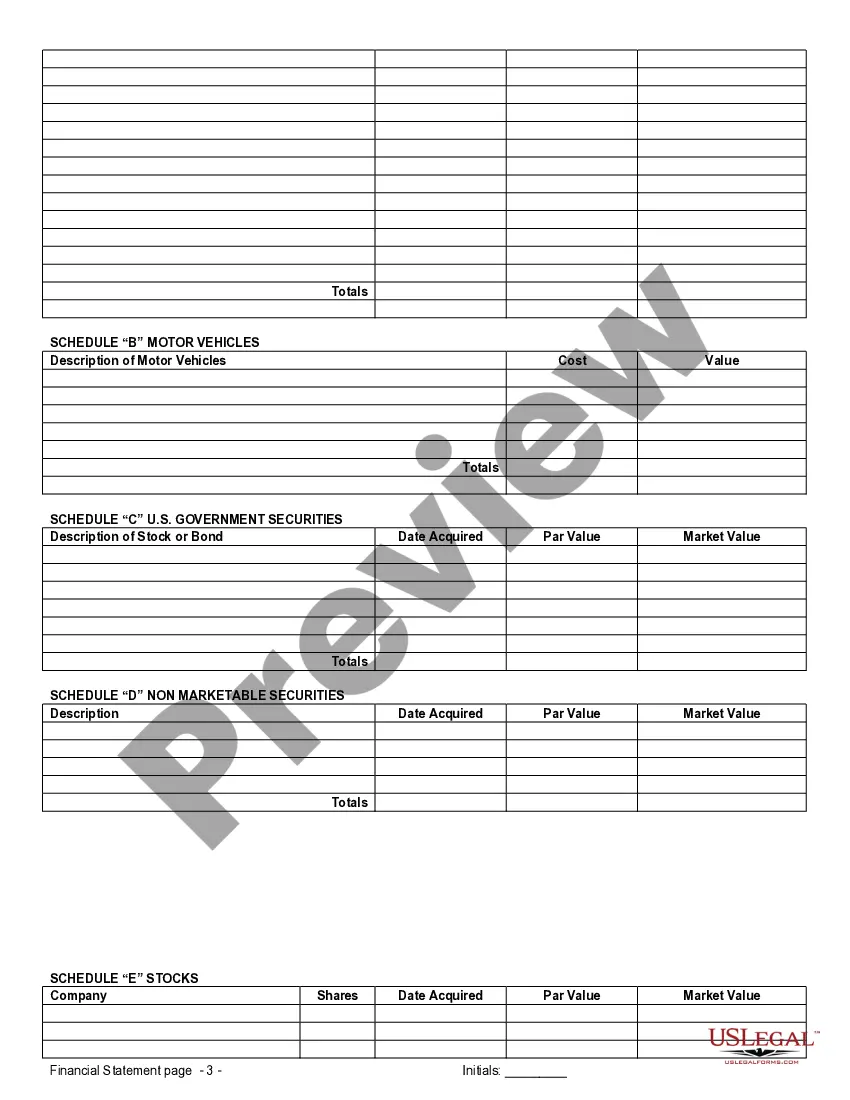

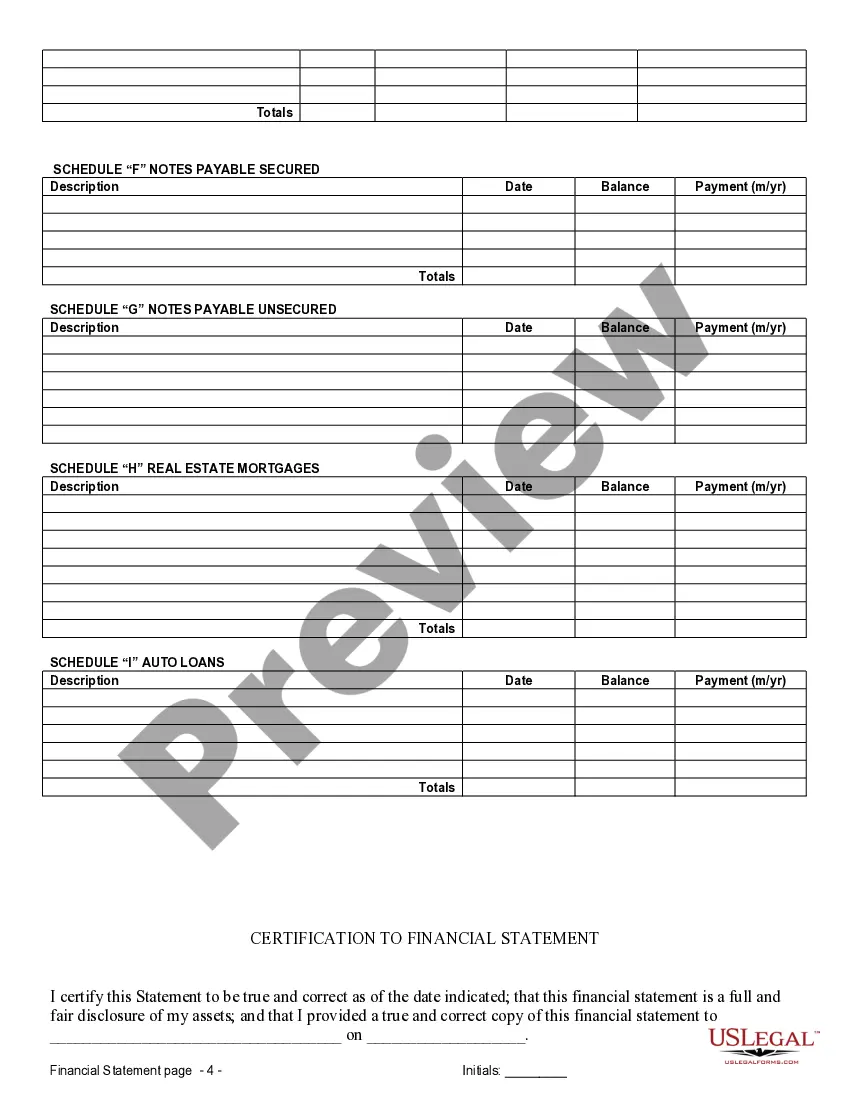

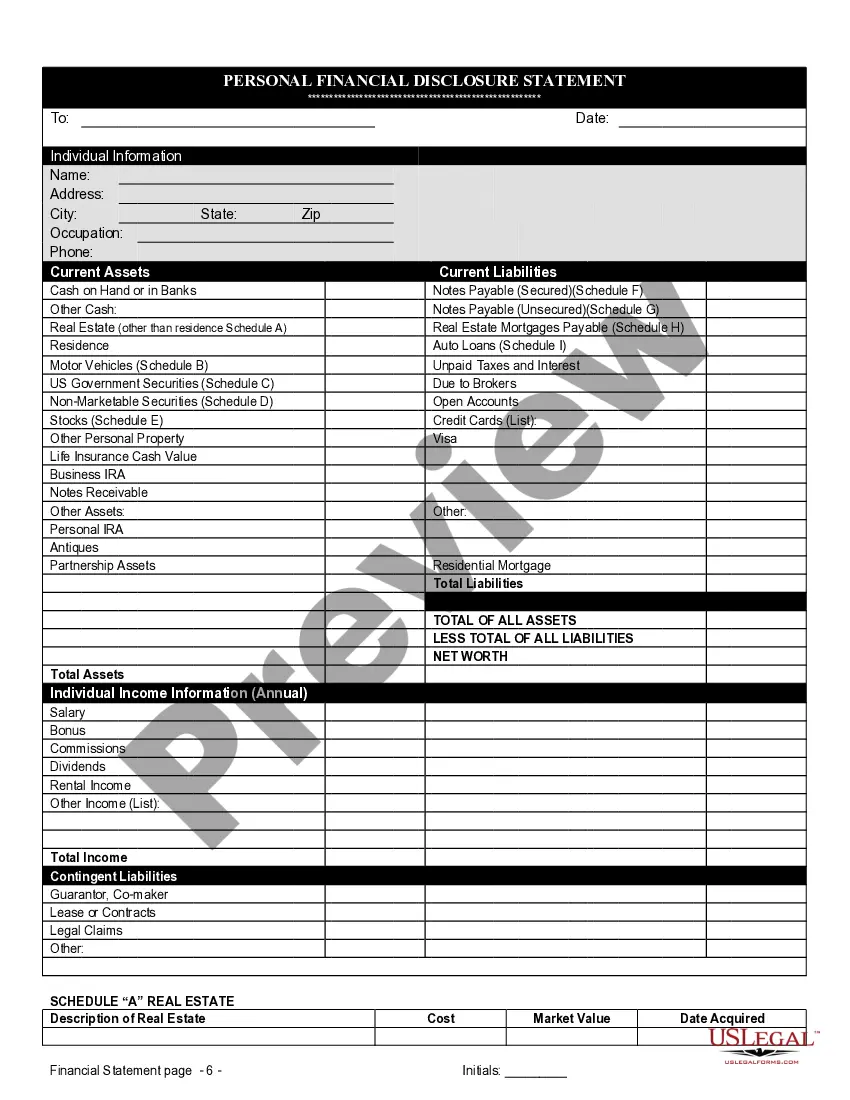

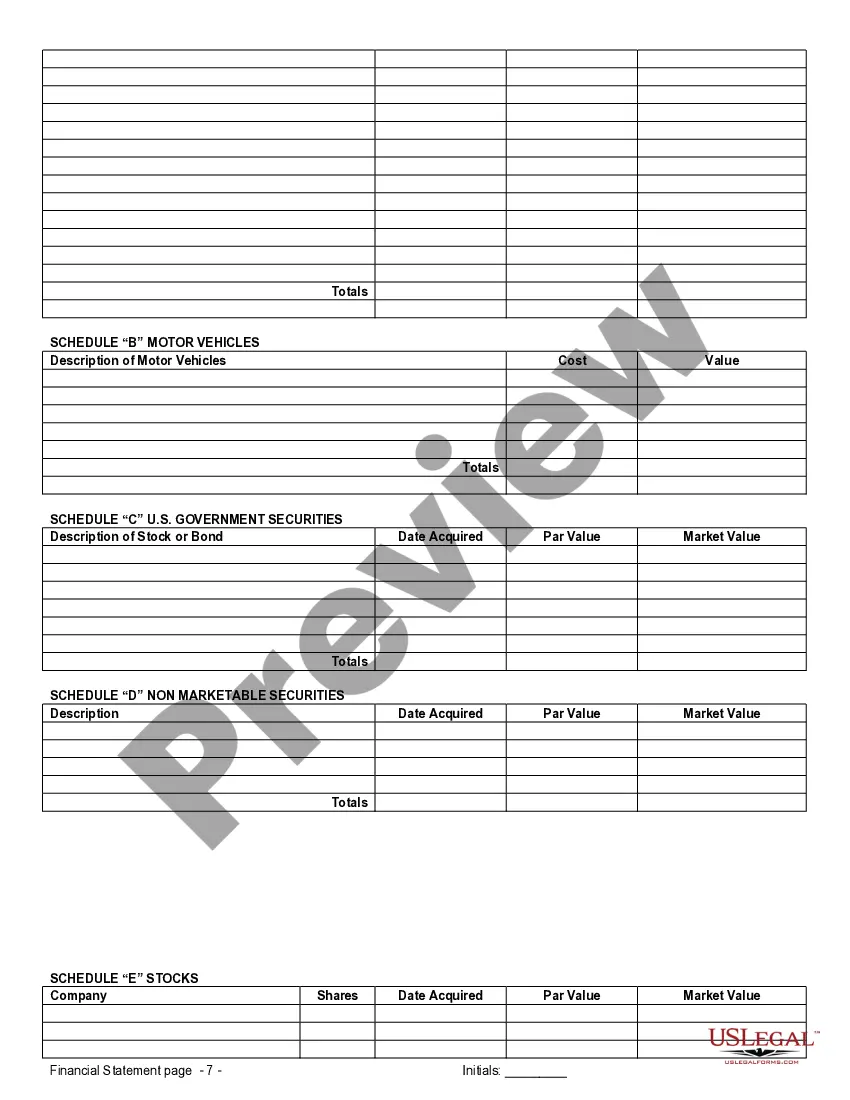

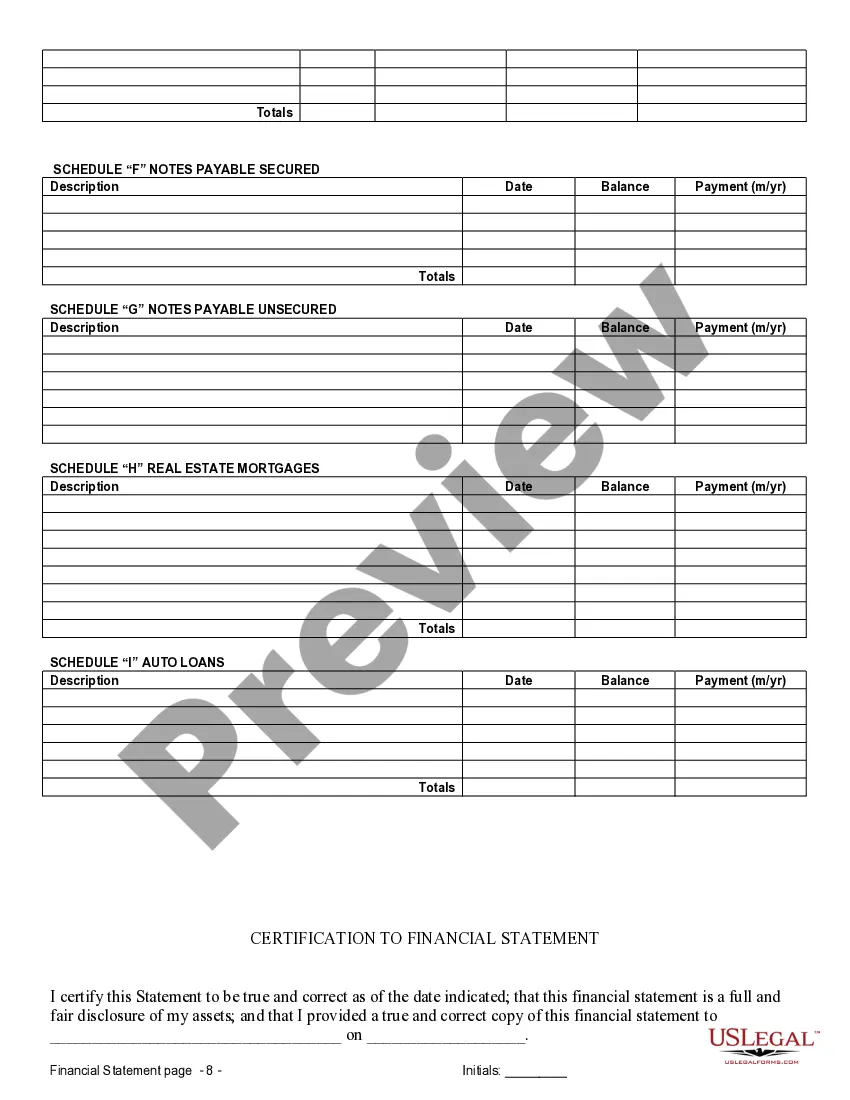

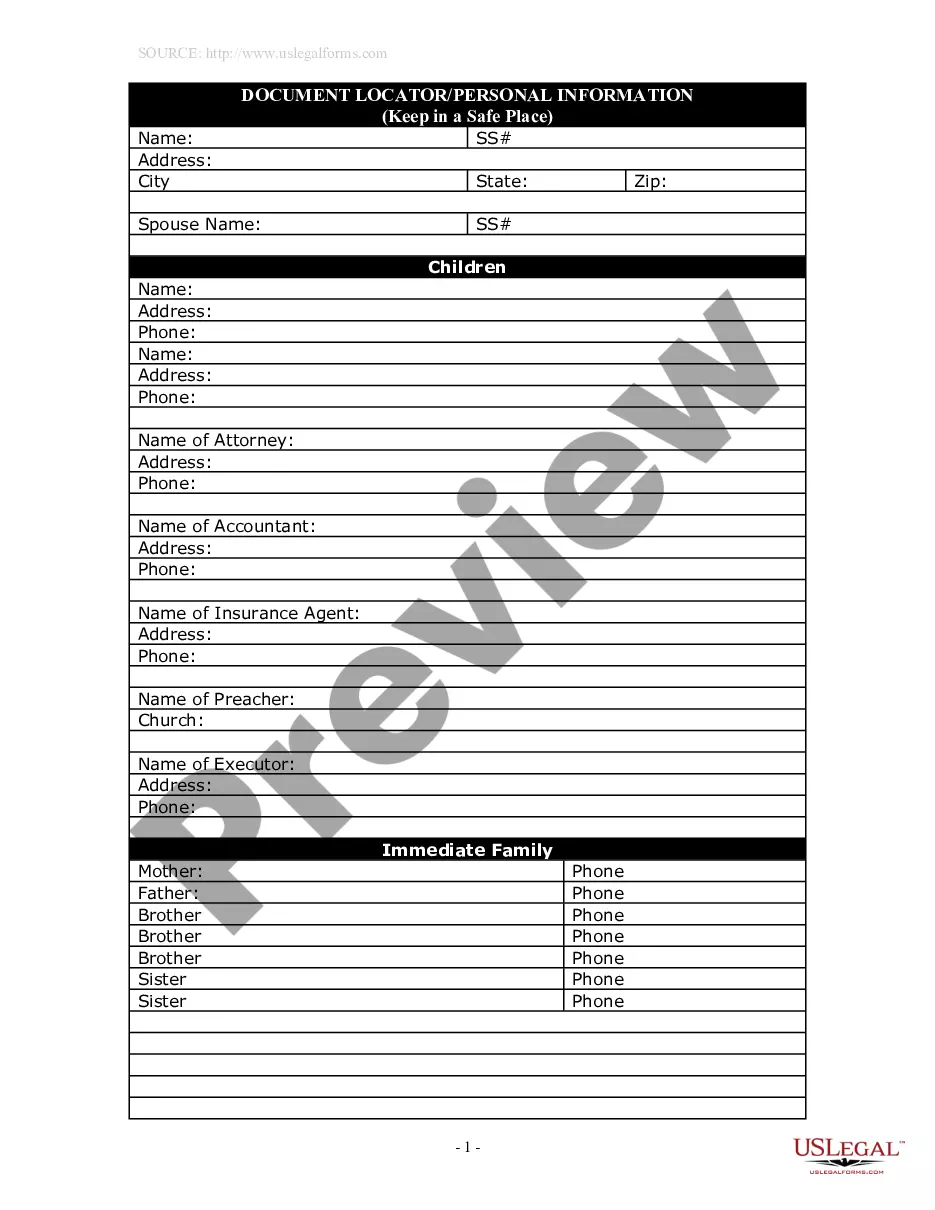

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Glendale Arizona Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Arizona Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Utilize the US Legal Forms and gain immediate access to any form template you desire.

Our helpful website, featuring a vast array of document templates, simplifies the process of locating and acquiring nearly any document sample you seek.

You can download, complete, and sign the Glendale Arizona Financial Statements solely in relation to the Prenuptial Premarital Agreement in just a few minutes rather than spending hours online searching for a suitable template.

Using our collection is an excellent way to enhance the security of your document submissions.

Locate the form you need. Ensure that it is the template you were seeking: check its title and description, and take advantage of the Preview feature if available. Alternatively, use the Search box to find the one you require.

Initiate the saving process. Click Buy Now and select your preferred pricing plan. Then, set up an account and complete your order using a credit card or PayPal.

- Our experienced legal experts routinely review all records to confirm that the templates are applicable to specific states and adhere to the latest laws and regulations.

- How can you access the Glendale Arizona Financial Statements in connection with the Prenuptial Premarital Agreement? If you have an account, simply Log In to your profile.

- The Download feature will be activated for all the documents you view.

- Moreover, you can retrieve all your previously saved documents from the My documents section.

- If you haven’t created an account yet, follow the instructions outlined below.

Form popularity

FAQ

Recent studies suggest that around 15% to 20% of couples enter marriage with a prenuptial agreement. These agreements are becoming more common as individuals seek financial security and clarity before tying the knot. In Glendale, Arizona, financial statements only in connection with prenuptial premarital agreements are essential for couples considering this route, helping them understand and document their financial goals.

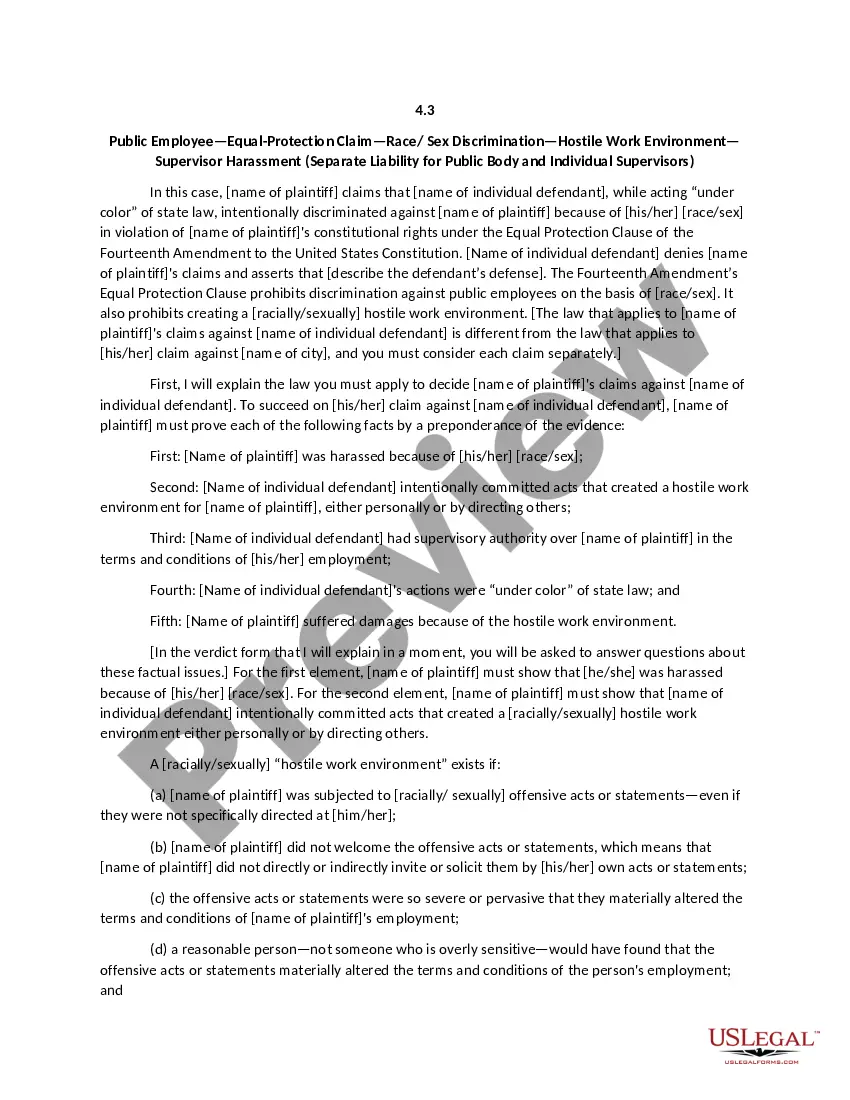

Judges have the authority to disregard prenuptial agreements under specific circumstances, such as if one party did not fully disclose assets. If a prenup is deemed unconscionable or signed under duress, it may be invalidated. Therefore, using detailed Glendale, Arizona financial statements only in connection with prenuptial premarital agreements can help ensure that both partners have transparent and fair financial disclosures.

Prenups can indeed be enforced if they adhere to state laws and both parties have complied with disclosure requirements. However, challenges may arise if either party claims they were coerced or did not understand the agreement. By carefully preparing Glendale, Arizona financial statements only in connection with prenuptial premarital agreements, couples can bolster the enforceability of their contracts.

Yes, prenups are enforceable in Arizona, provided they meet certain legal requirements. Couples must fully disclose their financial situations to each other, and the terms of the agreement must be fair to both parties. When considering Glendale, Arizona financial statements only in connection with prenuptial premarital agreements, it's important to ensure these statements accurately represent the financial realities of each partner.

The statute of frauds requires that prenuptial agreements be in writing and signed by both parties for them to be enforceable. This law aims to prevent misunderstandings and ensure both partners have clear documentation regarding their financial rights. In Glendale, Arizona, financial statements only in connection with a prenuptial premarital agreement play a crucial role in establishing the validity of these contracts.

Yes, prenuptial agreements are not just for the wealthy; anyone can create one to protect their financial future. These agreements allow individuals to determine how assets and debts will be handled in the event of a separation. Understanding the terms and conditions is important, especially regarding Glendale Arizona Financial Statements only in Connection with Prenuptial Premarital Agreement. Utilizing the resources on uslegalforms can make this process clearer and more efficient.

If your girlfriend moves in, you may want to consider a prenup to protect your financial interests, especially regarding shared assets and expenses. A prenup can help set clear expectations and rights concerning finances. This is particularly relevant when discussing Glendale Arizona Financial Statements only in Connection with Prenuptial Premarital Agreement. Platforms like uslegalforms can help streamline this process.

Arizona's prenuptial agreements are primarily governed by Arizona Revised Statutes Section 25-202. This statute lays out the requirements for enforceability, including full financial disclosure and both parties’ voluntary agreement. Understanding this statute is crucial to ensure your agreement meets legal standards. To guide you through this, consider consulting resources focusing on Glendale Arizona Financial Statements only in Connection with Prenuptial Premarital Agreement.

While prenups are traditionally crafted before marriage, couples can also create postnuptial agreements after they tie the knot. These agreements can update or modify existing terms. Engaging in a good discussion about financial responsibilities is crucial, regardless of the timing. For clarity and accuracy, look into Glendale Arizona Financial Statements only in Connection with Prenuptial Premarital Agreement through platforms like uslegalforms.

Yes, Arizona recognizes prenuptial agreements as legal and enforceable contracts, provided they meet certain guidelines. Both parties must fully disclose their financial situations, which includes financial statements, at the time of the agreement. This transparency helps prevent disputes in the future. Utilize resources like uslegalforms to ensure compliance with Glendale Arizona Financial Statements only in Connection with Prenuptial Premarital Agreement.