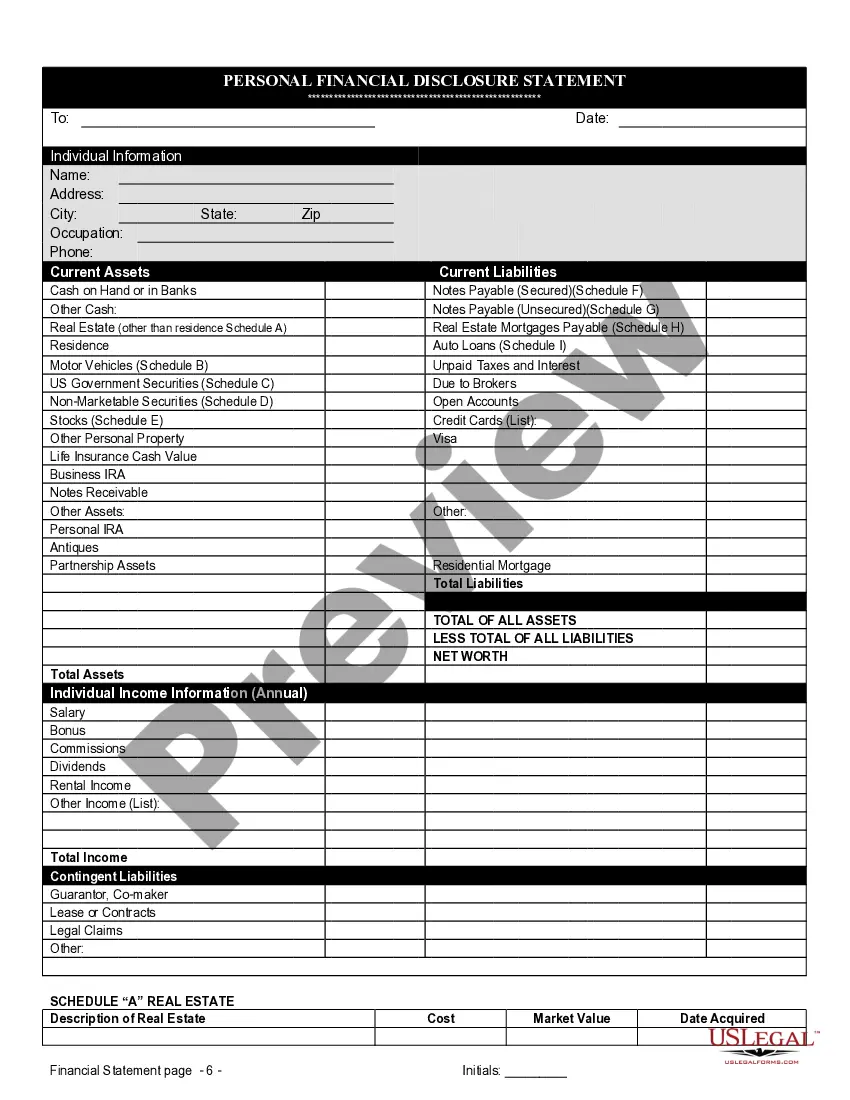

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

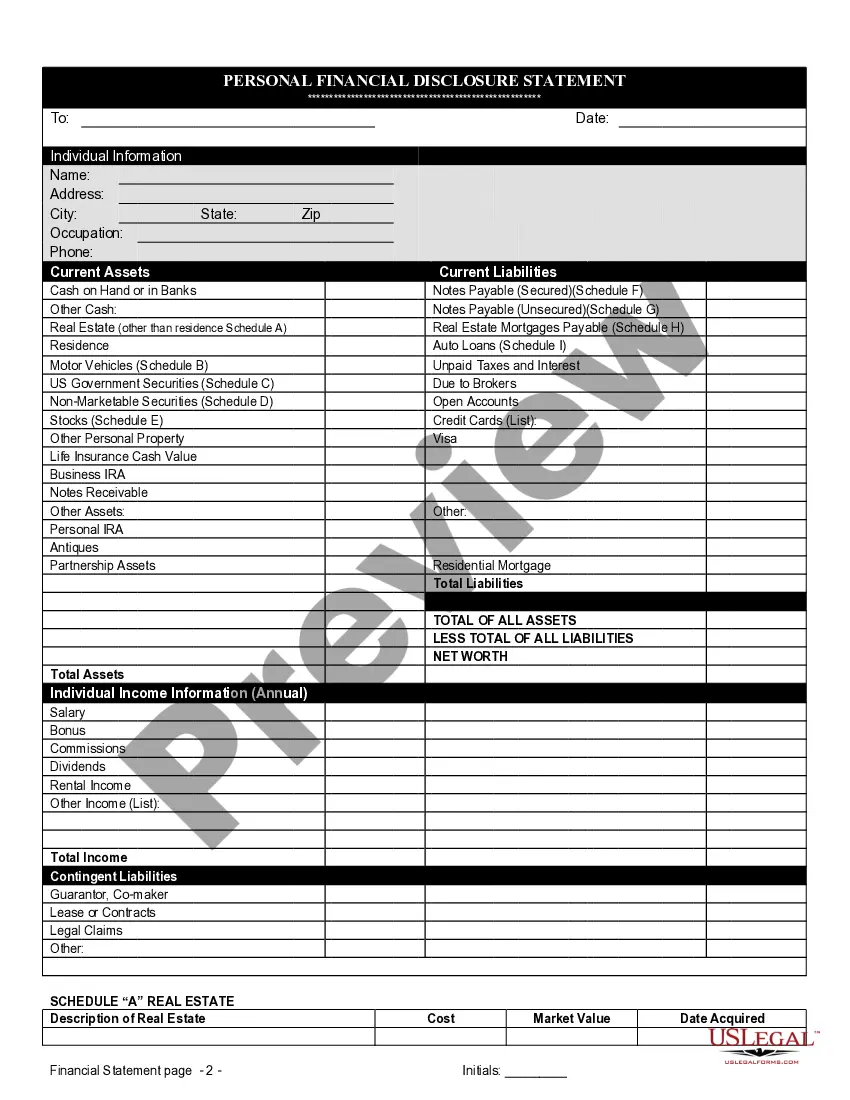

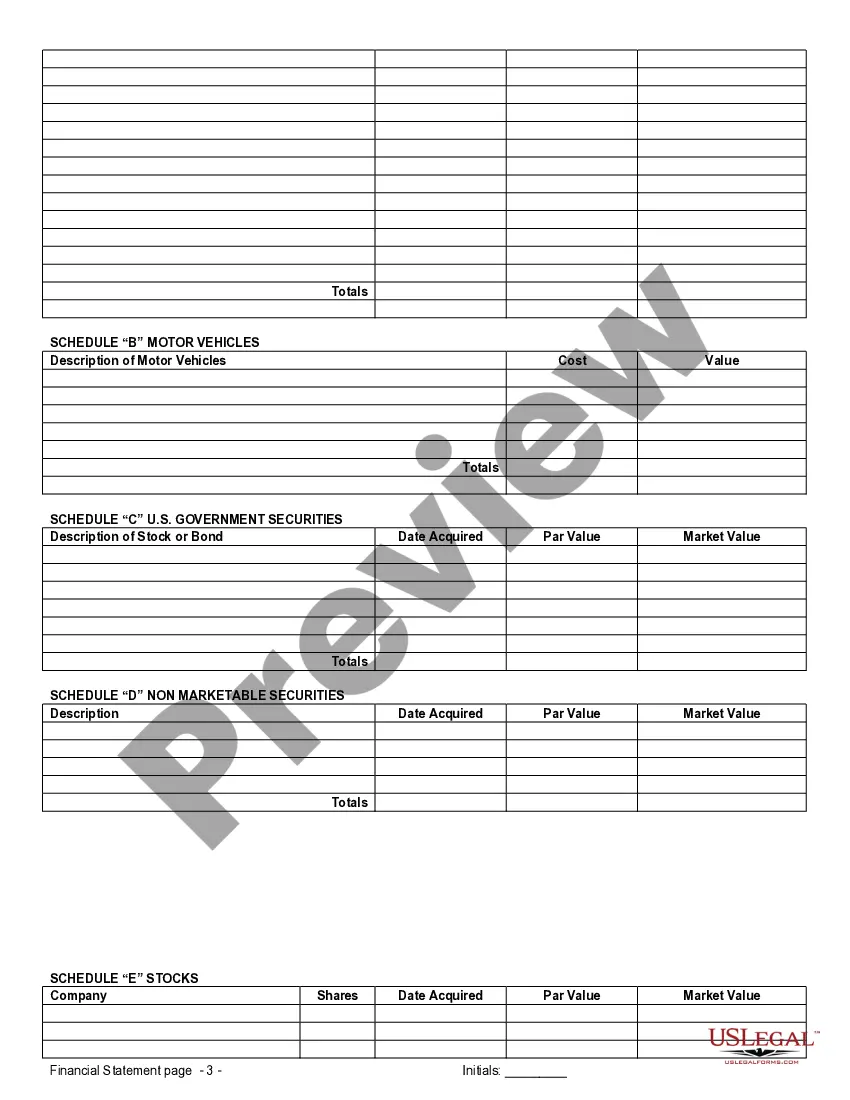

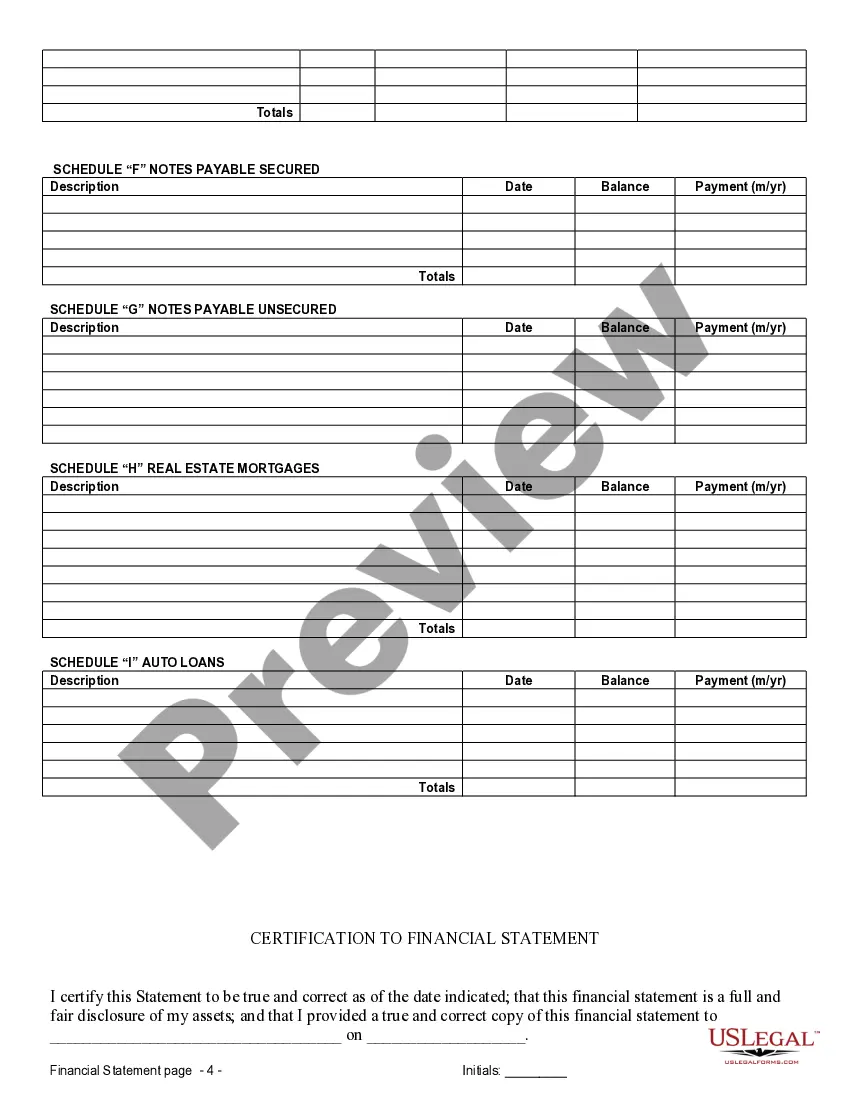

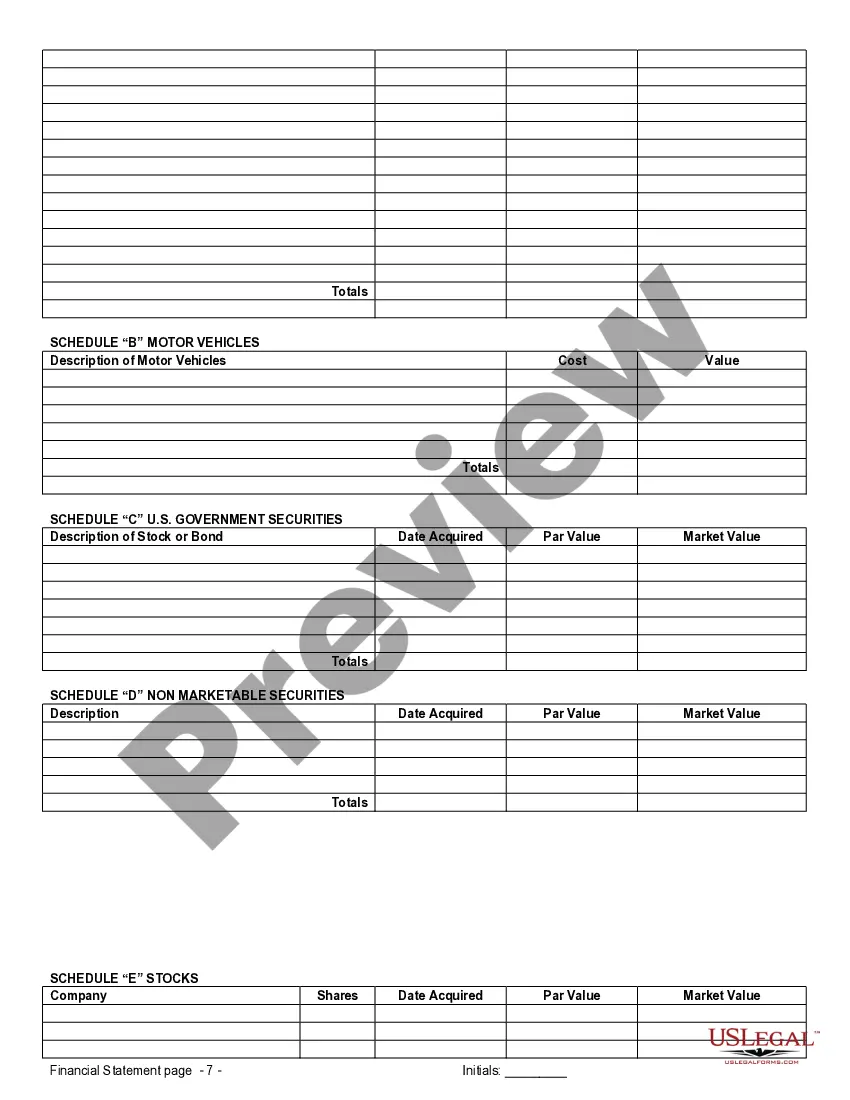

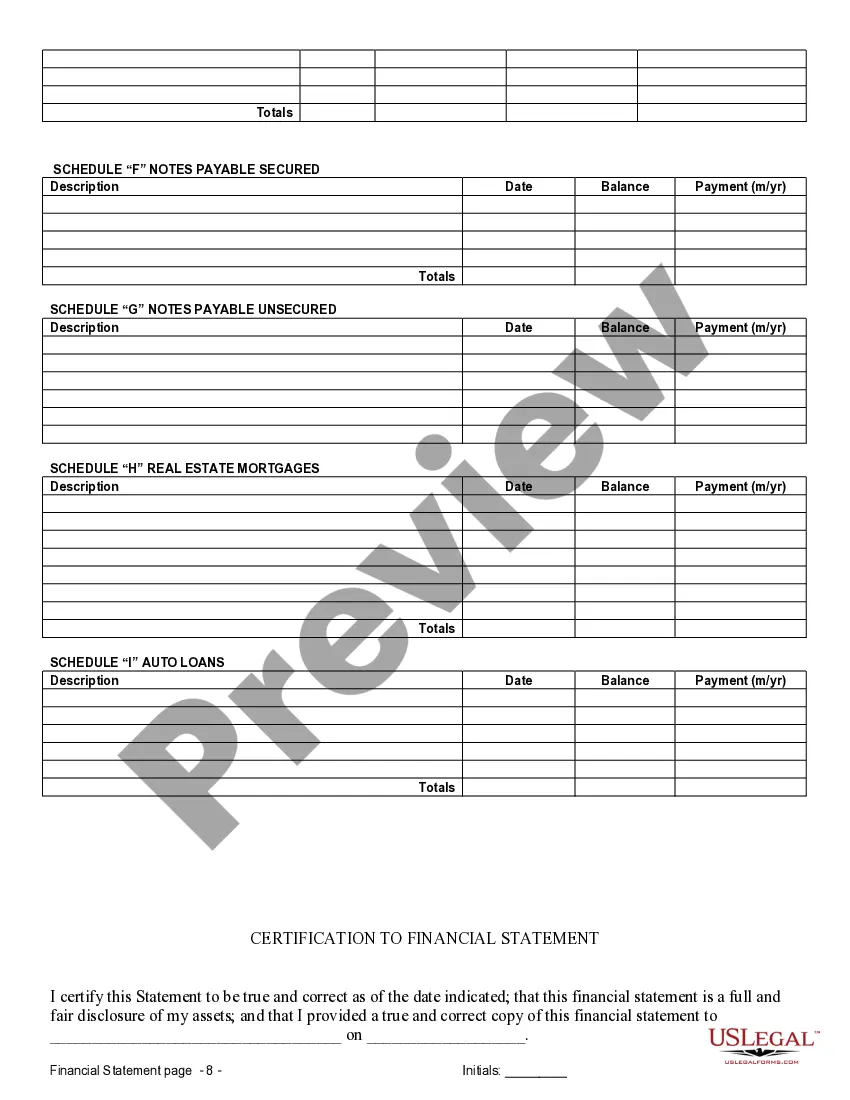

Maricopa Arizona Financial Statements Only in Connection with Prenuptial Premarital Agreement When entering into a prenuptial or premarital agreement in Maricopa, Arizona, it is crucial to include accurate and thorough financial statements to ensure the validity and enforceability of the agreement. Financial statements are formal documents that provide a comprehensive overview of the financial position of each party before marriage. Maricopa Arizona recognizes several types of financial statements exclusively for the purpose of prenuptial or premarital agreements, including but not limited to: 1. Personal Balance Sheets: A personal balance sheet outlines the individual assets, liabilities, and net worth of each party. It provides a snapshot of their finances, including bank accounts, investments, real estate, vehicles, personal belongings, debts, mortgages, loans, and other financial obligations. 2. Income Statements: Income statements show the income, expenses, and net profit or loss for a specified period. These statements demonstrate the current earning capacity and financial condition of each party involved. It is essential to disclose all sources of income, such as salaries, bonuses, commissions, dividends, rental income, alimony, child support, or any other financial resources. 3. Tax Returns: Providing copies of recent tax returns is critical when preparing financial statements. Tax returns give a detailed overview of income, deductions, and tax liabilities, offering additional evidence to support the financial information presented. 4. Bank Statements: Bank statements provide a comprehensive record of transactions made within a specified period. These statements reveal inflows and outflows of funds, including income deposits, expenses, loan payments, and investments. It is necessary to include a reasonable number of bank statements to accurately reflect the financial activities of each party before marriage. 5. Investment Statements: If either party holds investments such as stocks, bonds, mutual funds, or retirement accounts, providing investment statements is crucial. These documents disclose the nature and value of the investments, enabling a comprehensive understanding of the individual's financial portfolio. 6. Real Estate Documents: When any real estate properties are owned, it is vital to include relevant documents such as property deeds, mortgage agreements, leases, rental income statements, and property appraisals. These documents provide complete transparency regarding real estate assets and associated financial obligations. 7. Debts and Liabilities: The financial statements should also include a comprehensive overview of any outstanding debts or liabilities held by each party. This may include credit card debts, student loans, mortgages, car loans, personal loans, or any other financial obligations that could impact the financial well-being of the parties involved. By including these types of financial statements in a Maricopa Arizona prenuptial or premarital agreement, both parties can ensure transparency, fairness, and a clear understanding of each other's financial situation. It is highly recommended consulting a qualified family law attorney to ensure the accuracy and completeness of these statements, enabling the creation of a prenuptial agreement that protects the interests of both parties.Maricopa Arizona Financial Statements Only in Connection with Prenuptial Premarital Agreement When entering into a prenuptial or premarital agreement in Maricopa, Arizona, it is crucial to include accurate and thorough financial statements to ensure the validity and enforceability of the agreement. Financial statements are formal documents that provide a comprehensive overview of the financial position of each party before marriage. Maricopa Arizona recognizes several types of financial statements exclusively for the purpose of prenuptial or premarital agreements, including but not limited to: 1. Personal Balance Sheets: A personal balance sheet outlines the individual assets, liabilities, and net worth of each party. It provides a snapshot of their finances, including bank accounts, investments, real estate, vehicles, personal belongings, debts, mortgages, loans, and other financial obligations. 2. Income Statements: Income statements show the income, expenses, and net profit or loss for a specified period. These statements demonstrate the current earning capacity and financial condition of each party involved. It is essential to disclose all sources of income, such as salaries, bonuses, commissions, dividends, rental income, alimony, child support, or any other financial resources. 3. Tax Returns: Providing copies of recent tax returns is critical when preparing financial statements. Tax returns give a detailed overview of income, deductions, and tax liabilities, offering additional evidence to support the financial information presented. 4. Bank Statements: Bank statements provide a comprehensive record of transactions made within a specified period. These statements reveal inflows and outflows of funds, including income deposits, expenses, loan payments, and investments. It is necessary to include a reasonable number of bank statements to accurately reflect the financial activities of each party before marriage. 5. Investment Statements: If either party holds investments such as stocks, bonds, mutual funds, or retirement accounts, providing investment statements is crucial. These documents disclose the nature and value of the investments, enabling a comprehensive understanding of the individual's financial portfolio. 6. Real Estate Documents: When any real estate properties are owned, it is vital to include relevant documents such as property deeds, mortgage agreements, leases, rental income statements, and property appraisals. These documents provide complete transparency regarding real estate assets and associated financial obligations. 7. Debts and Liabilities: The financial statements should also include a comprehensive overview of any outstanding debts or liabilities held by each party. This may include credit card debts, student loans, mortgages, car loans, personal loans, or any other financial obligations that could impact the financial well-being of the parties involved. By including these types of financial statements in a Maricopa Arizona prenuptial or premarital agreement, both parties can ensure transparency, fairness, and a clear understanding of each other's financial situation. It is highly recommended consulting a qualified family law attorney to ensure the accuracy and completeness of these statements, enabling the creation of a prenuptial agreement that protects the interests of both parties.