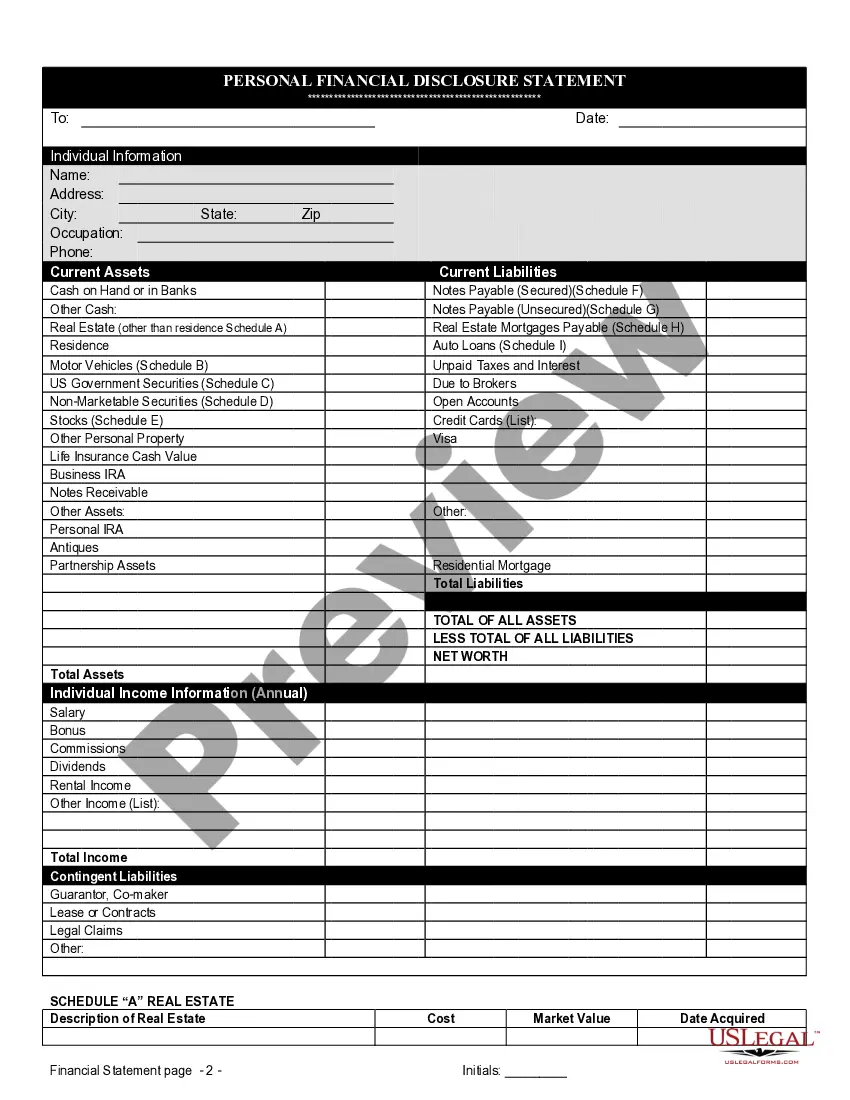

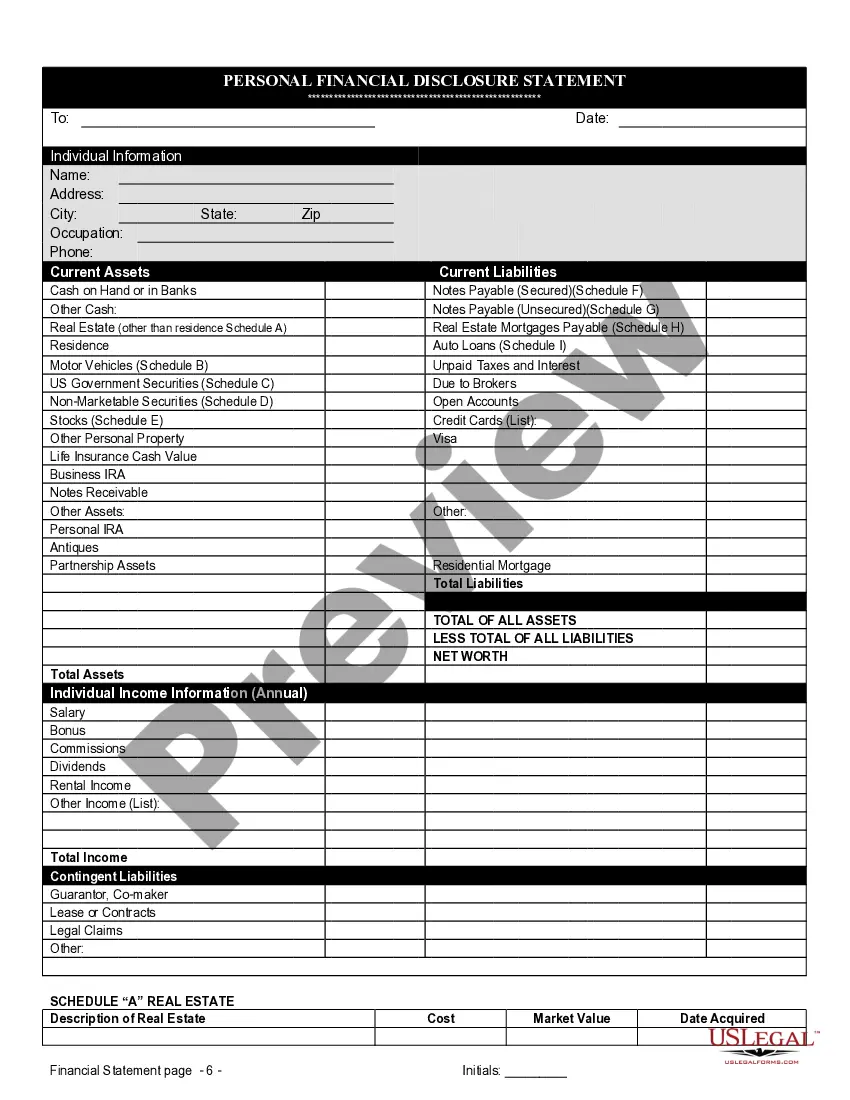

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Mesa Arizona Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Arizona Financial Statements Only In Connection With Prenuptial Premarital Agreement?

We consistently endeavor to diminish or evade legal complications when addressing intricate legal or financial matters.

To accomplish this, we enroll in attorney services that are typically quite costly.

Nevertheless, not every legal matter is equally intricate.

The majority can be managed independently.

Make use of US Legal Forms whenever you require to locate and download the Mesa Arizona Financial Statements solely in Relation to Prenuptial Premarital Agreement or any other form safely and effortlessly.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions.

- Our library empowers you to handle your affairs autonomously without relying on attorney services.

- We offer access to legal form templates that are not always readily available.

- Our templates are tailored to specific states and regions, which greatly eases the search process.

Form popularity

FAQ

The law does not allow a couple to include any terms regarding child custody, visitation or support in a prenuptial or postnuptial agreement. This is because a judge will make these decisions in a divorce case based on the child's best interests.

Be a written contract?no verbal agreements. Have lawful terms within the prenup. Include the signatures from both parties. Must be signed voluntarily (can't involve coercion, duress, intimidation, or deceit)

When planning a prenuptial agreement, it is imperative that both you and your future spouse disclose all of your financial assets and property at the time of marriage. Prenups are designed to help protect personal property and finances and to make sure property is fairly divided in case of a divorce.

A prenuptial agreement cannot include personal preferences, such as who has what chores, whose name to use, where to spend the holidays, information on child-rearing, or what relationship to have with specific relatives. Premarital agreements are meant to address monetary issues.

Rather, you can include whatever you want, but unless it's enforceable under California law and your family law judge agrees with it, it won't be enforced if you ever need to rely on the agreement. It's crucial to hire an experienced attorney to help you draft and execute your prenup.

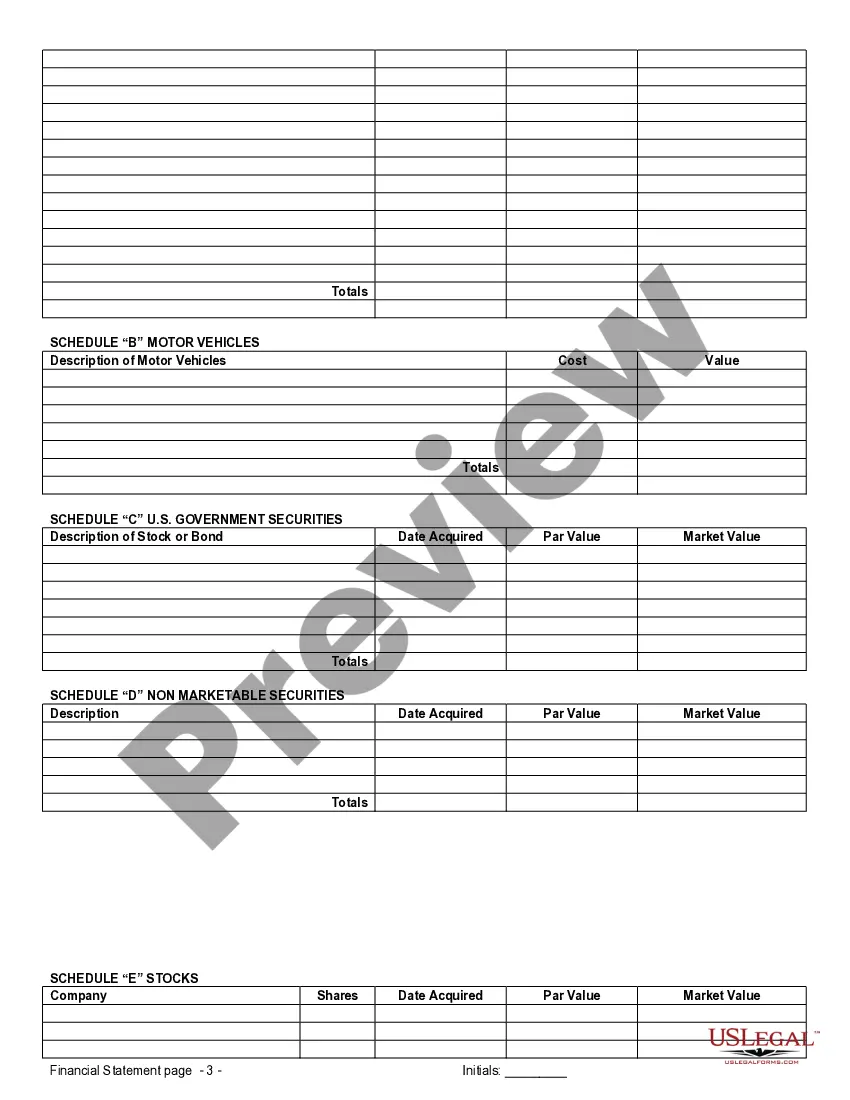

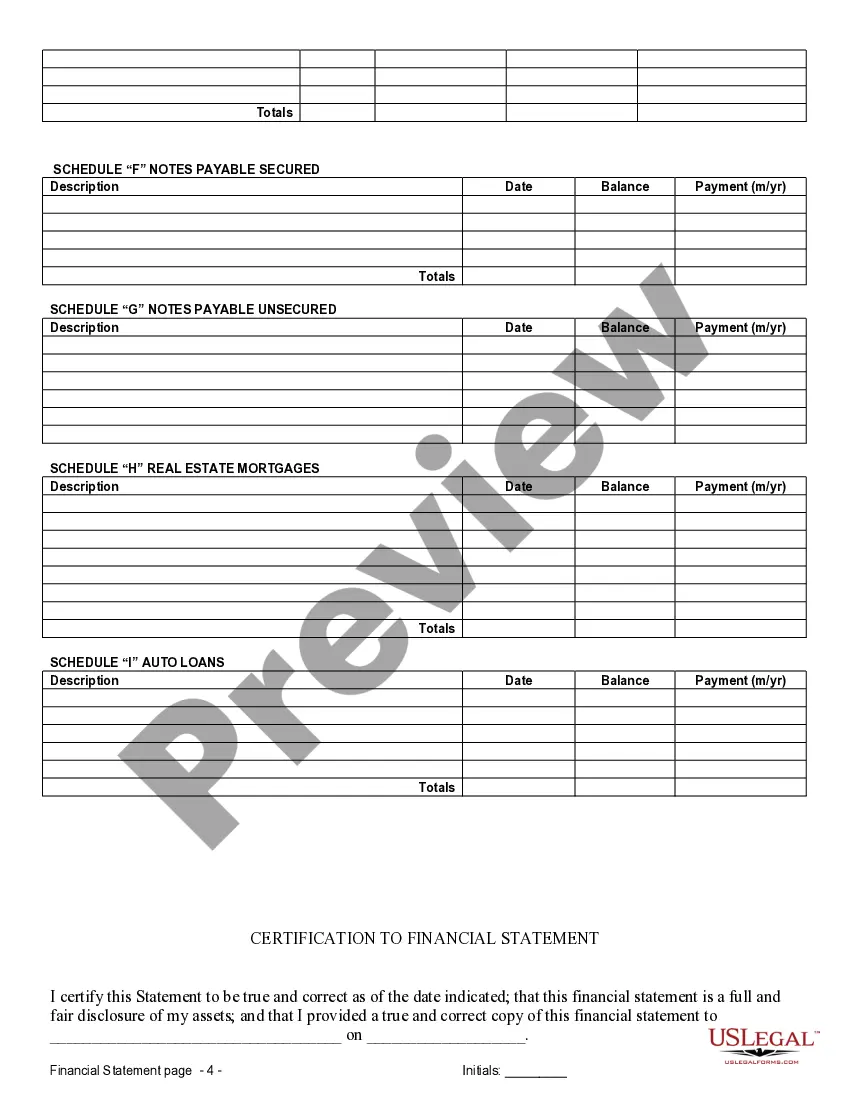

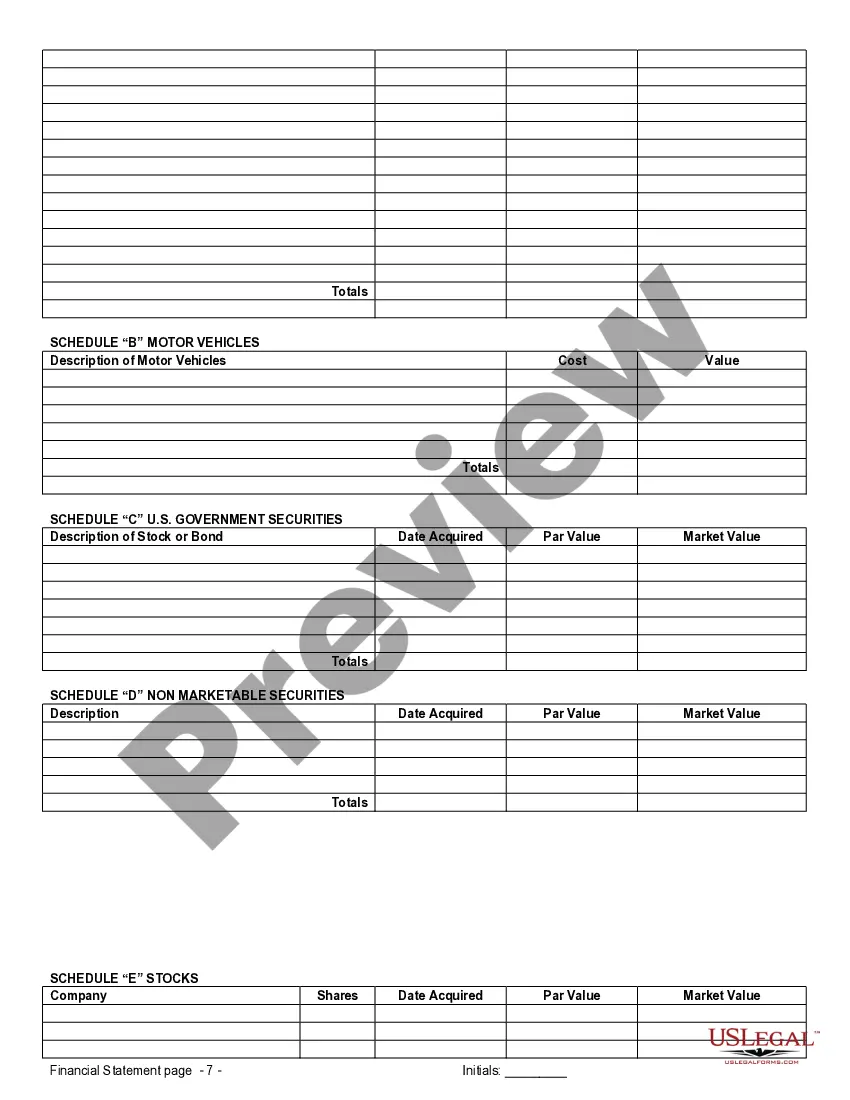

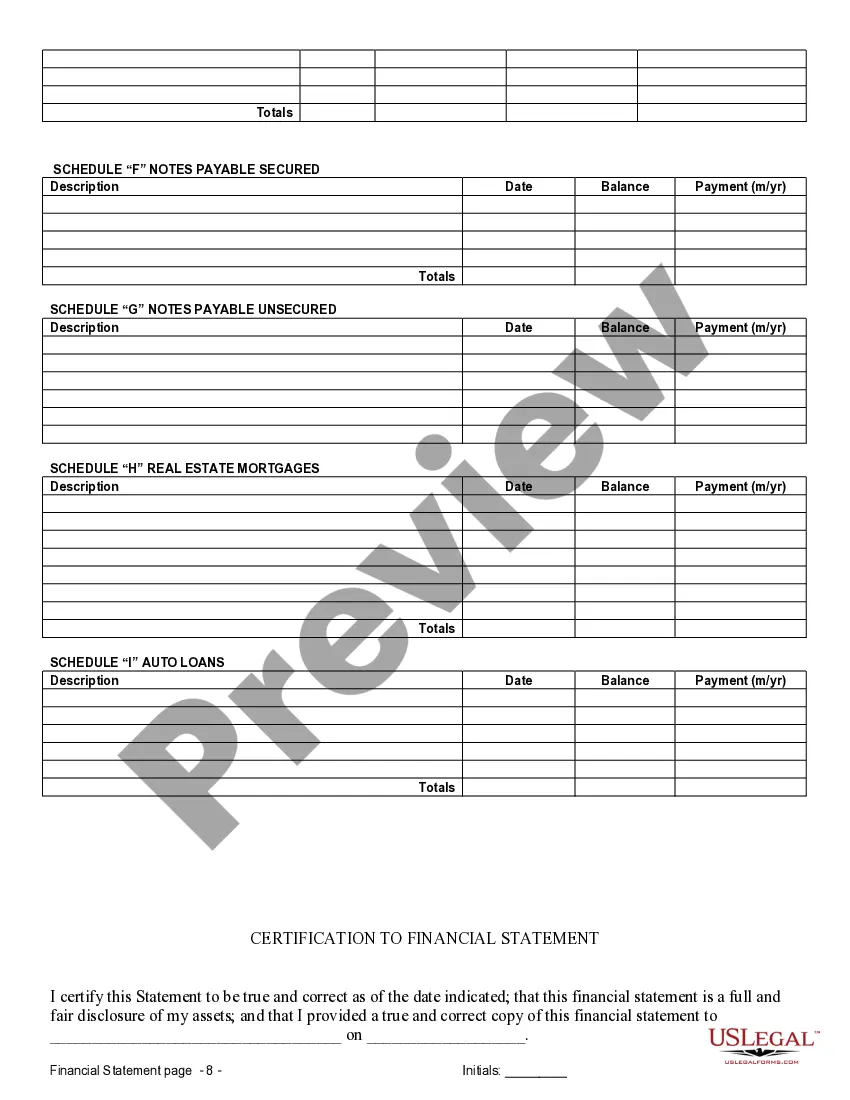

Simply put, both fiances must reveal all of their income, assets and debts when entering into a prenuptial agreement. All of it. This is done by attaching a ?financial schedule? to the end of your agreement, which is a snapshot of all of your income, assets, debt, and prospective inheritance.

The premarital assets of each spouse will remain separate unless they are put into a joint account or otherwise commingled. Some couples agree to open a joint bank account for household expenses and maintain separate accounts for other funds.

A prenuptial agreement does not cover the following: Child custody or visitation matters. Child support. Alimony in the event of a divorce. Day-to-day household matters. Anything prohibited by the law.

You can keep your finances separate: Without a prenuptial agreement, even a separate bank account will be considered marital property in a divorce. You can keep your finances truly separate with a prenuptial agreement.