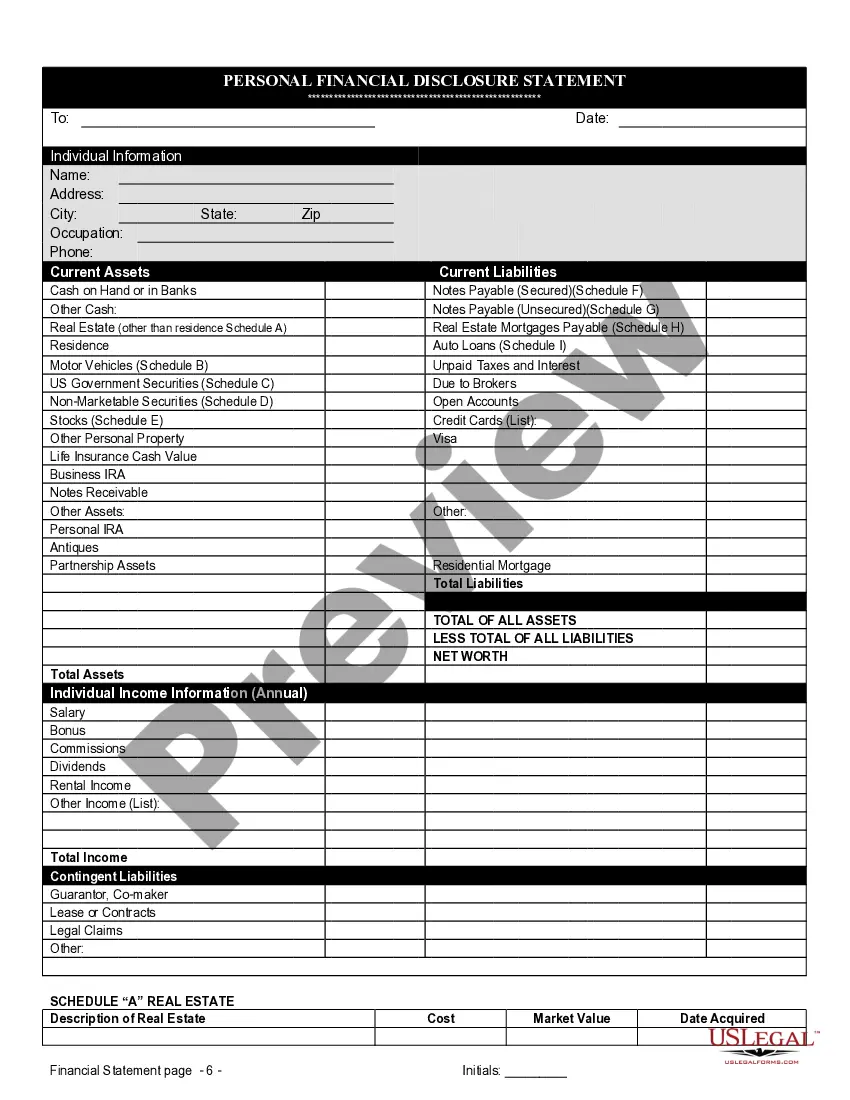

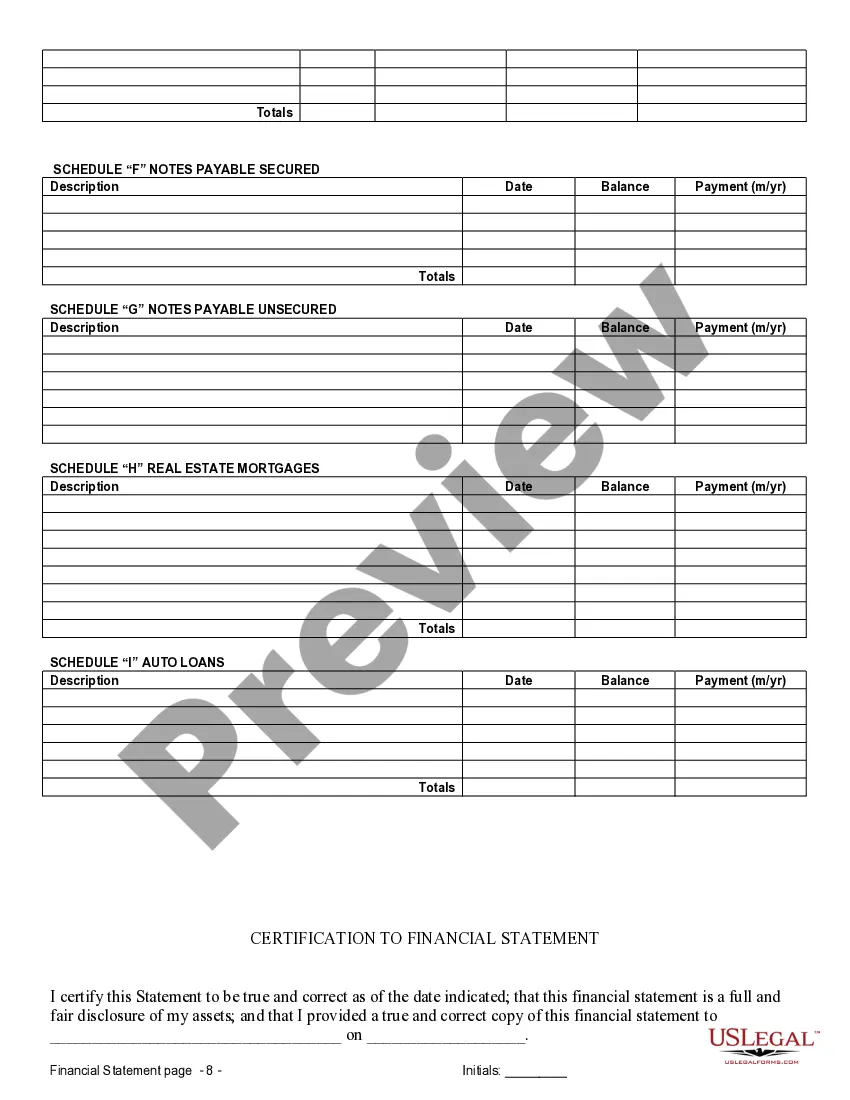

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

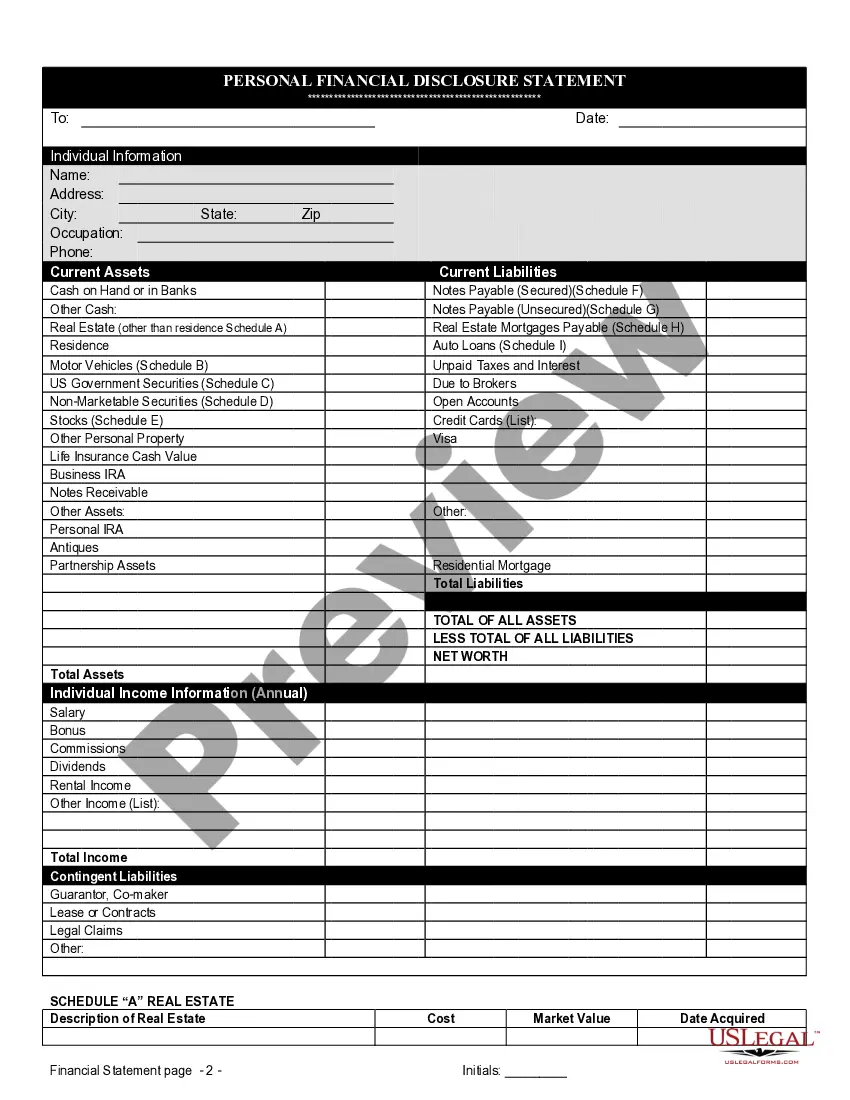

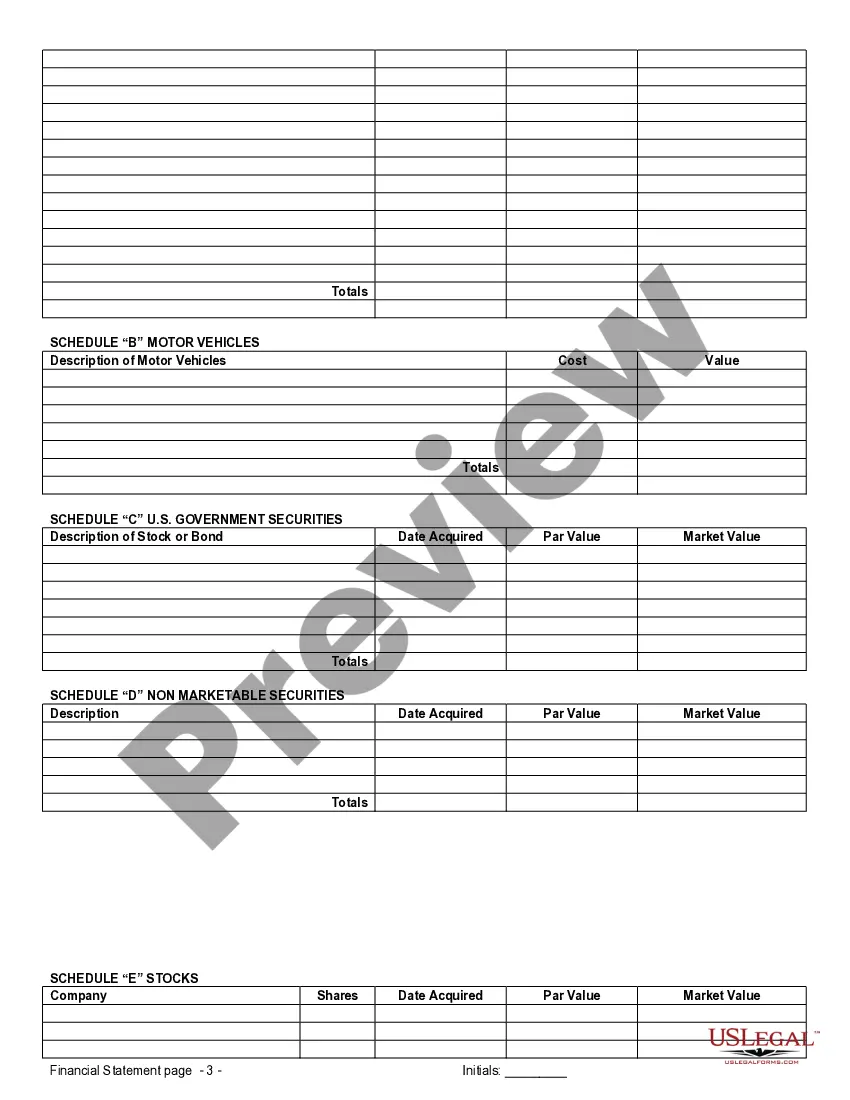

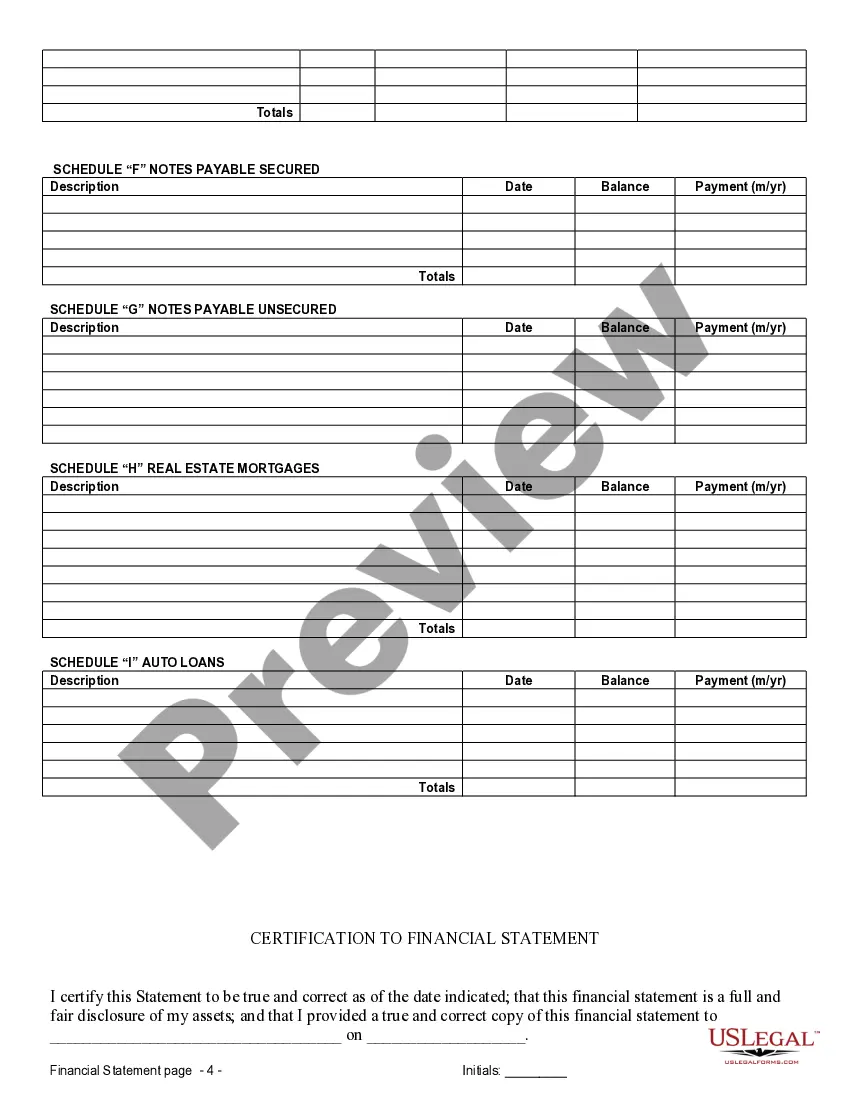

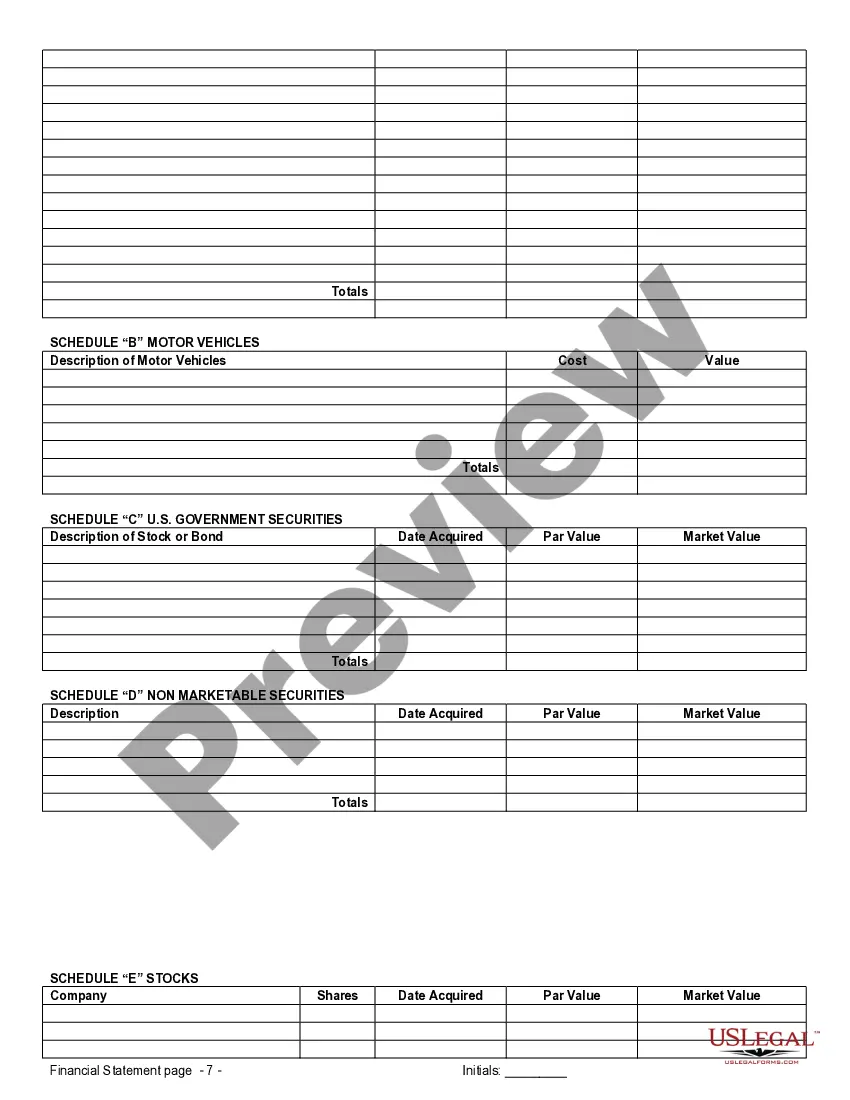

Lima, Arizona Financial Statements in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview Lima, Arizona financial statements play a crucial role in prenuptial (premarital) agreements, as they serve to set the stage for financial transparency and protect the interests of both parties entering the marriage. In this detailed description, we will delve into what Lima financial statements entail, their role within prenuptial agreements, and highlight different types of financial statements commonly used in this context. Lima, Arizona Financial Statements: 1. Personal Balance Sheet: This statement provides a snapshot of an individual's assets, liabilities, and net worth. It encompasses details such as bank account balances, real estate holdings, investments, and outstanding debts. The personal balance sheet is an essential component of financial disclosure in prenuptial agreements. 2. Income Statement: This statement outlines an individual's income and expenses, offering a comprehensive view of their financial situation. It includes details of earnings, such as salary, bonuses, investments, and other sources of income, as well as regular expenses like rent, utilities, and debt repayments. 3. Tax Returns: Tax returns provide valuable insights into an individual's income, deductions, and financial obligations to the government. By analyzing tax returns, parties can ensure full transparency about each other's financial standing and ensure that all tax liabilities are accounted for within the prenuptial agreement. 4. Business Financial Statements: If either party owns or operates a business, providing business financial statements becomes crucial. These statements include balance sheets, income statements, cash flow statements, and other relevant documents that shed light on the financial health and viability of the business. Importance of Financial Statements in a Prenuptial Agreement: Financial statements serve multiple purposes within a prenuptial agreement and are instrumental in achieving the desired financial protection for both parties. Here are their key roles: 1. Transparency and Disclosure: Financial statements facilitate an open and honest discussion regarding each party's financial situation, ensuring full disclosure of assets, liabilities, and income sources. This fosters trust and helps prevent any hidden financial surprises in the future. 2. Asset Protection: Financial statements allow parties to identify and protect their assets within the prenuptial agreement. By declaring assets explicitly, both parties can establish which assets are separate property and which may be subject to division in the event of a divorce. 3. Debt Allocation: If one or both parties have outstanding debts, financial statements aid in determining responsibility for these obligations. This helps allocate debts fairly and avoids any misunderstandings or disputes related to financial liabilities. 4. Spousal Support or Alimony Considerations: Accurate representation of income and financial standing through financial statements is crucial in determining the appropriate spousal support or alimony arrangement, if necessary, in the event of a divorce. In Conclusion: Lima, Arizona financial statements hold significant importance within prenuptial agreements, promoting financial transparency, asset protection, and fair decision-making. The types of financial statements mentioned above, such as personal balance sheets, income statements, tax returns, and business financial statements, ensure comprehensive disclosure and facilitate informed discussions between the parties involved. Remember, consulting with a qualified attorney is essential when drafting a prenuptial agreement to ensure compliance with relevant state laws and regulations.Lima, Arizona Financial Statements in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview Lima, Arizona financial statements play a crucial role in prenuptial (premarital) agreements, as they serve to set the stage for financial transparency and protect the interests of both parties entering the marriage. In this detailed description, we will delve into what Lima financial statements entail, their role within prenuptial agreements, and highlight different types of financial statements commonly used in this context. Lima, Arizona Financial Statements: 1. Personal Balance Sheet: This statement provides a snapshot of an individual's assets, liabilities, and net worth. It encompasses details such as bank account balances, real estate holdings, investments, and outstanding debts. The personal balance sheet is an essential component of financial disclosure in prenuptial agreements. 2. Income Statement: This statement outlines an individual's income and expenses, offering a comprehensive view of their financial situation. It includes details of earnings, such as salary, bonuses, investments, and other sources of income, as well as regular expenses like rent, utilities, and debt repayments. 3. Tax Returns: Tax returns provide valuable insights into an individual's income, deductions, and financial obligations to the government. By analyzing tax returns, parties can ensure full transparency about each other's financial standing and ensure that all tax liabilities are accounted for within the prenuptial agreement. 4. Business Financial Statements: If either party owns or operates a business, providing business financial statements becomes crucial. These statements include balance sheets, income statements, cash flow statements, and other relevant documents that shed light on the financial health and viability of the business. Importance of Financial Statements in a Prenuptial Agreement: Financial statements serve multiple purposes within a prenuptial agreement and are instrumental in achieving the desired financial protection for both parties. Here are their key roles: 1. Transparency and Disclosure: Financial statements facilitate an open and honest discussion regarding each party's financial situation, ensuring full disclosure of assets, liabilities, and income sources. This fosters trust and helps prevent any hidden financial surprises in the future. 2. Asset Protection: Financial statements allow parties to identify and protect their assets within the prenuptial agreement. By declaring assets explicitly, both parties can establish which assets are separate property and which may be subject to division in the event of a divorce. 3. Debt Allocation: If one or both parties have outstanding debts, financial statements aid in determining responsibility for these obligations. This helps allocate debts fairly and avoids any misunderstandings or disputes related to financial liabilities. 4. Spousal Support or Alimony Considerations: Accurate representation of income and financial standing through financial statements is crucial in determining the appropriate spousal support or alimony arrangement, if necessary, in the event of a divorce. In Conclusion: Lima, Arizona financial statements hold significant importance within prenuptial agreements, promoting financial transparency, asset protection, and fair decision-making. The types of financial statements mentioned above, such as personal balance sheets, income statements, tax returns, and business financial statements, ensure comprehensive disclosure and facilitate informed discussions between the parties involved. Remember, consulting with a qualified attorney is essential when drafting a prenuptial agreement to ensure compliance with relevant state laws and regulations.