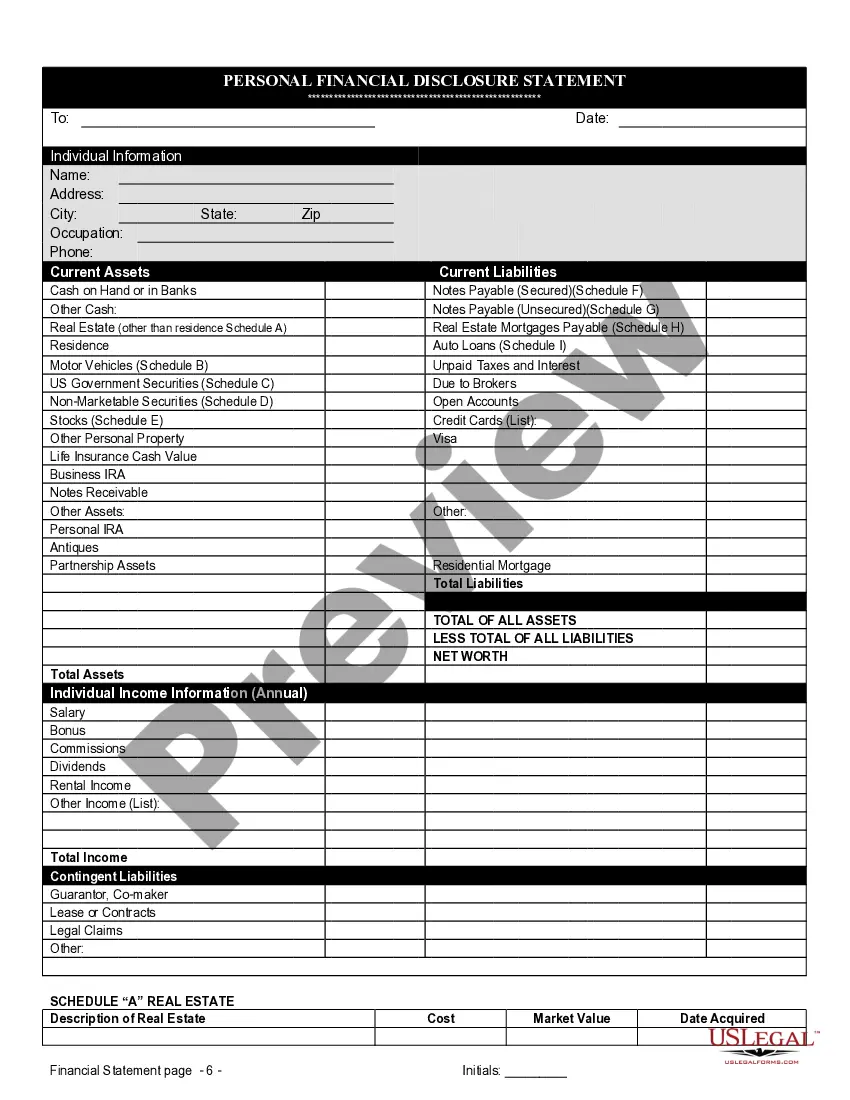

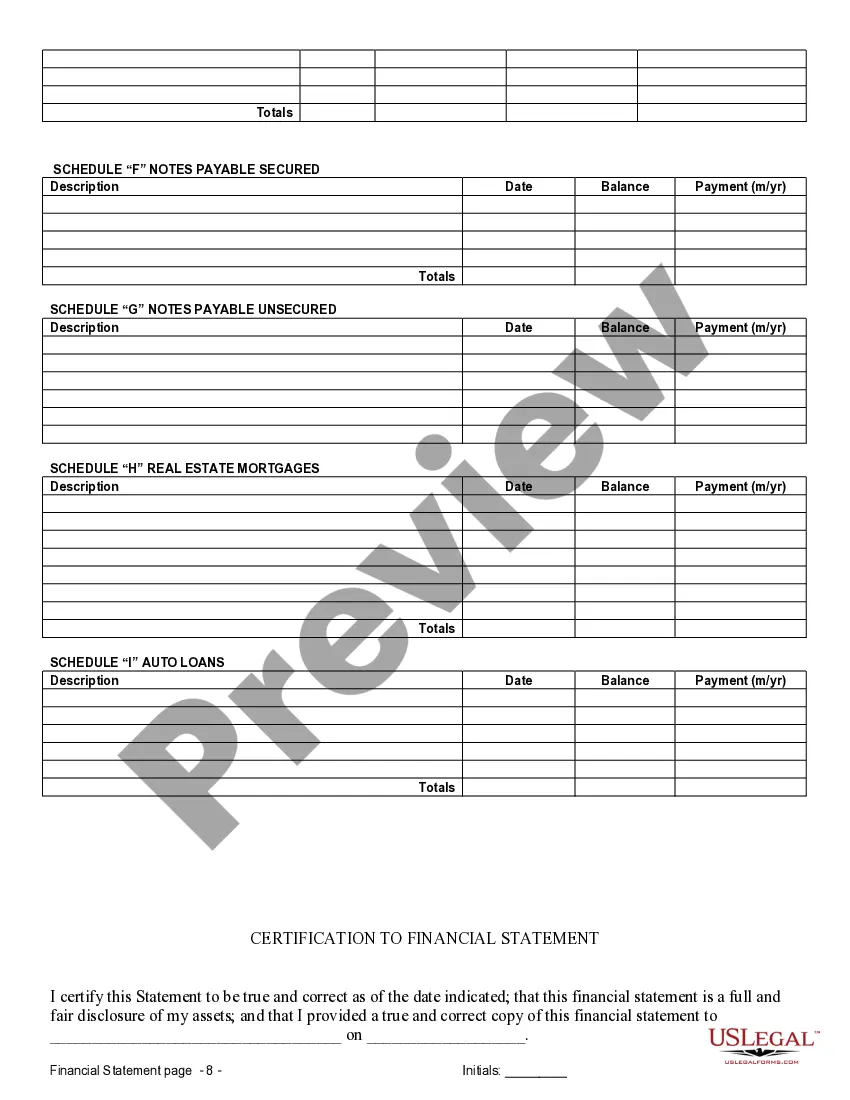

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

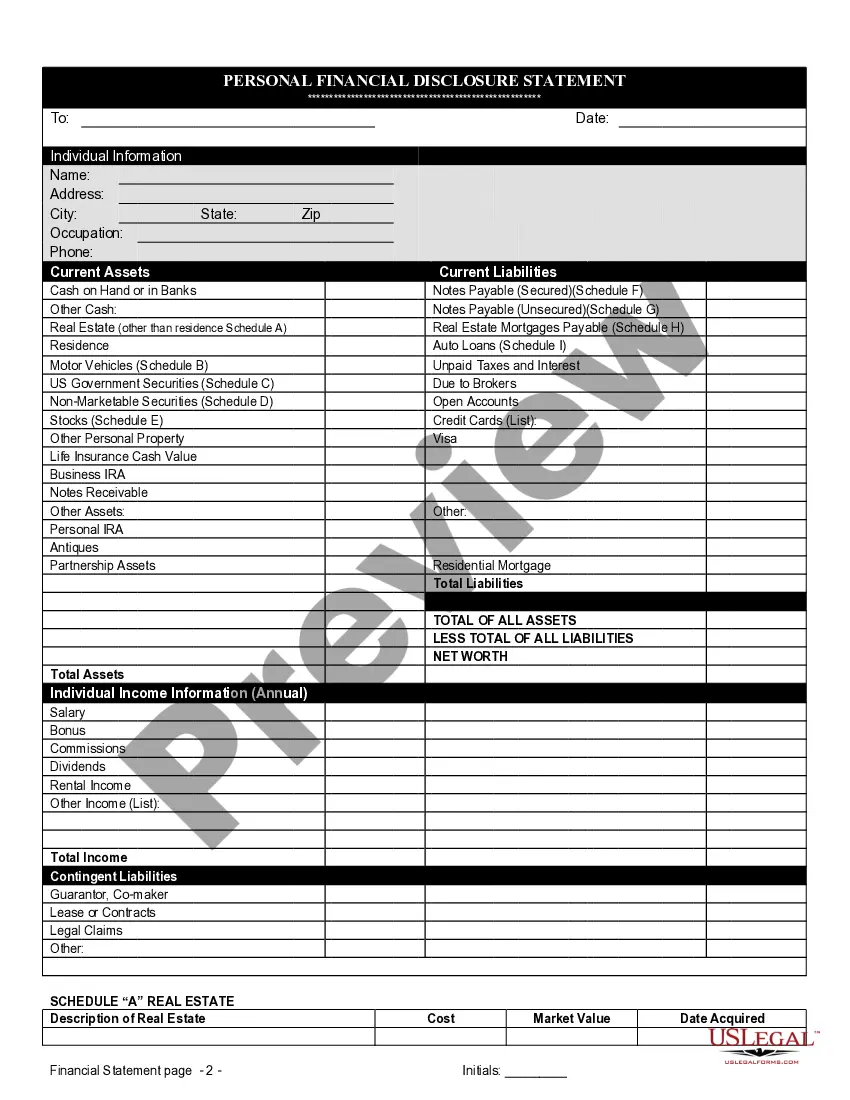

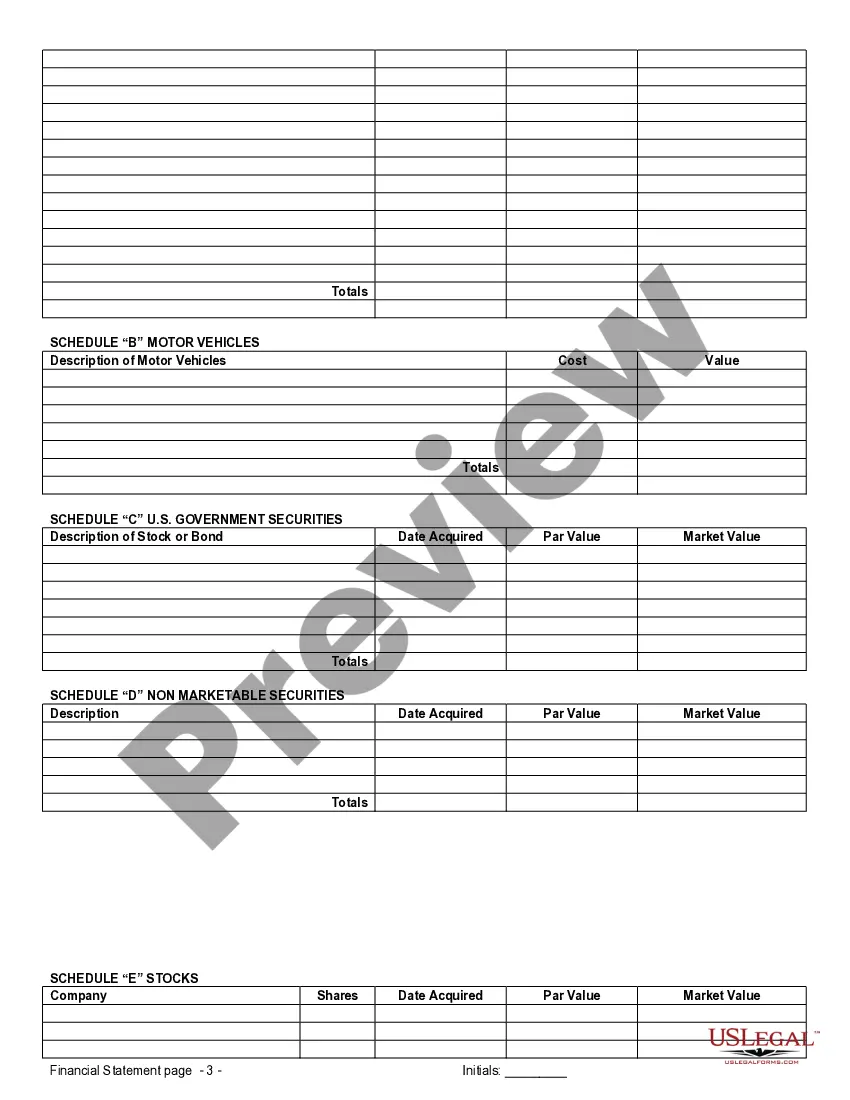

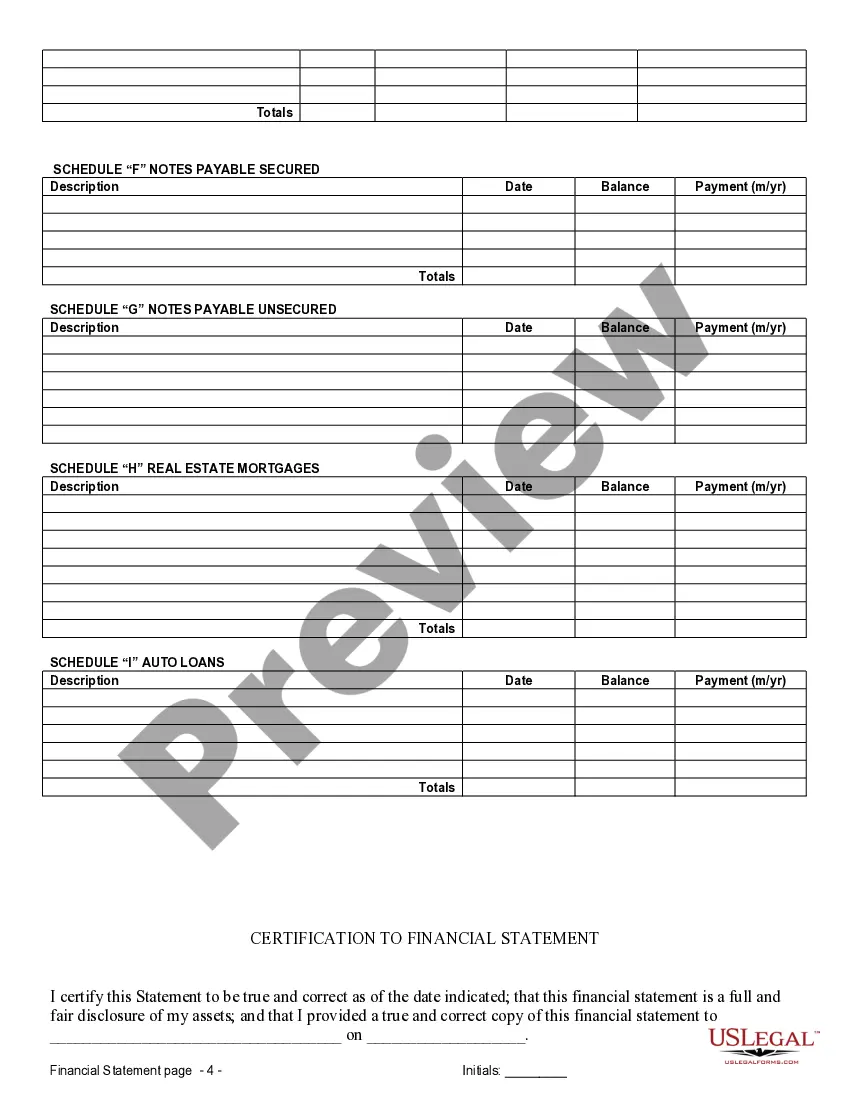

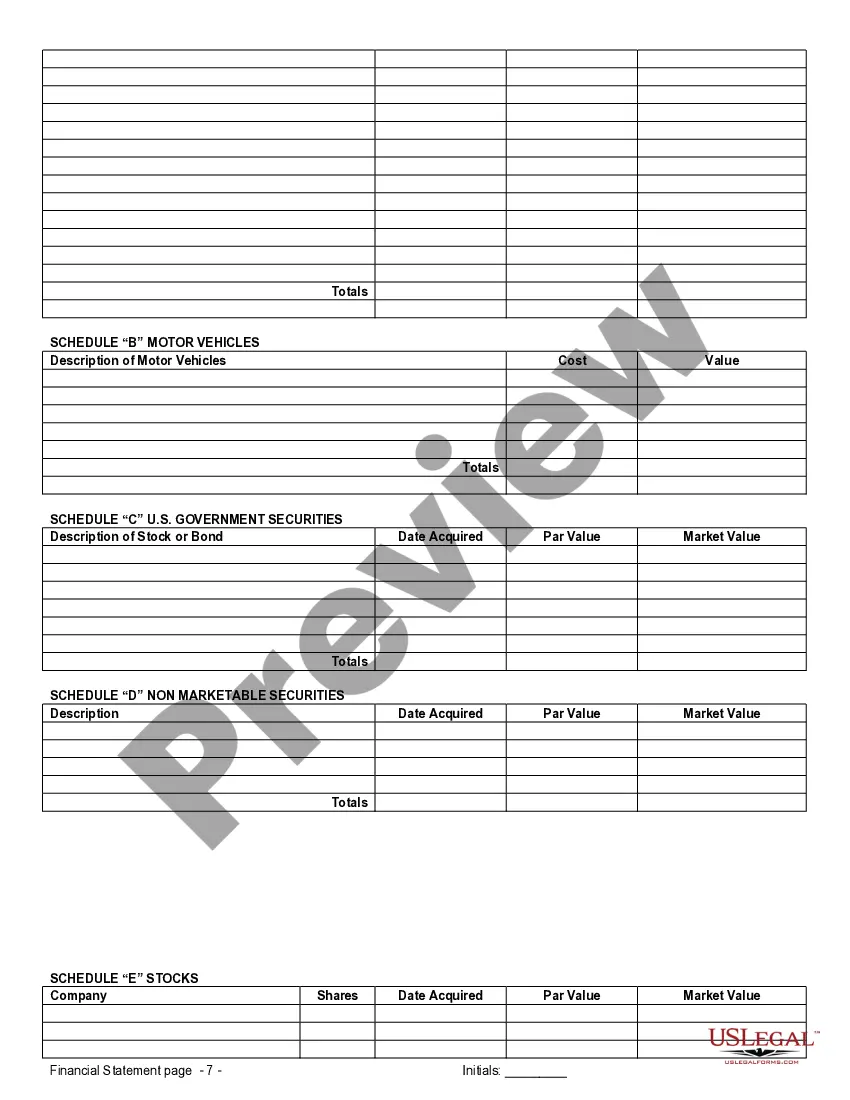

In Surprise, Arizona, financial statements are an essential component of prenuptial or premarital agreements. These statements provide a detailed overview of each party's financial status, ensuring transparency and establishing a foundation for financial arrangements within the marriage. Here, we will delve into the significance of Surprise Arizona Financial Statements only in Connection with Prenuptial Premarital Agreements, while incorporating relevant keywords. 1. Understanding the Purpose of Surprise Arizona Financial Statements in Prenuptial Agreements Financial statements in Surprise Arizona prenuptial agreements serve several purposes. They facilitate open and honest communication about each party's financial situation, assets, and debts. This transparency helps in determining fair division of assets, spousal support, and debt obligations in the event of a divorce. Keywords: Surprise Arizona prenuptial agreement, financial disclosure, fair division of assets. 2. Comprehensive Overview of Surprise Arizona's Financial Statements in Prenuptial Agreements Surprise Arizona financial statements included in prenuptial agreements encompass various aspects of an individual's financial picture. These may include income, expenses, savings, investments, real estate holdings, business interests, retirement accounts, and outstanding debts. Keywords: comprehensive financial overview, income and expenses, savings and investments, real estate holdings, retirement accounts. 3. Types of Surprise Arizona Financial Statements in Prenuptial Agreements There are different types of financial statements used in Surprise Arizona prenuptial agreements, each offering specific information. These may include: a. Balance Sheet: This statement provides a snapshot of an individual's assets, liabilities, and net worth at a specific point in time. It includes items such as bank accounts, properties, stocks, bonds, and outstanding debts. b. Income Statement: This statement outlines an individual's income and expenses, providing insights into their financial stability and spending habits. c. Statement of Cash Flows: This statement tracks the flow of cash in and out of an individual's accounts, detailing income sources, expenses, and any savings/investments. d. Statement of Net Worth: Similar to a balance sheet, this statement calculates the difference between an individual's assets and liabilities, revealing their overall financial position. e. Tax Returns: Requesting copies of recent tax returns offers a comprehensive view of an individual's income, tax deductions, and any potential tax liabilities. Keywords: balance sheet, income statement, statement of cash flows, statement of net worth, tax returns. 4. Legal Requirements and Considerations for Surprise Arizona Financial Statements Surprise Arizona has specific legal requirements when it comes to financial statements within prenuptial agreements. Both parties must fully disclose their financial information voluntarily and in good faith. Failure to provide accurate information can render the prenuptial agreement unenforceable. Consulting an experienced family lawyer in Surprise Arizona is crucial to ensure compliance and legality. Keywords: legal requirements, voluntary disclosure, enforceability, family lawyer. In summary, Surprise Arizona Financial Statements only in Connection with Prenuptial Premarital Agreements serve as a vital tool in establishing financial transparency and fairness within marriages. These statements, including balance sheets, income statements, and tax returns, help protect the interests of both parties and are crucial in determining asset division and financial obligations during a divorce. It is vital to consult a knowledgeable family lawyer when creating these statements to ensure compliance with Surprise Arizona's legal requirements. Keywords: financial transparency, asset division, financial obligations, legal compliance, family lawyer.In Surprise, Arizona, financial statements are an essential component of prenuptial or premarital agreements. These statements provide a detailed overview of each party's financial status, ensuring transparency and establishing a foundation for financial arrangements within the marriage. Here, we will delve into the significance of Surprise Arizona Financial Statements only in Connection with Prenuptial Premarital Agreements, while incorporating relevant keywords. 1. Understanding the Purpose of Surprise Arizona Financial Statements in Prenuptial Agreements Financial statements in Surprise Arizona prenuptial agreements serve several purposes. They facilitate open and honest communication about each party's financial situation, assets, and debts. This transparency helps in determining fair division of assets, spousal support, and debt obligations in the event of a divorce. Keywords: Surprise Arizona prenuptial agreement, financial disclosure, fair division of assets. 2. Comprehensive Overview of Surprise Arizona's Financial Statements in Prenuptial Agreements Surprise Arizona financial statements included in prenuptial agreements encompass various aspects of an individual's financial picture. These may include income, expenses, savings, investments, real estate holdings, business interests, retirement accounts, and outstanding debts. Keywords: comprehensive financial overview, income and expenses, savings and investments, real estate holdings, retirement accounts. 3. Types of Surprise Arizona Financial Statements in Prenuptial Agreements There are different types of financial statements used in Surprise Arizona prenuptial agreements, each offering specific information. These may include: a. Balance Sheet: This statement provides a snapshot of an individual's assets, liabilities, and net worth at a specific point in time. It includes items such as bank accounts, properties, stocks, bonds, and outstanding debts. b. Income Statement: This statement outlines an individual's income and expenses, providing insights into their financial stability and spending habits. c. Statement of Cash Flows: This statement tracks the flow of cash in and out of an individual's accounts, detailing income sources, expenses, and any savings/investments. d. Statement of Net Worth: Similar to a balance sheet, this statement calculates the difference between an individual's assets and liabilities, revealing their overall financial position. e. Tax Returns: Requesting copies of recent tax returns offers a comprehensive view of an individual's income, tax deductions, and any potential tax liabilities. Keywords: balance sheet, income statement, statement of cash flows, statement of net worth, tax returns. 4. Legal Requirements and Considerations for Surprise Arizona Financial Statements Surprise Arizona has specific legal requirements when it comes to financial statements within prenuptial agreements. Both parties must fully disclose their financial information voluntarily and in good faith. Failure to provide accurate information can render the prenuptial agreement unenforceable. Consulting an experienced family lawyer in Surprise Arizona is crucial to ensure compliance and legality. Keywords: legal requirements, voluntary disclosure, enforceability, family lawyer. In summary, Surprise Arizona Financial Statements only in Connection with Prenuptial Premarital Agreements serve as a vital tool in establishing financial transparency and fairness within marriages. These statements, including balance sheets, income statements, and tax returns, help protect the interests of both parties and are crucial in determining asset division and financial obligations during a divorce. It is vital to consult a knowledgeable family lawyer when creating these statements to ensure compliance with Surprise Arizona's legal requirements. Keywords: financial transparency, asset division, financial obligations, legal compliance, family lawyer.