Phoenix Arizona Registration of Foreign Corporation

Description

How to fill out Arizona Registration Of Foreign Corporation?

We constantly endeavor to reduce or prevent legal complications when handling intricate legal or financial matters.

To achieve this, we seek attorney services that are typically very costly.

Nevertheless, not every legal issue is of the same complexity.

The majority can be managed by ourselves.

Utilize US Legal Forms whenever you need to obtain and download the Phoenix Arizona Registration of Foreign Corporation or any other form quickly and securely. Simply Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always re-download it from within the My documents tab.

- US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our library enables you to take control of your affairs without the need for legal advice.

- We offer access to legal form templates that are not always readily accessible.

- Our templates are specific to state and locality, which greatly simplifies the search process.

Form popularity

FAQ

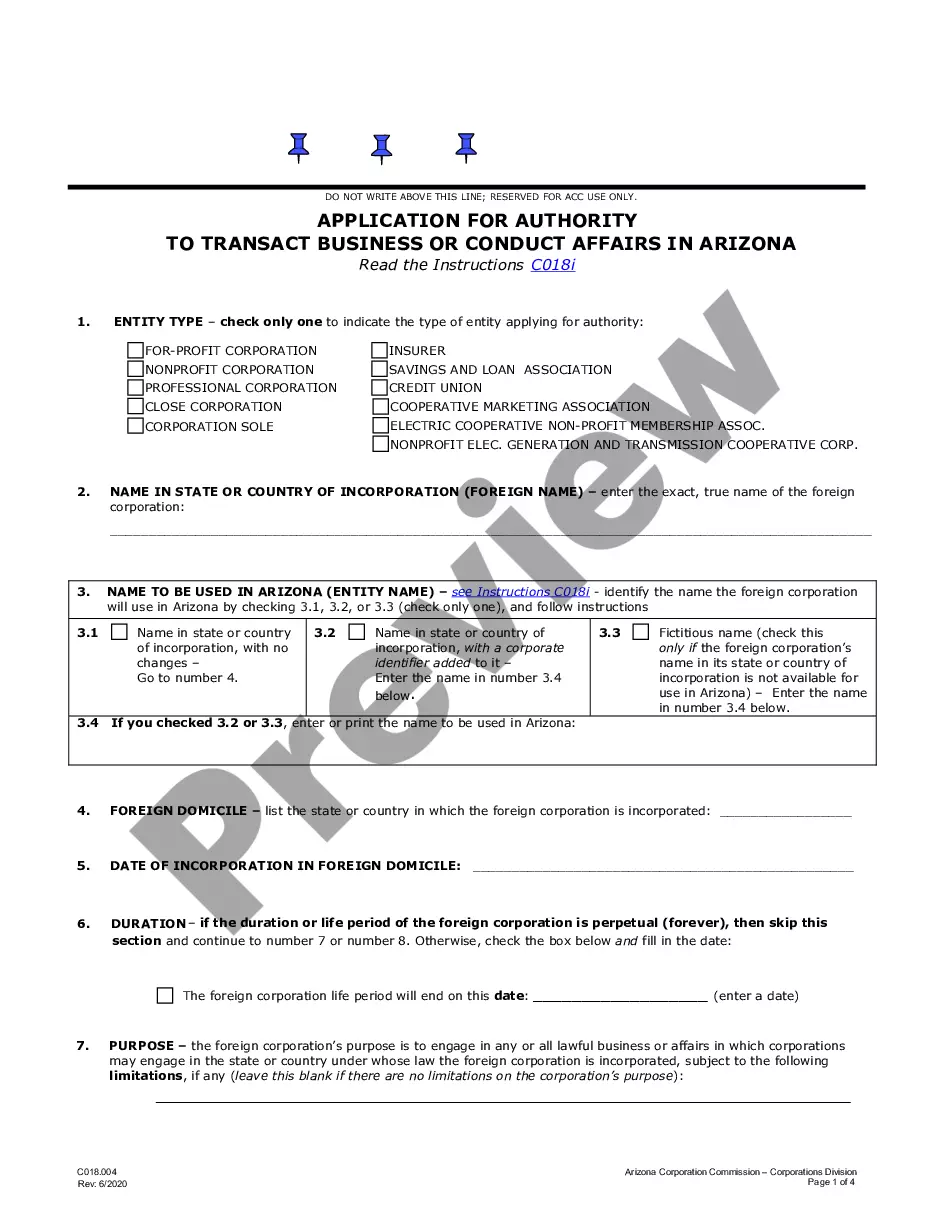

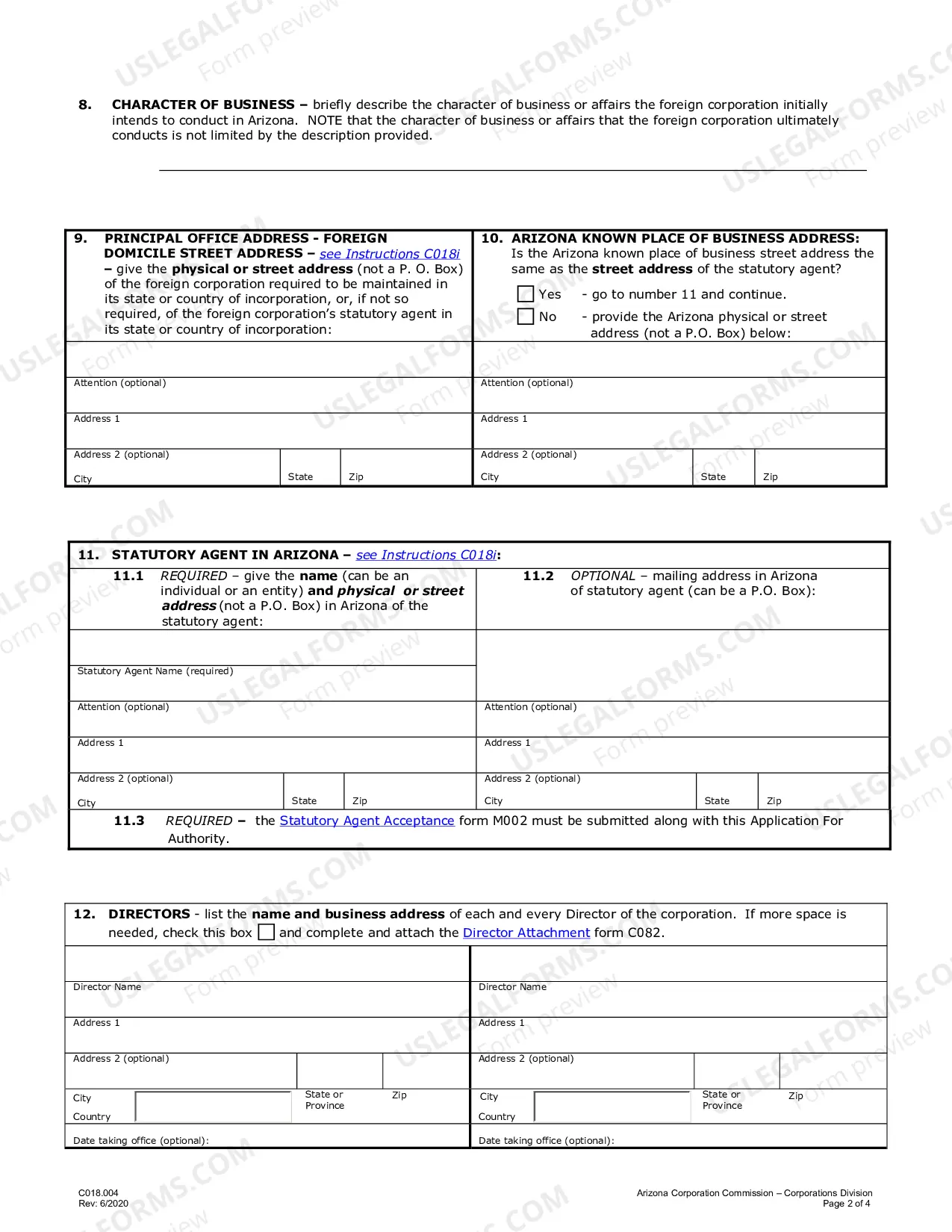

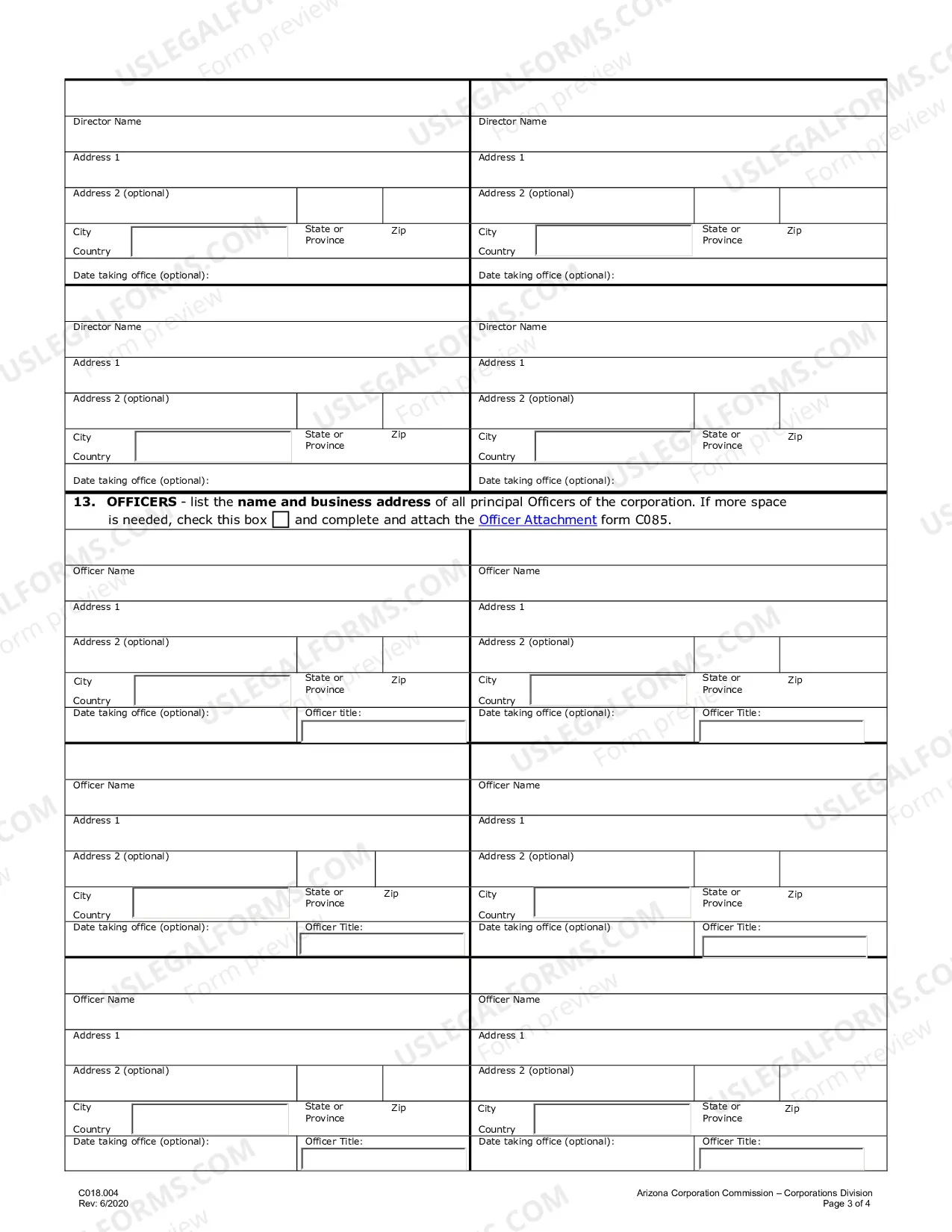

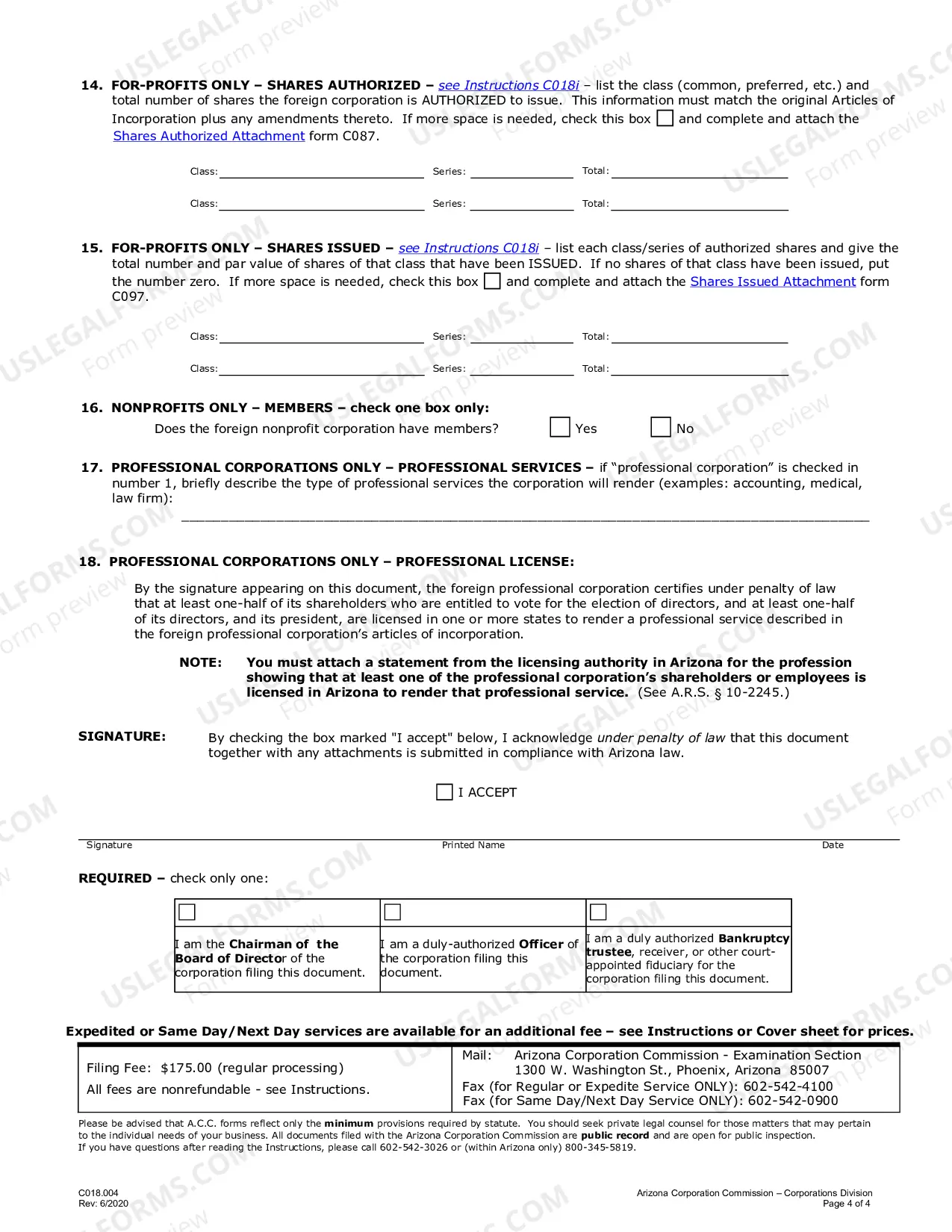

To register a foreign corporation in Arizona, you must file an Arizona Application for Authority to Transact Business in Arizona with the Arizona Corporation Commission, Corporations Division. You can submit this document by mail or in person.

How to Start an S Corp in Arizona Choose a Business Name.Appoint a Statutory Agent in Arizona.Choose Directors or Managers.File Articles of Incorporation/Organization with the Arizona Corporation Commission.Publish Arizona State Articles of Incorporation/Organization.File Form 2553 to turn business into an S Corp.

The registration of a trade name (business name, DBA) is not legally required in Arizona, but is an accepted business practice. In addition, the registration of the trade name may be required to open business bank accounts and help obtain additional licenses.

How much does it cost to form an LLC in Arizona? The Arizona Corporations Commission charges a $50 fee to file the Articles of Organization. It is an additional $35 for expedited processing.

A foreign limited liability company (?LLC?) that wants to transact business in Arizona must first apply to the Arizona Corporation Commission for a certificate of registration. See A.R.S. § 29-3902.

To register a foreign corporation in Arizona, you must file an Arizona Application for Authority to Transact Business in Arizona with the Arizona Corporation Commission, Corporations Division. You can submit this document by mail or in person.

If a foreign entity wants to transact business or conduct affairs in Arizona, it must register with the Arizona Corporation Commission.

The filing fee for the Arizona Foreign Registration Statement is $150 for regular processing or $185 for expedited processing.

What is a foreign corporation or foreign LLC? A foreign entity is a corporation or LLC that was formed or created in a state or country other than Arizona. Entities created under federal or Indian tribal law are also considered foreign entities.