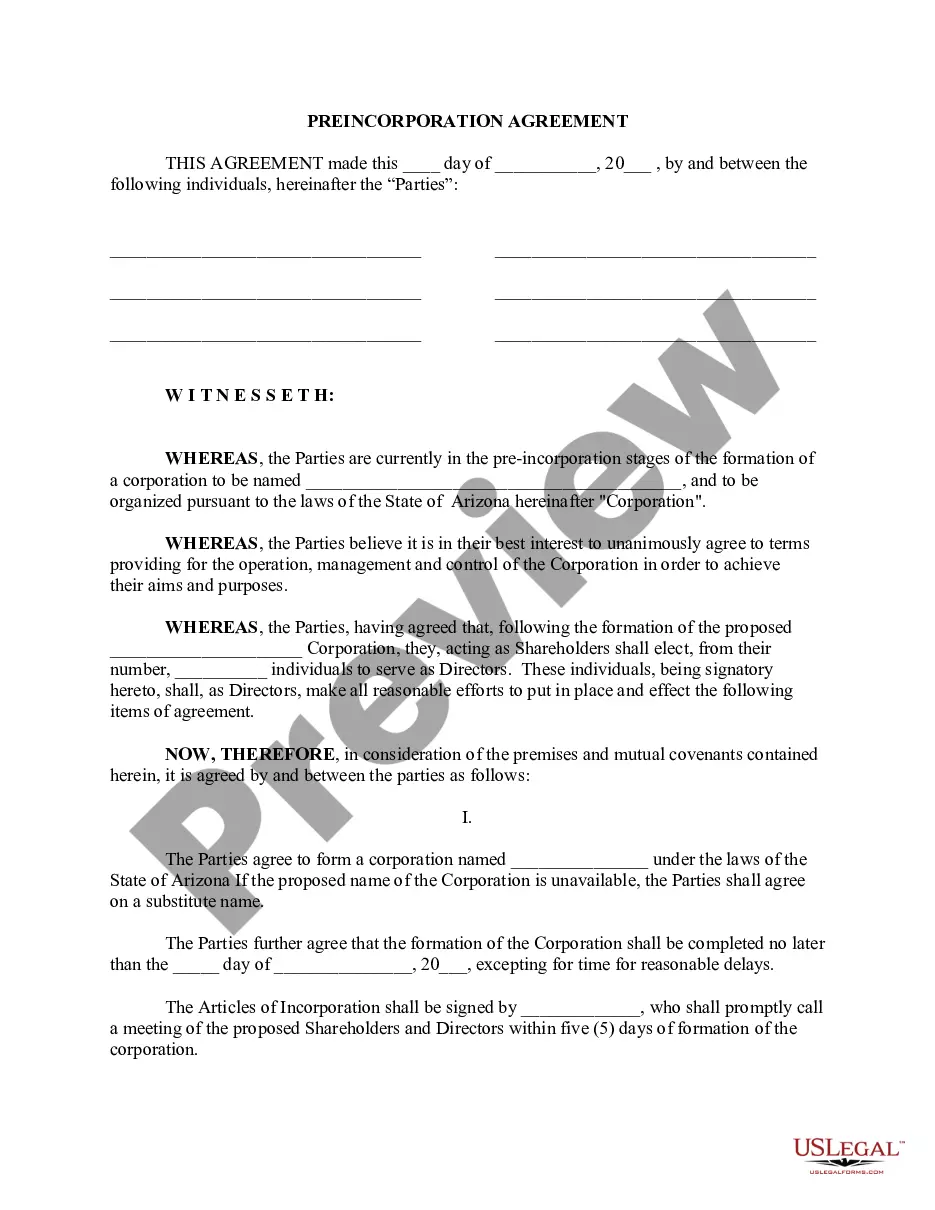

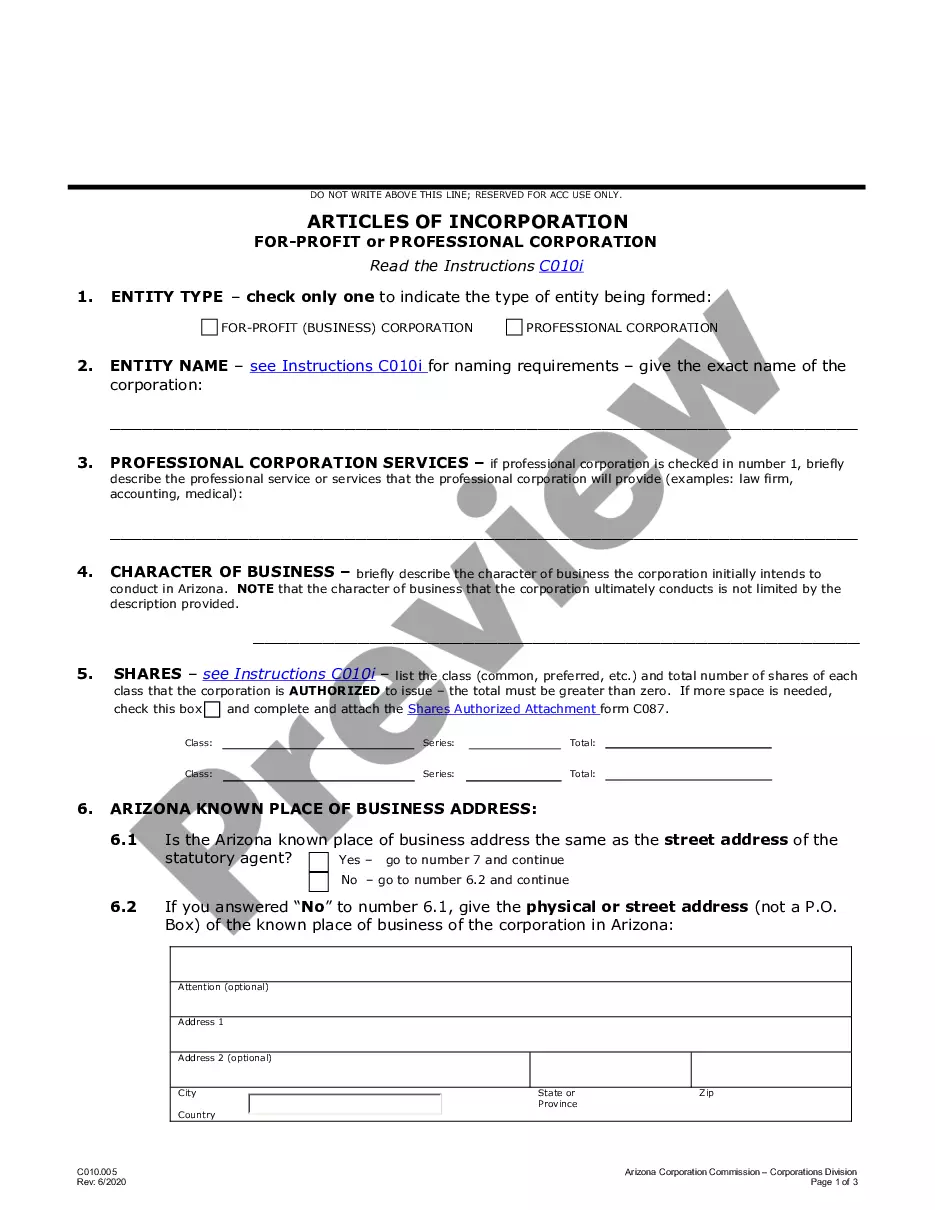

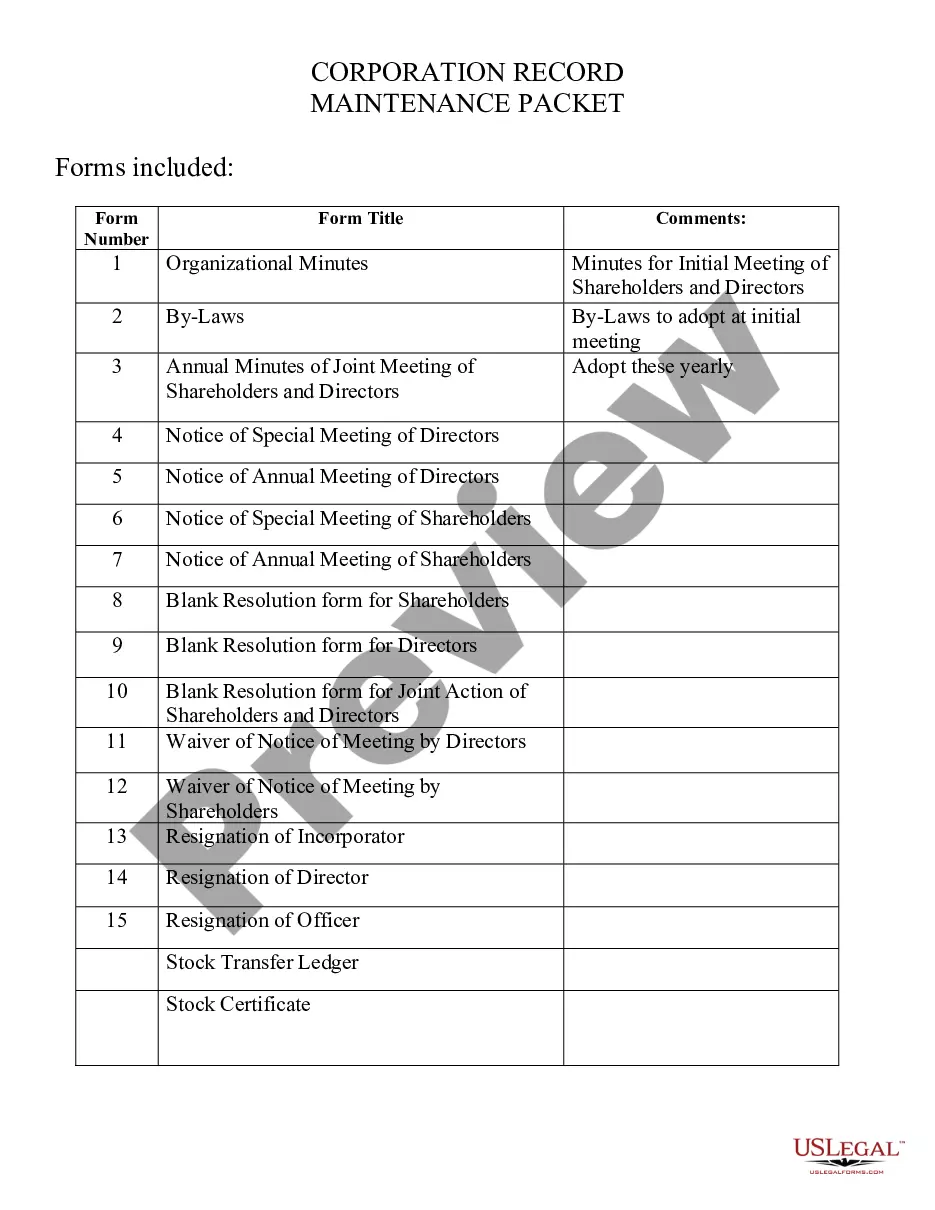

This Incorporation Package includes all forms needed to form a corporation in your state and a step by step guide to the incorporation process. The package also includes forms needed after incorporation, such as minutes, notices, and by-laws. Items Included: Steps to Incorporate, Articles or Certificate of Incorporation, By-Laws, Organizational Minutes, Annual Minutes, Notices, Resolutions, Stock Transfer Ledger, Simple Stock Certificate, IRS Form SS-4 to Apply for Tax Identification Number, and IRS Form 2553 to Apply for Subchapter S Tax Treatment.

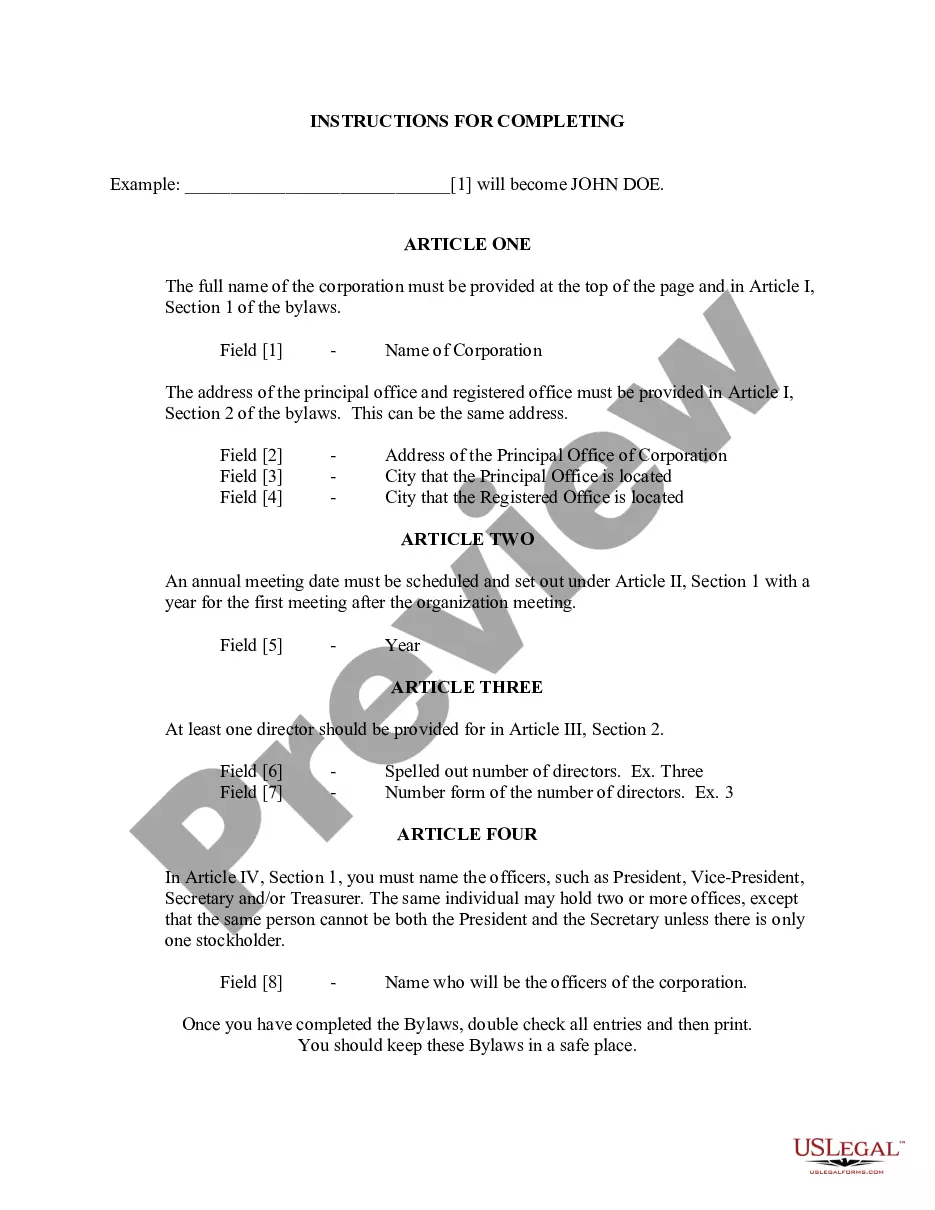

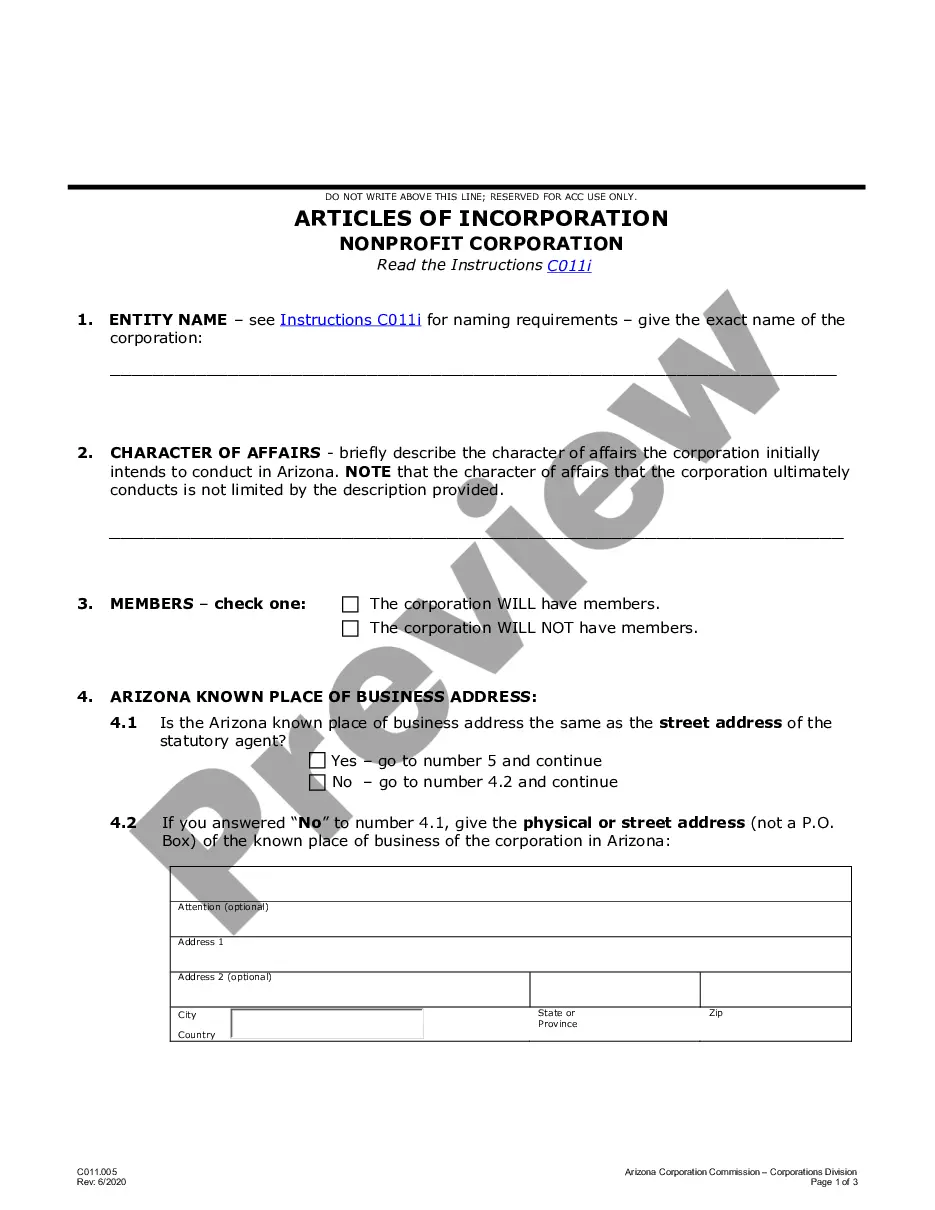

The Phoenix Arizona Business Incorporation Package is a comprehensive offering designed to assist individuals, entrepreneurs, and businesses in incorporating a corporation in the vibrant city of Phoenix, Arizona. This package encompasses a range of essential services, documentation, and support necessary to successfully establish a corporation and ensure legal compliance. Firstly, this package includes all the necessary paperwork to initiate the incorporation process. This may involve preparing the Articles of Incorporation, which outline the corporation's name, purpose, management structure, and other necessary details. Additionally, it involves the preparation of corporate bylaws, which serve as the internal rules and regulations governing the corporation's operations. Furthermore, the package includes assistance in obtaining the Employer Identification Number (EIN) from the Internal Revenue Service (IRS), a crucial requirement for tax purposes. The EIN is essential for corporate banking, hiring employees, and handling tax-related matters. Moreover, important entity formation documents such as the Statement of Information and the Initial List of Officers or Directors are typically included. These documents help establish the corporation's identity, identify key personnel, and fulfill state-mandated reporting requirements. In addition to the initial documentation, the Phoenix Arizona Business Incorporation Package often offers expedited filing and processing of incorporation documents. This ensures a faster turnaround time, allowing businesses to begin operating legally sooner. Depending on the package chosen, it may also include services such as registered agent representation. A registered agent is required by law to be the corporation's point of contact for legal and tax-related matters, receiving official notifications and documents on behalf of the corporation. The registered agent's service provides businesses with peace of mind and ensures compliance with legal requirements. Some Phoenix Arizona Business Incorporation Packages may also provide additional perks and benefits such as customizable sample agreements and contracts, access to legal resources, discounted business insurance rates, and ongoing compliance monitoring to ensure the corporation's continued adherence to legal obligations. Overall, the Phoenix Arizona Business Incorporation Package offers individuals and businesses a comprehensive set of services to successfully establish and incorporate a corporation in Phoenix, Arizona. Through efficient documentation preparation, expedited filing, and additional services, this package streamlines the incorporation process, allowing entrepreneurs to focus on building their businesses confidently and with peace of mind.