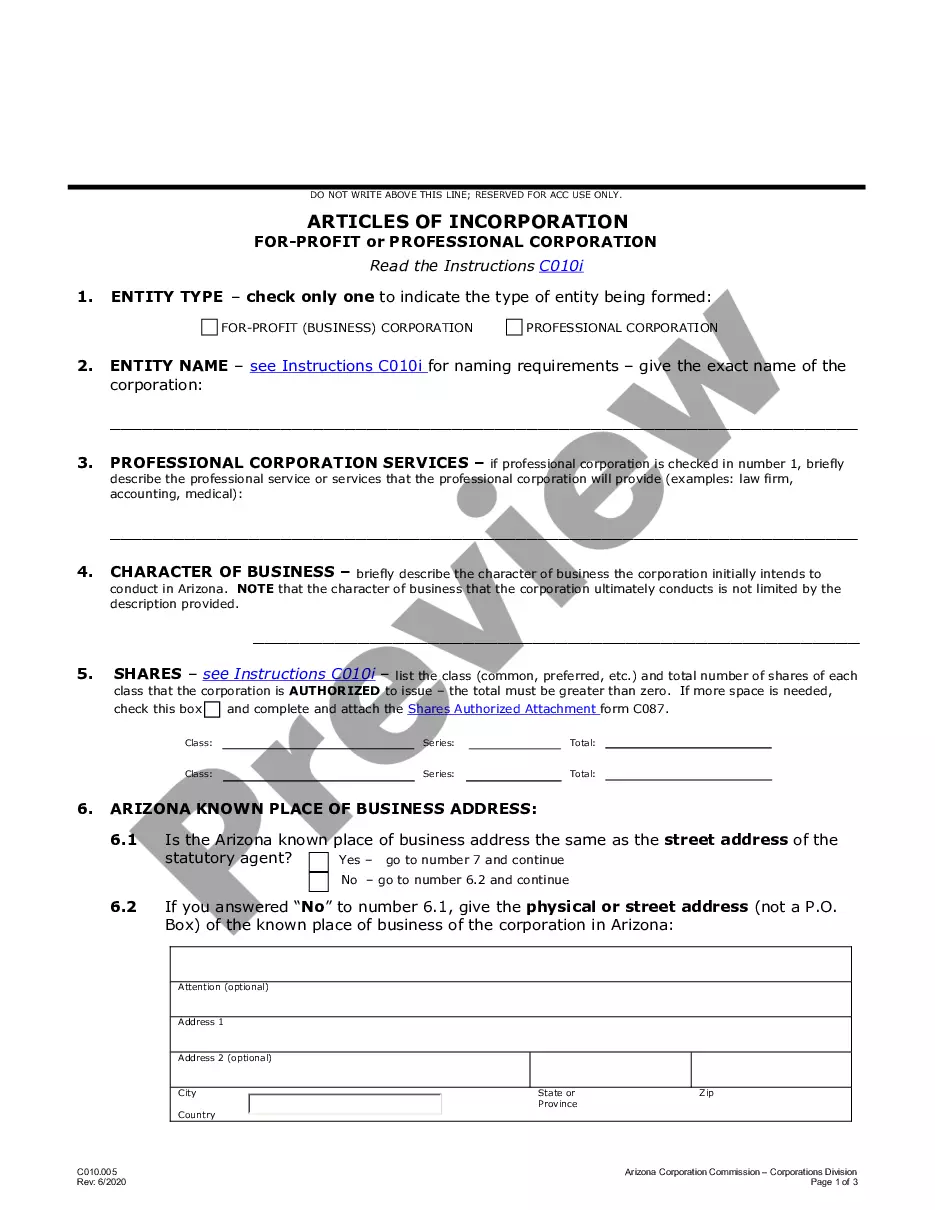

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new corporation. The form contains basic information concerning the corporation, normally including the corporate name, number of shares to be issued, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

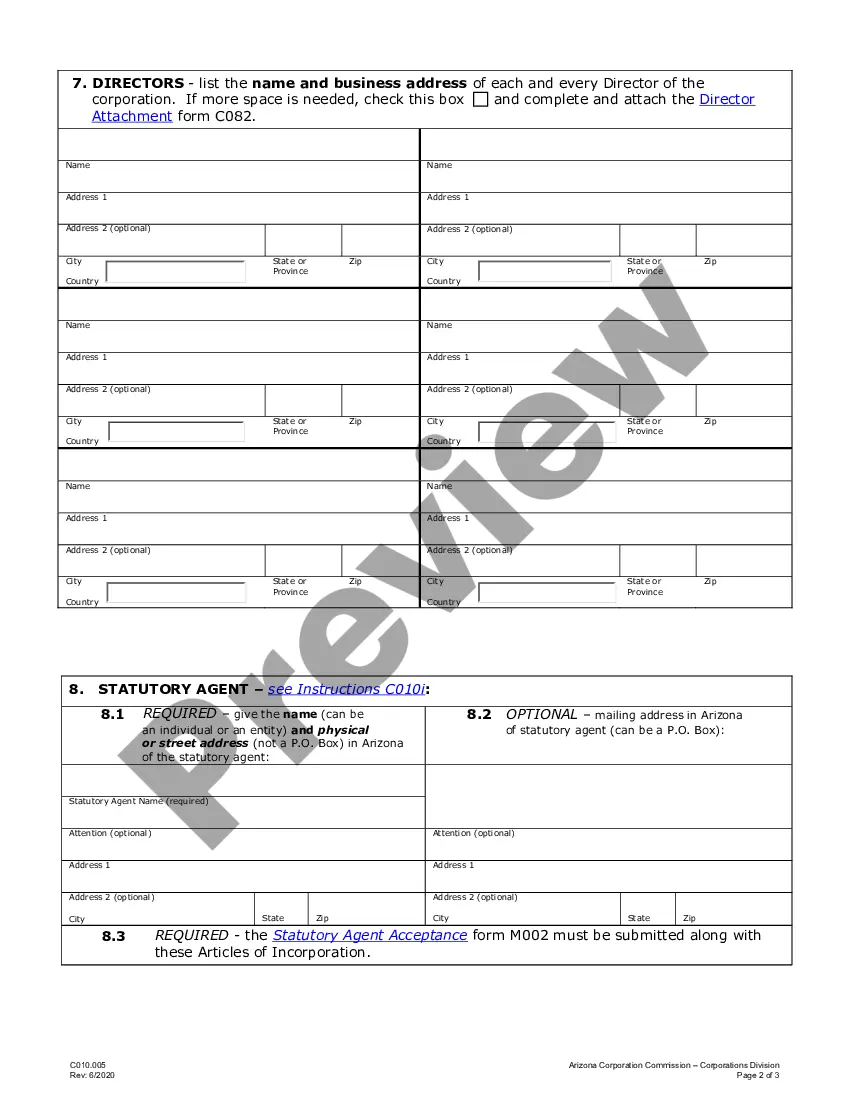

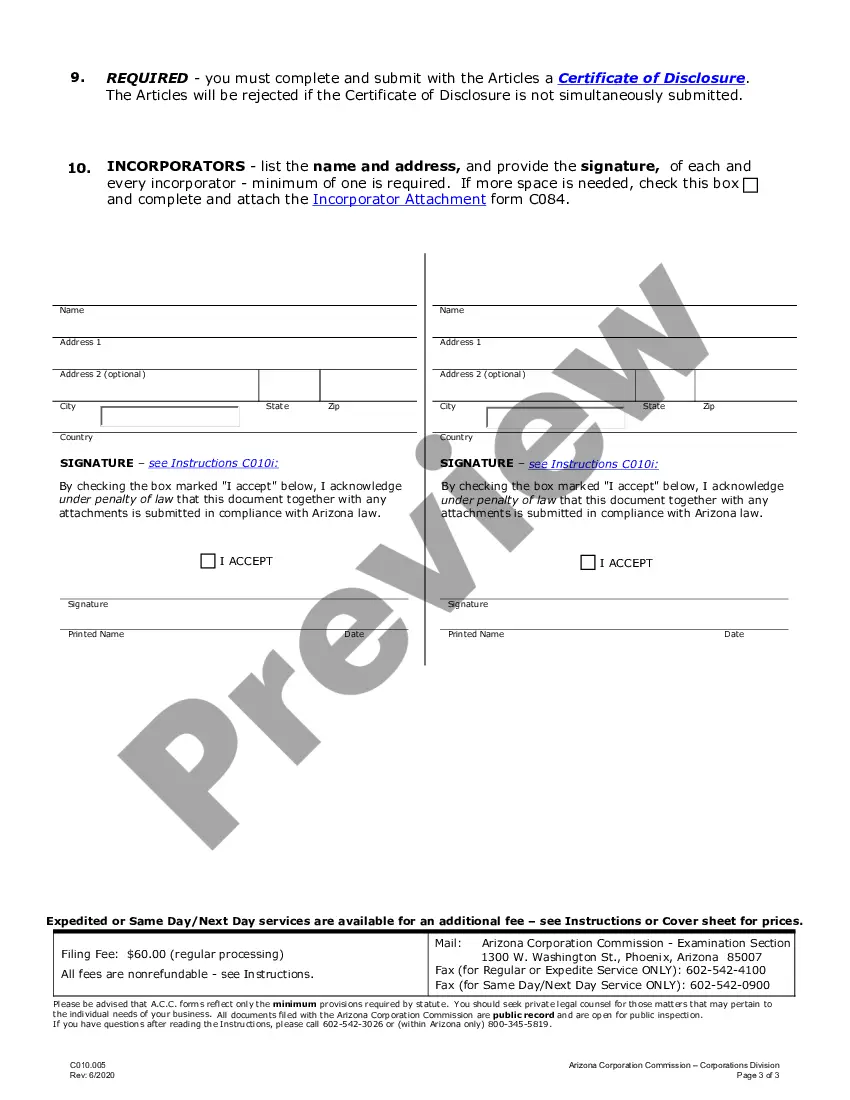

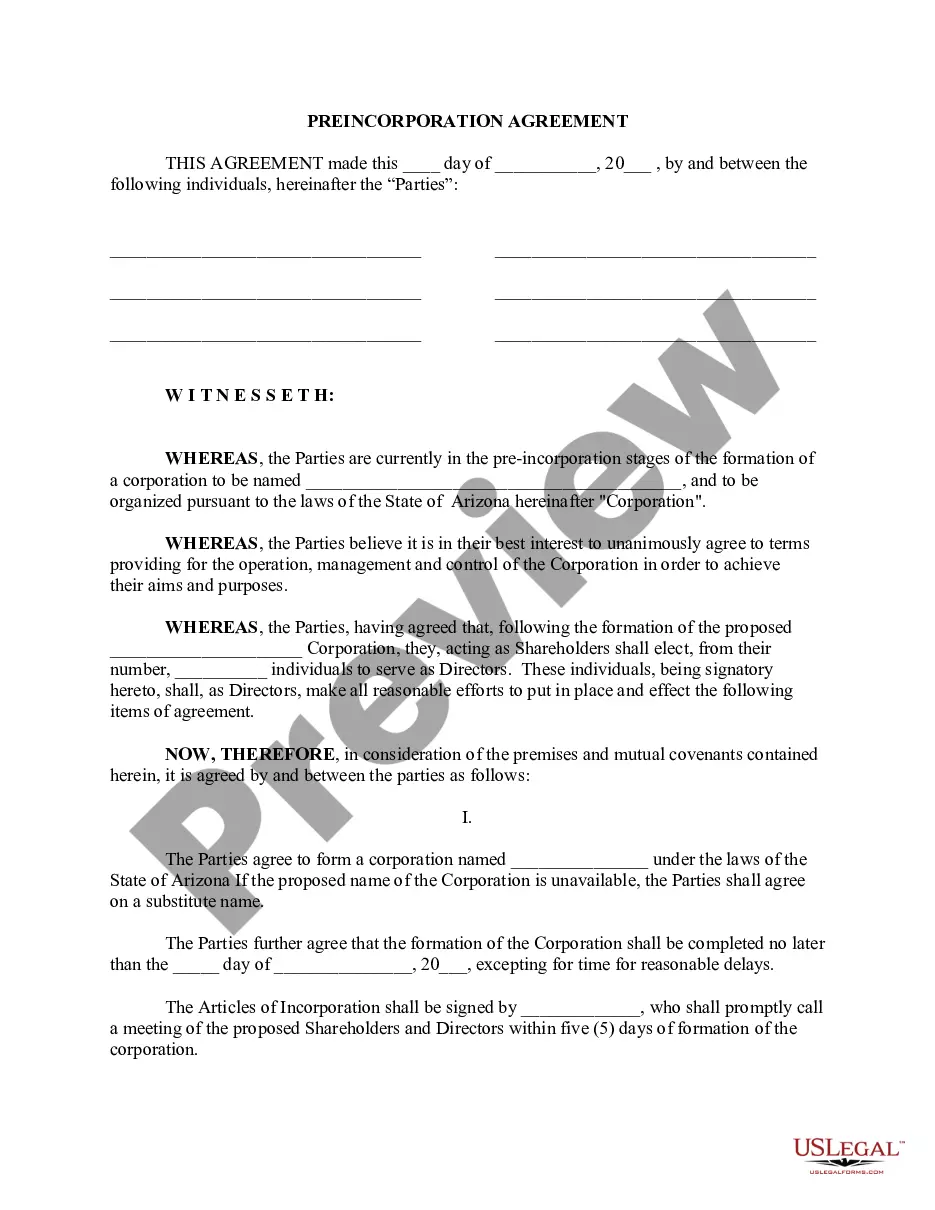

The Phoenix Arizona Articles of Incorporation for Domestic For-Profit Corporation is a legal document that formally establishes a corporation in the state of Arizona. It is a crucial step in the process of setting up a business entity, providing the necessary information to the Arizona Corporation Commission (ACC) for registration and legal recognition. The Articles of Incorporation for a Domestic For-Profit Corporation are specific to Phoenix, Arizona and outline key details and requirements that must be met by the corporation. These articles typically include the following information: 1. Corporate Name: The specific name under which the corporation will operate must be clearly stated. The name must not be confusingly similar to any other registered corporation in the state. 2. Business Purpose: A description of the primary business activities that the corporation will engage in must be provided. This description should be comprehensive enough to encompass the broad range of services or products the corporation plans to offer. 3. Registered Agent: The name and address of a registered agent who will act as the main point of contact for legal and official correspondence must be specified. The registered agent must have a physical address in Phoenix, Arizona. 4. Incorporates: The names and addresses of the individuals or entities involved in the formation of the corporation, known as incorporates, are required to be listed. 5. Capital Stock: The number of authorized shares of stock, their par value (if applicable), and any restrictions on their transfer must be stated. This section may also outline different classes of stock, such as common or preferred shares. 6. Directors: The names and addresses of the initial directors or board members of the corporation must be provided. The number of directors can vary, but it should meet the minimum requirement set by the ACC. 7. Duration: The intended duration of the corporation should be stated. Most corporations have a perpetual duration unless explicitly stated otherwise. 8. Effective Date: The date on which the Articles of Incorporation will become effective can be specified. It can be the date of filing or any future date as desired. Different types of Phoenix Arizona Articles of Incorporation for Domestic For-Profit Corporation may exist based on the specific needs or characteristics of the business entity. However, the above-mentioned details are common to all articles. It is important to consult with an attorney or use templates provided by the ACC to ensure compliance with all legal requirements and to create accurate and appropriate articles for a domestic for-profit corporation in Phoenix, Arizona.The Phoenix Arizona Articles of Incorporation for Domestic For-Profit Corporation is a legal document that formally establishes a corporation in the state of Arizona. It is a crucial step in the process of setting up a business entity, providing the necessary information to the Arizona Corporation Commission (ACC) for registration and legal recognition. The Articles of Incorporation for a Domestic For-Profit Corporation are specific to Phoenix, Arizona and outline key details and requirements that must be met by the corporation. These articles typically include the following information: 1. Corporate Name: The specific name under which the corporation will operate must be clearly stated. The name must not be confusingly similar to any other registered corporation in the state. 2. Business Purpose: A description of the primary business activities that the corporation will engage in must be provided. This description should be comprehensive enough to encompass the broad range of services or products the corporation plans to offer. 3. Registered Agent: The name and address of a registered agent who will act as the main point of contact for legal and official correspondence must be specified. The registered agent must have a physical address in Phoenix, Arizona. 4. Incorporates: The names and addresses of the individuals or entities involved in the formation of the corporation, known as incorporates, are required to be listed. 5. Capital Stock: The number of authorized shares of stock, their par value (if applicable), and any restrictions on their transfer must be stated. This section may also outline different classes of stock, such as common or preferred shares. 6. Directors: The names and addresses of the initial directors or board members of the corporation must be provided. The number of directors can vary, but it should meet the minimum requirement set by the ACC. 7. Duration: The intended duration of the corporation should be stated. Most corporations have a perpetual duration unless explicitly stated otherwise. 8. Effective Date: The date on which the Articles of Incorporation will become effective can be specified. It can be the date of filing or any future date as desired. Different types of Phoenix Arizona Articles of Incorporation for Domestic For-Profit Corporation may exist based on the specific needs or characteristics of the business entity. However, the above-mentioned details are common to all articles. It is important to consult with an attorney or use templates provided by the ACC to ensure compliance with all legal requirements and to create accurate and appropriate articles for a domestic for-profit corporation in Phoenix, Arizona.