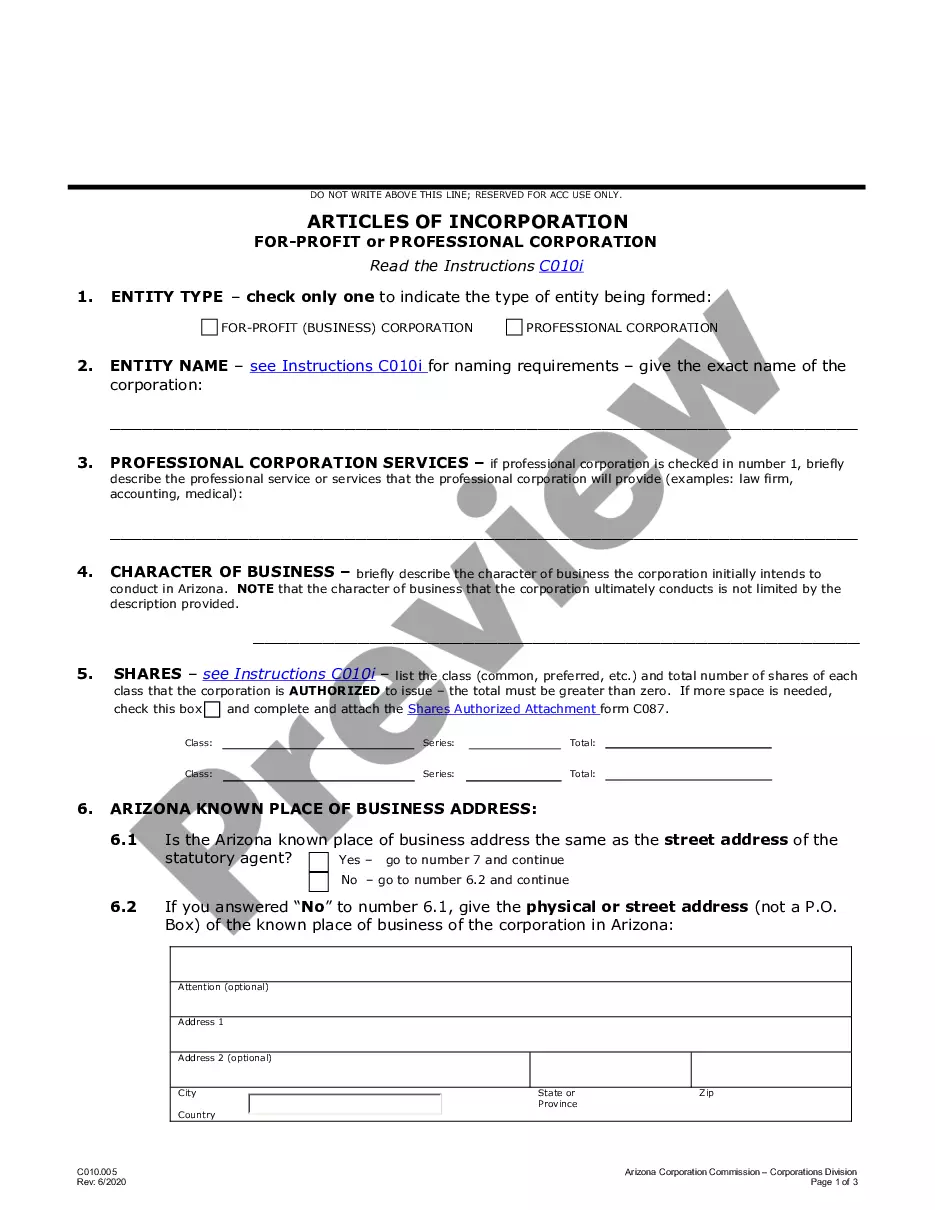

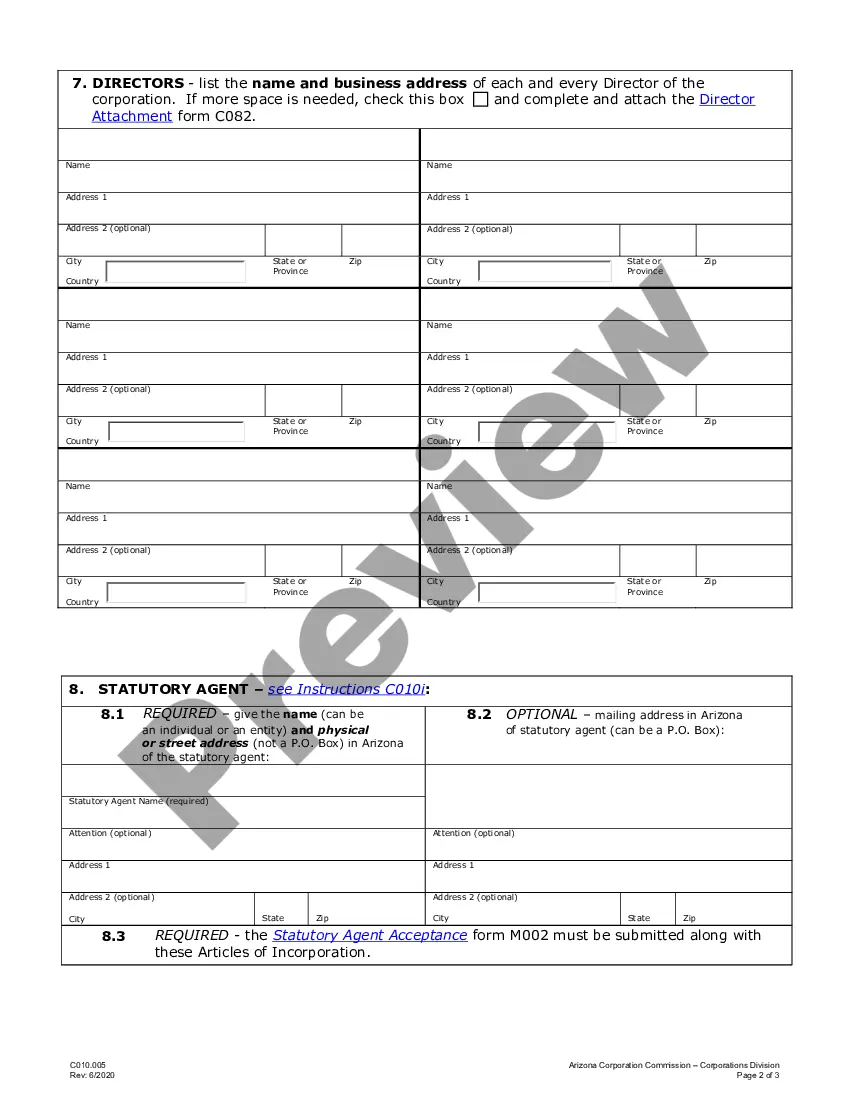

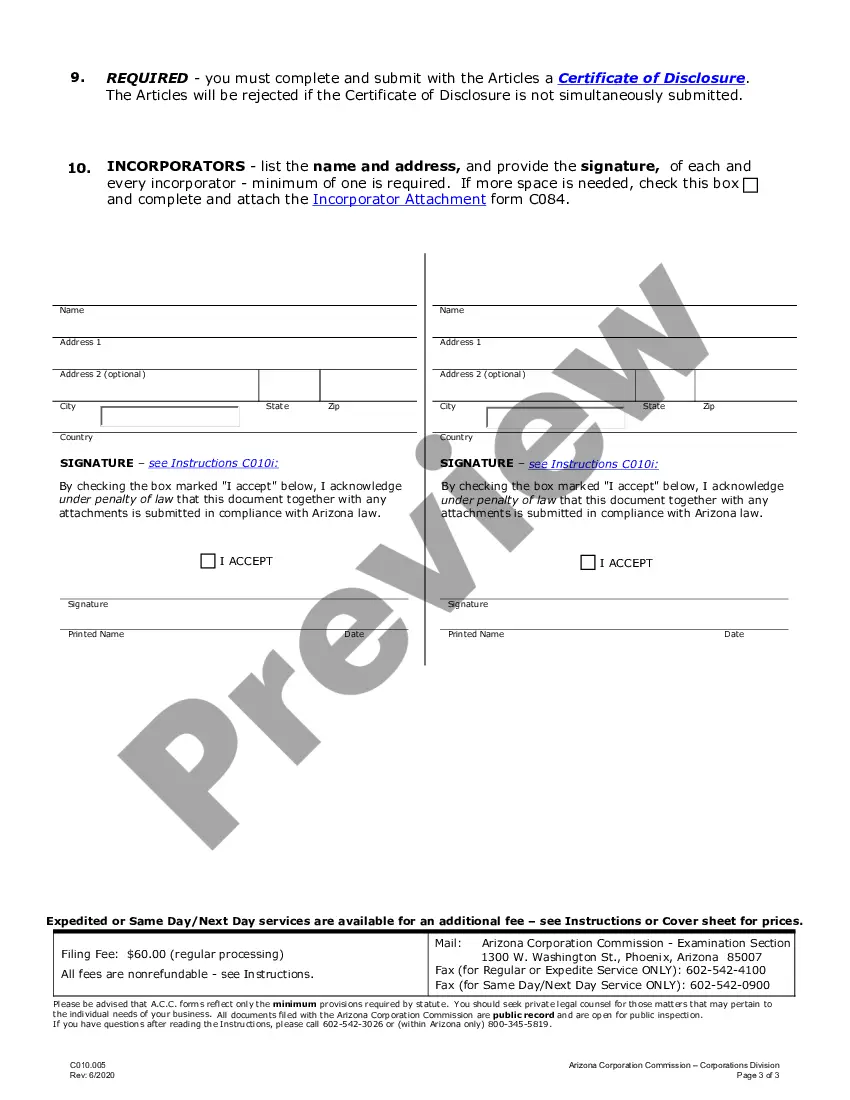

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new corporation. The form contains basic information concerning the corporation, normally including the corporate name, number of shares to be issued, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

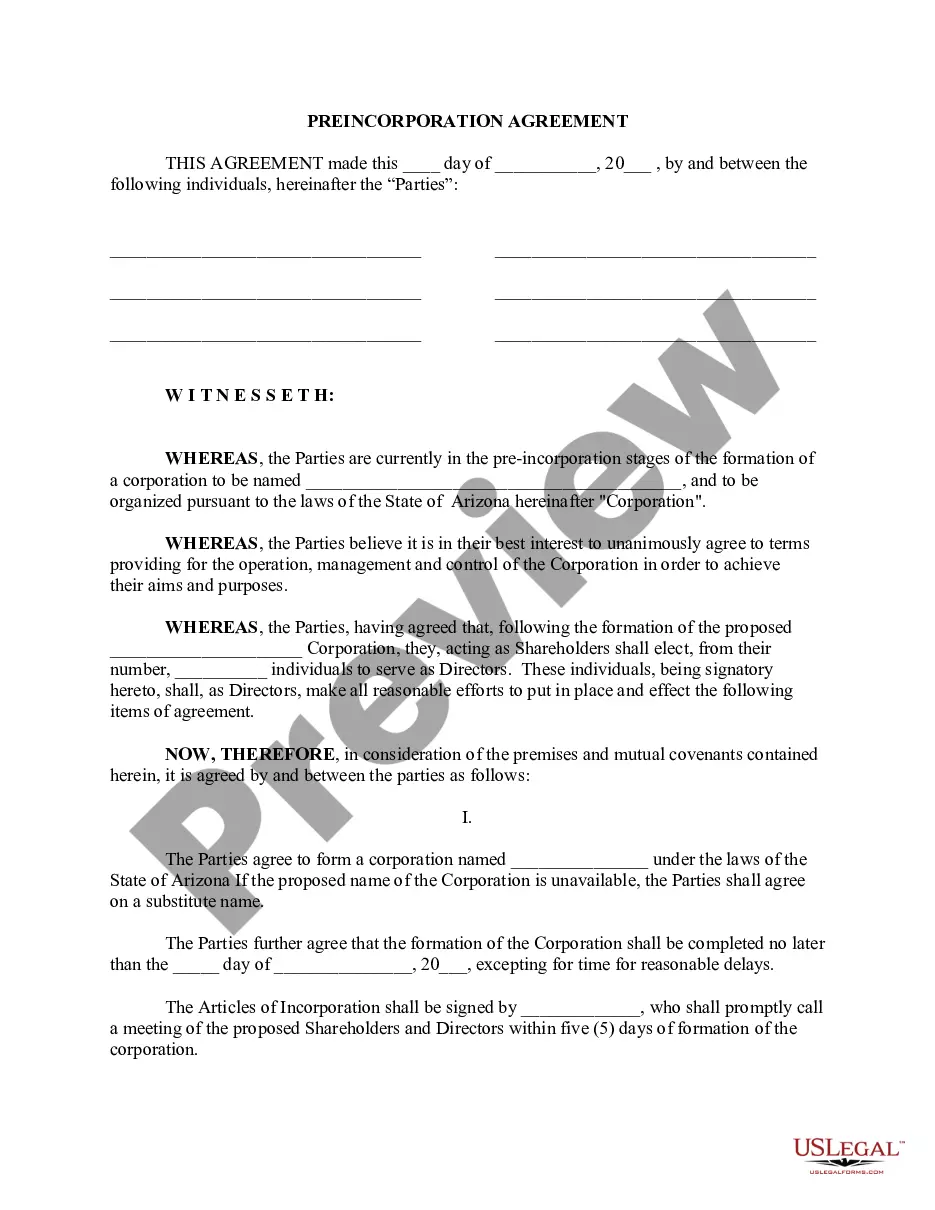

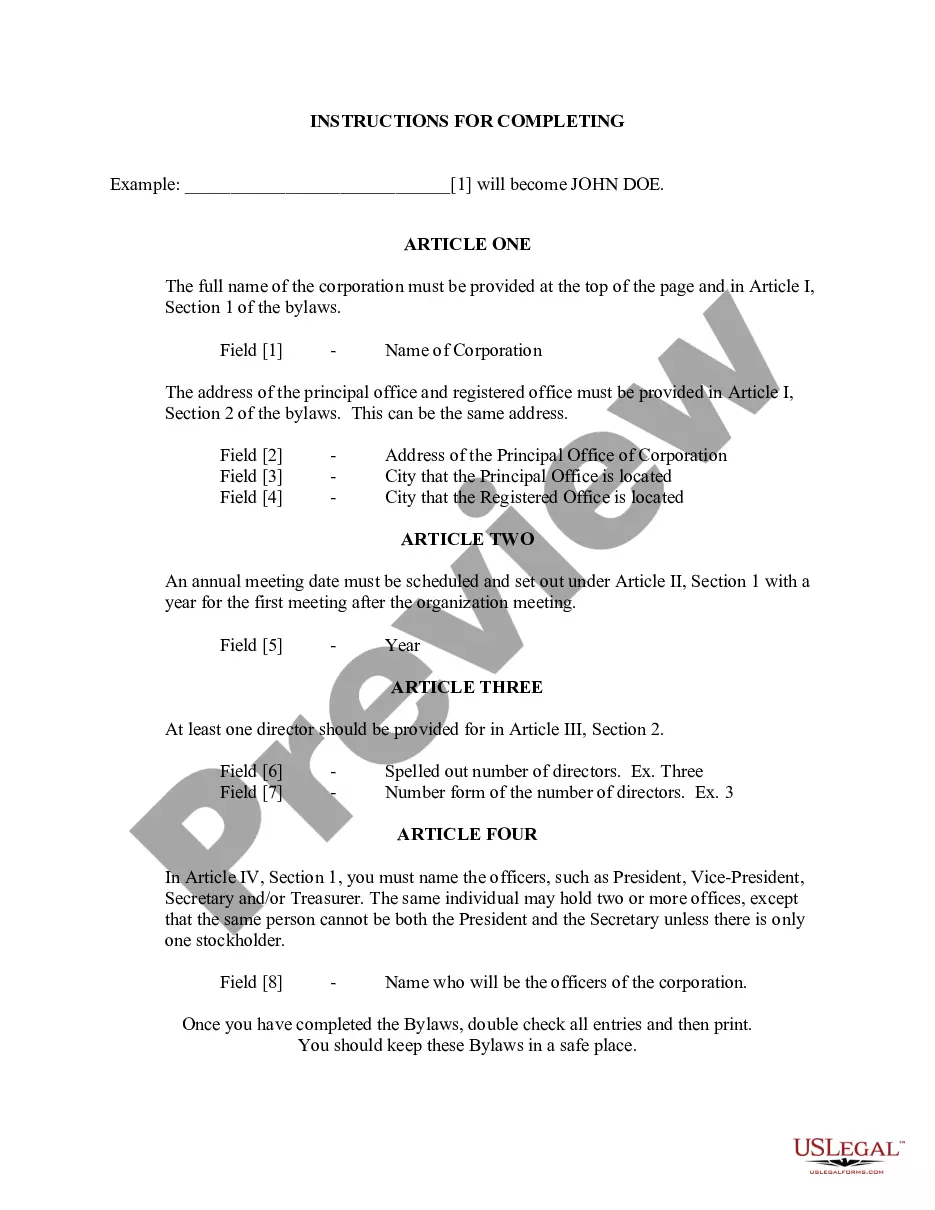

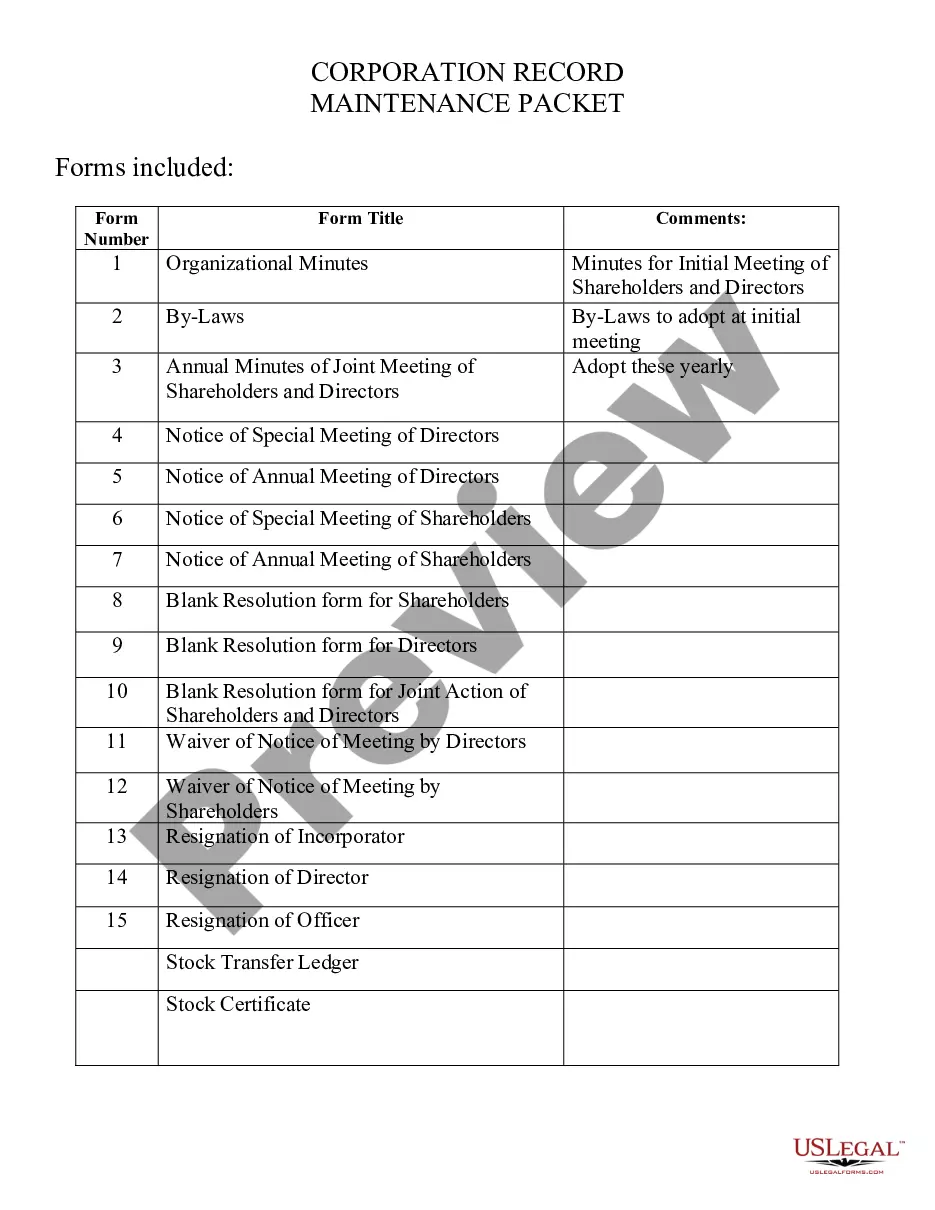

The Scottsdale Arizona Articles of Incorporation for Domestic For-Profit Corporation is a vital legal document that outlines the formation details and purpose of a corporation in the city of Scottsdale, Arizona. This document must be filed with the Arizona Corporation Commission (ACC) to officially establish the corporation and gain limited liability protections for its shareholders. The Articles of Incorporation typically include several key elements required by state law. These include: 1. Corporate Name: The chosen name of the corporation must be unique and distinguishable from other registered entities in Arizona. Keywords such as "Scottsdale," "Arizona," "corporation," or the specific nature of the business may be included to enhance local relevance and searchability. 2. Registered Agent: A corporation must designate a registered agent who will accept legal documents and official notices on behalf of the corporation. The registered agent must have a physical address in Scottsdale, ensuring compliance with Arizona statutes. 3. Business Purpose: The Articles of Incorporation require a clear statement of the corporation's purpose, which can be broad or specific. This section is vital for search relevancy, and keywords describing the primary business activities or industry of focus should be incorporated. 4. Capital Structure: It is essential to specify the authorized number of shares, par value, and classes of stock the corporation can issue. This section also outlines any restrictions or special provisions related to stock ownership, transfers, or dividends. 5. Incorporates: The names and addresses of the incorporates must be disclosed in the document. Incorporates are typically individuals who play a role in the initial setup of the corporation but may differ from the officers and directors of the corporation. While the basic structure of the Scottsdale Arizona Articles of Incorporation remains the same for most corporations, there might be some variations or specialized filing requirements for certain types of companies. These may include: 1. Professional Corporation (PC): Professionals such as doctors, lawyers, or architects may choose to form a professional corporation, which requires additional compliance with respective licensing boards or professional associations. 2. Close Corporation: This type of corporation allows for more flexibility in governance by offering more limited shareholders and relaxed regulations compared to larger corporations. Specific details are provided in the Articles of Incorporation. 3. Benefit Corporation: Benefit corporations are for-profit entities committed to achieving positive social or environmental impacts. They must outline their specific public benefits and adhere to higher standards of transparency and accountability. In conclusion, the Scottsdale Arizona Articles of Incorporation for Domestic For-Profit Corporation is a crucial legal document that establishes a corporation's formation and purpose in the city of Scottsdale. Properly completing and filing this document with the Arizona Corporation Commission is essential for securing legal recognition and enjoying the benefits and protections of incorporation.The Scottsdale Arizona Articles of Incorporation for Domestic For-Profit Corporation is a vital legal document that outlines the formation details and purpose of a corporation in the city of Scottsdale, Arizona. This document must be filed with the Arizona Corporation Commission (ACC) to officially establish the corporation and gain limited liability protections for its shareholders. The Articles of Incorporation typically include several key elements required by state law. These include: 1. Corporate Name: The chosen name of the corporation must be unique and distinguishable from other registered entities in Arizona. Keywords such as "Scottsdale," "Arizona," "corporation," or the specific nature of the business may be included to enhance local relevance and searchability. 2. Registered Agent: A corporation must designate a registered agent who will accept legal documents and official notices on behalf of the corporation. The registered agent must have a physical address in Scottsdale, ensuring compliance with Arizona statutes. 3. Business Purpose: The Articles of Incorporation require a clear statement of the corporation's purpose, which can be broad or specific. This section is vital for search relevancy, and keywords describing the primary business activities or industry of focus should be incorporated. 4. Capital Structure: It is essential to specify the authorized number of shares, par value, and classes of stock the corporation can issue. This section also outlines any restrictions or special provisions related to stock ownership, transfers, or dividends. 5. Incorporates: The names and addresses of the incorporates must be disclosed in the document. Incorporates are typically individuals who play a role in the initial setup of the corporation but may differ from the officers and directors of the corporation. While the basic structure of the Scottsdale Arizona Articles of Incorporation remains the same for most corporations, there might be some variations or specialized filing requirements for certain types of companies. These may include: 1. Professional Corporation (PC): Professionals such as doctors, lawyers, or architects may choose to form a professional corporation, which requires additional compliance with respective licensing boards or professional associations. 2. Close Corporation: This type of corporation allows for more flexibility in governance by offering more limited shareholders and relaxed regulations compared to larger corporations. Specific details are provided in the Articles of Incorporation. 3. Benefit Corporation: Benefit corporations are for-profit entities committed to achieving positive social or environmental impacts. They must outline their specific public benefits and adhere to higher standards of transparency and accountability. In conclusion, the Scottsdale Arizona Articles of Incorporation for Domestic For-Profit Corporation is a crucial legal document that establishes a corporation's formation and purpose in the city of Scottsdale. Properly completing and filing this document with the Arizona Corporation Commission is essential for securing legal recognition and enjoying the benefits and protections of incorporation.