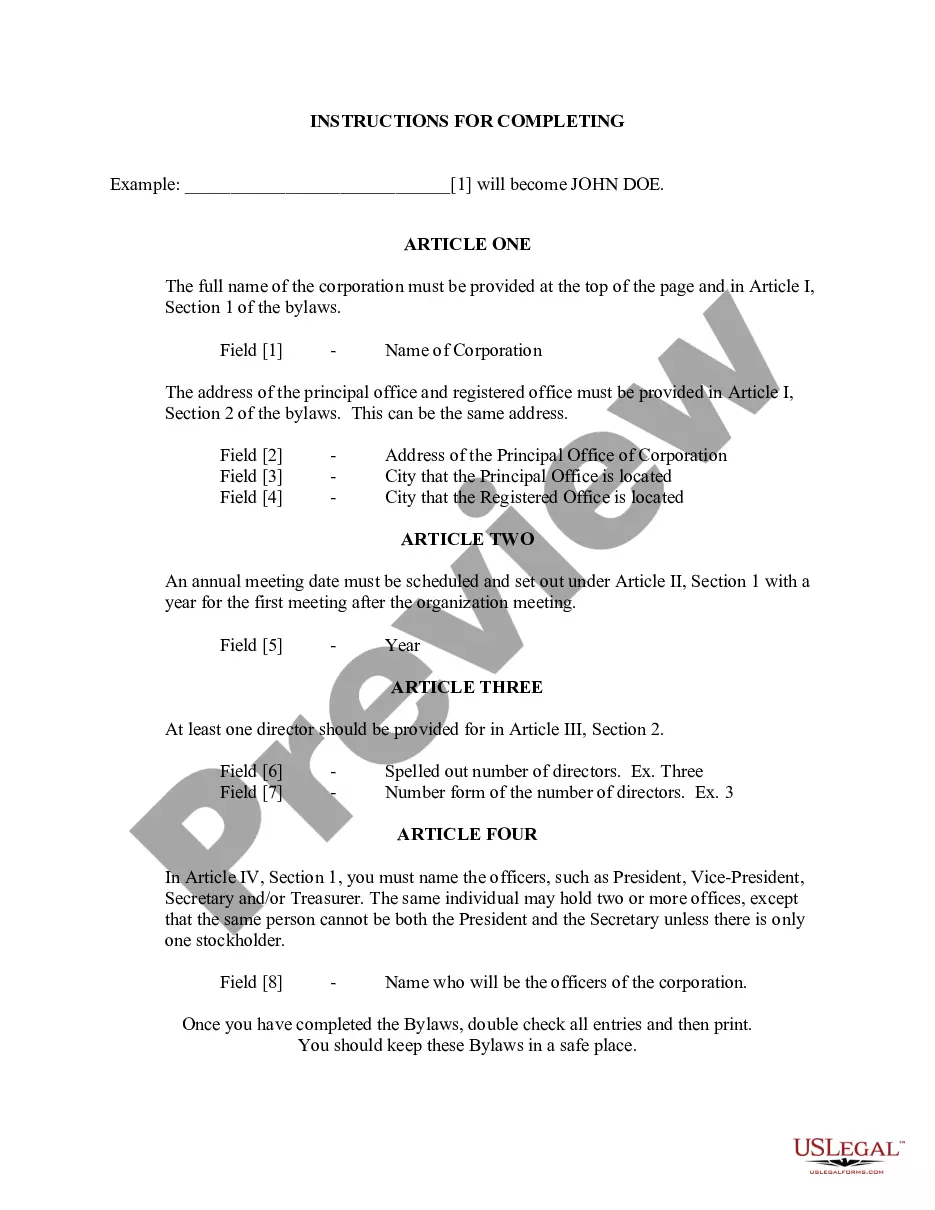

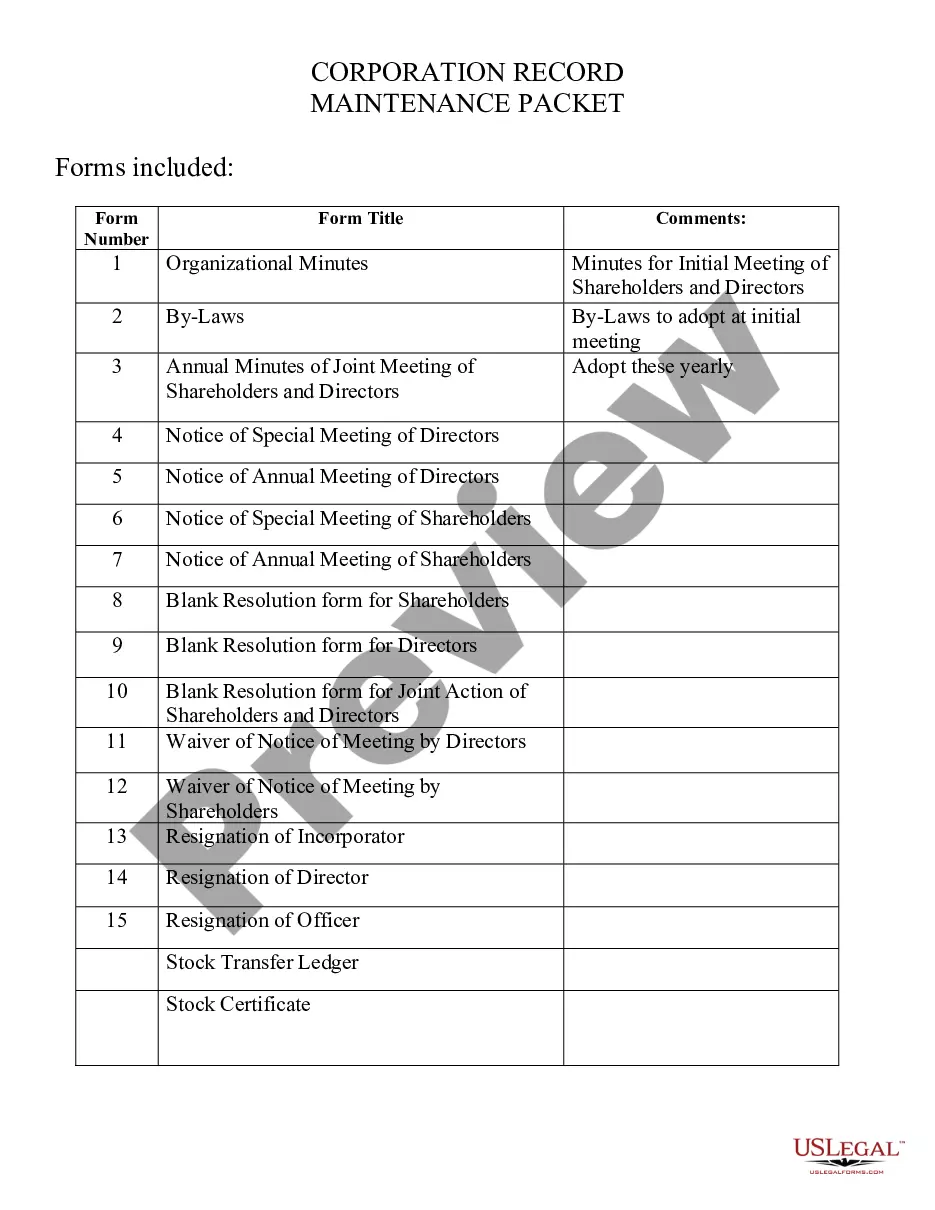

This form is By-Laws for a Business Corporation and contains provisons regarding how the corporation will be operated, as well as provisions governing shareholders meetings, officers, directors, voting of shares, stock records and more. Approximately 9 pages.

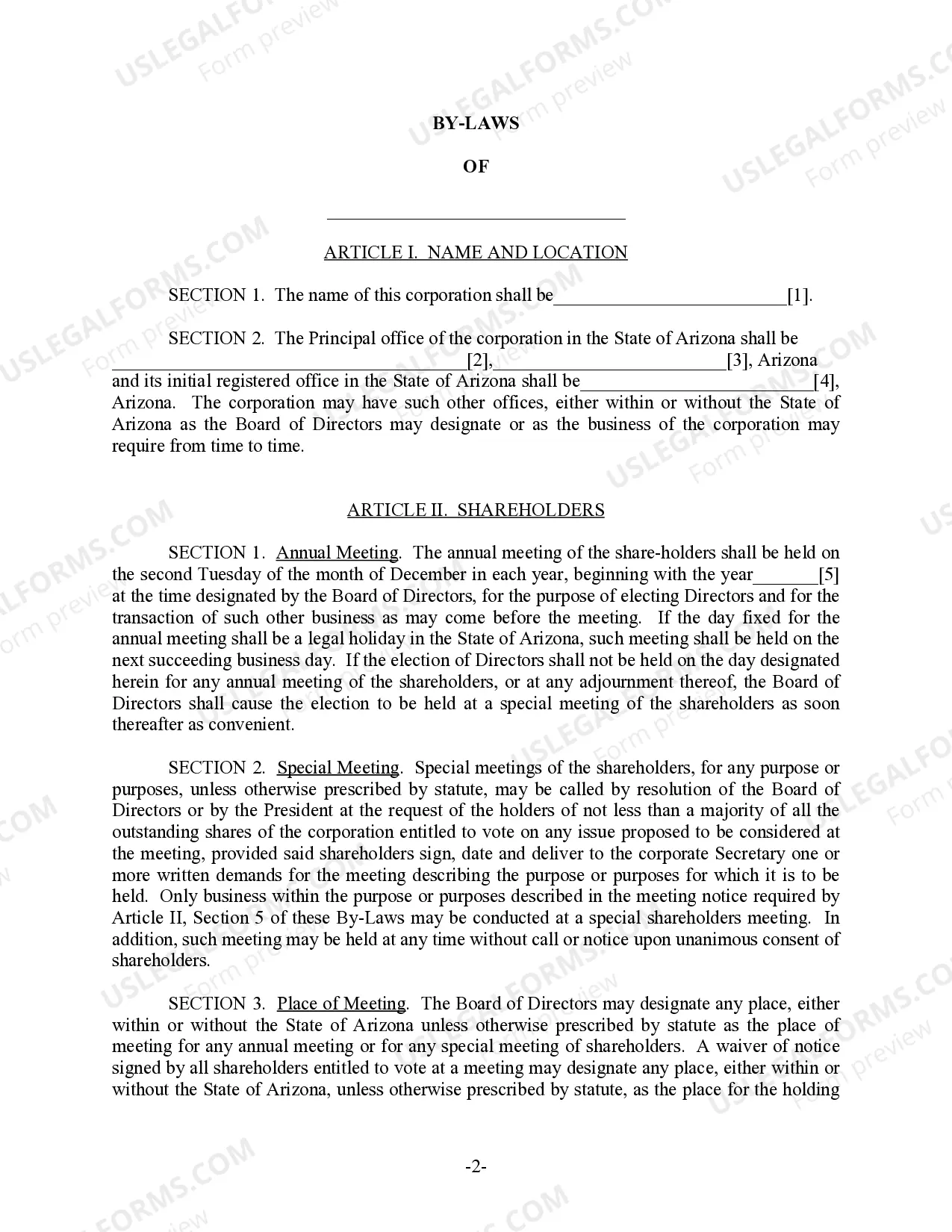

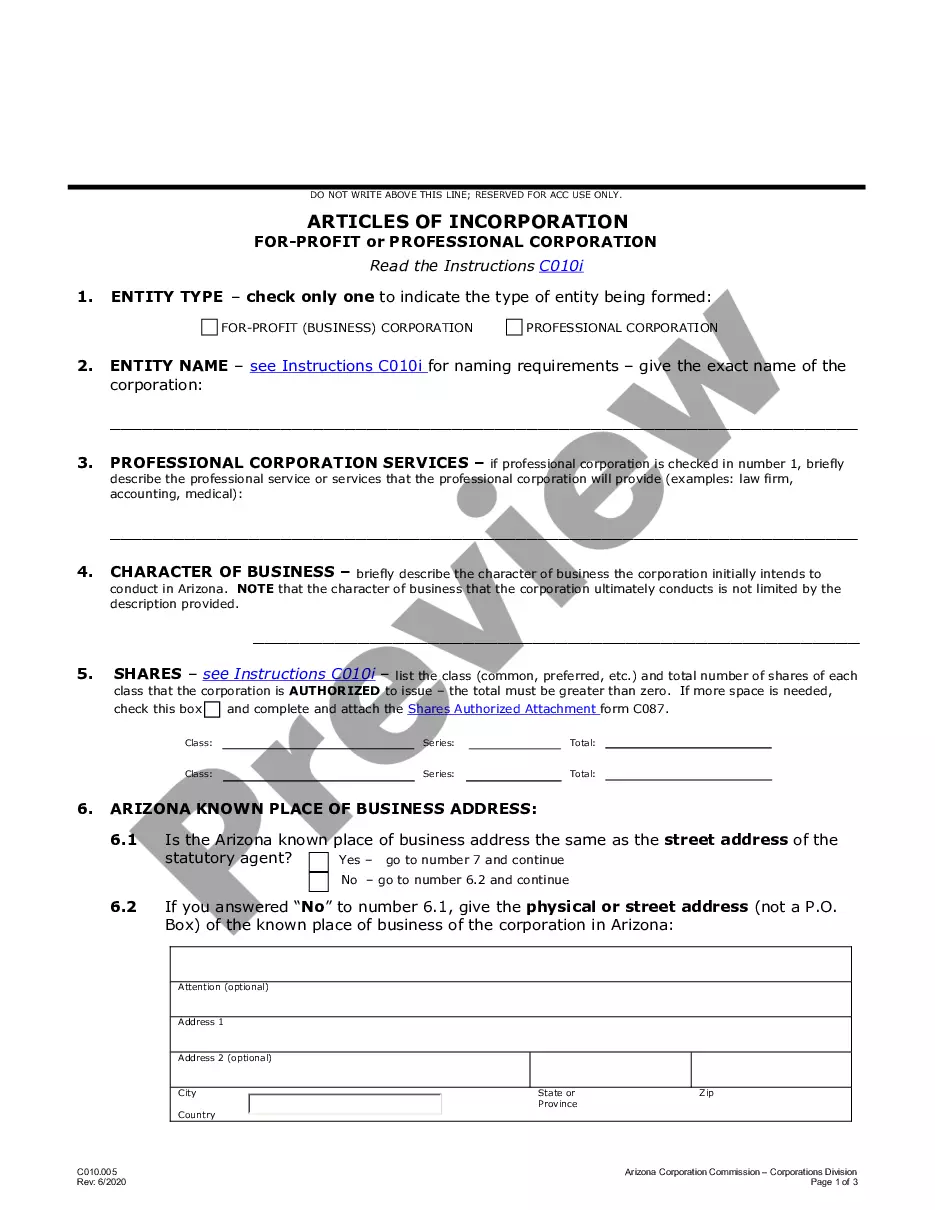

Gilbert Arizona Bylaws for Corporation serve as the governing documents that establish rules and regulations for the operation of corporations in the town of Gilbert, Arizona. These bylaws are specifically designed to ensure that corporations function in compliance with local laws and regulations, maintaining transparency, accountability, and legal standards. Bylaws typically cover a wide range of topics, and it's important for corporations to understand and adhere to them to avoid any legal complications or disputes. Here are the different types of Gilbert Arizona Bylaws for Corporations: 1. Articles of Incorporation: This is the initial legal document filed with the state when incorporating a corporation. While not technically a bylaw, it is a prerequisite for establishing the corporation's existence. The Articles of Incorporation outline key details such as the corporation's name, purpose, registered agent, shareholders' information, and stock structure. 2. Corporate Purpose: These bylaws define the corporation's primary objectives, stating the business activities the corporation is engaged in, and outlining any specific restrictions on its operations or industry-specific regulations. 3. Membership Structure and Shareholder Rights: This section specifies the rights and responsibilities of shareholders, including information on stock classes, voting rights, dividend distribution, transfer of shares, and shareholders' meetings. It outlines the procedures for electing officers and directors, as well as their roles and responsibilities. 4. Board of Directors: Bylaws also designate the composition and responsibilities of the board of directors that oversee the corporation's strategic decision-making process. It outlines the number of directors, board meetings, quorum requirements, and the terms of their service. It may also elaborate on committees, such as audit or compensation committees, and their functions. 5. Meetings and Voting: These bylaws establish the procedures for calling and conducting shareholder meetings, including the notice requirements, meeting agenda, and voting procedures. It outlines the criteria for establishing a quorum and the various voting methods that may be employed. 6. Officers and Executives: This section outlines the roles and responsibilities of officers and executives, such as the CEO, CFO, and any other designated positions. It specifies the appointment process, term limits, and the authority granted to them. 7. Amendments and Dissolution: Bylaws should have provisions that govern how and when they can be amended or repealed. It should also include procedures for dissolving the corporation, including the distribution of assets or the transfer of membership or shares. These different types of Gilbert Arizona Bylaws for Corporations serve as essential corporate governance tools. Corporations must familiarize themselves with these rules and regulations to ensure their operations remain legally compliant and maintain the public's trust. It is advisable for corporations to consult legal professionals well-versed in Arizona corporate law to ensure their bylaws accurately reflect their needs and align with local regulations.