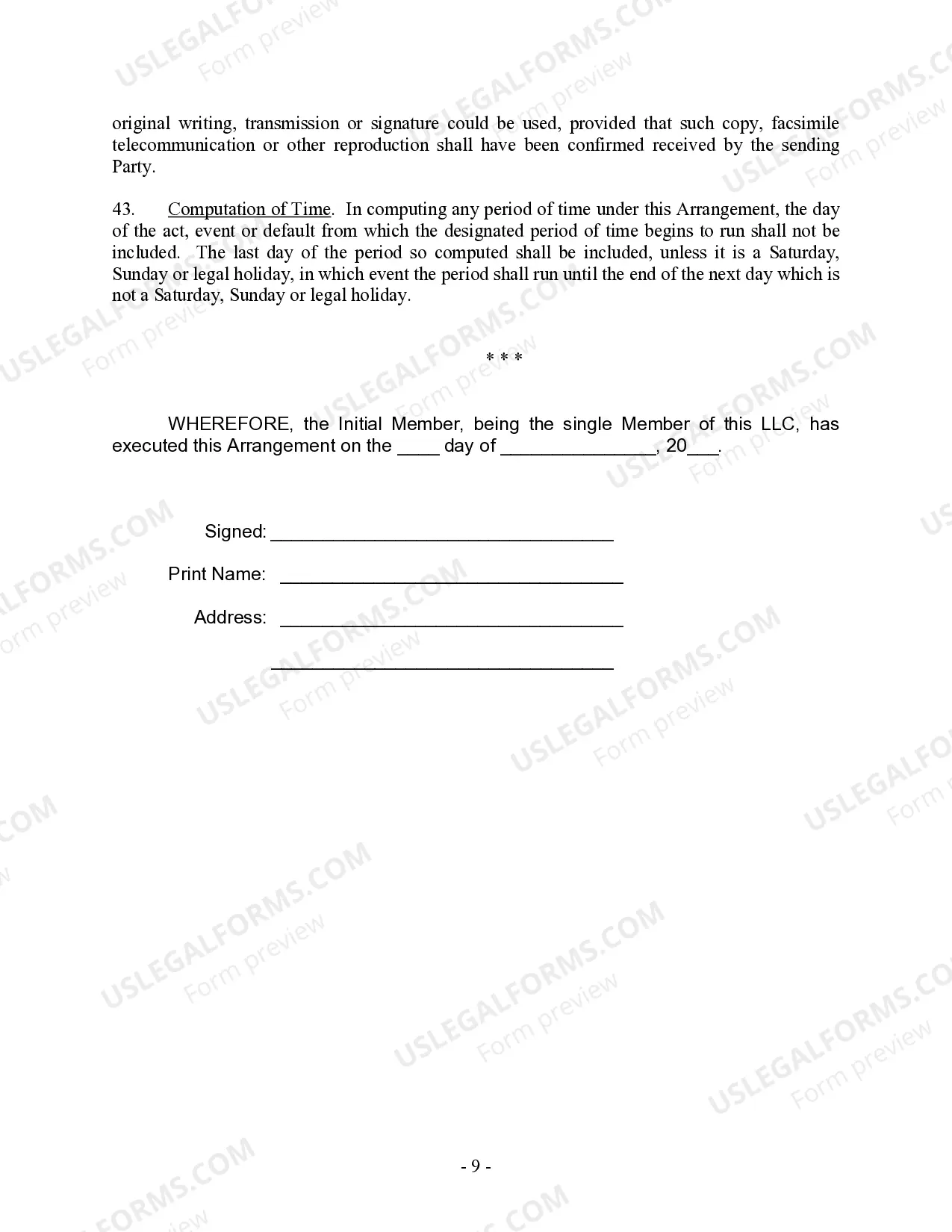

This Operating Agreement is for a Limited Liability Company with only one Member. This form may be perfect for an LLC started by one person. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual adding of new Members to LLC.

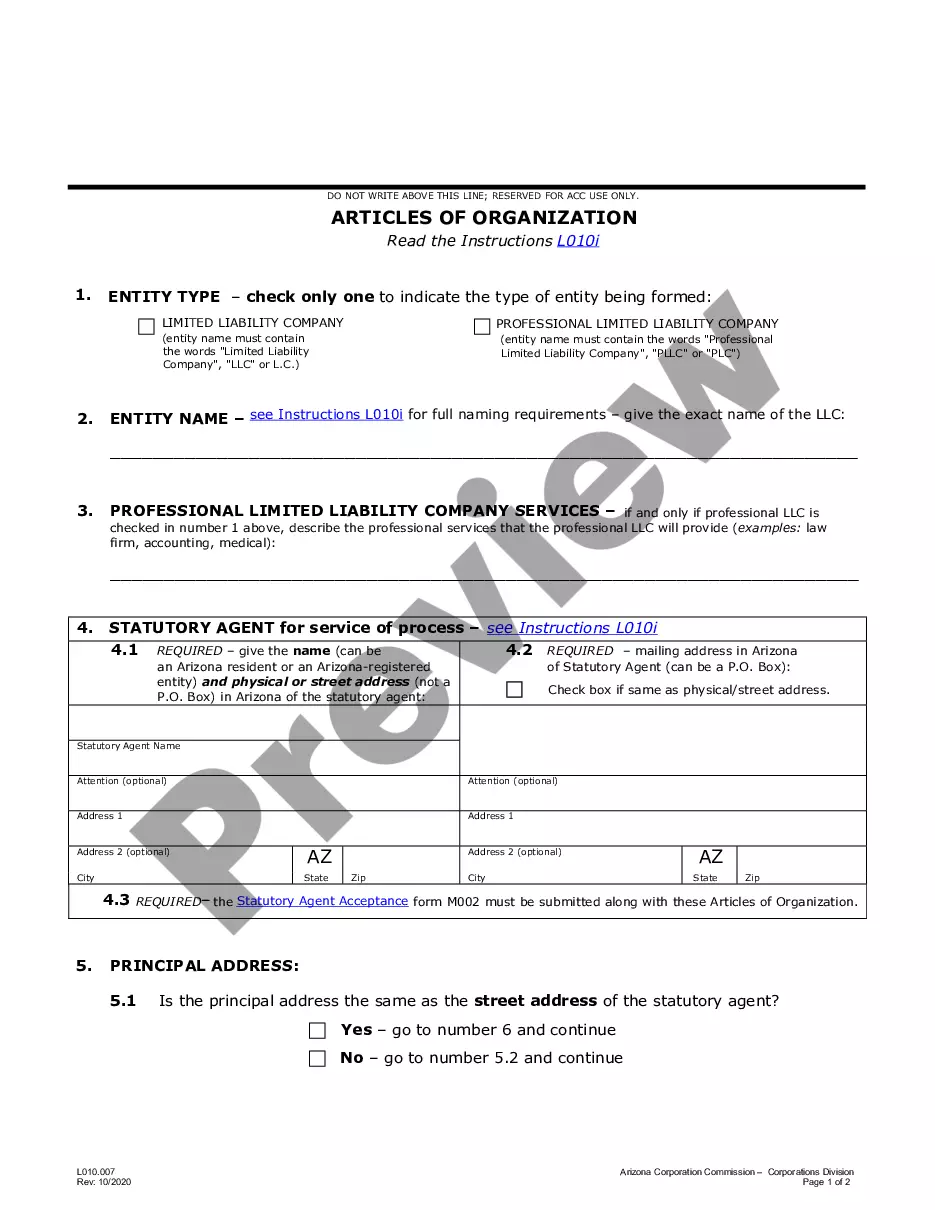

Surprise Arizona Single Member Limited Liability Company LLC Operating Agreement is a legal document that outlines the management and operation of a single-member limited liability company (LLC) in Surprise, Arizona. This agreement sets forth the rights and responsibilities of the single member, also known as the owner or member, and governs the internal affairs of the LLC. The Surprise Arizona Single Member Limited Liability Company LLC Operating Agreement addresses various aspects, including the purpose and nature of the LLC, the initial capital contribution, allocation of profits and losses, voting rights, and decision-making procedures. It also outlines the procedures for admitting new members, transferring ownership interests, and procedures for dissolving or terminating the LLC. In addition, the agreement details the roles and responsibilities of the member, such as the management of day-to-day operations, financial reporting and record-keeping, restrictions on member's authority, and provisions for resolving disputes. This agreement is essential for protecting the interests of the single member and ensuring the smooth operation and governance of the LLC. While there may not be different types of Surprise Arizona Single Member Limited Liability Company LLC Operating Agreements per se, the agreement can be customized or modified based on the specific needs and requirements of the LLC. Some LCS may choose to include additional provisions or clauses in their operating agreement to address specific concerns or circumstances. Example of additional provisions that can be included in the Surprise Arizona Single Member Limited Liability Company LLC Operating Agreement are: 1. Tax and accounting provisions: This provision may specify the tax treatment of the LLC, such as electing to be taxed as a disregarded entity or as a corporation, and outline the obligations and responsibilities of the member regarding tax filings and payment of taxes. 2. Management provisions: This provision can detail the specific management responsibilities of the member, such as the power to hire and fire employees, enter into contracts, and make financial decisions on behalf of the LLC. 3. Succession provisions: This provision can outline the process for transferring ownership interests in case of the member's death, incapacitation, or desire to sell their interest in the LLC. 4. Non-compete and non-disclosure provisions: These provisions can impose restrictions on the member from engaging in competing businesses or disclosing confidential information of the LLC to protect its interests. It is important to consult with a legal professional to properly draft and customize a Surprise Arizona Single Member Limited Liability Company LLC Operating Agreement that aligns with the specific needs of the LLC and complies with relevant state laws and regulations.Surprise Arizona Single Member Limited Liability Company LLC Operating Agreement is a legal document that outlines the management and operation of a single-member limited liability company (LLC) in Surprise, Arizona. This agreement sets forth the rights and responsibilities of the single member, also known as the owner or member, and governs the internal affairs of the LLC. The Surprise Arizona Single Member Limited Liability Company LLC Operating Agreement addresses various aspects, including the purpose and nature of the LLC, the initial capital contribution, allocation of profits and losses, voting rights, and decision-making procedures. It also outlines the procedures for admitting new members, transferring ownership interests, and procedures for dissolving or terminating the LLC. In addition, the agreement details the roles and responsibilities of the member, such as the management of day-to-day operations, financial reporting and record-keeping, restrictions on member's authority, and provisions for resolving disputes. This agreement is essential for protecting the interests of the single member and ensuring the smooth operation and governance of the LLC. While there may not be different types of Surprise Arizona Single Member Limited Liability Company LLC Operating Agreements per se, the agreement can be customized or modified based on the specific needs and requirements of the LLC. Some LCS may choose to include additional provisions or clauses in their operating agreement to address specific concerns or circumstances. Example of additional provisions that can be included in the Surprise Arizona Single Member Limited Liability Company LLC Operating Agreement are: 1. Tax and accounting provisions: This provision may specify the tax treatment of the LLC, such as electing to be taxed as a disregarded entity or as a corporation, and outline the obligations and responsibilities of the member regarding tax filings and payment of taxes. 2. Management provisions: This provision can detail the specific management responsibilities of the member, such as the power to hire and fire employees, enter into contracts, and make financial decisions on behalf of the LLC. 3. Succession provisions: This provision can outline the process for transferring ownership interests in case of the member's death, incapacitation, or desire to sell their interest in the LLC. 4. Non-compete and non-disclosure provisions: These provisions can impose restrictions on the member from engaging in competing businesses or disclosing confidential information of the LLC to protect its interests. It is important to consult with a legal professional to properly draft and customize a Surprise Arizona Single Member Limited Liability Company LLC Operating Agreement that aligns with the specific needs of the LLC and complies with relevant state laws and regulations.