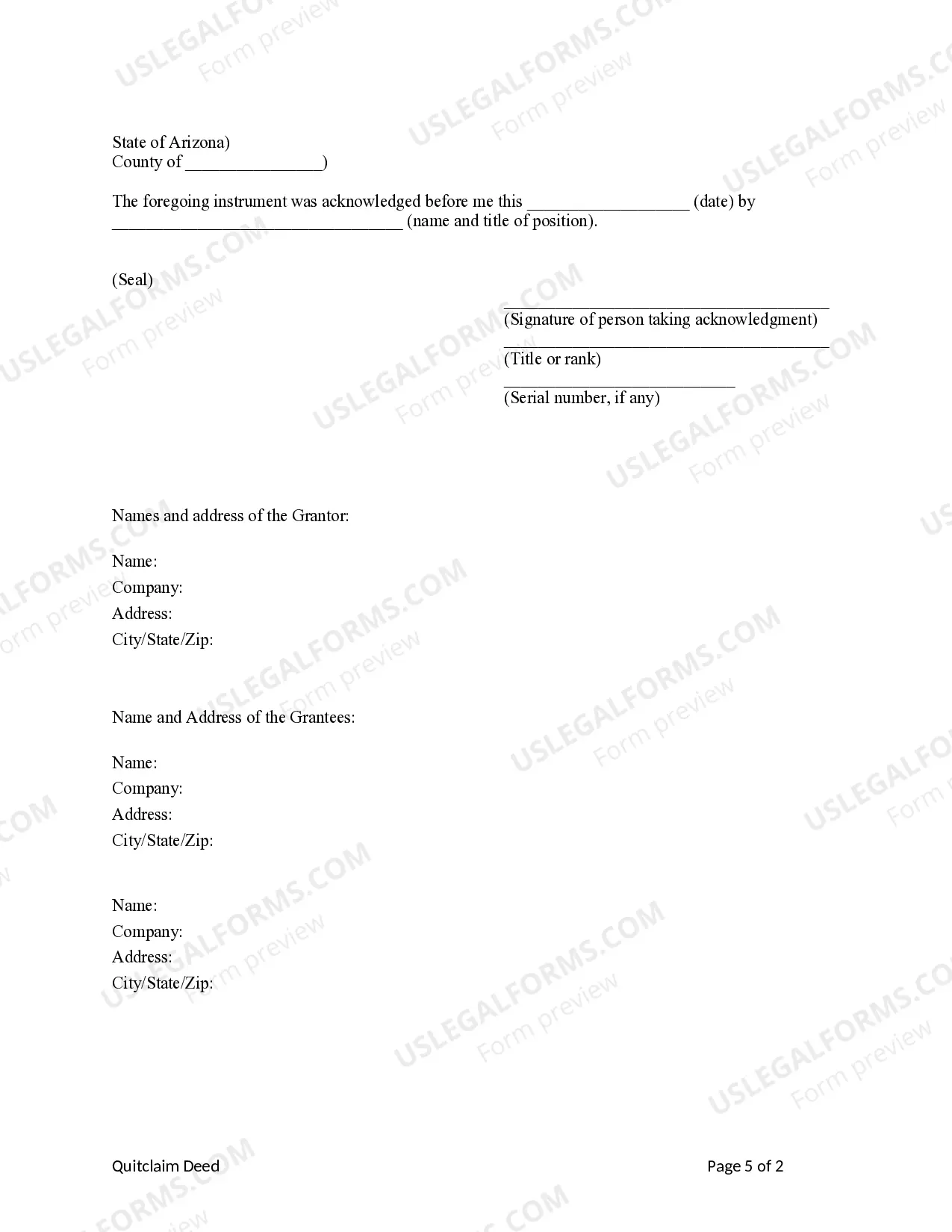

This form is a Renunciation and Disclaimer of Property received by the beneficiary. The beneficiary received an interest in the described property through the last will and testament of the decedent. However, under the provisions of the Arizona Revised Statutes, Title 14, Article 8, the beneficiary has decided to disclaim a partial interest or the entire interest in the described property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Title: Tucson Arizona Renunciation and Disclaimer of Property from Will by Testate | Comprehensive Guide Introduction: In Tucson, Arizona, the Renunciation and Disclaimer of Property from Will by Testate refers to the legal process by which a named beneficiary in a will voluntarily gives up their rights to inherit property or assets bequeathed to them by a testator. This renunciation can occur for various reasons, including personal choices, financial considerations, or a desire to disclaim certain property. In this article, we will explore the concept of Tucson Arizona Renunciation and Disclaimer of Property from Will by Testate in detail, highlighting its different types and how they are governed under Arizona law. I. Understanding Renunciation and Disclaimer in Tucson, Arizona: 1. Definition — Renunciation and Disclaimer: Renunciation is the act of voluntarily giving up one's rights to property, while disclaimer involves the refusal to accept gifts or bequests left by the testator. 2. Renunciation vs. Disclaimer: Renunciation typically occurs when a beneficiary rejects their entire share of the inheritance, including both property and debts, while disclaimer allows a beneficiary to decline specific assets or liabilities. II. Types of Tucson Arizona Renunciation and Disclaimer of Property from Will by Testate: 1. Absolute Renunciation: This form of renunciation involves completely refusing the inheritance, relinquishing all legal rights and interests in the bequeathed assets. 2. Partial Renunciation: A partial renunciation allows the beneficiary to disclaim only a portion of the inheritance, enabling them to retain certain property or assets mentioned in the will. 3. Conditional or Contingent Renunciation: Beneficiaries might renounce their inheritance subject to specific conditions, such as receiving it at a later date or only if certain requirements are met. 4. Specific Asset Disclaimer: Beneficiaries can disclaim particular assets mentioned in the will, ensuring they do not take ownership or assume any associated liabilities. 5. Renunciation of Executor ship: In some cases, a named executor may renounce their appointment to oversee the estate distribution process. This renunciation allows the court to appoint an alternate executor to carry out the testator's wishes. III. The Process of Renunciation and Disclaimer in Tucson, Arizona: 1. Legal Requirements: Beneficiaries need to follow specific legal procedures outlined in the Arizona Revised Statutes (AS) to ensure their renunciation or disclaimer is valid. 2. Timeline: The renunciation or disclaimer must be made within a specific period after the testator's death, as defined by Arizona law. 3. Documentation: Renunciation and disclaimer are generally done through a written document, which must comply with the applicable legal requirements, such as being duly signed, notarized, and possibly filed with the court. 4. Effect on Estate Distribution: Once the renunciation or disclaimer is made, the disclaimed assets typically pass to the next beneficiary in line or as per the testator's alternate provisions outlined in the will. 5. Tax Considerations: It is crucial to consider any potential tax implications when renouncing or disclaiming property, as different rules may apply depending on the circumstances. Conclusion: The Tucson Arizona Renunciation and Disclaimer of Property from Will by Testate provide beneficiaries with the legal option to refuse or give up their inheritance rights in a will. Whether one wishes to reject the entire inheritance, specific assets, or executor ship, it is essential to consult with an experienced attorney familiar with Arizona law to ensure compliance with all legal requirements and to understand any possible consequences. By understanding the different types and processes involved, beneficiaries can make informed decisions regarding renunciation or disclaimer in alignment with their unique circumstances and wishes.