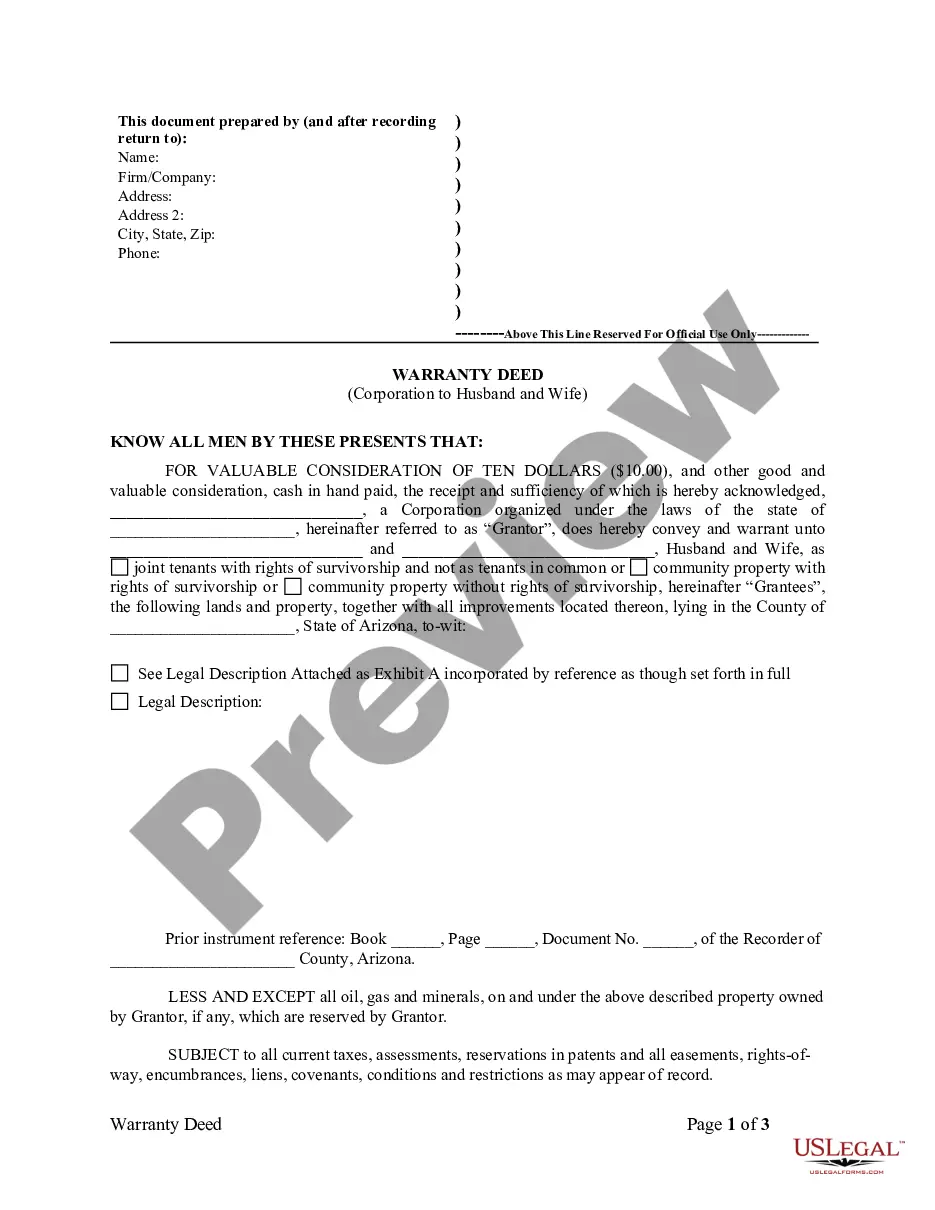

This Warranty Deed from Corporation to Husband and Wife form is a Warranty Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and warrants the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

Scottsdale Arizona Warranty Deed from Corporation to Husband and Wife

Description

How to fill out Scottsdale Arizona Warranty Deed From Corporation To Husband And Wife?

If you have previously utilized our service, Log In to your account and store the Scottsdale Arizona Warranty Deed from Corporation to Husband and Wife on your device by selecting the Download button. Ensure your subscription is active. If not, renew it based on your payment plan.

If this is your initial encounter with our service, adhere to these straightforward steps to obtain your document.

You have continual access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to use it again. Utilize the US Legal Forms service to swiftly locate and download any template for your personal or professional requirements!

- Confirm you’ve located a suitable document. Browse the description and utilize the Preview option, if offered, to assess whether it fulfills your needs. If it doesn’t suit you, employ the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Enter your credit card information or the PayPal option to finish the transaction.

- Obtain your Scottsdale Arizona Warranty Deed from Corporation to Husband and Wife. Choose the file format for your document and save it on your device.

- Finalize your form. Print it or use professional online editors to complete it and sign it electronically.

Form popularity

FAQ

To transfer a property title to a family member in Arizona, you will typically need to complete a deed, such as the Scottsdale Arizona Warranty Deed from Corporation to Husband and Wife. Ensure you follow all legal requirements, including signing and notarizing the deed. Resources like US Legal Forms can assist you in obtaining the correct documents and navigating the transfer process smoothly. This way, you can make the transfer with confidence.

Yes, you can transfer a deed without an attorney in Scottsdale, Arizona. However, it is highly recommended to understand the specific requirements involved in the Scottsdale Arizona Warranty Deed from Corporation to Husband and Wife. Utilizing platforms like US Legal Forms can simplify this process, providing you with the necessary forms and guidance. This ensures your deed transfer is handled correctly and legally.

In Arizona, a deed must be signed, notarized, and recorded with the county recorder’s office to be legally effective. It should contain a legal description of the property and the names of both the granter and grantee. When preparing a Scottsdale Arizona Warranty Deed from Corporation to Husband and Wife, working with platforms like USLegalForms can ensure that you meet all legal requirements and create a proper document.

The most common type of deed used in Arizona is the warranty deed, which provides the highest level of protection for buyers. It protects the new owners by affirming that the seller legally owns the property and can transfer it without issues. If you need to create a Scottsdale Arizona Warranty Deed from Corporation to Husband and Wife, this deed type is an ideal choice.

A warranty deed is a legal document used to transfer property ownership in Arizona. It guarantees that the grantor holds clear title to the property and has the right to transfer it. This document is essential when executing a Scottsdale Arizona Warranty Deed from Corporation to Husband and Wife, ensuring that the new owners are protected from any claims against the property.

To add someone to a house deed in Arizona, you need to create a new deed, such as a Scottsdale Arizona Warranty Deed from Corporation to Husband and Wife. This requires the current owner to draft the deed with both parties' names and submit it for signature. Finally, you must record the new deed with the county recorder's office to finalize the addition.

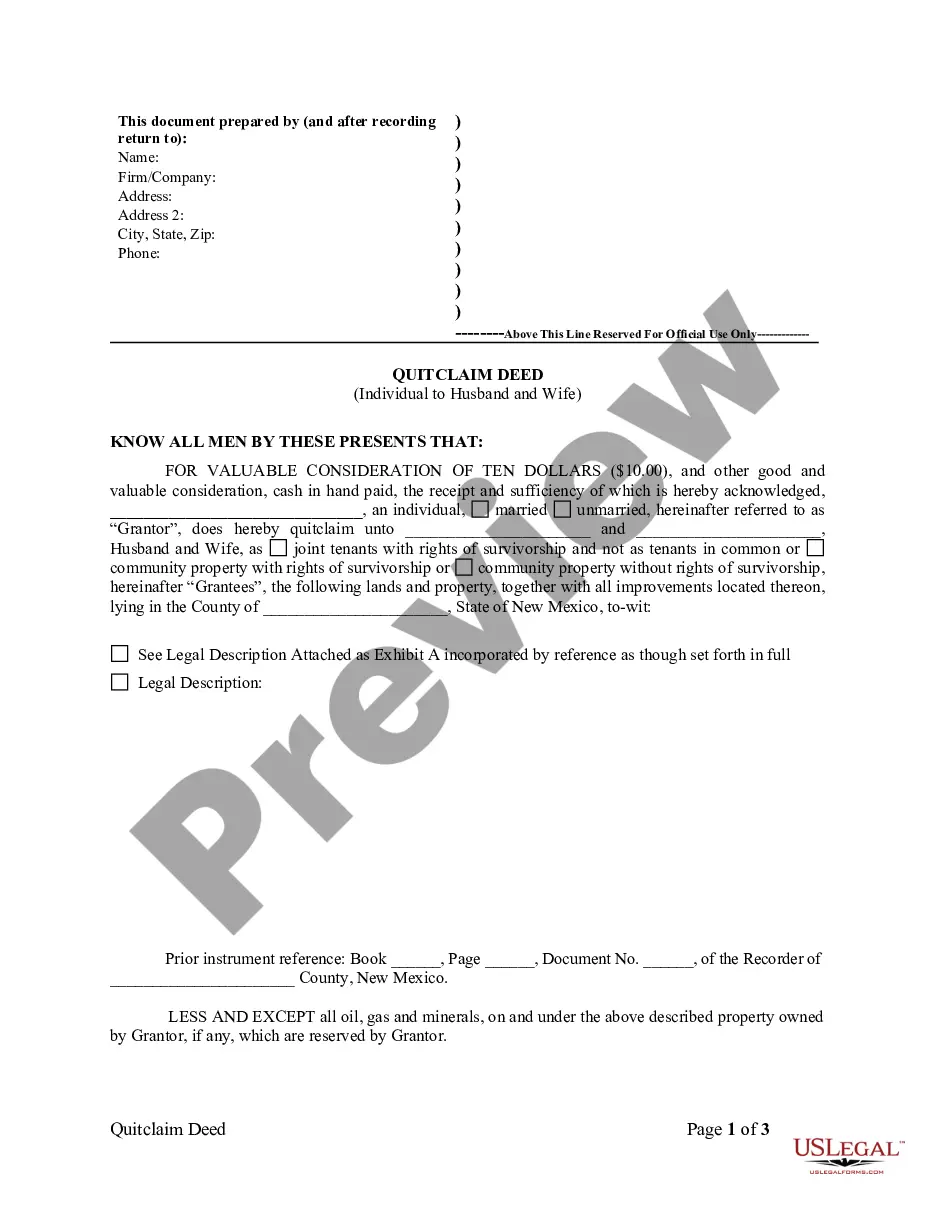

The main difference between a warranty deed and a quit claim deed lies in the level of protection they offer. A Scottsdale Arizona Warranty Deed from Corporation to Husband and Wife includes a guarantee that the seller has clear title to the property, while a quit claim deed transfers whatever interest the seller has without any guarantees. This distinction can significantly affect your ownership rights.

To add a spouse to a deed in Arizona, you'll need to create a new warranty deed that includes both names, like a Scottsdale Arizona Warranty Deed from Corporation to Husband and Wife. This document should be signed by the current owner and then recorded at the county recorder's office. It's important to consider any potential tax implications before making this change.

Yes, a warranty deed proves ownership of a property in Arizona. A Scottsdale Arizona Warranty Deed from Corporation to Husband and Wife provides a guarantee that the grantor has clear title to the property being transferred. This legal document protects the buyer against any claims or issues that may arise regarding property ownership.

Transferring property to a family member in Arizona typically involves creating a new deed, such as a Scottsdale Arizona Warranty Deed from Corporation to Husband and Wife. You must include the family member's name, and potentially structure it for tax implications. Once the deed is completed and signed, you need to record it at the county recorder's office for it to take effect legally.

Interesting Questions

More info

An “equitable lien” is just like a mortgage and is similar to the type of interest you need to pay on the house from the lender. You can sell your spouse's non-financial assets. You're an adulteress, and you have an unpaid debt in the form of a loan that you need to pay back. Or your spouse has gone into business for himself, and you need the cash. You can sell your spouse's non-financial assets, like a business, which she can either use or keep. When you buy a property as your spouse, she's your spouse's personal representative. What this means is that she's responsible for managing your assets, making tax payments and managing finances. If her finances have gone south, she'll also be responsible for making sure the finances of you and your kids are in order. If your property is subject to a lien (see next point), she'll be responsible for the payment of the lien.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.